Last Night's Market Recap

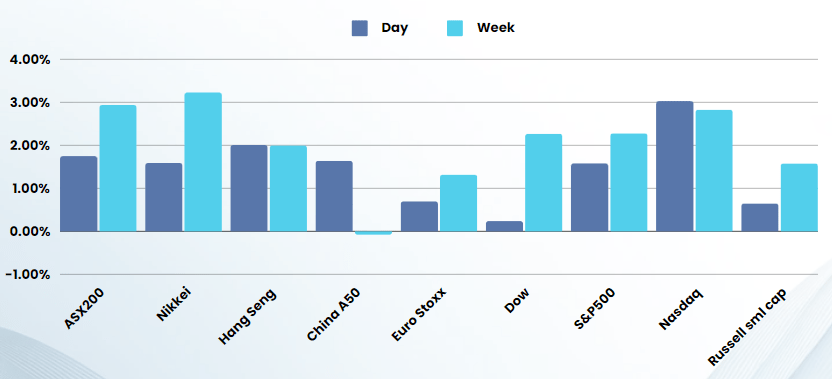

S&P 500 - Heatmap

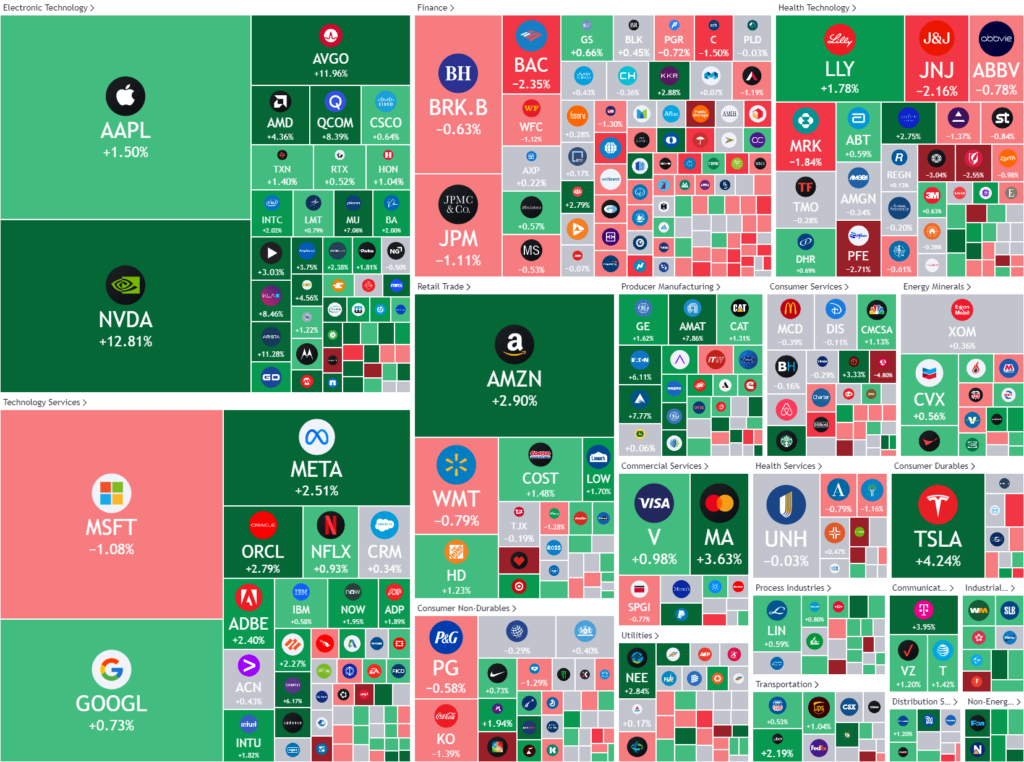

Overnight – Tech stocks bounce as Powell opens the door to Sept rate cuts

Stocks notched one of their biggest gains since February overnight, as the Federal Reserve kept rates unchanged, though signaled that it that potential cut in September was on the table.

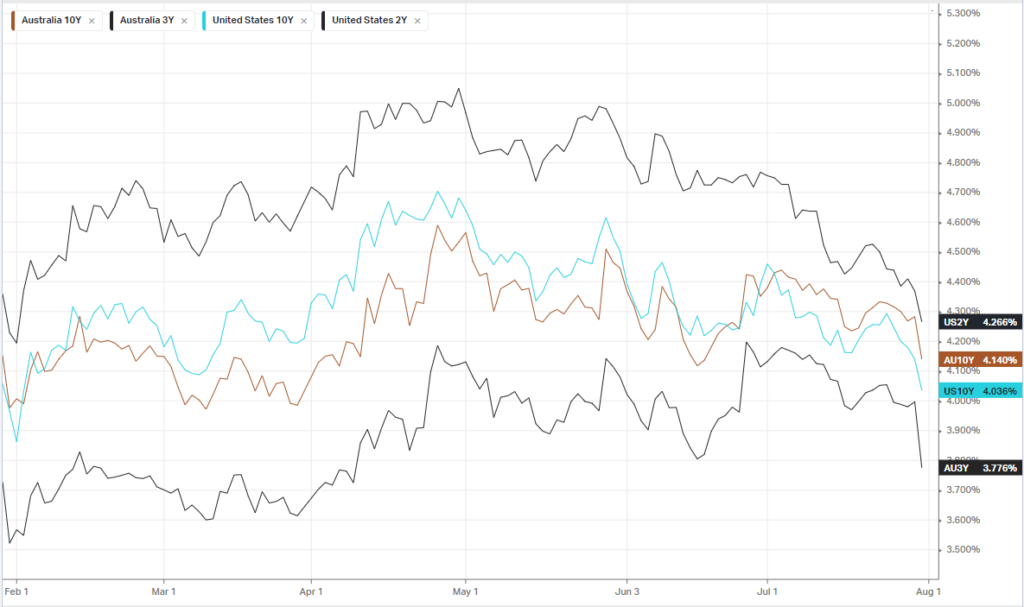

The Federal Reserve left interest rates unchanged Wednesday, but acknowledged recent progress on inflation and cooling in the labor market, stoking investor hopes that the central bank could begin cutting rates sooner rather than later. Futures are almost fully pricing for a quarter-point easing in September, with a small chance of a reduction of 50 basis points, and have 66 basis points of easing priced in by Christmas.

This tone gave huge support to tech stock sentiment, with the Mag7 driving the market higher. Nvidia ridiculously jumped an astonishing 13% (or $380B in market cap) on a broker upgrade, a super-sized moved for such a little catalyst

Gold Futures rose 1% as investors poured into the safe-haven metal after Israel said it had launched a target strike in Beirut, stoking fears of an Israel-Lebanon war.

- Meta +2.48% (+5.48% post earnings) – delivered better-than-expected guidance for the current quarter after reporting second-quarter results that beat analyst estimates on the top and bottom lines. Looking ahead to Q3, the company guided for total revenue to be in the range of $38.5B to $41B, or $39.75B at the midpoint, beating Wall Street estimates of $39.09B. On the negative side, the company expects infrastructure costs will be a significant driver of expense growth next year as we recognize depreciation and operating costs associated with our expanded infrastructure footprint.

- Advanced Micro Devices +5% – gained 5% after the chipmaker reported better-than-expected Q2 results, underpinned by record data center revenue as customers including Meta and Microsoft continued to ramp up orders. The tone on data center GPU was very solid, especially around customer breadth as both OCI and META are now ramping strongly alongside MSFT – w/shipments starting shortly to TSLA and very strong momentum with enterprises.

- Starbucks +3% – the coffee chain met expectations for quarterly profit, even as its global sales declined on persistent weakness in consumer spending in its top markets of the U.S. and China.

- T-Mobile US +4% – the telecoms giant after the telecoms company raised its full-year forecast for monthly bill-paying phone subscriber additions as more customers opted for its discounted unlimited plans that include streaming perks.

- Pinterest -14% – the social media service offered a softer-than-expected outlook for its third quarter, despite achieving a record 522 million global monthly active users, marking a 12% increase from the previous year.

Bonds

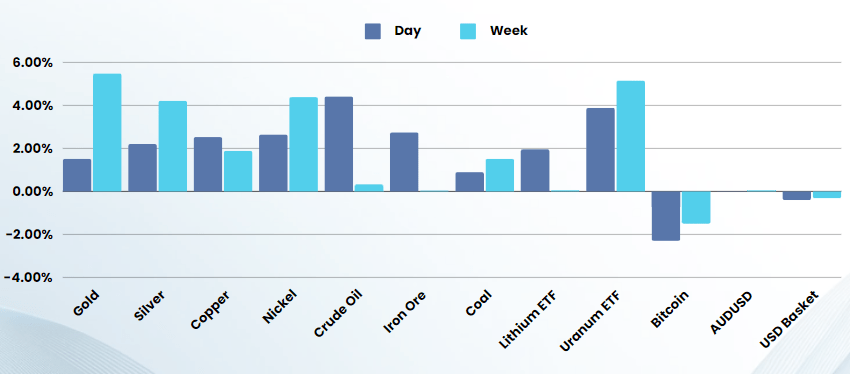

Commodities & FX

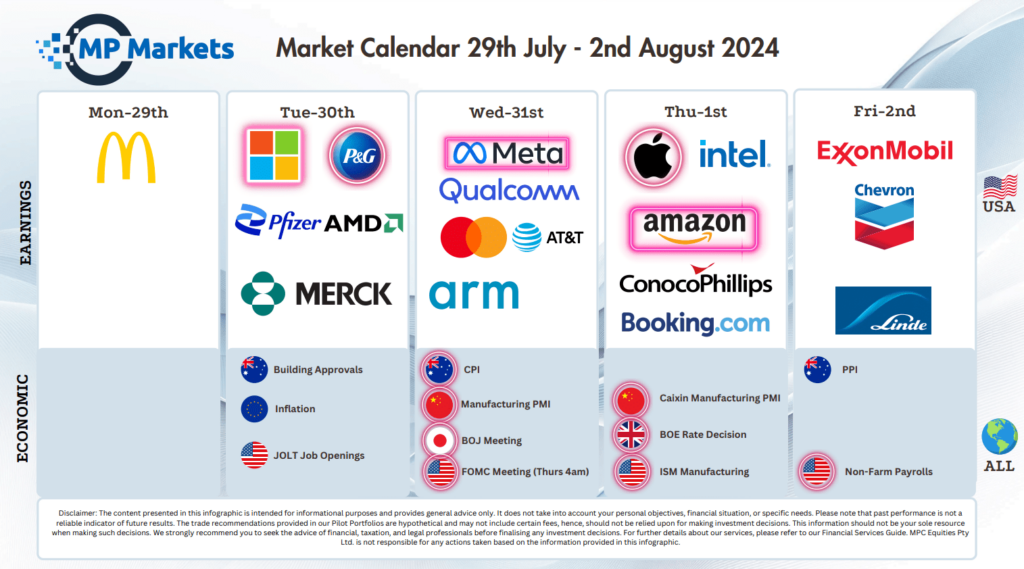

The Day Ahead

ASX SPI 8078 (+0.21%)

The ASX will hit fresh intra-day highs today as commodities, energy and global equities moved higher overnight, although yesterdays outperformance on month end makes it unlikely we will see a significant move higher.

Yesterdays pressure relieving inflation data and the Feds lean towards rate cuts has given the RBA enough room to be patient on change in rates, almost certainly removing any chance of further rate hikes, providing a positive catalyst for interest rate sensitive stocks, particularly REITS, small caps and high PE growth stocks

Company specific:

- Kelly Partners Group is expected to release earnings