Last Night's Market Recap

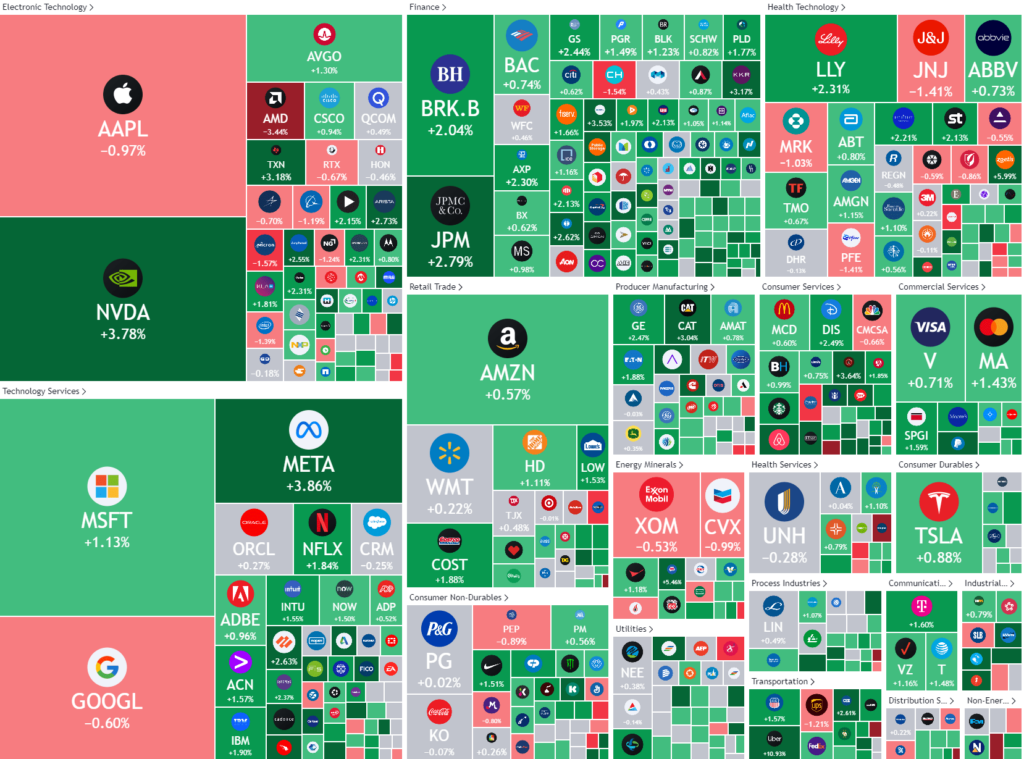

S&P 500 - Heatmap

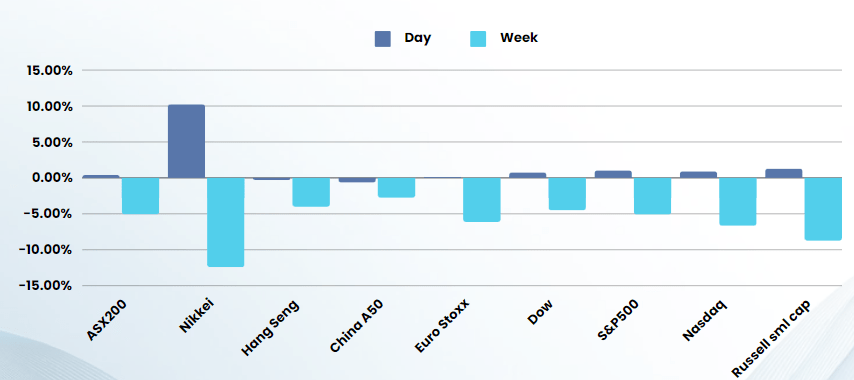

Overnight – Investors “Buy the Dip” as global markets stabilise

Global equites stabilized overnight as dip buyers piled into beaten down tech stocks following a rout a day earlier, though gains were limited amid lingers concerns about an economic slowdown.

Earlier the Nikkei’s roughly 10% rebound in Tokyo brought some relief after the index’s 12.4% drop on Monday kicked off a global rout with the Japanese benchmark’s biggest one-day sell-off since the 1987 Black Monday crash.

Tech stocks were led higher by a rebound in NVIDIA as bargain seeking investors bought the dip from a day earlier. The rebound in Nvidia comes even as reports suggest that the chipmaker is experiencing delays in rolling out its Blackwell chip. Chips will remain in focus Tuesday as Super Micro Computer reports quarterly earnings after the bell, with investors eager for cues on demand from the artificial intelligence industry. Apple, however, struggled to participant in the broader rally as investor sentiment remained soured after Warren Buffet cut his stake in the iPhone maker by nearly 50%.

U.S. Federal Reserve policymakers pushed back on Monday against the notion that weaker-than-expected July jobs data means the economy is in a recessionary freefall. Late on Monday San Francisco Fed President Mary Daly said the jobs report leaves “a little more room for confidence that we’re slowing but not falling off a cliff.” But she said it was “extremely important” to keep the jobs market from falling over.

Oil prices recovered after selling off on Monday. U.S. crude settled up 0.36% at $73.20 a barrel while Brent finished at $76.48 per barrel, up 0.24% on the day. In precious metals, gold prices fell as the dollar firmed and bond yields rose, although expectations of a U.S. rate cut in September and escalating Middle East tensions limited losses.

Company specific

- Uber +11% – the ride-hailing firm beat estimates for second-quarter revenue and core profit, helped by steady demand for its ride-sharing and food-delivery services.

- Caterpillar +3% – after the industrial giant reported a rise in quarterly adjusted profit, lifted by resilient demand for its larger excavators and other construction equipment against the backdrop of increased infrastructure spending in the U.S.

- Palantir Technologies +10% – the software services provider raised its annual revenue and profit forecast for the second time this year.

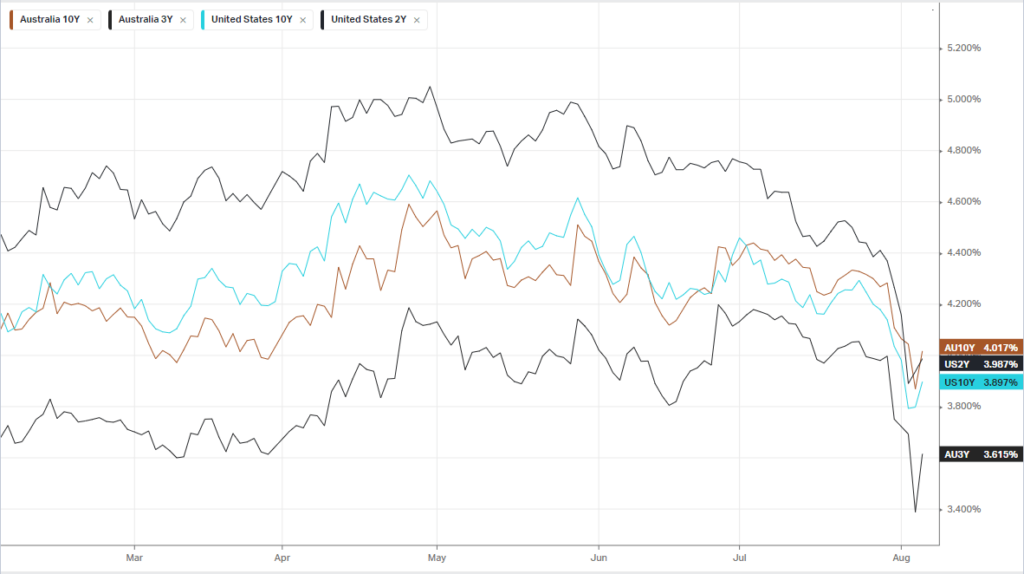

Bonds

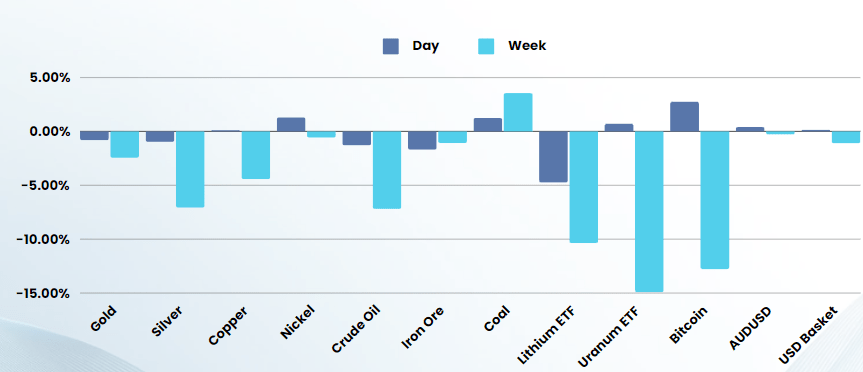

Commodities & FX

The Day Ahead

ASX SPI 7615 (-0.02%)

The local market is in for a calmer session today, with investors likely to be hunting for bargains in beaten down stocks from the last few sessions.

RBA Gov Michelle Bullock was very thankful for the timing of global volatility as it relieved pressure on the RBA’s decision to leave rates unchanged yesterday, rather than be forced into a humiliating hike. This should provide some support to interest rate sensitive sectors/stocks

Company specific:

- Audinate (AD8) – was punished yesterday for a stupidly timed guidance release. We expect the stock to find a base today and head back into the long term range. The result was fairly positive, although the company was realistic on their 2025 outlook, an unbelievably silly thing to do after the 3rd most volatile day in history

- Woodside (WDS) – Woodside punished as investors query ‘marginal’ green projects The oil and gas producer had almost $2.6 billion wiped off its market value as investors struggled to accept projected returns on a large US acquisition.