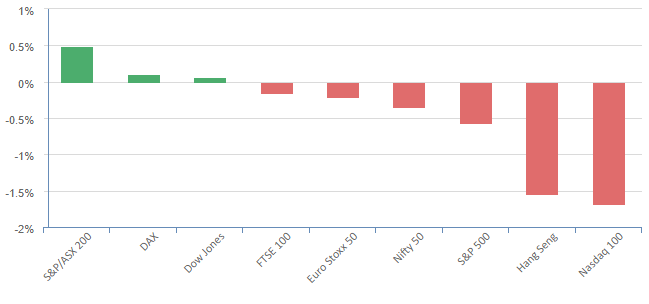

Overnight – US stocks start the year in “not so magnificent” fashion

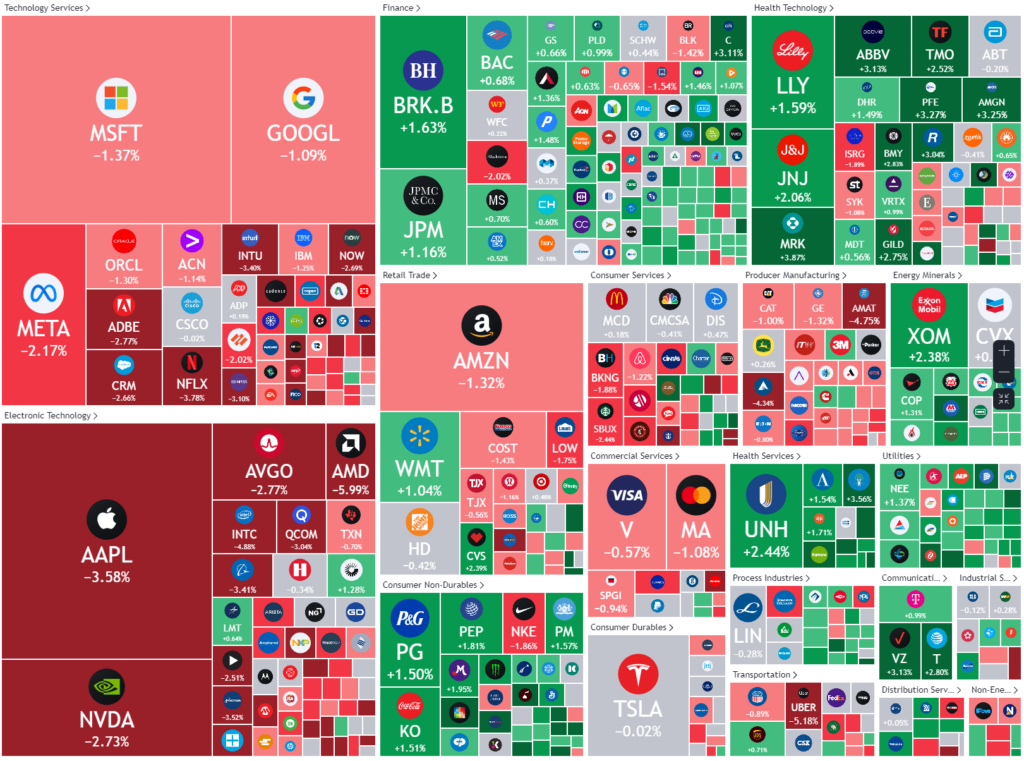

Much like the Christmas and NY hangover most of us are feeling, US Stocks trimmed some fat from the Santa rally with the “Magnificent 7” leading the move down as Apple was downgraded by Barclays, triggered a 4% fall in the stock while other M7 constituents, Nvidia, Meta and Microsoft fell around 2%

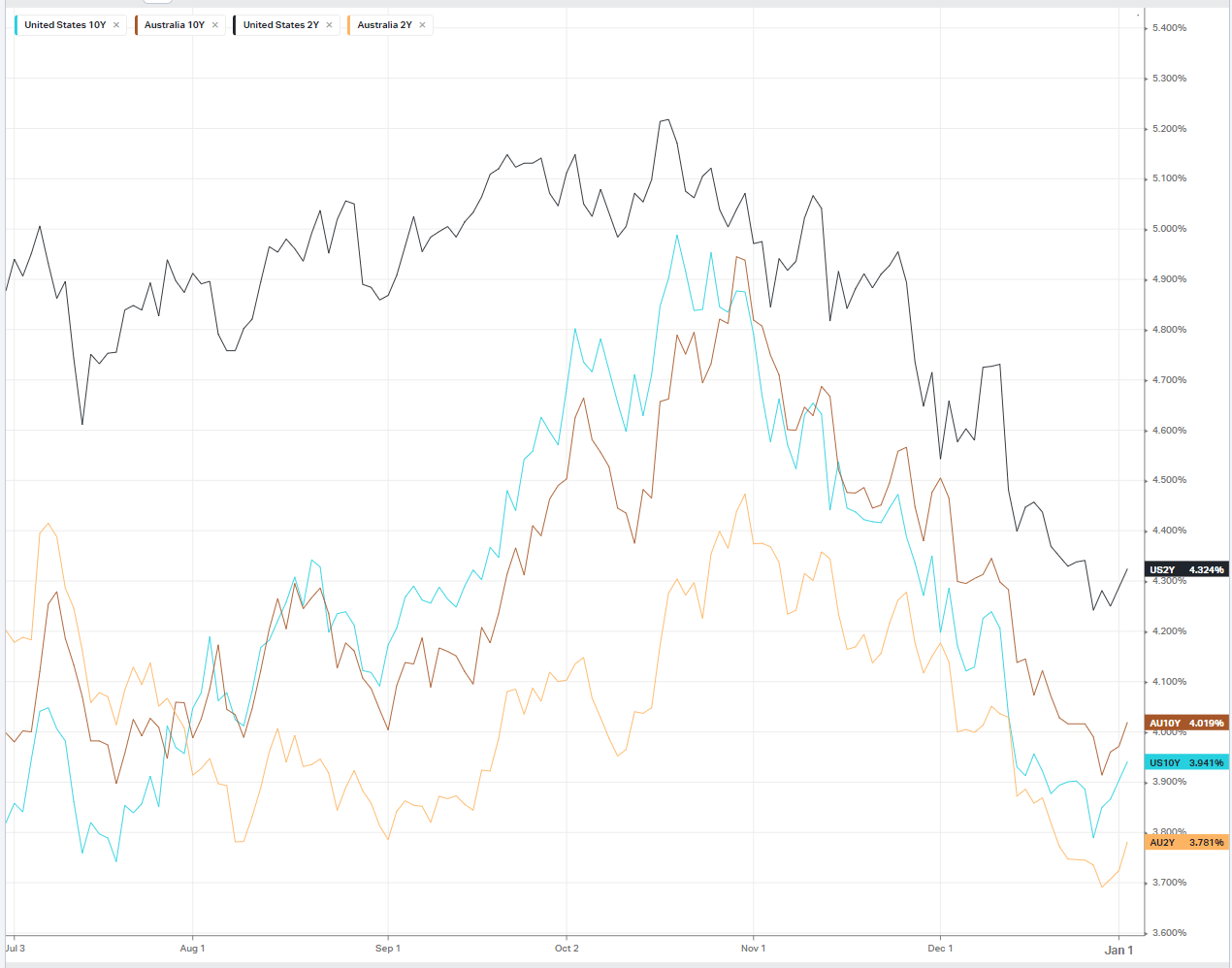

equities were pressured on Tuesday as U.S. Treasury yields climbed, with the yield on 10-year notes ticking above 4.000% to a two-week high before easing slightly. The Treasury move reflects investors’ realizing they may have gotten o over excited in their expectations around cuts this year in US, which weighed on growth stocks – among them tech stocks.

Meanwhile banking stocks were upgraded by Citi and non-cyclical Healthcare stocks finished positive on the night, in stark contrast to the growth end of the market.

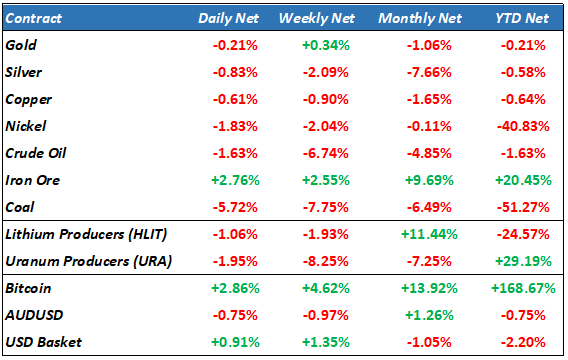

The USD rallied, dragging down commodity prices, while oil prices eased from the early highs prompted by potential US/Iran issues in the Red Sea to finish down as concerns around supply issues eased

S&P 500 - Heatmap

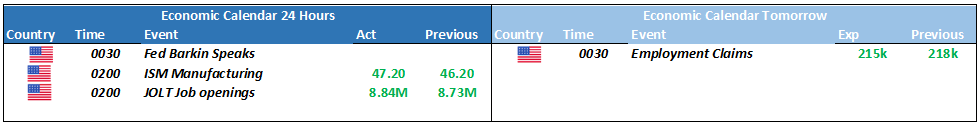

The Day Ahead

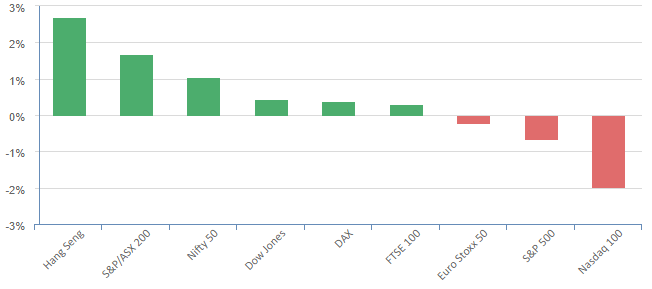

ASX SPI 7539 (-1.01%)

The ASX is likely to open lower with futures pointing to a 1% drop. However, this will likely be a buying opportunity as the rally in Iron ore, banking and healthcare stocks make up the lions share of our index, while the weakest sector overnight, the tech sector, is very little.

While the ASX200 just fell shy of a record close, we expect the underlying nature of our value based index should not fall as rapidly as the speculation fuelled, eye wateringly high PE stocks in the Nasdaq

- Infratil said its investment in CDC Data Centres has jumped by $133 million in the October to December period, taking the total valuation to a mid-point of $4 billion, up from $3.8 billion three months ago. CDC affirmed its FY 2024 earnings guidance of $260 million to $270 million.

- Strike Energy has delivered 33 terajules of gas from the Walyering gas field in WA in December, in an “operational milestone” following maintenance which limited deliveries. Strike and Alinta Energy are joint venture partners in the Walyering project.