Last Night's Market Recap

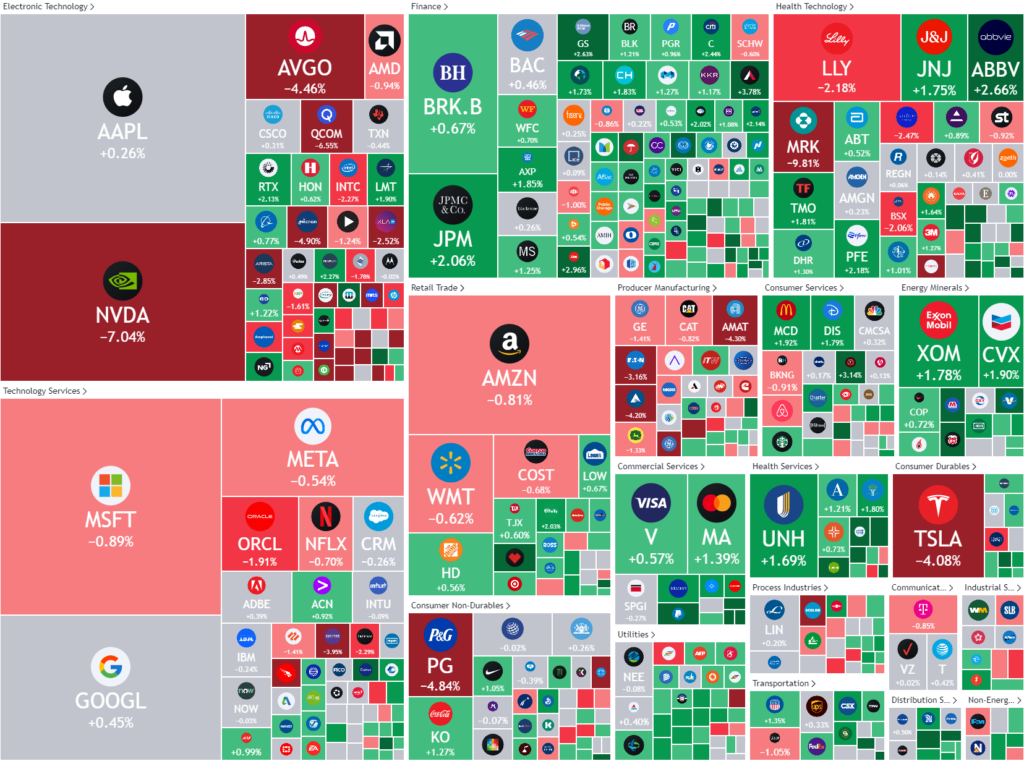

S&P 500 - Heatmap

Overnight – Microsoft and Nvidia crushed as AI revenue doesn’t materialise

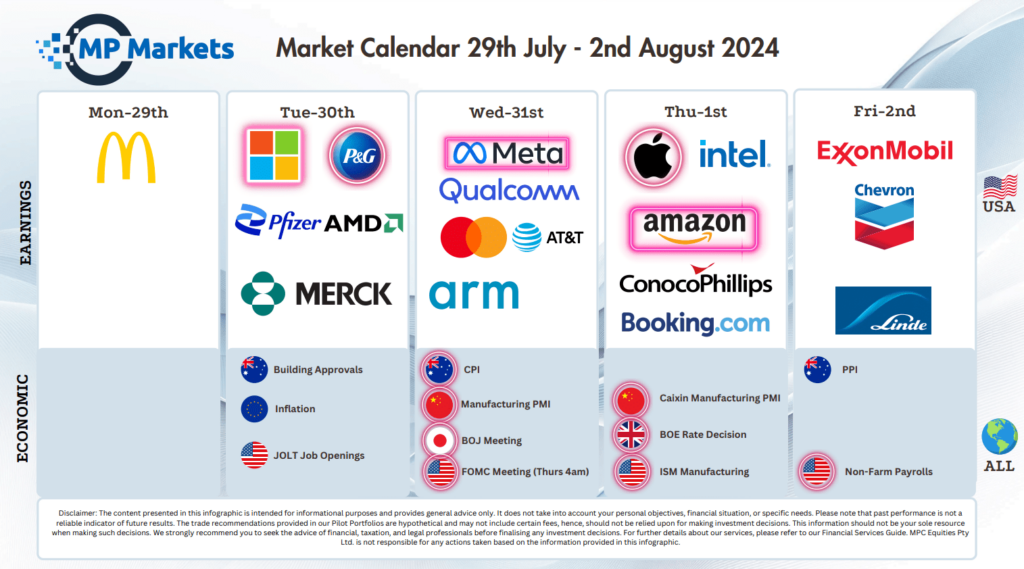

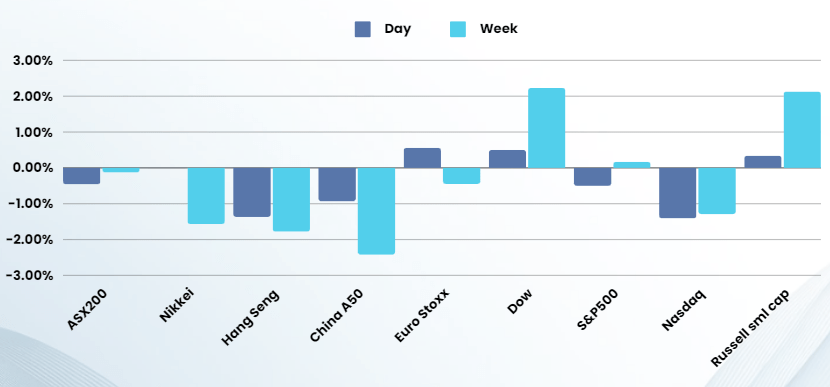

Stocks headed lower led by tech amid cautious trading as the Fed kicked off its two-day meeting and investors awaited further earnings from big tech.

The Fed kicked off its two meeting that is expected to culminate in an unchanged decision on interest rates Wednesday. But following a string of data showing inflation, investors will be looking for Fed Chair Jerome Powell to lay the groundwork for a September rate cut. Markets have fully priced in a 25 basis point cut in September, with a small chance of a reduction of 50 basis points, and have 66 basis points of easing priced in by the end of the year.

The start of the Fed meeting arrived on the heels of data showing that job openings, a measure of labour demand, fell to 8.18M in June from 8.23M in May, though that was still above economists estimates of 8.18M. Signs of ongoing labour demand underpinned consumer confidence in July, which rose to a reading of 100.3 from 97.8 the prior month.

Tech led the market lower, with NVIDIA down 7%, driving downside momentum as rotation out of the tech resumed.

The earnings report from Microsoft will be closely watched as a gauge the adoption of the AI Revolution as Microsoft and Nvidia are the two best barometers in technology on the pace of AI adoption globally

Beyond Microsoft, tech heavyweights Meta and Apple are set to report earnings on Wednesday and Thursday, respectively.

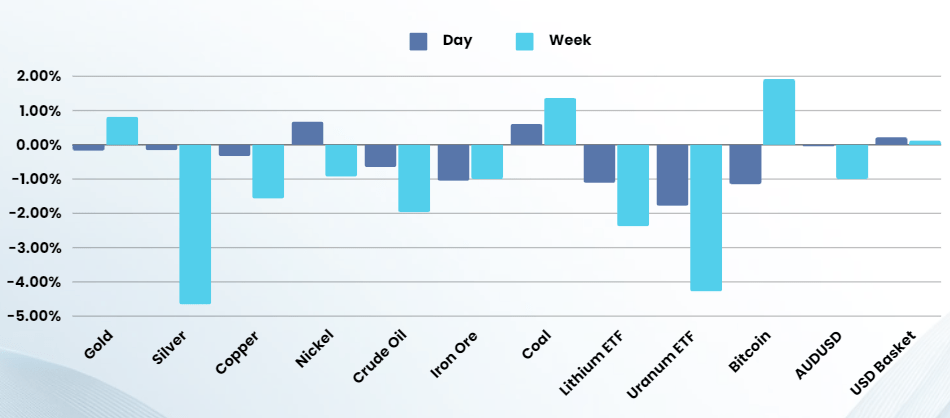

Gold Futures rose 1% as investors poured into the safe-haven metal after Israel said it had launched a target strike in Beirut, stoking fears of an Israel-Lebanon war.

- Microsoft -1% (-6% post earnings) – Microsoft’s stock dropped over 5% in after-hours trading after its Q4 cloud revenue growth fell short of expectations. The company reported earnings per share of $2.95 on $64.7 billion revenue, with Azure’s 29% growth missing the 30.2% estimate. Despite increased investments and capital spending of $19B in Q4, signs of slowing cloud growth concerned investors. Productivity and business processes revenue rose 11%, and personal computing revenue increased by 3%.

- Merck -9% – stock slumped more than 9% after the drug maker cut its full-year earnings forecast mainly due to one-time charges from its acquisition of eye-focused drug developer EyeBio.

- Pfizer +1% – stock was up nearly 1% after the drugs giant raised its annual profit forecast after reporting better-than-expected sales of its COVID vaccine and antiviral treatment

- JetBlue +12% – stock soared 12% after the low-cost carrier posted a surprise second-quarter profit and announced plans to deepen its cost cuts.

- PayPal +8% – stock rose more than 8% after the payments giant raised its forecast for full-year adjusted profit for the second time, betting on resilient consumer spending in the back-to-school and upcoming holiday shopping seasons.

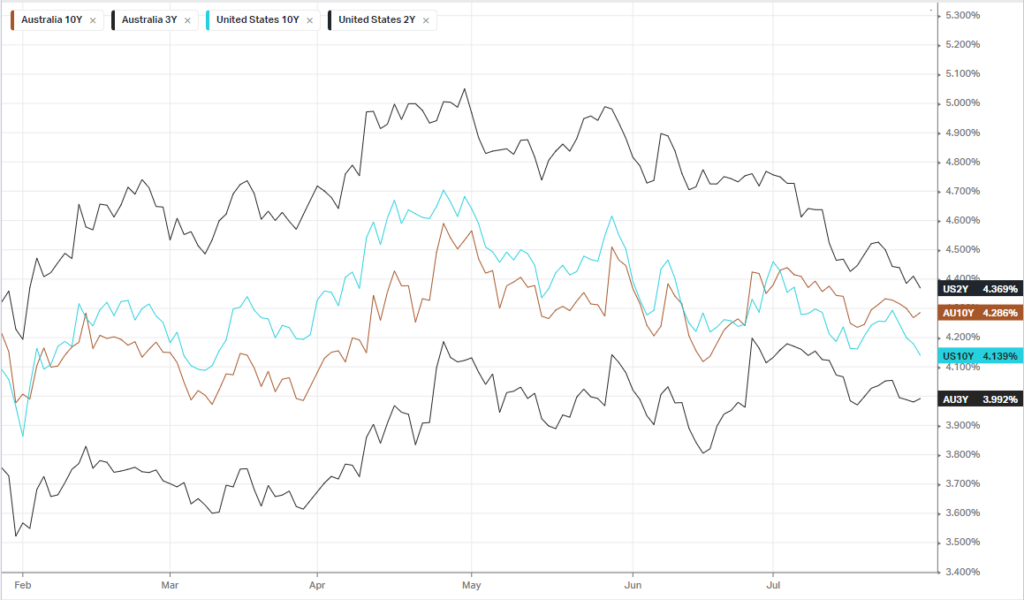

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7943 (+0.36%)

Australian shares are expected to open higher ahead of key June quarter inflation data, which could influence further action by the Reserve Bank of Australia (RBA). Investors are closely watching the June quarter consumer price index (CPI) set for release at 11.30am AEST. This data is crucial in determining if the RBA will raise rates to 4.6 percent, with bond traders currently assigning a 20 percent chance of a rate hike next week. NAB economists noted the importance of this data, indicating it will show if inflation could prompt the RBA to reconsider its outlook for returning to the target by 2026. Retail sales data will also be released at 11.30am AEST.

Company specific:

- Rio Tintohas recorded $5.8 billion in profit after tax for the half year. The mining giant booked underlying earnings before interest, taxes, depreciation, and amortisation of $12.1 billion and net cash was $7.1 billion It also declared an interim ordinary dividend of US177¢ per share.

- Origin Energysays its revenue from Australia Pacific LNG was 2 per cent higher at $2.6 billion in the June quarter. Even so, revenue for FY24 was 12 per cent lower than FY23, with the company citing lower commodity prices as the main reason.

- Centuria Industrial REITis due to release earnings and ALS hosts an AGM.