Overnight – Rising Bond Yields gatecrashes 2024 Bull market

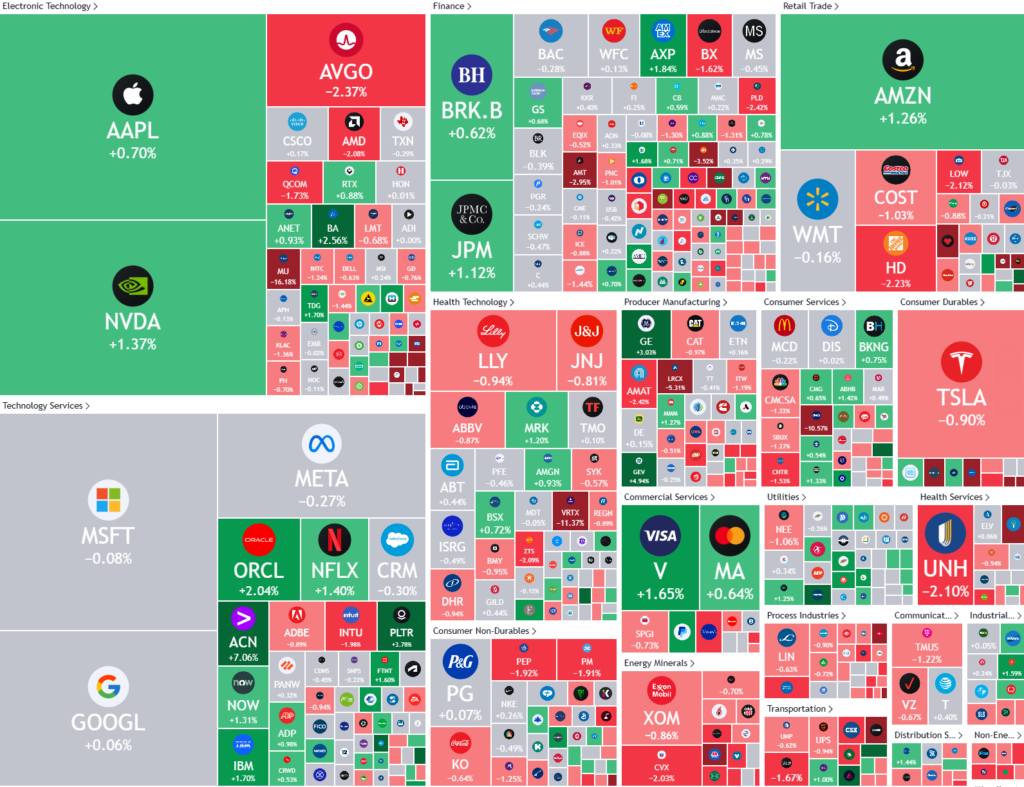

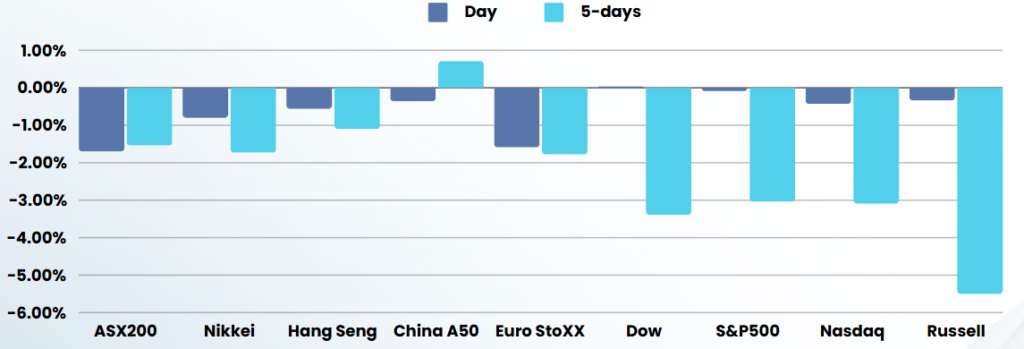

Equities were broadly weak overnight, with the DOW eking out a gain, snapping its longest losing streak since 1974, even as the post-Federal Reserve rebound ran out of steam.

Gross domestic product increased at an upwardly revised 3.1% annualized rate, having been previously reported to have expanded at a 2.8% pace last quarter. The US economy grew faster than previously estimated in the third quarter, driven by robust consumer spending, according to data released earlier Thursday.

The economy grew at a 3.0% pace in the April-June quarter, and is expanding at a pace that is well above what Federal Reserve officials regard as the non-inflationary growth rate of around 1.8%. This data plays into the idea that the Federal Reserve will be slow to cut interest rates further next year.

The US central bank cut interest rates by 25 basis points on Wednesday, as widely expected, but also the policymakers also indicated that they see just two more 25 bps rate cuts next year, compared with a prior forecast in September for four cuts.

The Federal Open Market Committee (FOMC) economic projections showed that inflation was still a long way from its 2% target, with the targeted metric expected to end this year at 2.4% and at 2.5% next year.

The prospect of interest rates remaining higher for longer than expected sent Wall Street indexes sharply lower on Wednesday, with heavy losses in the technology sector.

ASX SPI 8114 (-0.62%)

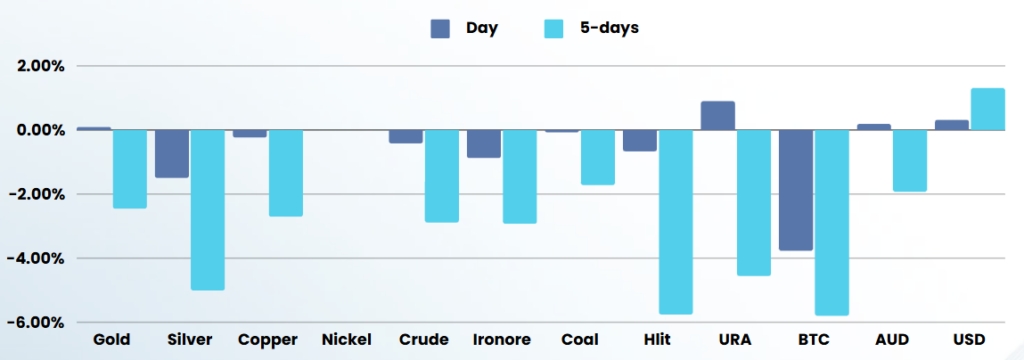

The poor end to the year will continue as global bond yields trade towards their highest levels in 2024, in a year of rate cuts in the US

We highly recommend and end of year clean up of portfolios and high levels of cash leading into 2025