Overnight – Strong jobs numbers reinforce “goldilocks” scenario

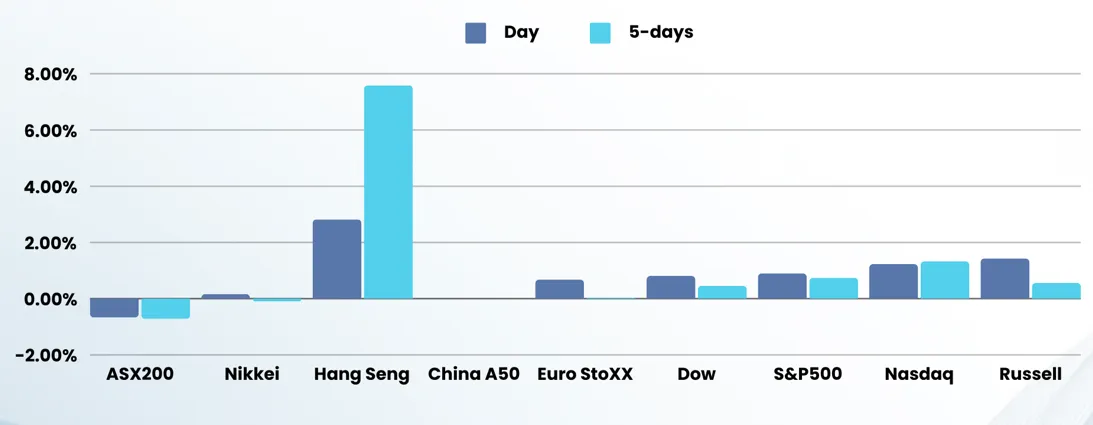

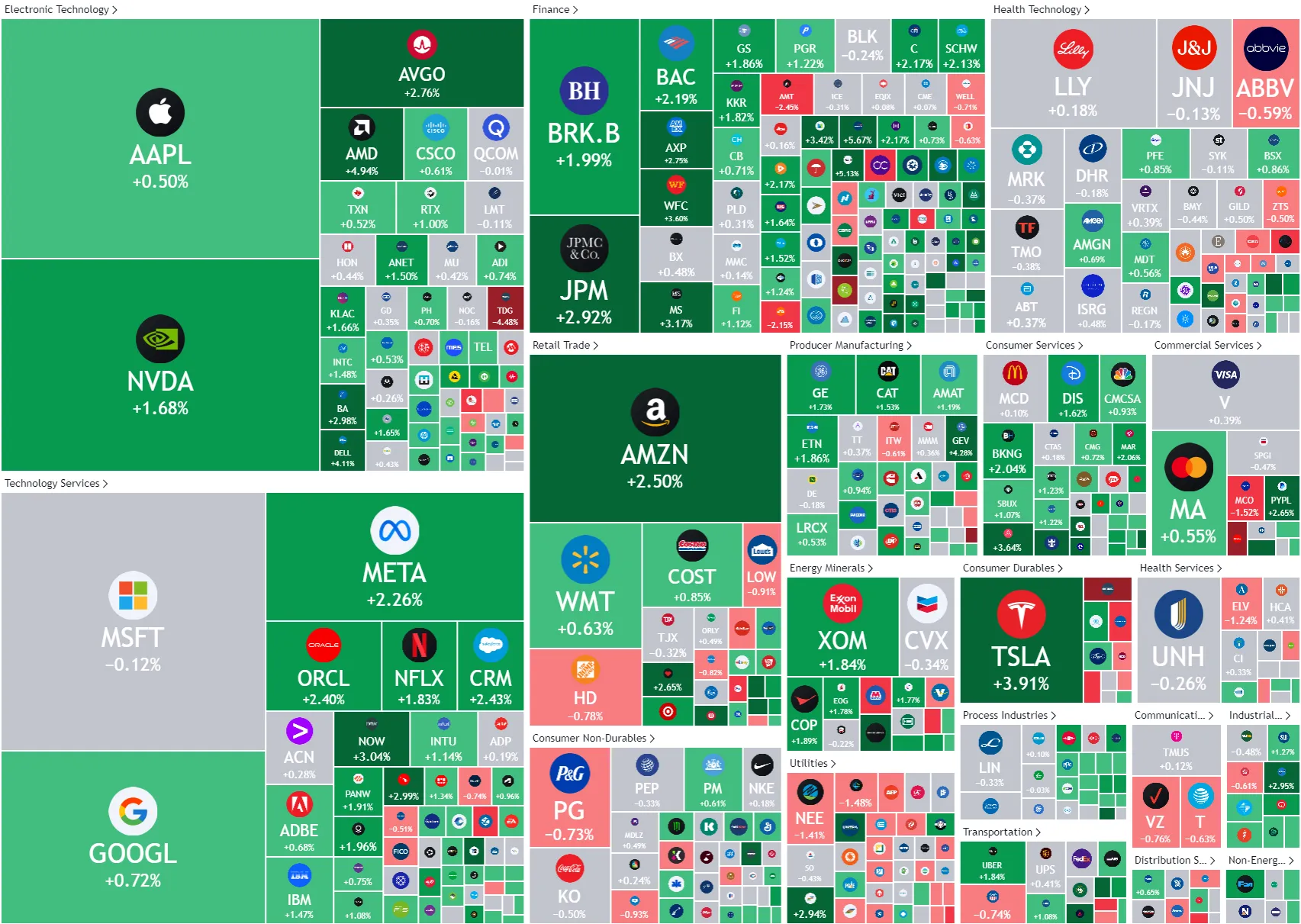

Stocks headed higher on Friday as the US jobs numbers showed resilience in the economy, putting to bed any further calls for 50bps at the November meeting

Wall Street responded positively to the jobs report, with the Dow Jones Industrial Average reaching a record closing high of 42,352.75, up 0.81%. The S&P 500 and Nasdaq Composite also made gains, rising 0.90% and 1.22% respectively. The dollar index jumped to a seven-week high, reflecting both the strong jobs data and geopolitical risks. In the commodities market, gold prices slipped as expectations for a large Fed rate cut diminished. The reopening of U.S. East Coast and Gulf Coast ports following a wage deal settlement brought additional relief to the U.S. economy, although clearing cargo backlogs is expected to take time.

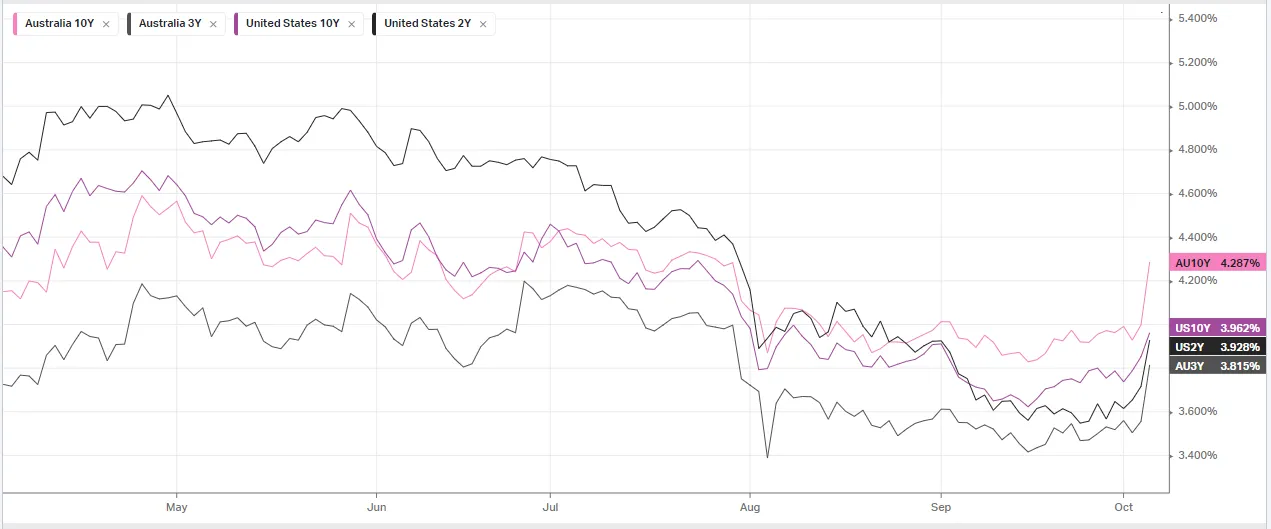

The U.S. labor market showed unexpected strength in September, with nonfarm payrolls increasing by 254,000 jobs, surpassing economists’ estimates of 140,000. The unemployment rate fell to 4.1%, below expectations, while August job growth was revised higher. This robust jobs report led to a significant shift in market expectations regarding Federal Reserve policy, with traders now anticipating a 97% probability of a quarter-point rate cut in November, up from 68% the previous day. The strong employment data also caused U.S. Treasury yields to rise to their highest levels since early August.

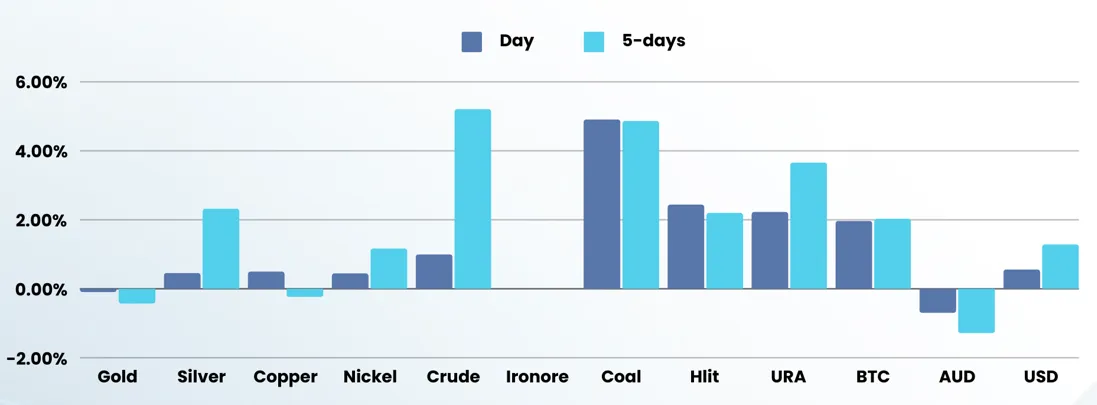

Oil prices and geopolitical tensions dominated market sentiment this week, with crude oil experiencing its largest weekly gain in over a year due to escalating Middle East conflicts. The threat of a region-wide war pushed prices higher, but gains were tempered by U.S. President Joe Biden’s discouragement of Israeli strikes on Iranian oil facilities. Despite these tensions, oil prices settled with moderate increases, with U.S. crude up 0.9% at $74.38 per barrel and Brent crude rising 0.55% to $78.05 per barrel.

ASX SPI 8251 (+0.31%)

It should be a quiet day on the ASX today with many states on a public holiday.

We should see broad strength, but must watch for any significant movements when China rejoins global markets after a 7-day break.