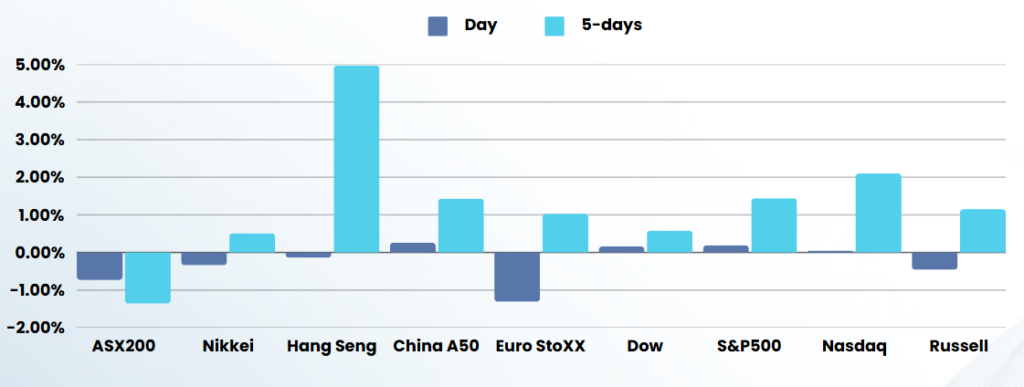

Overnight – Stocks drift as Fed suggests prolonged pause in rates

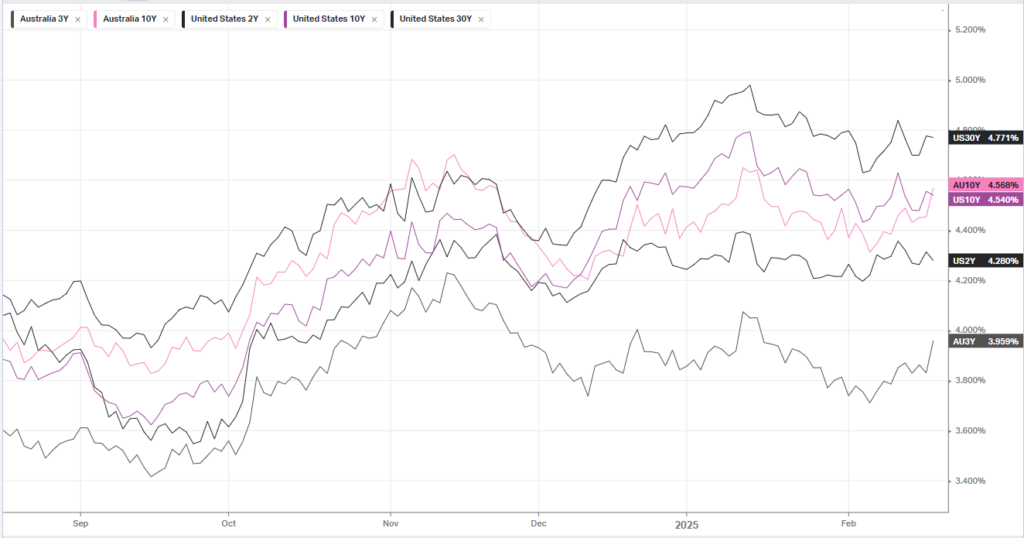

Stocks drifted sideways overnight as the minutes from the Federal Reserve’s January meeting was uneventful, broadly confirming investor expectations for an extended pause on rate cuts.

Federal Reserve policymakers were in favor of a wait-and-see approach on further rates cuts, citing the need for further evidence that inflation is slowing at a time when the persistent strength in the economy and fears of the inflationary-impact of tariffs threaten to undo the central bank’s progress toward the 2% inflation goal, according to the minutes of Federal Reserve’s January meeting released Wednesday.

Fed members echoed the sentiment for a prolonged pause, with participants observing that “the Committee was well positioned to take time to assess the evolving outlook for economic activity, the labor market, and inflation, with the vast majority pointing to a still-restrictive policy stance.”

Corporate Earnings

- Apple Inc – was flat even as it unveiled a new lower-priced iPhone model on Wednesday dubbed the iPhone 16e, which is set to hit shelves later this month.

- Arista Networks – slid more than 6%, with analysts noting a year-over-year decline in revenue from Meta Platforms a major customer of the networking equipment provider.

- Occidental Petroleum – shares were nearly 5% higher after the oil and gas firm unveiled production forecasts that were short of estimates, but announced plans to divest some of its upstream assets for $1.2 billion.

- Etsy – fell 8% after its fourth-quarter revenue fell shy of Wall Street’s expectations.

ASX SPI 8348 (-0.04%)

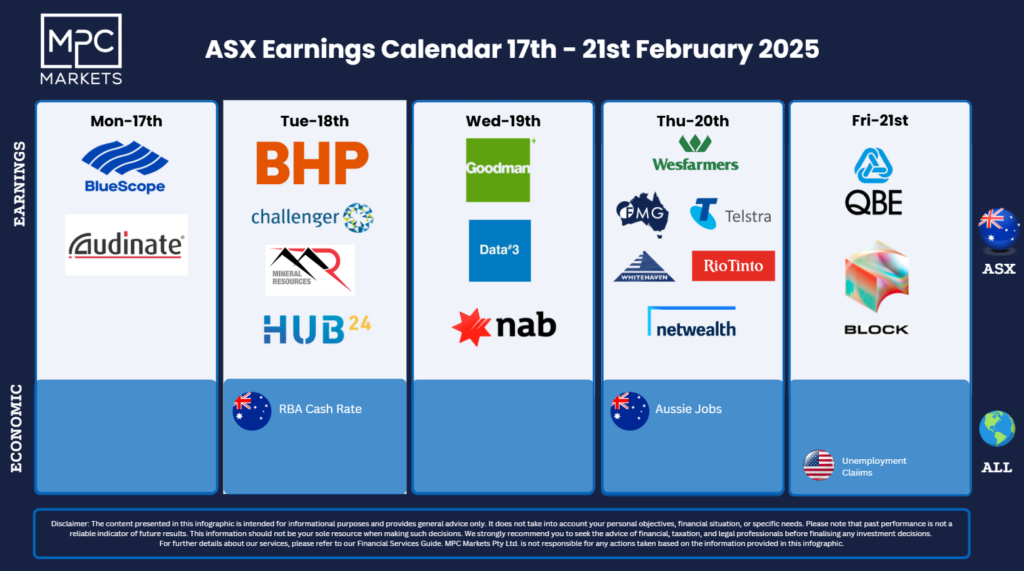

The ASX is poised to open lower with a glut of big company earnings. TLS, RIO, WES, ANZ, TCL, TAH, FMG, MGH, WHC to name a few.

We remain on the sell side, cautious of slowing momentum in price action

Company Specific

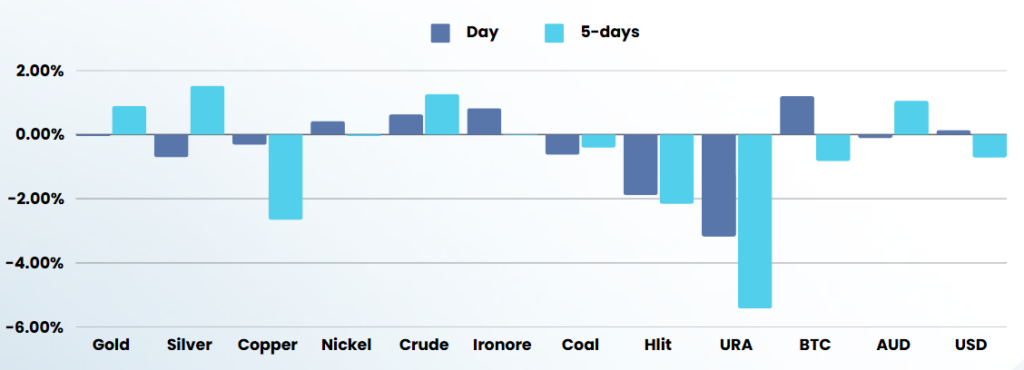

- Rio Tinto – reported a 7.6 per cent drop in underlying earnings in 2024, reflecting a lower iron ore price as it cut its dividend. Its US-listed shares were 2.7 per cent lower in late New York trading.

- Wesfarmers – Retail conglomerate Wesfarmers’ net profit rose 2.9 per cent to $1.47 billion in the six months to December 31. The owner of Kmart, Officeworks and Bunnings recorded a 3.6 per cent increase to its earnings before interest and tax at $2.3 billion in its half-year results. Revenue was booked at $23.5 billion, up 3.6 per cent.

- ANZ – reported growing deposits in the three months to the end of September, despite mortgage stress forcing some homeowners to refinance. All retail and commercial divisions, including the bank’s New Zealand and Suncorp Bank businesses, increased deposits by between 1 per cent and 5 per cent in the first quarter. Australian retail loans edged 1 per cent higher, while Australian commercial loans held flat. Impaired assets grew around $200 million to $1.9 billion, their highest level since September 2021. The bank said the rise was primarily driven by Australian mortgage restructures.

- Fortescue – While net profit halved and the dividend was cut to 50c from 1.08, the results were largely in-line with expectations