Overnight – Nvidia beats analyst expectations…but not the markets

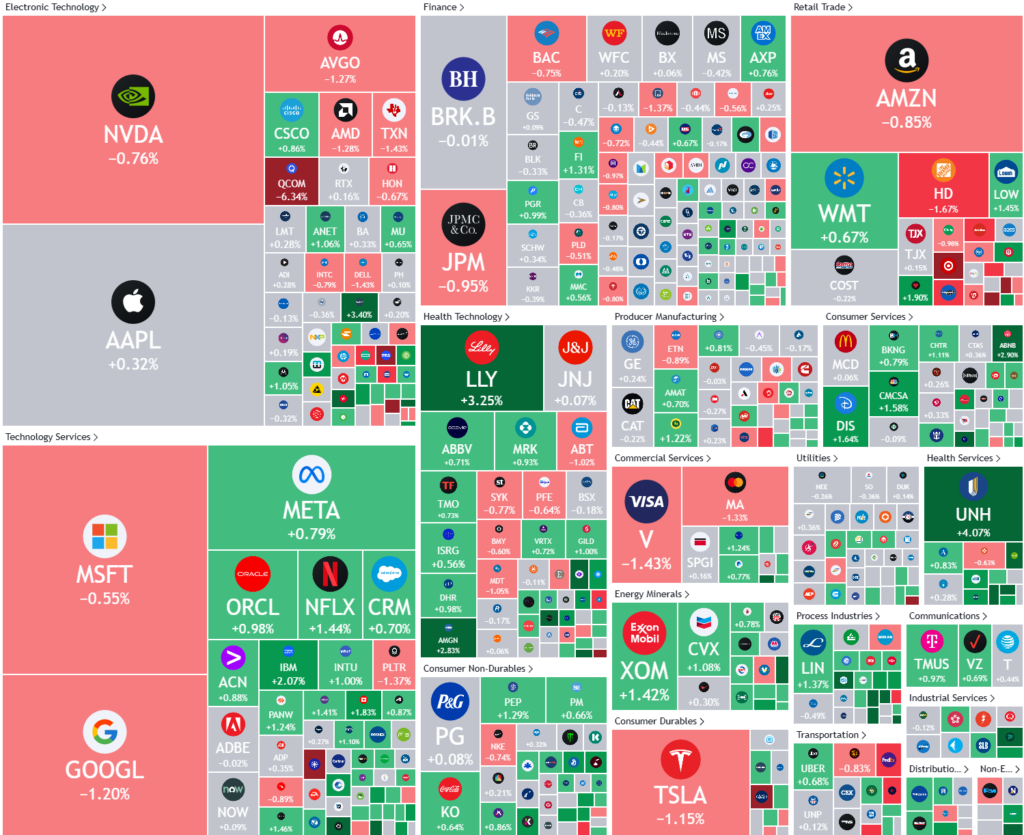

Stocks finished the day session mixed ignoring a slump in Target and caution in tech ahead of Nvidia’s quarterly earnings which beat the analysts expectations, but disappointed investors

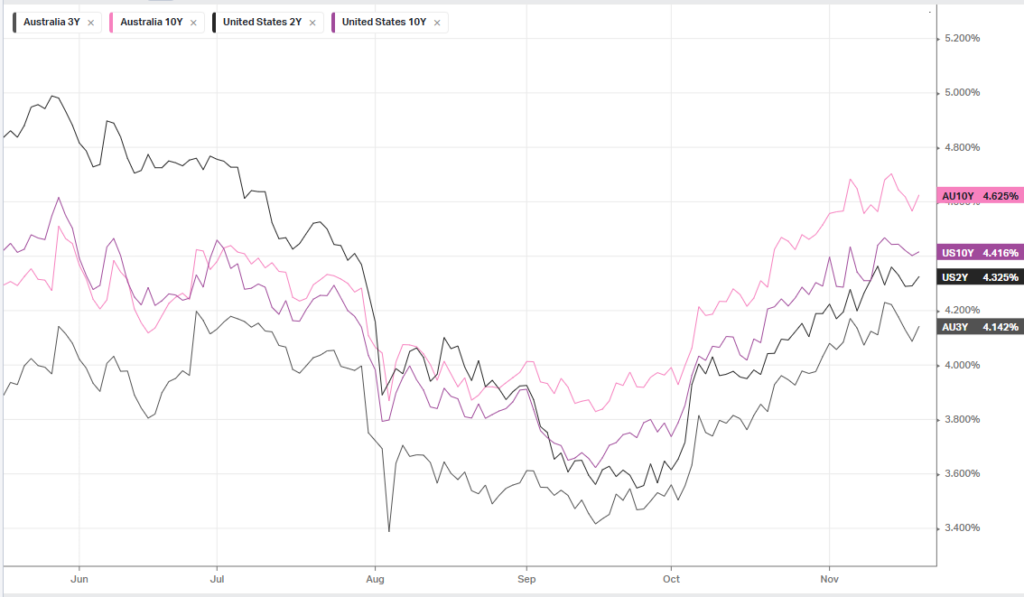

The slew of Fed speak continued to this week, with investors keen for clues on whether Fed members would continue to express caution on further rate cuts ahead. Federal Reserve Governors Lisa Cook said that future rate cuts would be depend on incoming economic data. Federal Reserve governor Michelle Bowman backed a cautious approach to rate cuts amid expectations that the neutral level or end point for rates may be higher than previously expected at time when progress against inflation has stalled in recent months.

Investors continue to bet that interest rates will fall in the near-term, with traders pricing in a 60.6% chance for a 25 basis point cut by the Federal Reserve in December, CME Fedwatch showed.

Nvidia Results

NVIDIA’s stock price closed at $145.84. It is up 12.73% in the last 3 months and up 192.01% in the last 12 months.

Vs Guidance –

- Revenue for the quarter came in at $35.1B versus the consensus estimate of $33.09B.

- EPS of $0.81, $0.06 better than the analyst estimate of $0.75

- Data center revenue was $30.8 billion, up 17% from Q2 and up 112% from a year ago. That compared with estimates for $28.84B.

Outlook – Looking ahead to Q4, revenue is expected to be $37.5B, plus or minus 2%, compared with estimates of $37.09B. This is what disappointed analysts

After market share price reaction – The initial reaction saw shares drop up to 4% in afterhours trade as the normally “hyper-bullish” outlook from the company underwhelmed. This was despite beating analysts expectations, however, Nvidia’s track record of 9 consecutive quarters in a row means that traders would have been expecting higher numbers than analysts

Nvidia was trading 142.50, down 2% at 845am AEDST, pushing the Nasdaq down 0.5%

Stock specific

- Target – stock slumped more than 21% after the retailer reported third-quarter earnings that fell well short of analyst expectations and provided disappointing guidance for the full year. The earnings missed triggered a selloff across retailers, with Dollar Tree, Home Depot and Five Below Inc in the red.

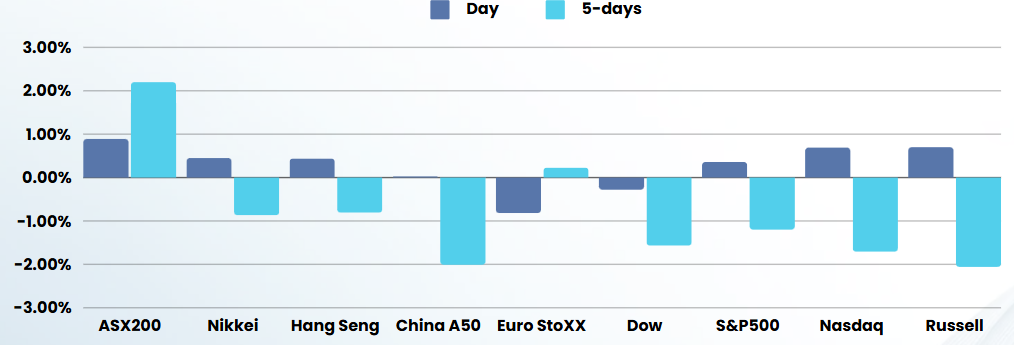

ASX SPI 8370 (+0.13%)

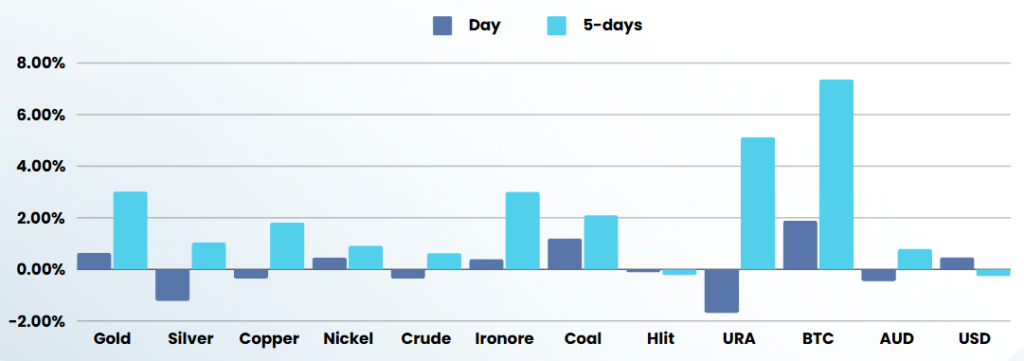

The local market should be relatively buoyant today as investors re-focus after Nvidia earnings. A huge amount of AGMs will mean there will be single stock risks, but the grind higher of commodities will help support the index

Today – 30 AGMs are scheduled, including Accent Group, Evolution Mining, HUB24, Insignia Financial, Mineral Resources, New Hope, News Corp, NextEd, Ramelius Resources, Regis Resources, ResMed and Worley.