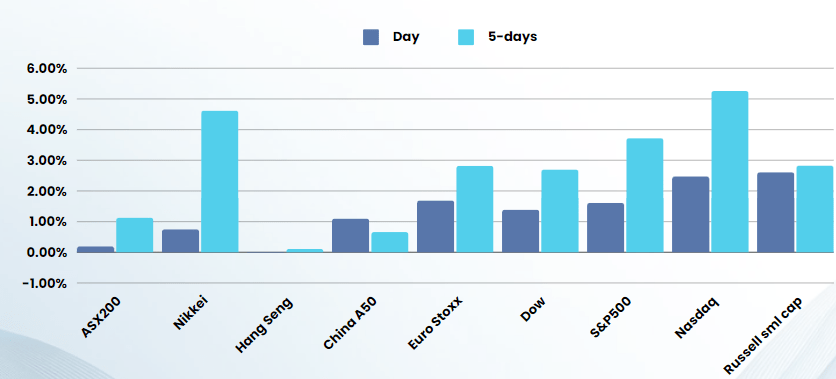

Last Night's Market Recap

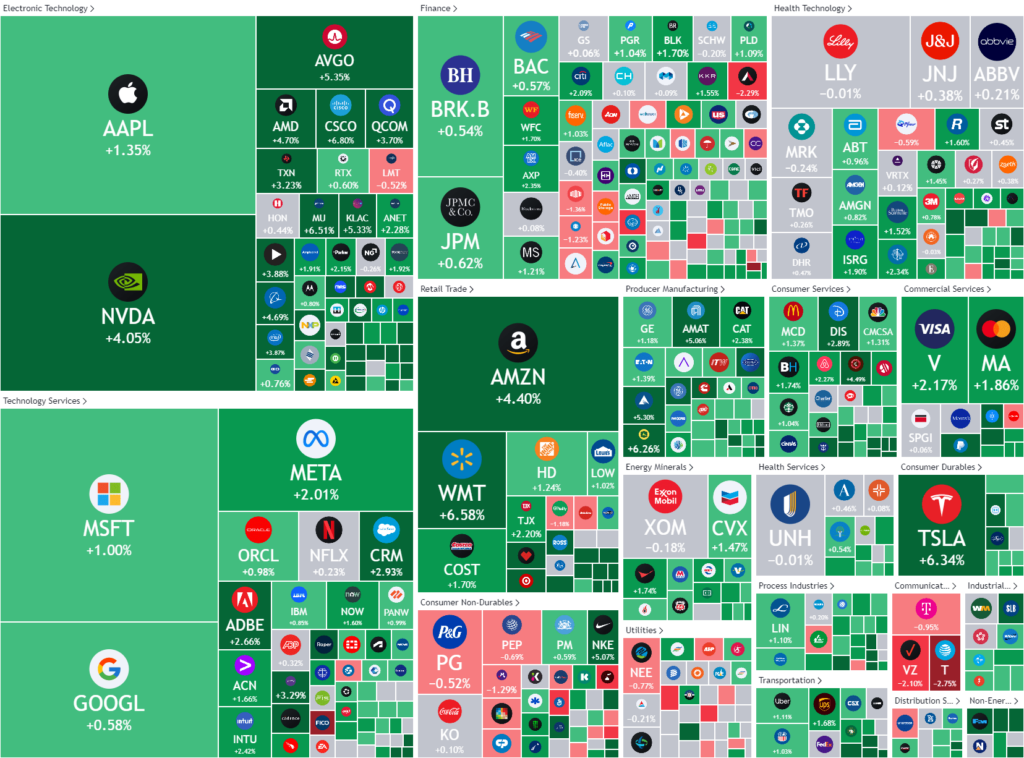

S&P 500 - Heatmap

Overnight – “What recession?” Retail sales show US consumer still spending

Stocks closed higher for the sixth straight session Thursday, as fears of an economic slowdown were dispelled following stronger-than-expected labor market and retail sales data.

U.S. retail sales rose by a larger than expected amount in July, pointing to resilience in consumer spending activity, allaying fears of an imminent recession in the world’s biggest economy. Retail sales rose by 1% last month, accelerating from an unchanged reading in June, according to Commerce Department data released earlier Thursday, more than the 0.4% expected. On an annual basis, retail sales rose by 2.7%, having increased by a revised lower 2.0% in June.

On the labour market front, the number of Americans filing new applications for unemployment benefits fell last week, reinforcing concerns of a gradual softening of the labour market. Softer CPI and producer price index readings this week suggested inflation was cooling, raising expectations of an interest rate cut in September.

With the annual Jackson Hole Symposium (junket) starting next Friday the market thinks Fed Chairman Jerome Powell is likely lay out the case for rate cuts starting September when he takes to the stage at the annual central bank symposium in Jackson Hole, Wy., slated for next week but the Fed chief is expected to stress that cuts would be “orderly,” downplaying the prospect of a 50 basis point cut next month. We think the recent strength in the consumer and above target inflation (albeit softening) means there is no rush for the central bank to make any decisions, especially leading into an election in November

Company specific

- Walmart +7% – the retail giant, often considered as a bellwether for retail demand, reported its second-quarter earnings on Thursday, topping analyst expectations, driven by robust e-commerce growth and improved margins.

- Cisco Systems +5.6% – the networking equipment giant reported better-than-expected fourth-quarter earnings and announced a restructuring plan.

Bonds

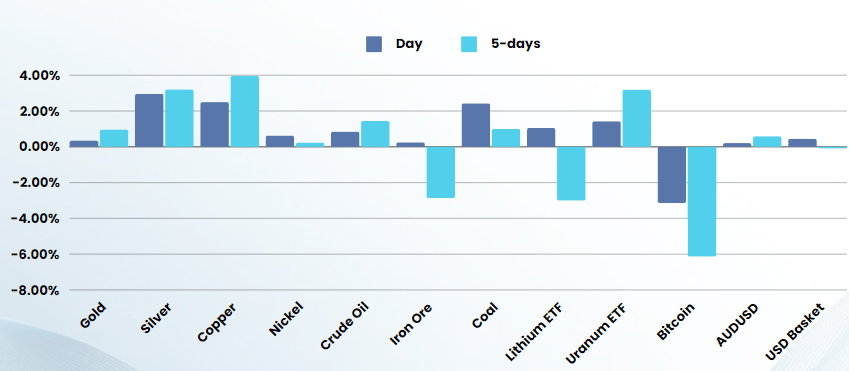

Commodities & FX

The Day Ahead

ASX SPI 7888 (+0.98%)

Commodities made a mild recovery overnight which will help the market higher after heavy selling in the Iron ore focused miners this week. The resilient consumer domestically and abroad will delay the expected rate cuts in the US and put further pressure on the RBA to hike rates, particularly after the strong jobs data in AU yesterday

Tone of Earnings so far – this week has proven that good results AND optimistic outlook for “market darlings” are heavily rewarded. Any form of “miss” or reduction in guidance, or poor to conservative outlooks are punished.

Earnings will be in focus with the following companies due to report

Company Earnings: Amcor (AMC) | GQG Partners (GQG) | Domain Holdings (DGH) | ASX (ASX)

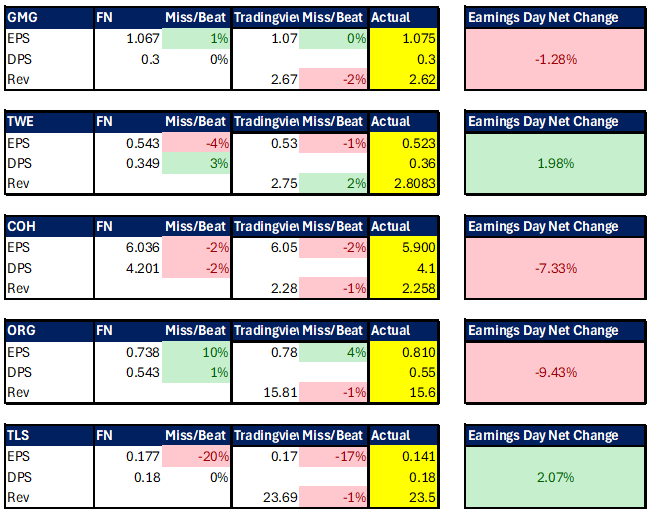

Yesterdays Key Earnings Results: