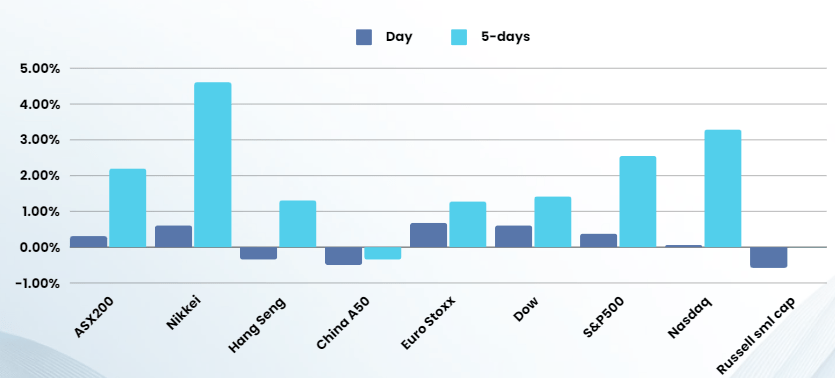

Last Night's Market Recap

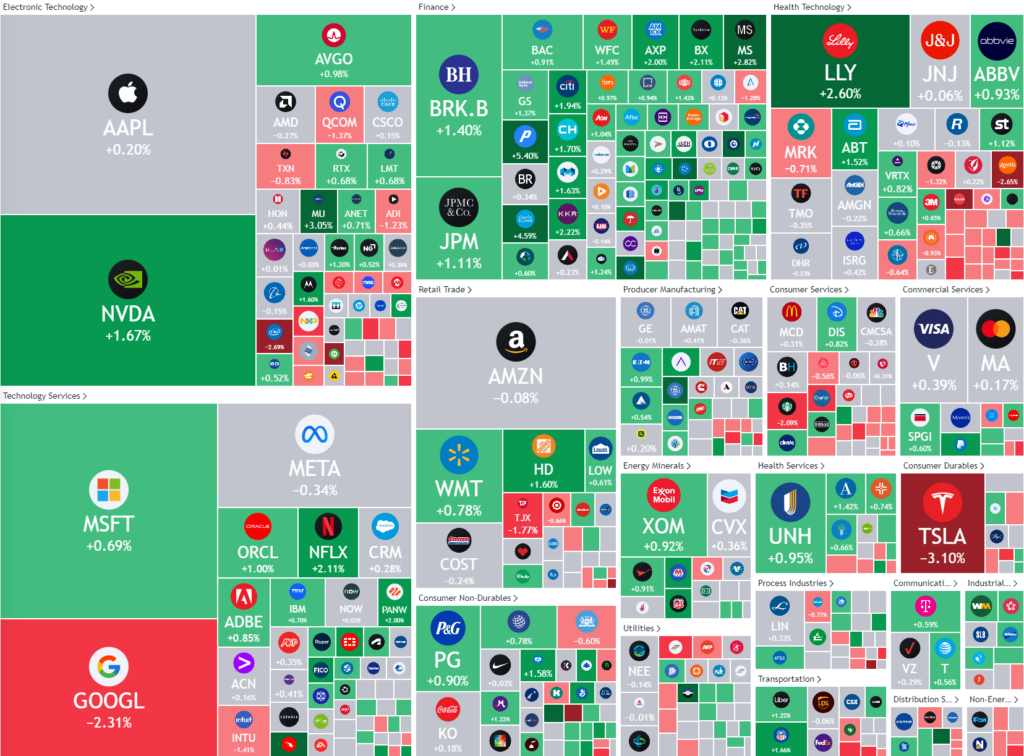

S&P 500 - Heatmap

Overnight – Stocks drift higher as Investors put Inflation in the rear-view mirror

Stocks drifted higher driven by encouraging data showing a continued slowdown in inflation. This has raised expectations that the Federal Reserve might soon begin cutting interest rates, potentially as early as next month.

The latest Consumer Price Index (CPI) revealed that inflation slowed to an annual rate of 2.9% in July, down slightly from 3.0% in June, aligning with economists’ predictions. Excluding the volatile categories of food and fuel, the “core” CPI rose by 3.2% over the past year, just below the expected 3.3%. This data comes on the heels of a cooler-than-expected Producer Price Index (PPI) for July, signaling that the Fed’s efforts to control inflation through aggressive rate hikes are starting to take effect. Jefferies noted that the Fed has been seeking evidence that its policies are impacting demand and inflation, with recent data confirming this trend.

In corporate news, Intel disclosed that it sold its 1.18 million share stake in British chipmaker Arm Holdings during the second quarter, as revealed in a regulatory filing. This move follows Intel’s earlier decision to implement significant cost-cutting measures, including a 15% reduction in its workforce and the suspension of its dividend, due to a decrease in traditional data center semiconductor spending and a shift toward AI-focused chips.

Alphabet Inc., the parent company of Google, saw its shares drop by 2% after a Bloomberg report suggested that the U.S. Department of Justice (DOJ) is considering actions to curb Google’s dominance in online search, with the possibility of pursuing a breakup of the company. This potential legal action adds to the increasing regulatory pressure on Google as it faces ongoing scrutiny over antitrust concerns.

Cisco Systems reported better-than-expected earnings for the fourth quarter, which boosted its stock by about 5% in after-hours trading. The company posted adjusted earnings per share of $0.87, exceeding analysts’ estimates of $0.85, with revenue slightly above expectations at $13.6 billion, though this marked a 10% decline from the previous year. Cisco also announced a restructuring plan involving job cuts, with expected pre-tax charges of up to $1 billion for severance and other termination benefits, the majority of which will be recognized in the first quarter of fiscal 2025.

These developments highlight a period of economic transition, with cooling inflation influencing Federal Reserve policy while companies like Intel, Alphabet, and Cisco respond to changing market conditions and regulatory challenges.

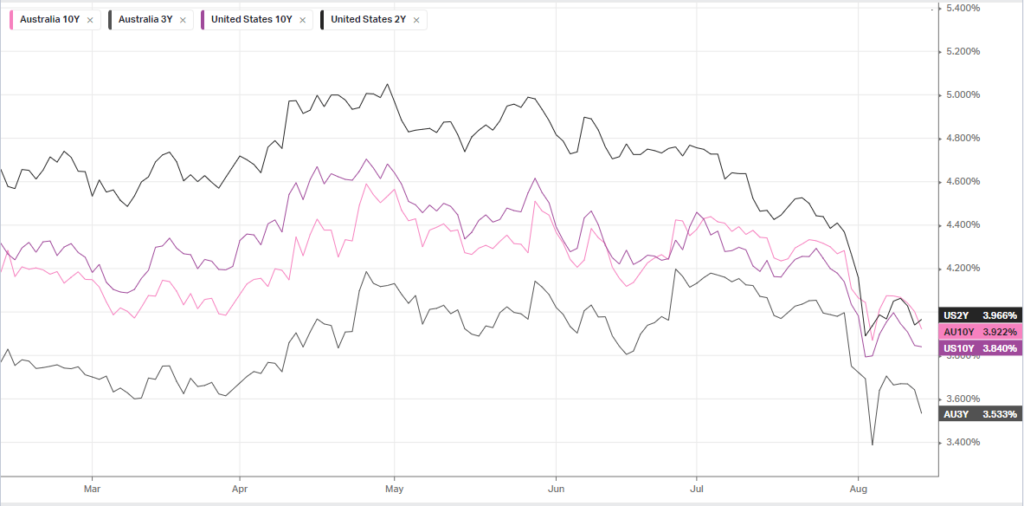

Bonds

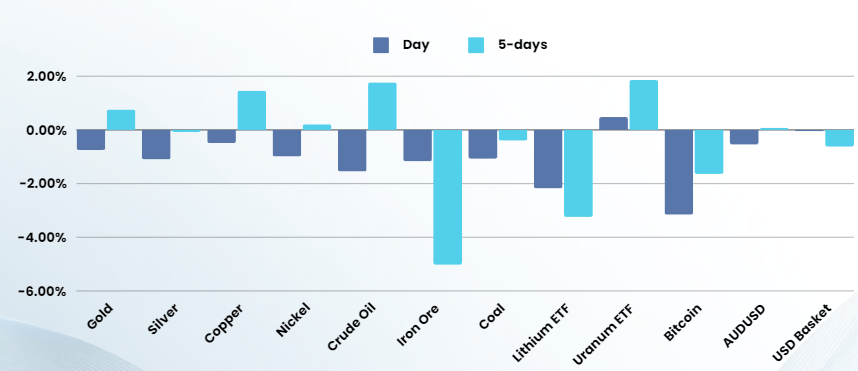

Commodities & FX

The Day Ahead

ASX SPI 7832 (+0.35%)

we will be dragged down by the materials sector broadly today, however with some large weighted companies reporting/reported in the last few days, earnings results and broker moves will likely drive the market

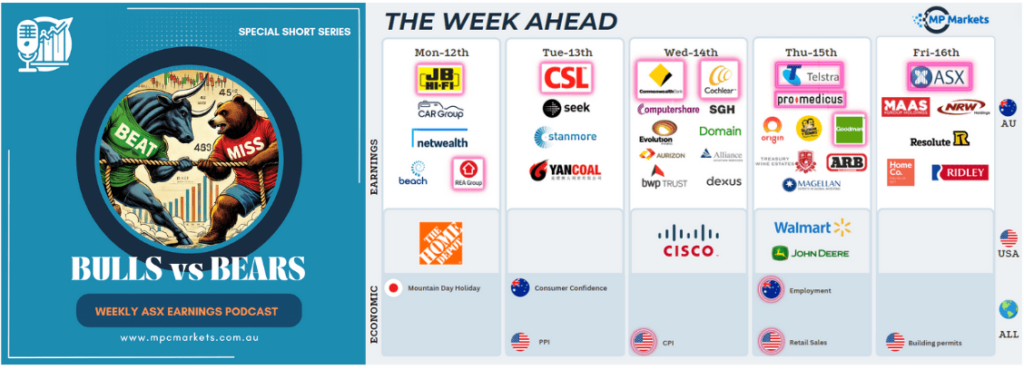

Earnings will be in focus with the following companies due to report

Company Earnings: Goodman Group (GMG) | Telstra (TLS) | Cochlear (COH) | Treasury Wines (TWE) | Origin (ORG)

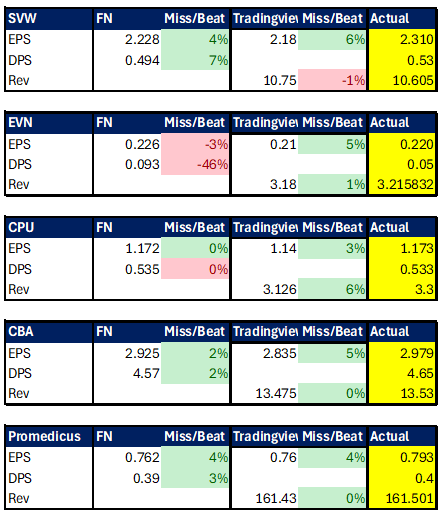

Results versus expectations for yesterdays results below