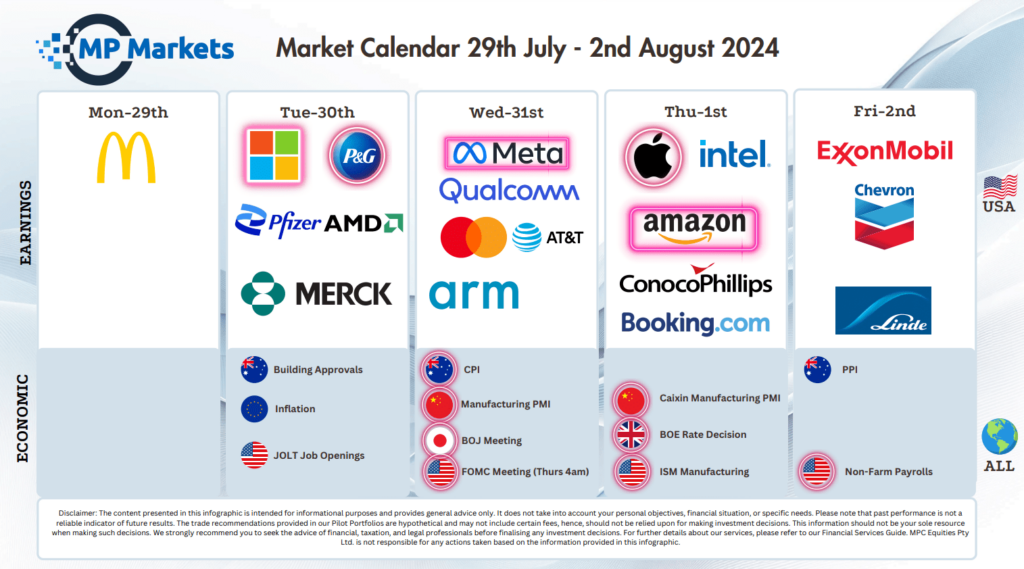

Last Night’s Market Recap

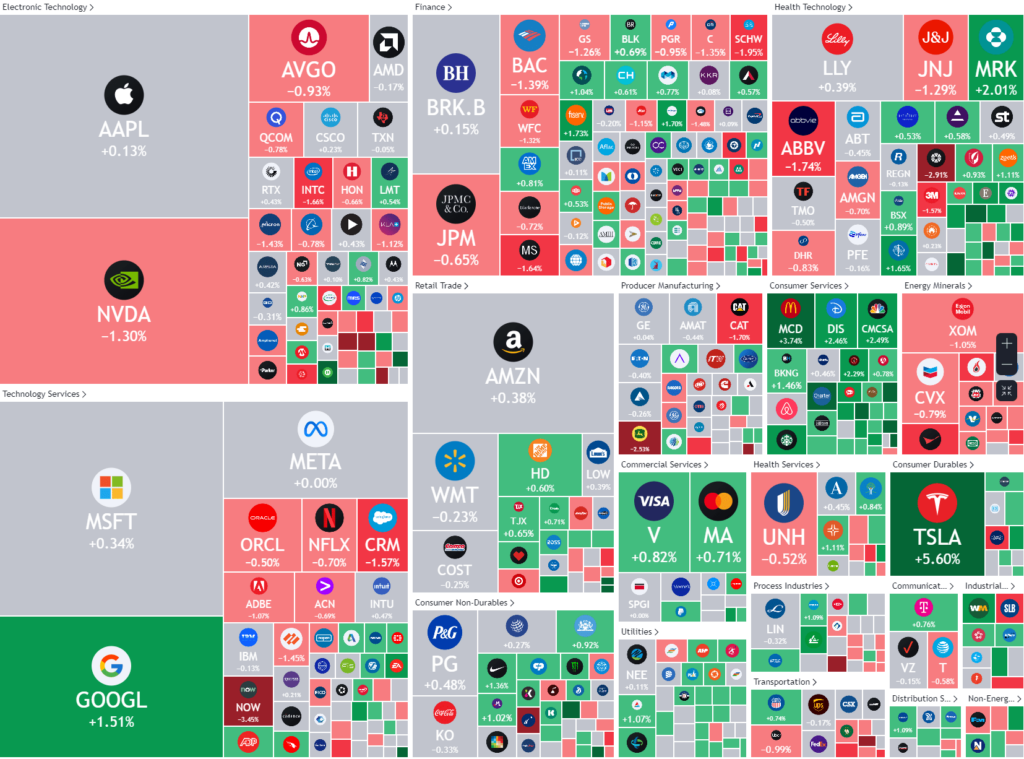

S&P 500 – Heatmap

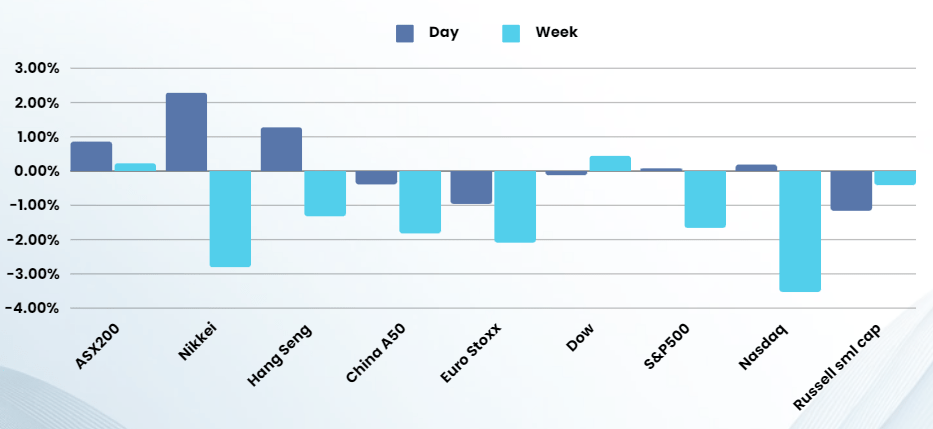

Overnight – Market mixed as investors wait on earnings and Central Banks

Equities closed slightly higher as investors kept their powder dry ahead of tech earnings and the Federal Reserve meeting due this week

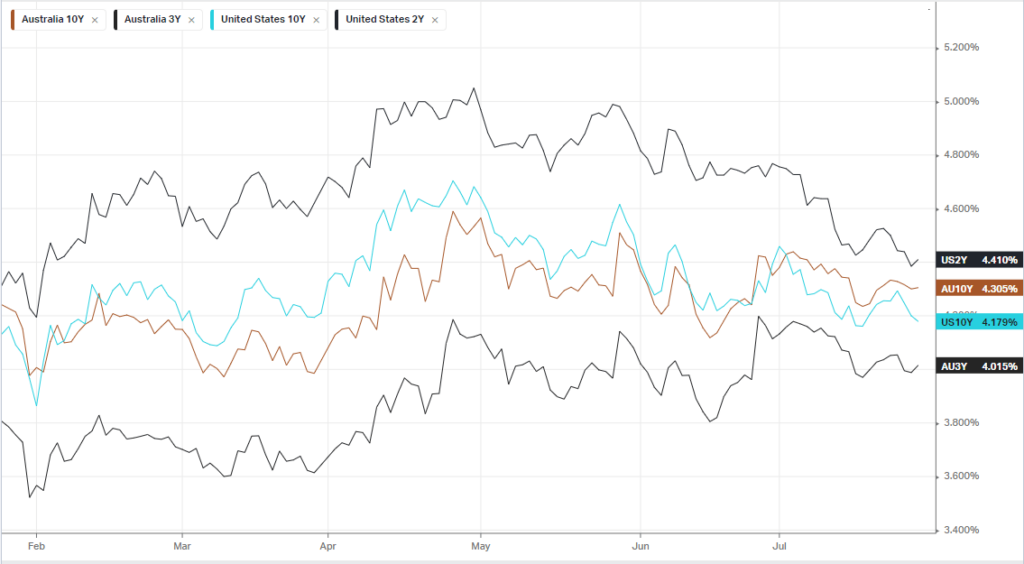

The U.S. Federal Reserve concluded its latest meeting on Wednesday and is widely anticipated to maintain current interest rates. The market predicts the FOMC will hold steady at 5.375% but may suggest a potential rate cut in September. Chair Powell is expected to indicate that the Fed is nearing a decision to lower its target rate. The key driver pushing the FOMC towards a rate cut is the favorable inflation data from May and June. Following stronger inflation figures in the first quarter, primarily due to residual seasonality and typical month-to-month fluctuations, the second quarter showed substantial improvement in inflation news.

Earnings reports from some of Wall Street’s biggest companies are also on tap this week, with Microsoft and Apple set to report on Tuesday and Thursday, respectively. Other tech majors including Meta, AMD and Amazon are also set to report earnings through the week. The results come in the wake of an extended rout in technology stocks, as the sector was walloped by profit-taking and as expectations of rate cuts saw investors pivot into more economically sensitive sectors. Underwhelming earnings from Google last week also sparked increased caution ahead of the tech earnings, with investors waiting to see whether increased investment in artificial intelligence was bearing fruit.

Adding to the huge week of earnings and Central bank updates, the week ends with Friday’s nonfarm payrolls number, with economists expecting the U.S. economy to have created 177,000 jobs in July, moderating from 206,000 in the prior month.

Company Earnings

- McDonald’s +4% – stock rose nearly 4% even as it reported a surprise drop in quarterly global comparable sales. Some on Wall Street expressed optimism about the fast-food chain’s five-dollar meal deals, which were launched on Jun. 25, delivering improved results in the back half of the year.

Bonds

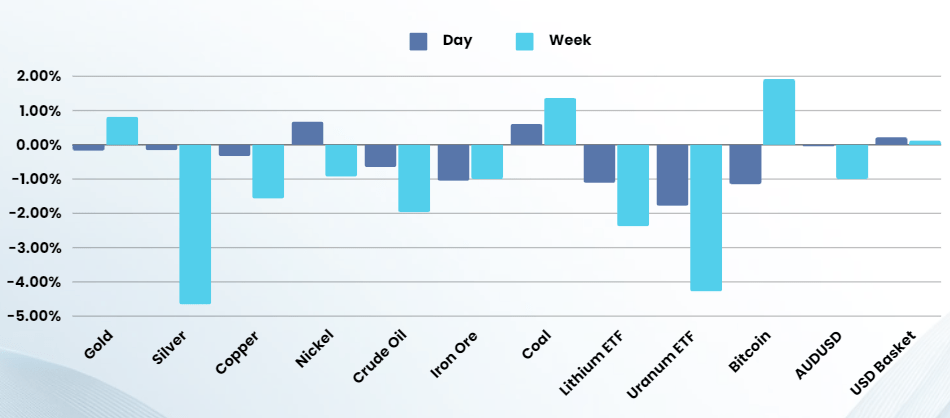

Commodities & FX

The Day Ahead

ASX SPI 7900 (-0.69%)

The local market is a nervous one, with concerns over the global slowdown hurting materials stocks as commodity & energy prices fall.

Despite China stimulus, the recent fall in commodity prices is a clear signal of slowing global demand which can only lead to slowing growth (or cheap commodity prices)

We expect some erratic movements in individual stocks over the coming week as fund managers and investor reposition before AU earnings season starts next week

Company specific:

- Earnings –Credit Corp and Pinnacle Investment Management

- Quarterly updates – Champion Iron, IGO and Perseus Mining each provide quarterly updates.