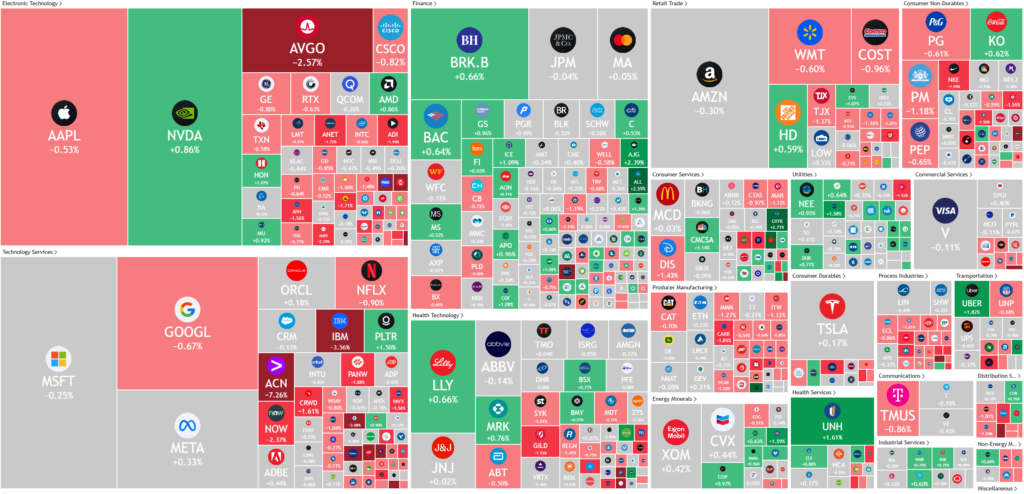

Overnight – investor optimism runs out of steam as stocks drift lower

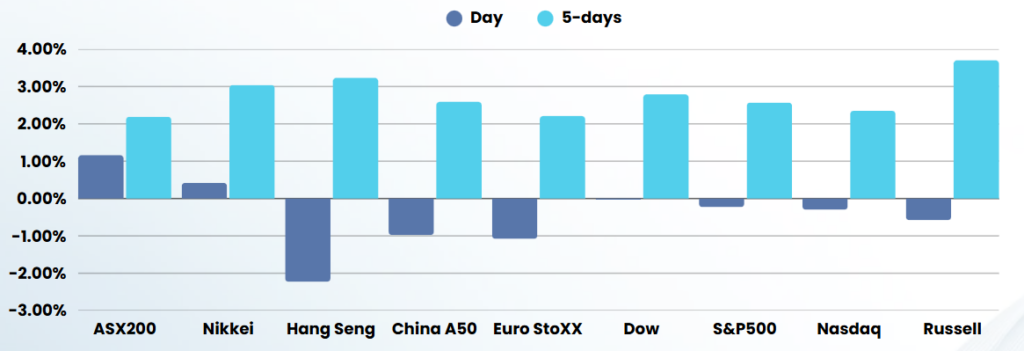

Equities gave back the rate cut optimism that followed the Federal Reserve meeting and an their unchanged outlook on two rate cuts this year run out of steam

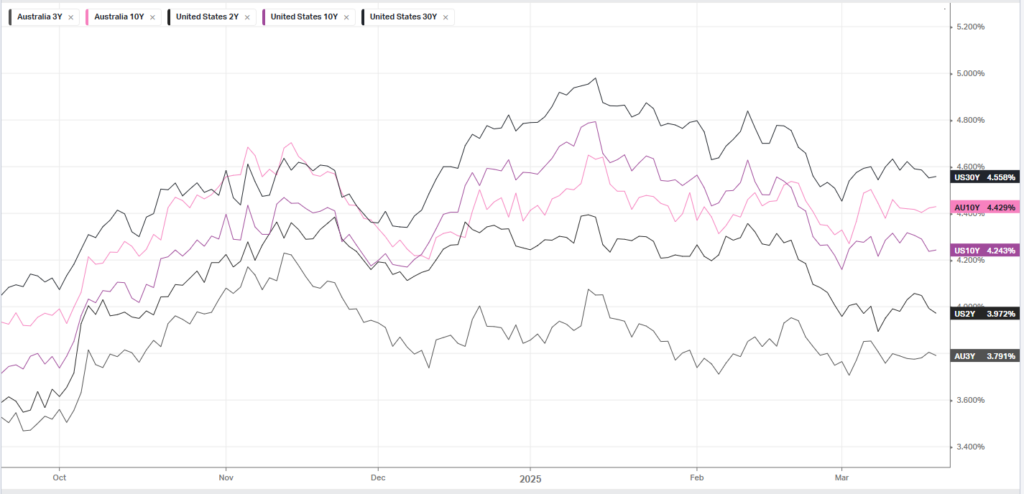

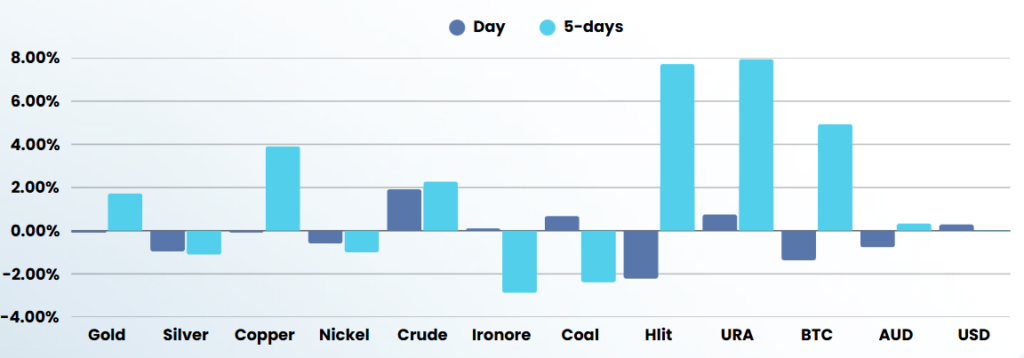

The Fed kept its benchmark interest rate unchanged at 4.25% to 4.5% on Wednesday, as widely expected, leaving it there for a second consecutive meeting. The central bank maintained its outlook that rates will fall to 3.75% to 4% in 2025, suggesting that it will cut rates twice by December. But this came even as the central bank forecast higher inflation in 2025, with core personal consumption expenditures index- the Fed’s preferred inflation gauge- expected to be 2.8% in 2025, up from a prior forecast of 2.5% and well above the central bank’s annual 2% target. The Fed also trimmed its gross domestic product forecast for the year, and flagged growing uncertainty over the impact of Trump’s policies on the economy. Fed Chair Jerome Powell said it was still too soon to gauge the impact of Trump’s tariff policies on inflation and the economy at large. But the Fed’s inflation and GDP targets suggest that the impact will not be negligible.

US Initial job claims, a proxy for hiring, inched up to 223,000 in the week ended on March 15, increasing from an upwardly-revised mark of 221,000, according to Labor Department data on Thursday. Economists had seen the figure at 224,000.

Apple reportedly is set looking to tap Vision Pro creator Mike Rockwell to turn around Siri as the tech giant seeks to boost its foray into AI, Bloomberg reported, citing unnamed sources. The move comes as CEO Tim Cook has reportedly lost confidence in AI head John Giannandrea to execute on product development. Its shares fell 0.5%. Tesla Inc cut losses to end flat despite after the EV maker recalling almost all Cybertrucks in the United States to fix an exterior panel that could delaminate and detach, increasing the risk of a crash.

On the earnings calendar, investors will have the chance to parse through quarterly results from a range of companies later in the day, including logistics group FedEx, chipmaker Micron Technology and shoe seller Nike.

ASX SPI 7867 (+0.43%)

The ASX is in for a quiet day with likely selling as investors are hesitant to take weekend risk with Trump providing a constant drip feed of “major” announcements

Company Specific

- Nine Entertainment has begun negotiations to sell its controlling stake in Domain to US real estate conglomerate CoStar.

- The ACCC has found Woolworths and Coles are some of the most profitable supermarket retailers in the world but concedes little can be done about their market dominance.