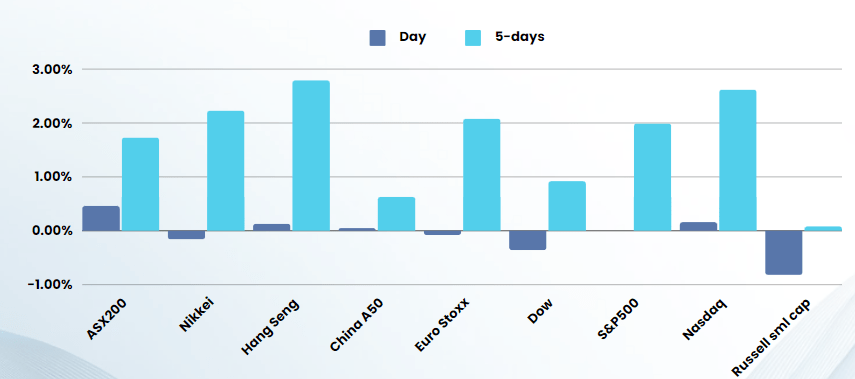

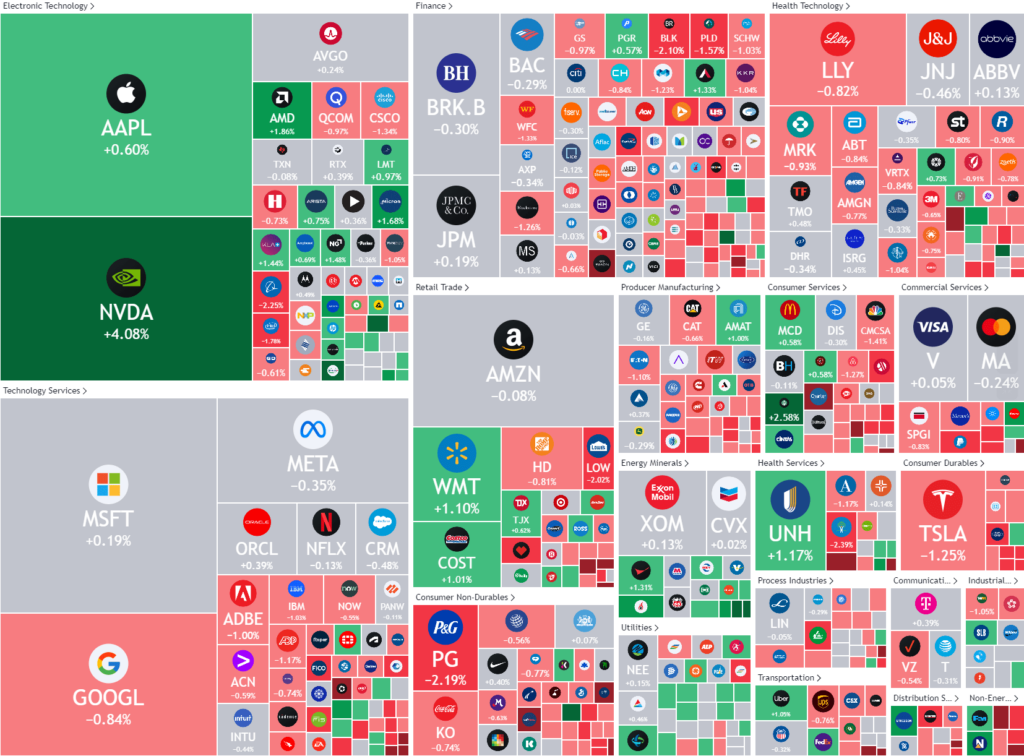

Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Investors take a welcome breather ahead of inflation data

Investors took a welcome breather to start the week as key inflation data is due over the next few days

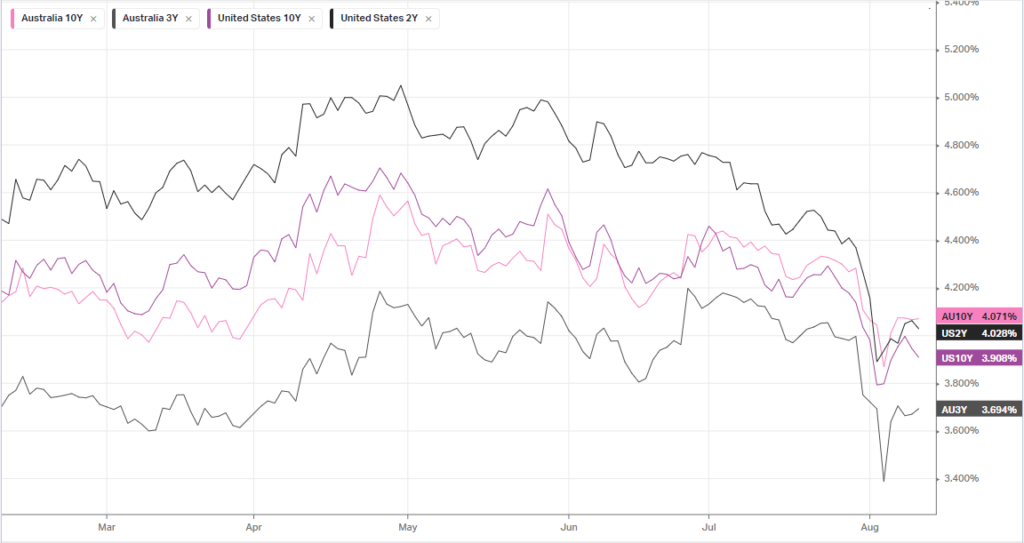

The focus this week is squarely on consumer price index inflation data, due on Wednesday, for more cues on the economy and cooling inflation. The reading is expected to have cooled slightly in July from the prior month – a trend that is likely to ramp up optimism over lower interest rates. The Federal Reserve is widely expected to begin cutting rates in September, amid growing signs of a cooling U.S. economy, but investors are split over whether the U.S. central bank will authorise a 25 basis point or 50 basis point cut. The Fed recently signalled that any more encouraging economic data will set the stage for a September rate cut, and that it did not need to see inflation reaching its 2% annual target to begin trimming rates.

US earnings is now winding down with some earnings are also on tap this week, although the quarterly earnings season has now mostly wound down, with Home Depot and Cisco Systems are set to report in the coming days. Earnings season has been mostly positive, according Factset, of the 91% of the companies in the S&P 500 that reported earnings for Q2 so far, about 78% reported a positive EPS surprise.

Oil capped its biggest daily gain since October as fears of a potential Iranian response to last month’s assassination of a Hamas leader in Tehran outweighed a dip in broader markets. The US has prepared for what could be significant attacks by Iran or its proxies in the Middle East as soon as this week, White House national security spokesman John Kirby said on Monday.

Company specific

- Riley Financial Inc (RILY) -52% – lost half its $500m value overnight after the investment bank said it’s suspending its dividend due partly to the fallout from a loan it provided to help the former chief executive of Franchise Group Inc. acquire the company last year

Bonds

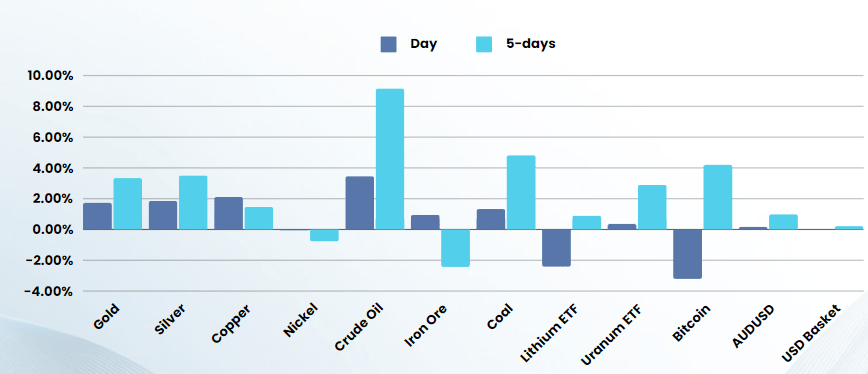

Commodities & FX

The Day Ahead

ASX SPI 7759 (+0.00%)

We are likely to see a bid tone to the market today as commodities and the energy sector recover on middle east fears and general positivity on earnings so far this week

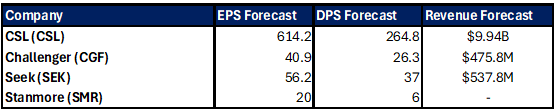

Earnings will be in focus with the following companies due to report

Company Earnings: CSL (CSL) | Seek (SEK) | Stanmore (SMR) | Yancoal (YAL) | Challenger (CGF)

Tone of Earnings so far – Looking very binary so far this earnings season, with good results AND optimistic outlook rewarded. Poor results and poor outlooks have been punished.

“Outlook” is the buzz word this earnings season with changing economic conditions ahead. Last half results will be relevant to any form of “miss” but for a “beat” it could be considered “rear-view mirror”