Overnight – Stocks surge as Fed maintains two-cut outlook

Stocks surged higher overnight as the Federal Reserve’s left rates unchanged but maintained the outlook for 2 more cuts this year

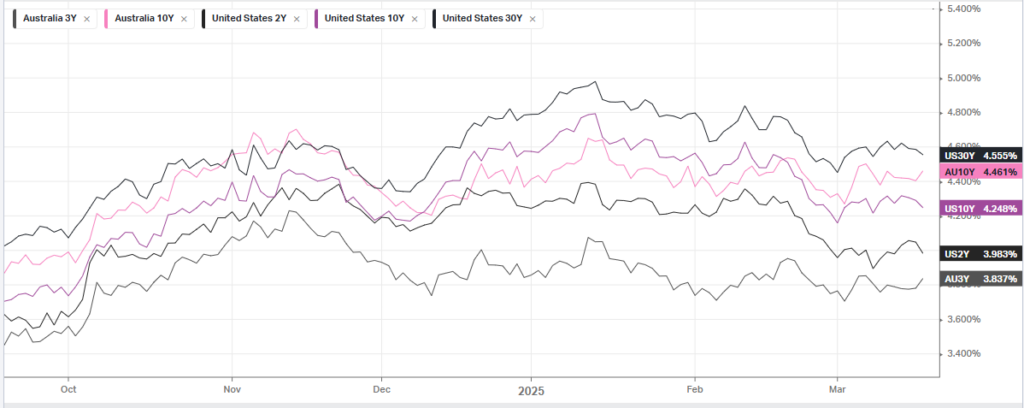

Despite acknowledging a more challenging path for inflation, the Fed continued to predict two rate cuts for the year. The Federal Open Market Committee (FOMC) kept its benchmark rate within the range of 4.25% to 4.5%. Fed members anticipate the benchmark rate will decrease to 3.9% by the end of the year, aligning with previous forecasts from December. The outlook for rate cuts in 2026 and 2027 also remained unchanged, with projected rates of 3.4% and 3.1%, respectively.

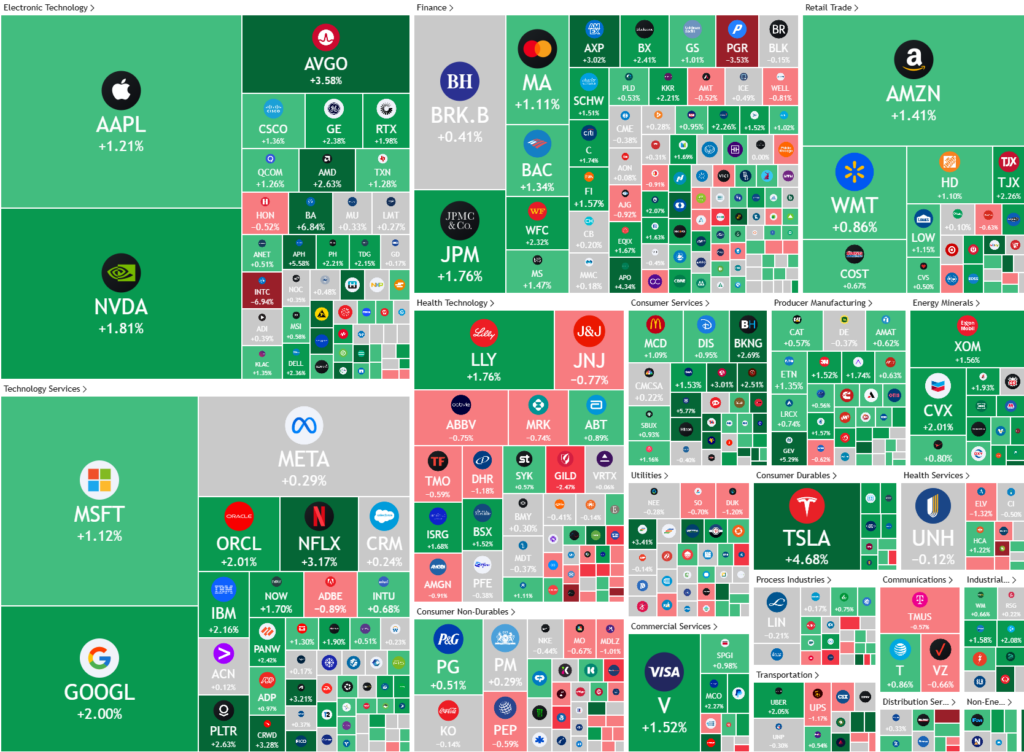

The Fed’s decision to maintain its rate-cut forecast, despite higher inflation projections, was somewhat offset by expectations of weaker economic growth. According to Fed Chairman Jerome Powell, this slower growth could help counterbalance the increased inflation. In the corporate sector, several notable developments influenced stock performance. Tesla’s stock rose over 4% after securing a crucial permit from the California Public Utilities Commission, marking a significant step toward launching its robotaxi service. This permit allows Tesla to manage a fleet of vehicles for transporting employees on scheduled trips.

Other significant movements included Boeing, which saw its stock jump by 7% following positive remarks from its CFO, Brian West, regarding improving operational performance. NVIDIA also experienced a rise of more than 2% after CEO Jensen Huang downplayed the near-term impact of tariffs. Conversely, General Mills’ stock fell by 2% as the company forecasted a sharp decline in annual sales and profits due to increased competition from cheaper private label brands.

ASX SPI 7884 (+0.65%)

The local market should bounce today after a significant underperformance over the last few weeks against the US. We still favour selling the bounce as the issues for the US have not changed and the rally will be short lived