Last Night's Market Recap

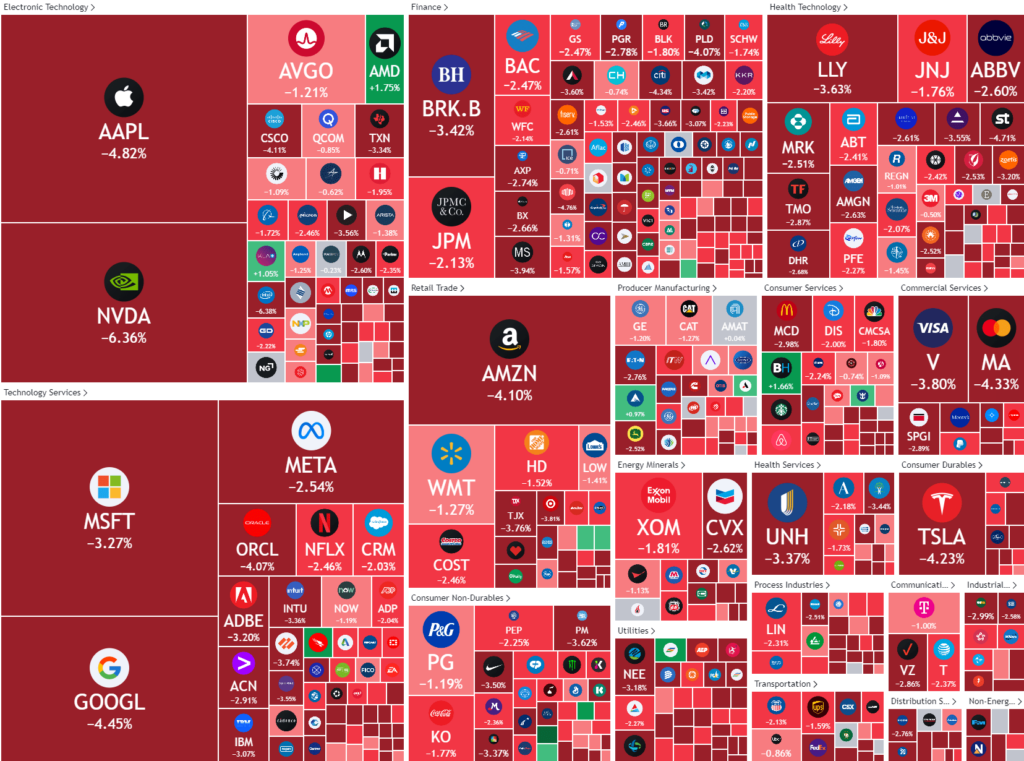

S&P 500 - Heatmap

Overnight – Equities implode as Japan stocks eclipse the ’87 Black Monday crash

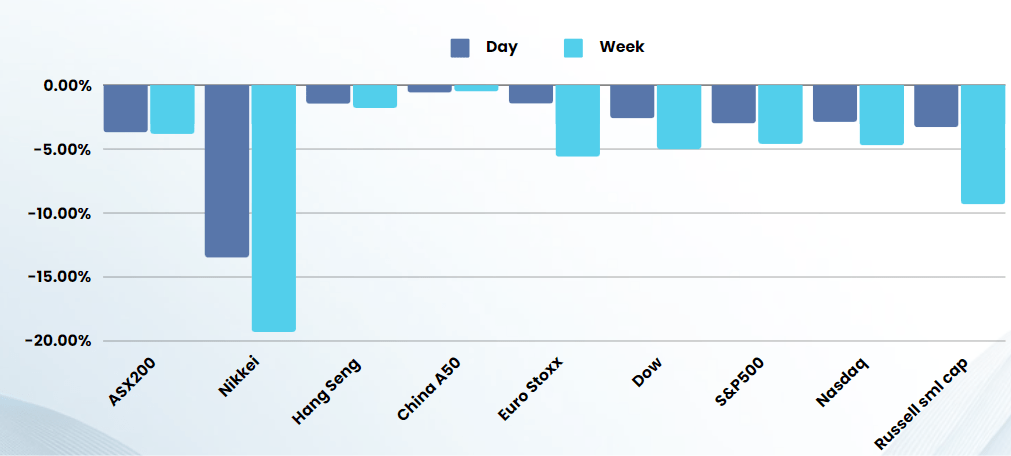

In one of the scariest sessions I’ve seen since the GFC, global equities imploded overnight, led by a 13.5% fall in Japan’s Nikkei, the largest fall since the Black Monday crash back in 1987

There is a lot to digest from overnight so I will start with some context on just how large moves in markets were last night

Key points

- VIX – 3rd largest spike ever

- Nikkei – largest single day drop eclipsing the ’87 Black Monday crash

- Nasdaq – Opened down 1050 points, the largest single day points drop ever

The hefty losses followed on last week’s selloff on fears of an economic slowdown and there was nowhere to hide as commodities, bonds, crypto and stocks all got hammered overnight, with the AI heavy Nasdaq opening the session down 5.5% or 1005 points, the largest 1-day points drop in history. The “fear and greed” index the VIX (Volatility index) registered its third highest “fear” reading in history on the open of the US session as investors scrambled. Thankfully the US session stabilized from that point, clawing back nearly half of the losses to finish down 3%

A string of weak readings ramped up concerns that the Federal Reserve had kept interest rates at elevated levels for too long, and that chances of a soft landing for the economy were fading. This notion came to a head on Friday after nonfarm payrolls data for July missed expectations by a wide margin, indicating a substantial cooling in the labor market. While the data did drive up hopes for more interest rate cuts by the Fed, it drained any appetite for risk-driven assets.

Chicago Federal Reserve President Austan Goolsbee stated on Monday that the central bank is prepared to respond to signs of economic weakness, hinting that current interest rates may be too prohibitive. Investors took this as a sign “emergency rate cuts” could be made, a ridiculous notion that indicates just how panicked markets were at stages overnight

The speed at which this market has turned has definitely blindsided investors, both institutional and retail. While MPC clients are already positioned defensively, for those who aren’t, we recommend reviewing your portfolio. Trimming growth stocks, consumer discretionary and cleaning out your non-performers is likely a smart move as “hope” isn’t an investment thesis

Company specific

- Apple stock fell over 4% after Warren Buffett’s Berkshire Hathaway unloaded nearly half of its stake in the iPhone maker as part of a broader selloff of stocks.

- Alphabet, meanwhile, fell more than 6% after a Federal judge on Monday ruled that Google is “monopolist” and violated antitrust laws in search and text advertising markets.

- Nvidia stock fell 7% after reports of a delay in the launch of the chipmaker’s upcoming artificial-intelligence chips due to design flaws.

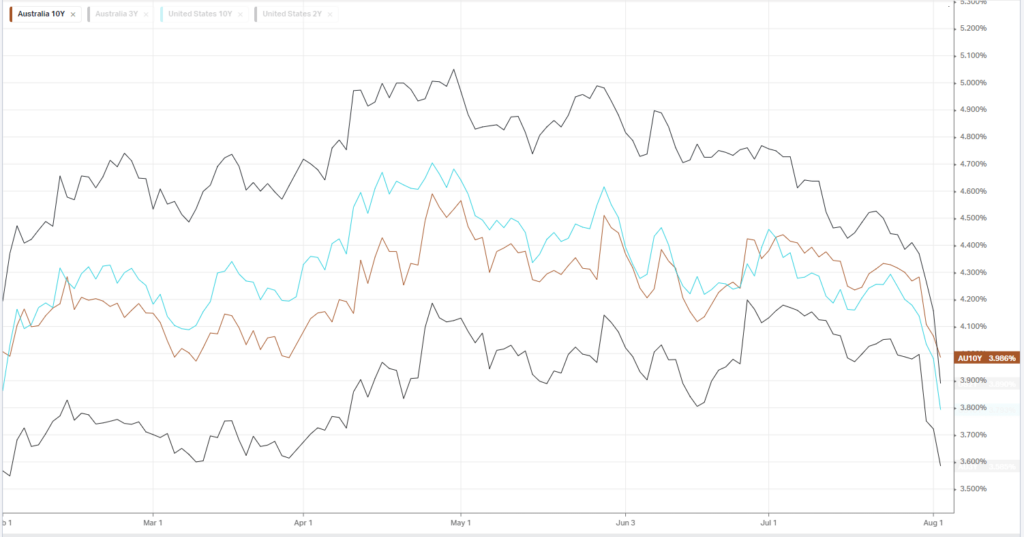

Bonds

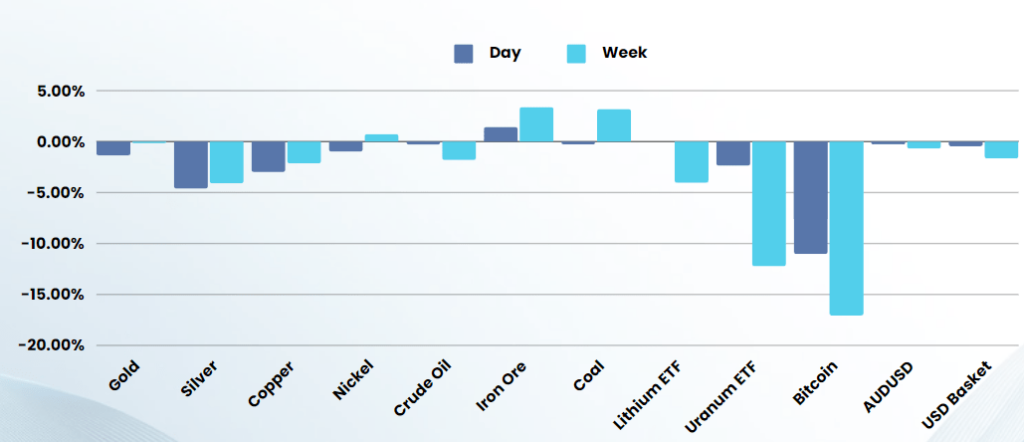

Commodities & FX

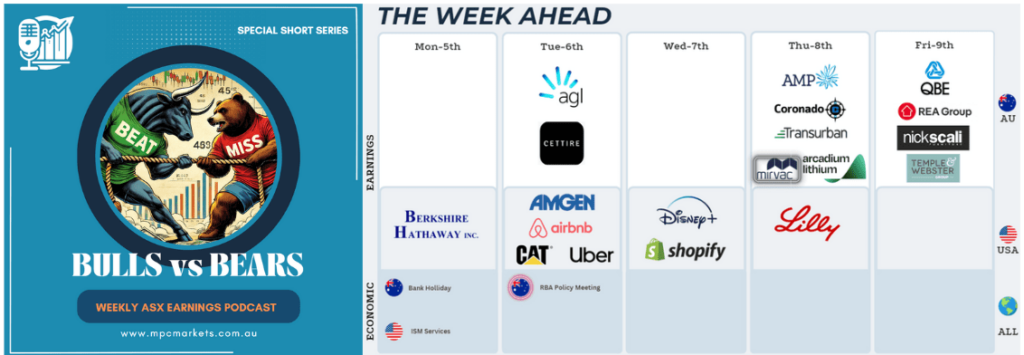

The Day Ahead

ASX SPI 7576 (-0.30%)

It might sound strange, but we are expecting a bounce after the open today. Reason being is that when the ASX closed at “peak panic” yesterday at with the Nasdaq Futures down 5.5% and Nikkei down 13.5%. Since then the Nasdaq has recovered 2.5% and the Nikkei 8-9%

Either way, the market wont be easy and caution is warranted. We remain cautious and defensive

Company specific:

- Audinate (AD8) – has reported strong preliminary unaudited results for FY24, with revenue increasing by 28.4% to approximately US$60 million (A$91.5 million). The company’s EBITDA is expected to be in the range of A$19.5 million to A$20.5 million, a significant increase from A$11 million in FY23. Gross profit also saw a notable rise, up 33.2% to approximately US$44.5 million, with gross margins improving to 74.3%, driven by a favorable shift towards software-based Dante implementations.