Last Night's Market Recap

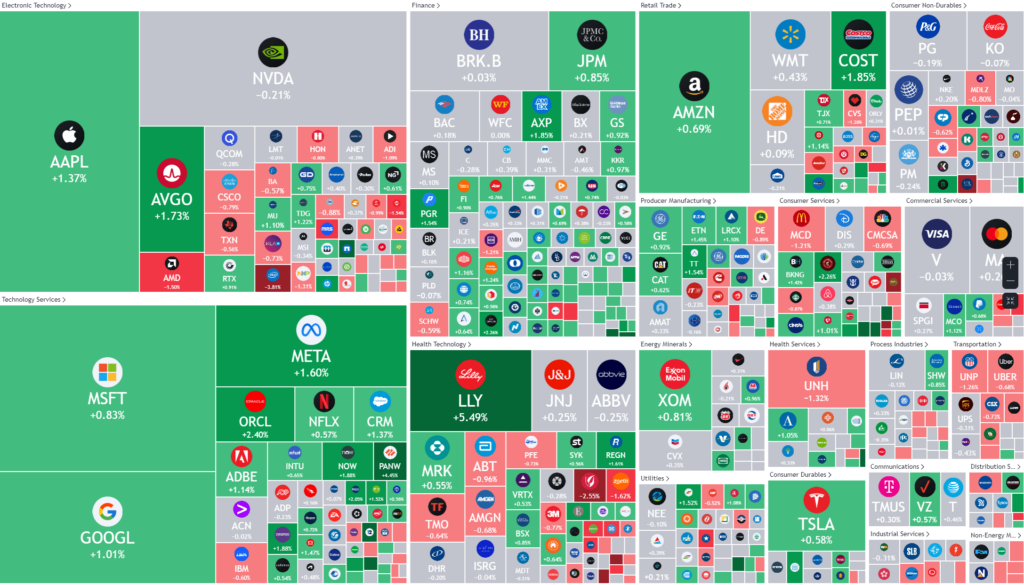

S&P 500 - Heatmap

Overnight – Both Bulls and Bears battered after tumultuous week as stocks finish almost unchanged

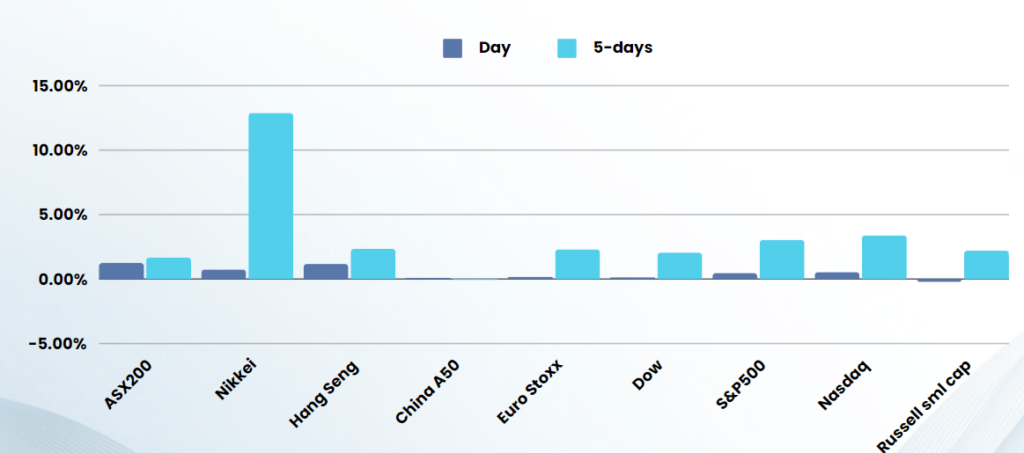

Both bearish and bullish Investors were battered and bruised this week as the recovery in stocks continued following a major selloff earlier this week when concerns about an incoming recession took center stage and a recovery in the latter half of the week left us largely unchanged

Wall Street has few major cues left to trade on as the week draws to a close, and thus focus is now turning to key consumer price index inflation data due next week. The reading comes amid increased conviction that U.S. inflation is easing and will give the Federal Reserve enough confidence to begin cutting interest rates from September. Recent fears of a recession saw traders bet that the Fed will cut rates by an outsized 50 basis points next month, compared to earlier expectations for a 25 basis point cut, CME Fedwatch showed.

Amidst the various macroeconomic factors driving up cross-asset volatility in recent weeks, concerns about AI spending have further impacted equities. As such, Nvidia’s Q2 earnings on August 28 will be closely watched, as they “may hold the fate of the Big Tech vs. rotation trade,” strategists noted.

Retailers are fueling a summer rush of imports to the United States this year as companies guard against a potential strike by port workers and ongoing shipping disruptions from attacks in the Red Sea ahead of a shortened holiday shopping season. Container imports and freight rates surged in July, signaling an earlier than usual peak season for an ocean shipping industry that handles about 80% of global trade. July is expected to be the peak for U.S. retailers, which account for about half of that trade, and August is expected to be almost as robust, analysts said.

The S&P 500 and Nasdaq are now each up about 12% since Dec. 31, and the selloff has made tech stocks less expensive based on price-to-earnings ratios.

Both Bulls and Bears battered after tumultuous week as stocks finish almost unchanged

Company specific

- Take-Two Interactive +4.4% – videogame publisher climbed 4.4% as it expects net bookings to grow in fiscal years 2026 and 2027.

- Expedia +10.2% – after the online travel agency beat analysts’ expectations for second-quarter profit.

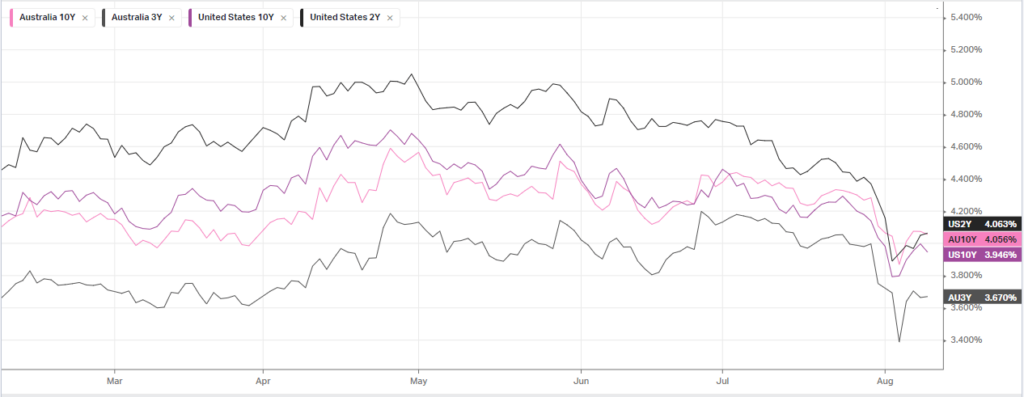

Bonds

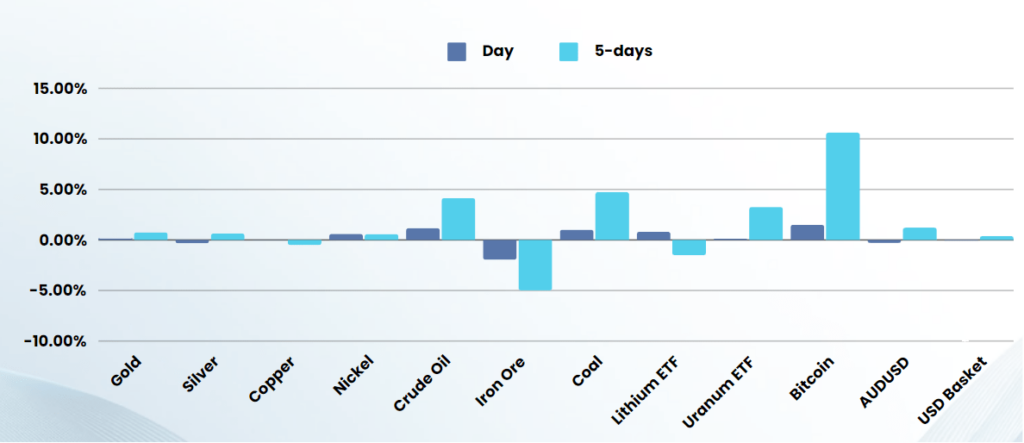

Commodities & FX

The Day Ahead

ASX SPI 7781 (+0.59%)

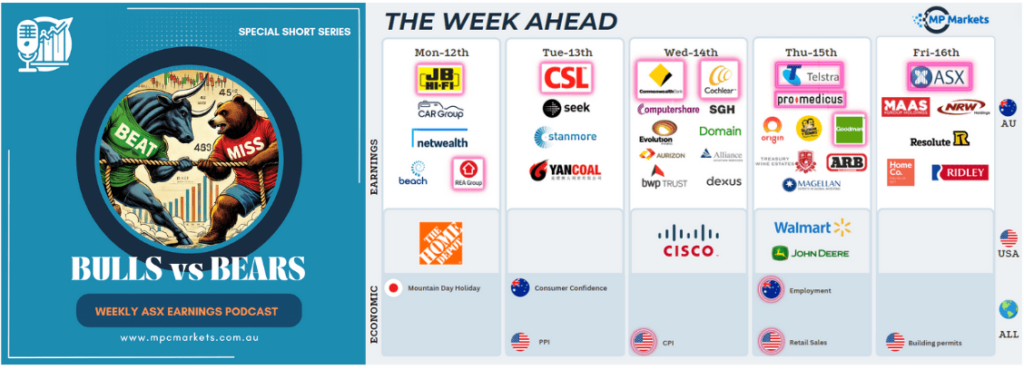

Earnings will be the big focus of this week with major names like CBA, Cohlear, Goodman Group, Promedicus, JB HiFi

“Outlook” will be the buzz word this earnings season with changing economic conditions making last half results more “rear-view mirror”

Company Earnings: JB HiFi (JBH) Netwealth (NWL) Carsales (CAR)