Overnight – Stocks rally despite Putin lowering Nuclear strike threshold

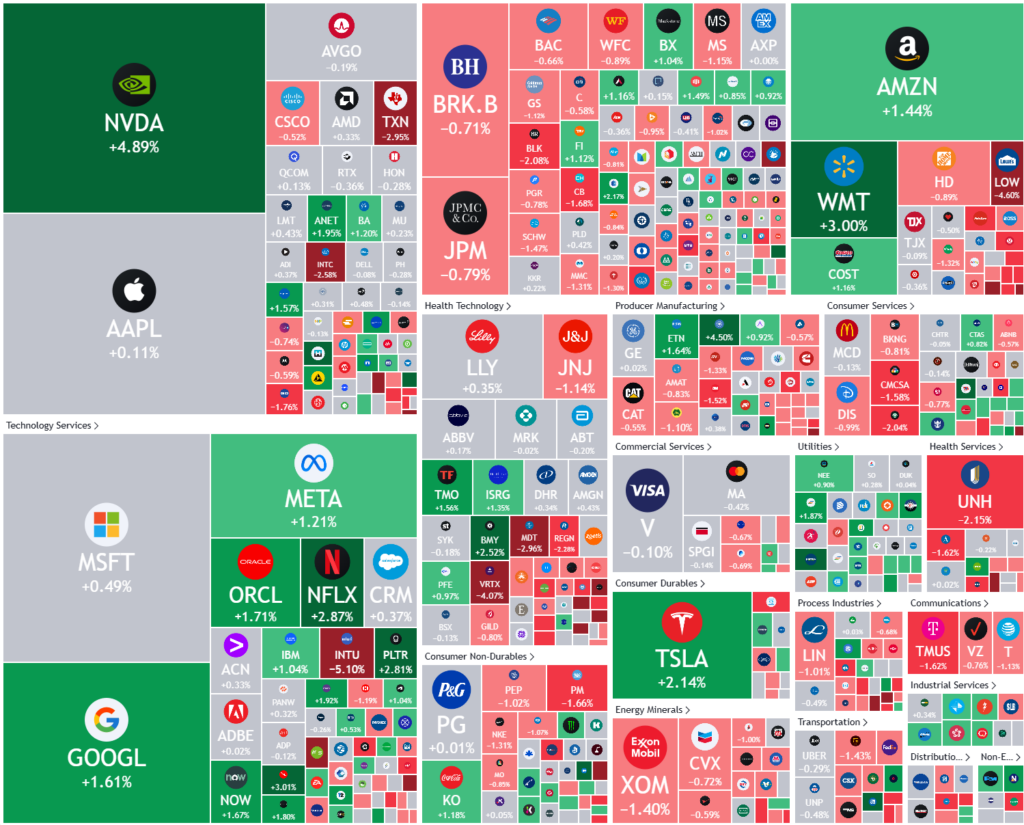

Stocks climbed overnight, despite an escalation from Russia by lowering the Kremlin’s threshold to authorise a nuclear strike. The rally was led by a jump in technology shares as investors eagerly awaited results this week from Nvidia

Nvidia, which reports third-quarter results on Wednesday, rose 3.9% and was the biggest positive on the S&P 500 and Nasdaq. The technology sector was up 1.2%. Other mega cap stocks also rose, including Apple and Amazon.com.

All three major indexes opened lower and the benchmark index dropped as much as 0.64% after Russian President Vladimir Putin lowered the threshold for a nuclear strike in response to a broader range of conventional attacks earlier in the day, and Moscow said Ukraine had struck deep inside Russia with U.S.-made long-range missiles.

Stocks pared losses as Russian Foreign Minister Sergei Lavrov said Moscow will do everything possible to prevent the breakout of a nuclear war.

The biggest takeaway is that the Mega caps have become the markets favoured safe haven as the caution around what’s going on in Ukraine fed into the MAG7

Russian President Vladimir Putin has signed a revised doctrine to lower the threshold for the Kremlin to authorise a nuclear strike. The doctrine allows Russia to consider a strike if faced by aggression “with the use of conventional weapons”. It also says an attack against Russia by a non-nuclear power with the “participation or support of a nuclear power” would be seen as a “joint attack”.

The way the US equity market brushed off the latest heightened geopolitical tensions is a good indicator that the “melt up” rally will continue as fundamentals have left the building

Stock specific

- Walmart – Shares rose over 3% as Walmart’s earnings were upbeat and “seeing some resilience” in the consumer ahead the holidays is a positive, he added. The third quarter adjusted earnings per share (EPS) came in at $0.58, topping consensus expectations of $0.53. Walmart’s revenue for the quarter rose to $169.6 billion, also above the $167.67 billion estimated by analysts.

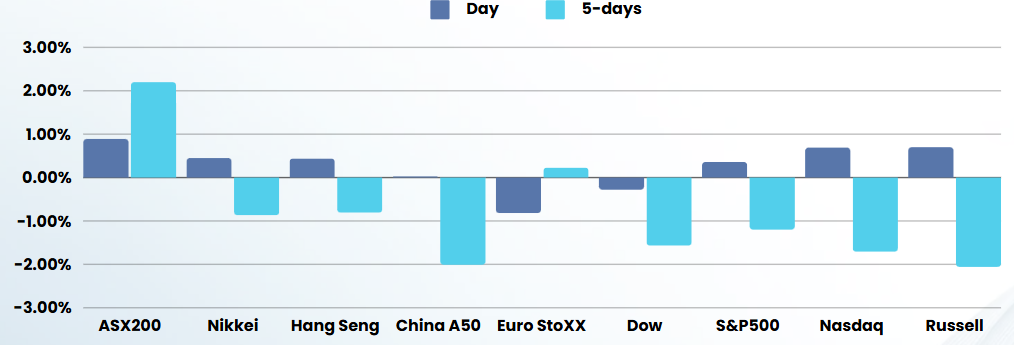

ASX SPI 8402 (-0.01%)

We are unlikely to see the same blind enthusiasm as the US markets today, with SPI futures pointing to a weak to neutral start to the day. The small cap part of the market may continue to see inflows as momentum builds in the smaller end of the market.

Shares in dual-listed packaging giant Amcor will be watched closely this morning, following news overnight that the company will buy New York-listed packaging business Berry Group in a deal valued at around $US8.4 billion ($13 billion).

Today – WEB Travel is expected to release earnings. Boss Energy, Charter Hall, Downer EDI, Mount Gibson Iron and Pacific Smiles all host AGMs.