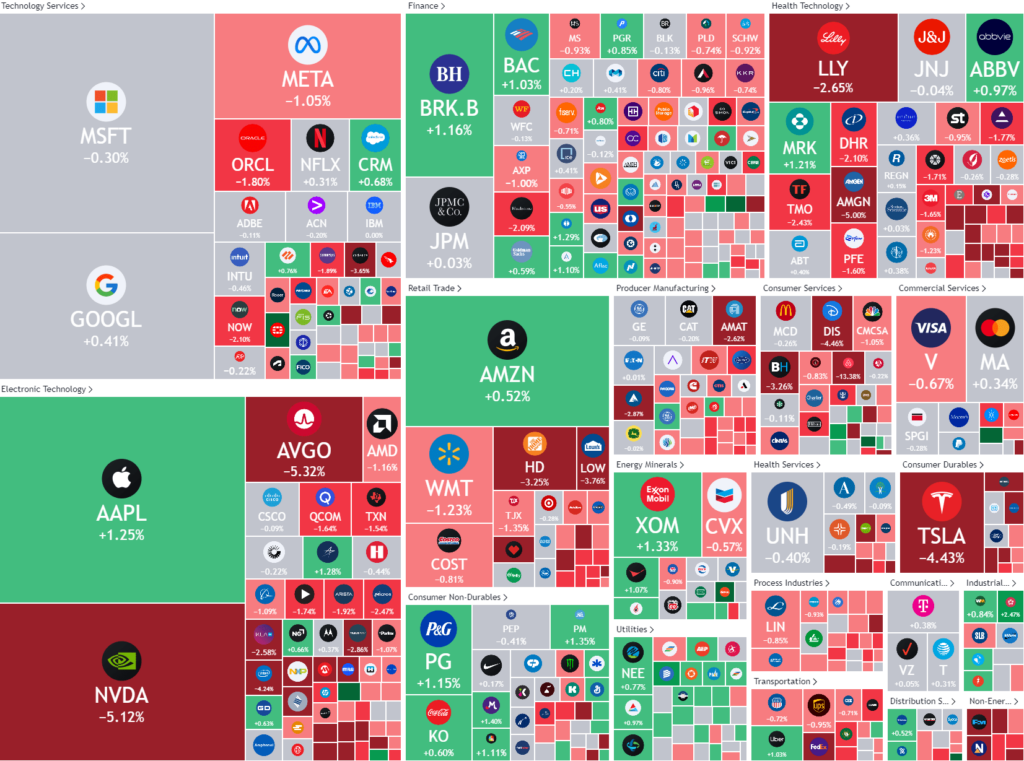

Last Night's Market Recap

S&P 500 - Heatmap

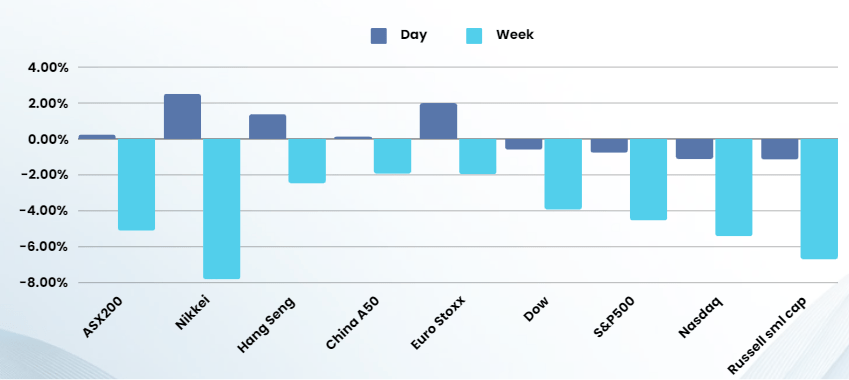

Overnight – “Buy the dip” sentiment fades fast as risks weigh on markets

Investors enthusiasm to “buy the dip” faded within one session as equites turned lower mid-session in the US on a slump in Super Micro Computer pressured chips stocks, weighing on the broader market.

Super Micro Computer stock fell 20% after the data center operator’s June quarter earnings missed estimates, raising more concerns over just how much demand the artificial intelligence industry was generating.

The last few days has seen some foolishly alarmist calls on interest rates, with the financial press jumping on calls for “emergency rate cuts” which is, at best reactionary, but realistically stupid. Goldman Sachs wrote a sensible assessment of the market overnight saying “Sentiment towards risk-driven assets remained frail amid persistent concerns over slowing growth and middling earnings. Goldman Sachs noted that its Financial Stress Index (FSI) has tightened significantly over the past two days but remains within normal historical levels. Most of the tightening has been driven by higher expected volatility in the equity and bond markets, while conditions in short-term funding markets have remained broadly stable. “So while market stress is noticeably higher than a week ago, our FSI suggests that there have been no serious market disruptions to date that would force policymakers to intervene.”

The resilience of S&P 500 earnings remains intact despite growing recession fears and recent negative price action, Citi strategists said in a Wednesday note. The bank’s Citi Economic Data Change index, which summarizes US macro data trends, is indicating further deterioration for the U.S. economy. But interestingly, while economic data was weak in 2022, S&P 500 earnings growth remained flat rather than severely negative, as rolling earnings recessions mitigated the overall index impact. Overall, the strategists maintain confidence in their $250 EPS forecast for the S&P 500 in 2024, which is slightly higher than the current bottom-up consensus of around $243.

Energy stocks led the market higher, underpinned by a jump in oil prices after data showed U.S. crude stocks fell more than expected in the week ended Aug. 2. The Energy Information Administration reported Wednesday that U.S. crude stocks fell by 3.7M barrels in the week through Aug. 2., compared with estimates for a 1.6M barrel decline.

Company specific

- Walt Disney -4% – after the entertainment giant reported a drop in profits at its Experiences segment that includes parks and consumer products, which makes up just over half of profit, even as its Entertainment unit, with the combined streaming businesses of Disney+, Hulu and ESPN+, posted a profit for the first time.

- Shopify +18% – after the e-commerce platform beat expectations for quarterly revenue, as its artificial intelligence-powered tools helped pull in more merchants to its e-commerce services.

- Airbnb -13% – after the house rental company forecast third-quarter revenue below estimates and warned of shorter booking windows, suggesting travelers were waiting until the last minute to book due to economic uncertainty.

Bonds

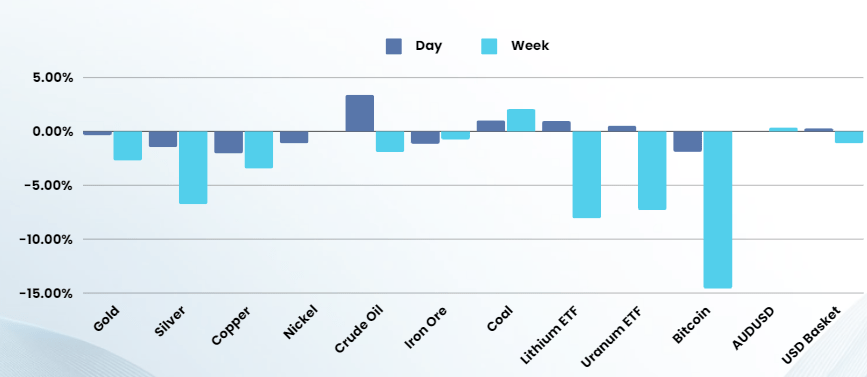

Commodities & FX

The Day Ahead

ASX SPI 7598 (-0.43%)

The ASX jumps into first gear for earnings today with 7 companies reporting earnings. This should provide a welcome distraction from the crazy start to the week, as investors focus on company fundamentals, rather than the broader moves created by financial markets instruments like the Yen and over-leveraged US investors

That said, the pace at which the “buy the dip” sentiment faded in the US is concerning so companies will need to be cautious about the wording of their releases.

“Outlook” will be the buzz word this earnings season with changing economic conditions making last half results more “rear-view mirror”

Company specific:

- Earnings results due today: AMP, Charter Hall Long Wale REIT, Light & Wonder, Mirvac, NexGen Energy, Piedmont Lithium and Transurban all deliver earnings results.