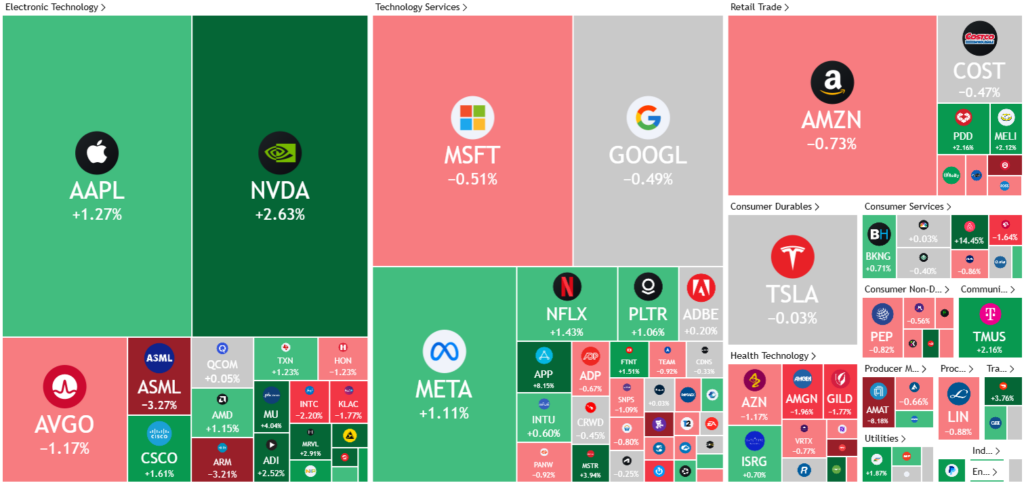

U.S. Stock Futures Edge Higher in Holiday-Thinned Trade; Focus on Tariffs and Fed Policy

U.S. stock index futures inched higher in light trading on Monday evening, as markets assessed the impact of potential trade tariffs and the Federal Reserve’s interest rate outlook. Trading volumes remained subdued due to a U.S. market holiday, limiting fresh catalysts from Wall Street.

As of 18:55 ET (23:55 GMT), S&P 500 Futures rose 0.2% to 6,141.0 points, Nasdaq 100 Futures gained 0.1% to 22,220.0 points, and Dow Jones Futures advanced 0.2% to 44,712.0 points.

Investor attention remained on former President Donald Trump’s commitment to reciprocal tariffs, which would match duties imposed by trading partners. Trump reiterated that VAT-based tax systems in Europe and Asia could be considered tariffs, raising concerns over global trade tensions. The proposed duties, set to take effect in April, could drive inflation higher as importers absorb the costs.

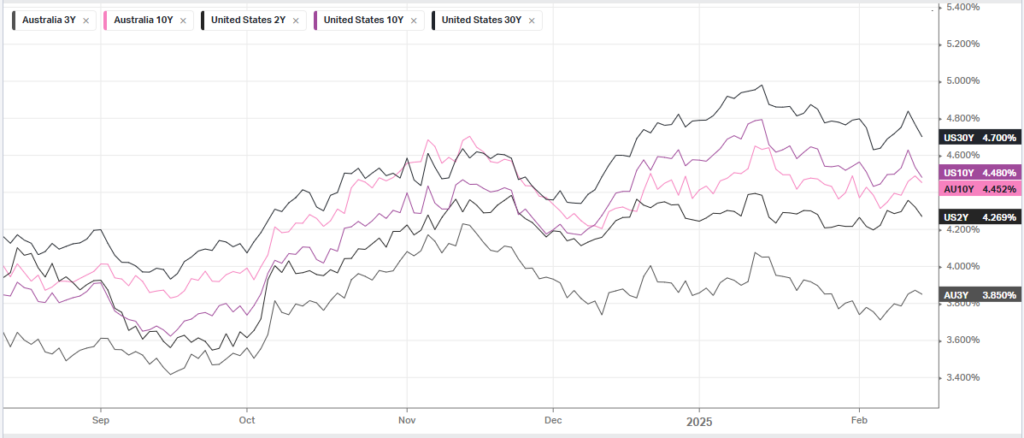

Meanwhile, Federal Reserve Governor Christopher Waller downplayed inflationary risks from the tariffs but emphasized that interest rates should remain unchanged in the near term. He cited persistent inflation and labor market strength as key considerations. The Fed left rates steady in January and is expected to maintain its stance following cumulative rate cuts of 1% in 2024.

ASX SPI 8513 (+0.02%)

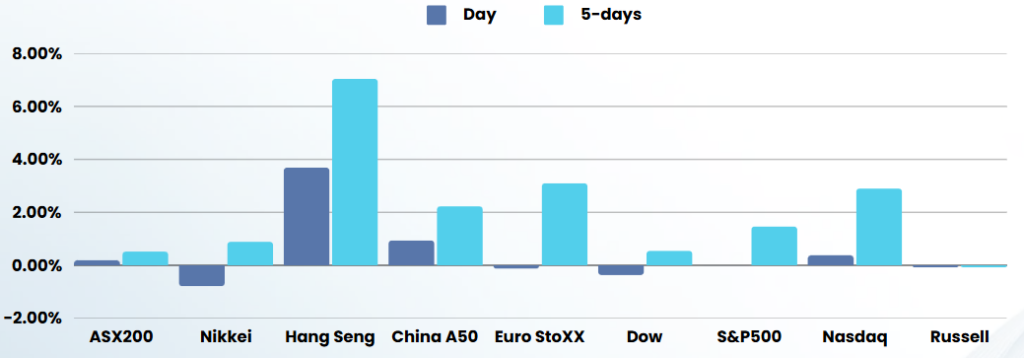

ASX Slips as Property and Energy Stocks Weigh on Market

The S&P/ASX 200 fell 0.5% (42.7 points) to 8,494.40 on Tuesday, driven by declines in property and energy stocks. The Australian dollar eased to US63.44¢ after reaching a two-month high on Monday.

Woodside dropped 1.9%, signaling a potential 20% shortfall in its final dividend. Real estate stocks declined following weak earnings from Dexus, with Scentre falling 2% and Mirvac down 1.6%.

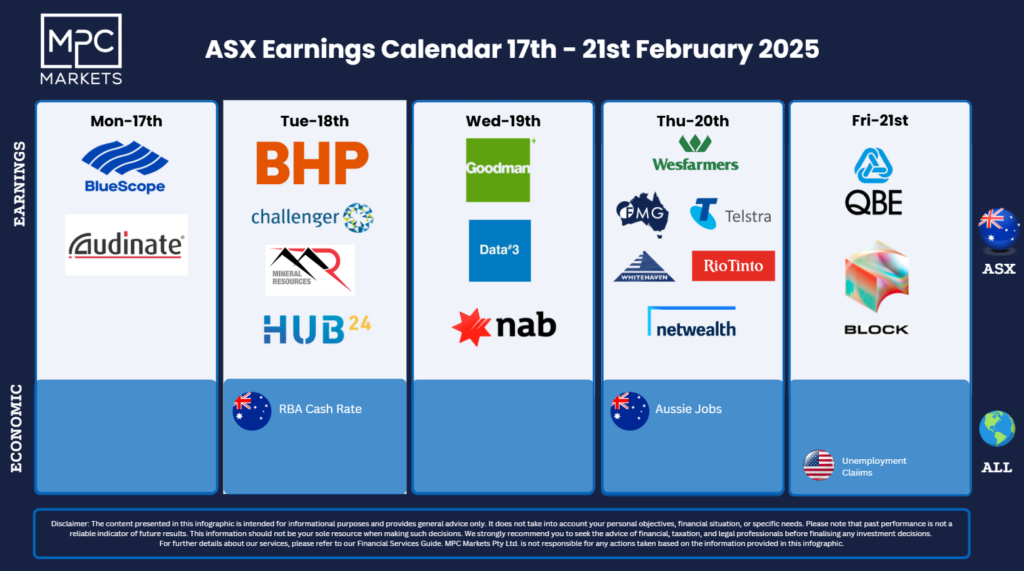

Challenger plunged 10.3% despite a 12% profit increase, while Hub24 gained 7.4% on strong earnings and a 30% dividend hike. Markets await the RBA’s expected rate cut and Governor Michele Bullock’s commentary on reinflation risks.