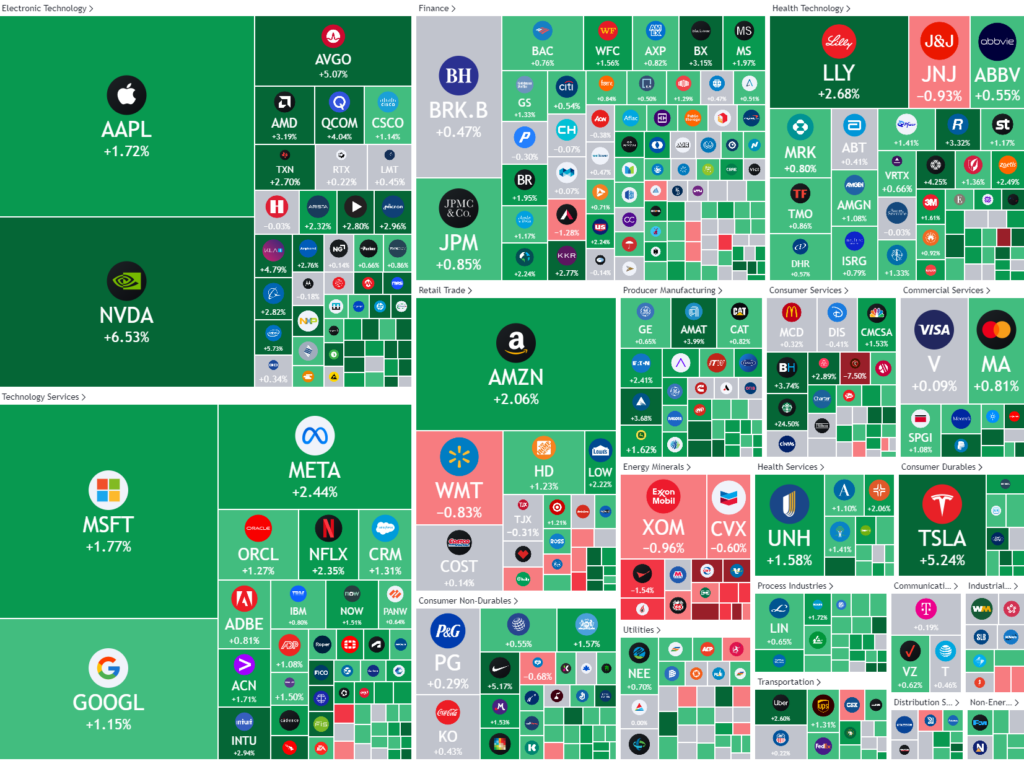

Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Stocks rally as inflation shows further signs of easing

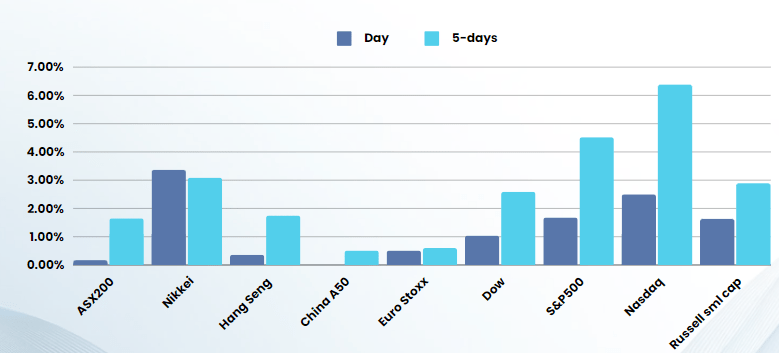

Stocks surged overnight as fresh evidence of easing inflation bolstered expectations for a Federal Reserve rate cut as early as next month, causing Treasury yields to drop.

US Producer prices softened in July ahead of CPI release tomorrow, with the data revealing that PPI increased by 0.1% in July on a monthly basis, below the 0.2% rise economists had forecast. On an annual basis, it rose to 2.2%, slightly under the estimated 2.3%. Excluding volatile food and energy prices, “core” PPI remained unchanged from the previous month, against an anticipated 0.2% increase. Annually, core PPI was at 2.4%, compared to the expected 2.7% rise. A cooler-than-anticipated PPI report offered support for those advocating a near-term rate cut

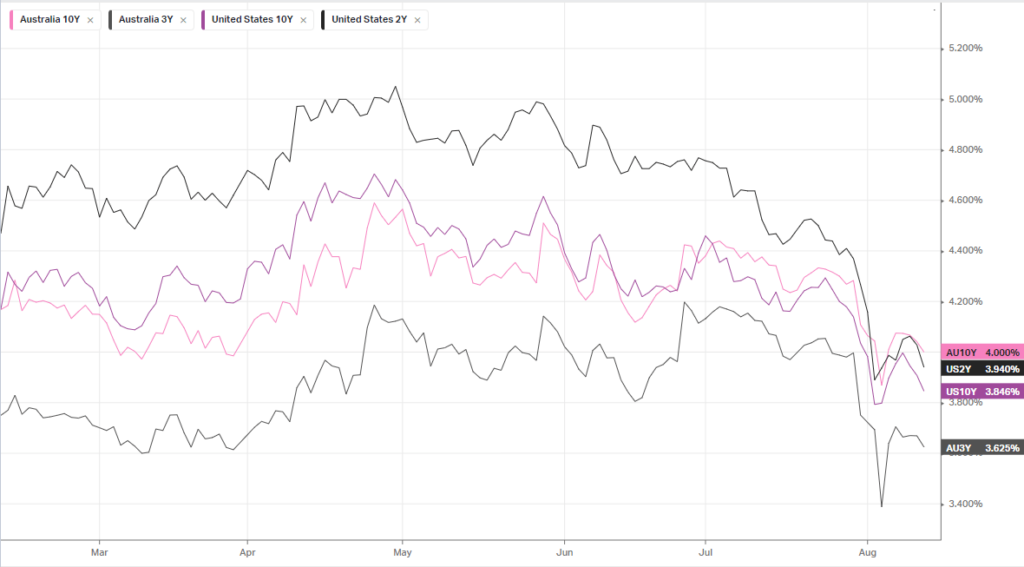

Treasury yields fell significantly as investor confidence in a September rate cut grew, with the odds of a 25 basis point cut at 45%, while a larger cut is priced at 55%.

The reaction to the inflation data seems to be overly optimistic, with the market already pricing in “under control” inflation for months. We see the focus switching to leading indicators, with figures like employment and retail sales (on Friday) likely to start having more of an influence

Oil capped its biggest daily gain since October as fears of a potential Iranian response to last month’s assassination of a Hamas leader in Tehran outweighed a dip in broader markets. The US has prepared for what could be significant attacks by Iran or its proxies in the Middle East as soon as this week, White House national security spokesman John Kirby said on Monday.

Bonds

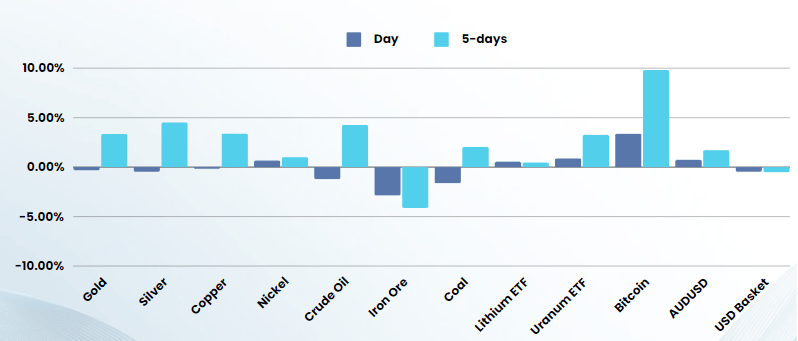

Commodities & FX

The Day Ahead

ASX SPI 7827 (+0.73%)

We are likely to see a broadly firmer market following the offshore lead.

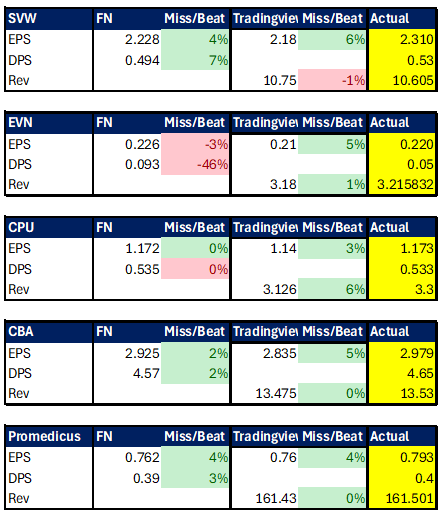

Earnings will be in focus with the following companies due to report

Company Earnings: Commonwealth Bank (CBA) | Computershare (CPU) | Cochlear (COH) | Evolution (EVN) | Domain (DGH)

Results versus expectations below

CBA Results initial

CBA Results: The overall tone of the investor presentation was one of cautious optimism, with a focus on disciplined execution and maintaining strong capital and credit positions.

- Expectations: The analyst sentiment was mixed, with a general expectation of solid performance but concerns about valuation and the ability to meet high market expectations(CBA Expectations Aug 20…).

Comparison: The results largely met expectations, though they did not significantly outperform. The cautious tone in the investor presentation reflects the broader sentiment of the analysts, who were skeptical about substantial outperformance given the high expectations.

In summary, CBA’s actual results were generally in line with analyst expectations, with some areas slightly exceeding expectations (like dividends) and others, such as profitability, reflecting the anticipated challenges.