Last Night's Market Recap

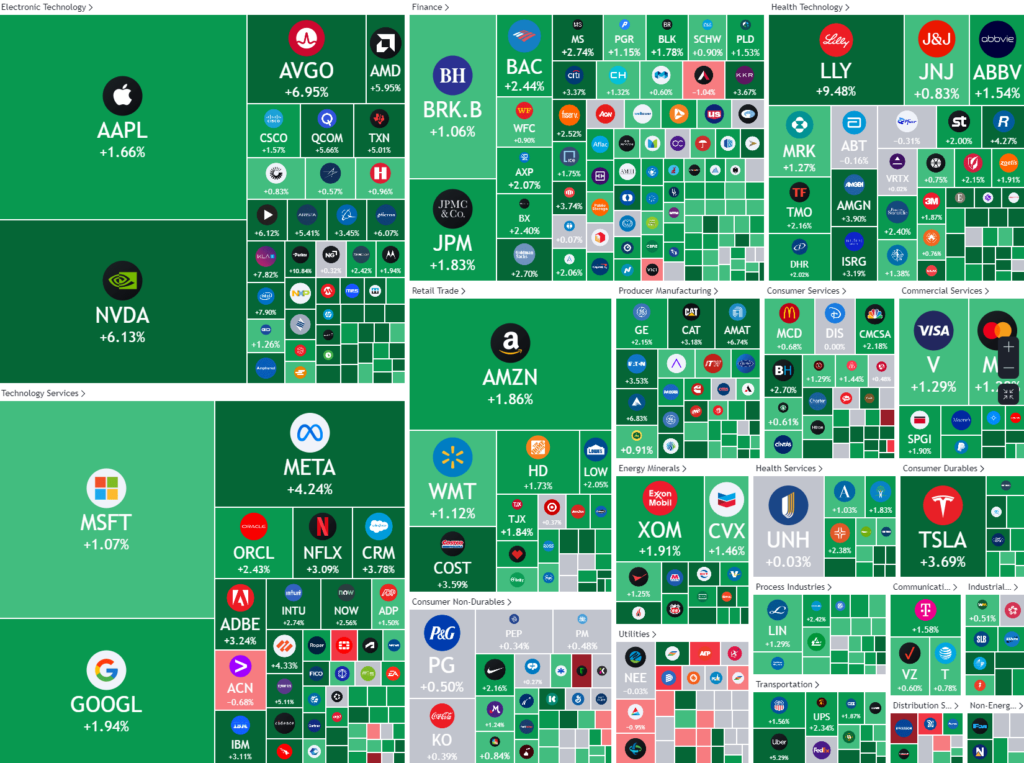

S&P 500 - Heatmap

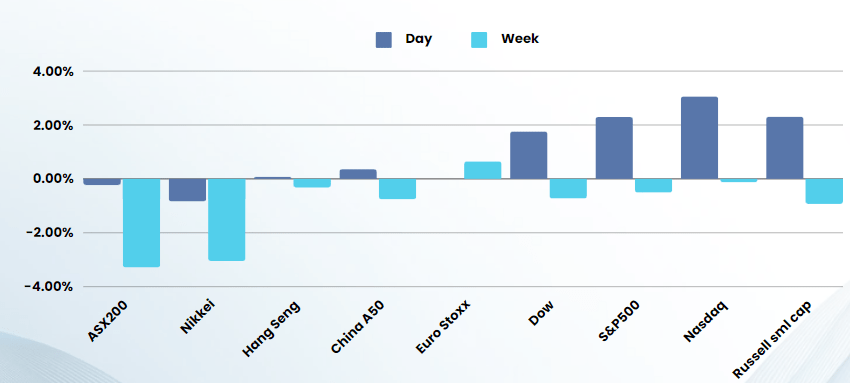

Overnight – Better than expected Labour data hoses down recession fears

Investors breathed a sigh of relief as better-than-feared labor market data cooled worries that a recession may be on the horizon.

Data released earlier Thursday showed the number of Americans filing new applications for unemployment benefits came in at 233,000 for the week ended Aug. 3. This was below the 241,000 expected, and a reduction from the revised 250,000 the prior week, which was an 11-month high. The report eased jitters about weakness in the labour market following last week’s soft nonfarm payrolls report. The main Wall Street indices have suffered steep losses over the past few weeks, with the Nasdaq having entered correction territory, on increasing fears of a recession, following a slew of weak readings on the labour market and business activity.

Richmond Fed president Thomas Barkin on Thursday downplayed calls for urgent rate-cutting action, and said the Fed has time to wait to assess the pace of slowing in the economy. The Fed has “some time” to assess whether this is an economy that’s “gently moving into a normalizing state … or one where you really do have to lean into it,” Barkin said Thursday at a virtual event put on by the National Association for Business Economics.

Around three-quarters of the global carry trade, the trigger for the huge spike in volatility early in the week, has been removed, JPMorgan strategists said in a Wednesday note. In their recent report, JPMorgan noted that the risk-reward for global carry is low due to the upcoming US elections and the potential repricing of funders on lower US rates. Also, they pointed out that rates momentum is expected to turn more significantly against G10 carry, which favours a rotation to value.

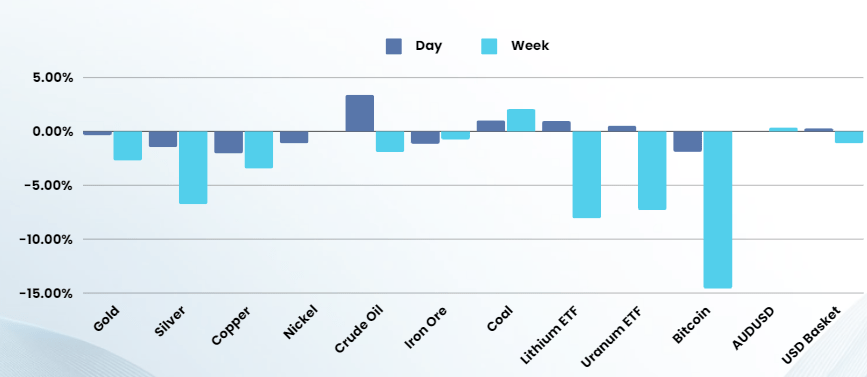

Oil prices settled higher on Thursday for the third consecutive session, after U.S. jobs data eased demand concerns and war in the Middle East helped prices recover from an eight-month low on Monday. Poor Chinese economic data has kept commodities pinned down, however the “stimulus hopes” sentiment is likely to creep back in

Company specific

- Eli Lilly +9% – after the drug maker raised its annual profit forecast and sales of its popular weight-loss drug Zepbound crossed $1 billion for the first time in a quarter.

- Bumble -29% – after the online dating agency cut its annual revenue growth forecast, sparking worries about its growth plans. “The path to returning to year over year revenue growth remains unclear which in-turn provides limited valuation support [for the share price,” UBS said in a Thursday note.

- Warner Bros -9% – the entertainment giant reported a quarterly net loss of $10 billion, announcing it has written down the value of its traditional television networks by $9.1 billion, a dramatic recognition of how fast streaming is eroding the cable business model. “The likely loss of NBA rights is expected to drive downside to networks advertising and affiliate estimates,” UBS said as it cut its forecast on the company’s EBITDA for 2024 to $9.1B from $9.5B.

- Under Armour +19% – after reporting quarterly earnings topped Wall Street estimates and the sportswear giant full-year earnings guidance also surprised to the upside.

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7722 (+1.06%)

After an exhausting week of volatility, the US market has nearly recovered what was looking like a disaster just 4 days ago. The ASX has recovered very little of the heavy losses, mainly due to commodity prices and Big4 bank losses. We expect commodity prices to recover, despite soft Chinese data, as recession fears are unwound

“Outlook” will be the buzz word this earnings season with changing economic conditions making last half results more “rear-view mirror”

Company Earnings: Life360 (360) | QBE Insurance (QBE) | REA Group (REA) | Nick Scali (NCK) | NewsCorp (NWSA)

- QBE (QBE) – has doubled its after-tax profits in the half year to June 30 to $US802 million ($528 million) and declared a 24c interim dividend, up from 14¢ in the 2023 period, as lower catastrophe costs boosted the bottom line. “Premium growth continued through rate increases and targeted new business growth,” the company said in an ASX disclosure, though the benefits were partly offset by sales of its offshore businesses. Chief executive Andrew Horton said the closure of the middle-market North American business had allowed for “portfolio optimisation”.