Last Night's Market Recap

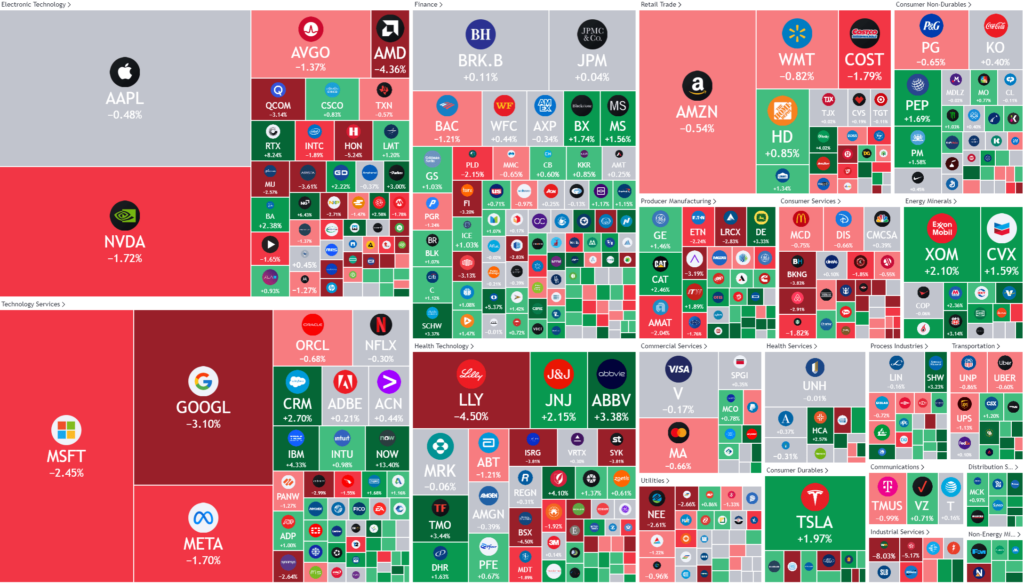

S&P 500 - Heatmap

Overnight – Tech wreck continues in Mag7

Equities attempted a rebound early in the session but failed to hold those gains as Google led the Mag7 lower

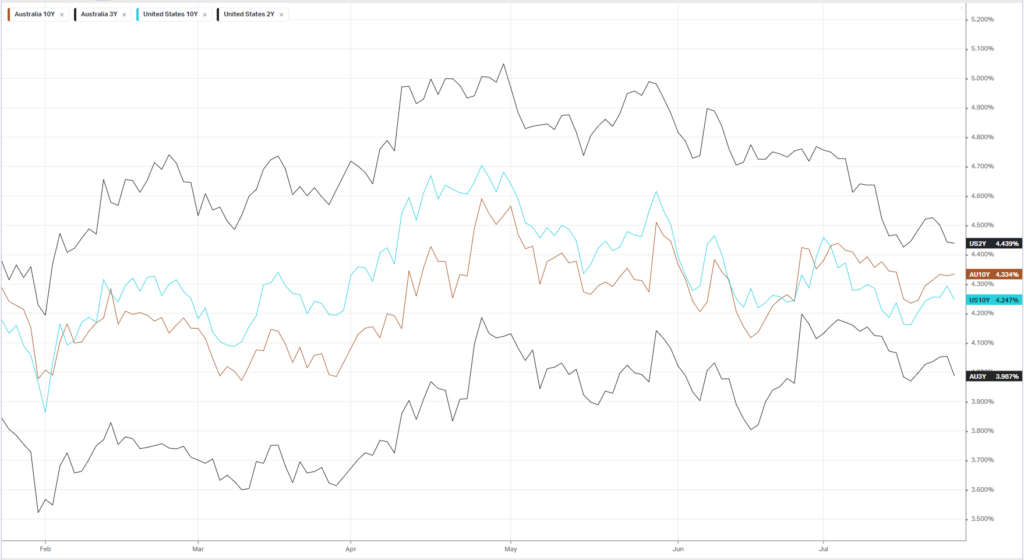

US GDP grew 2.8% in the second quarter, versus forecasts of a 2% growth, and an improvement from the 1.4% growth in the first three months of the year. However, the prices component, an inflation guage, in the release saw a fall to 2.3%, from 3.1% in the first quarter. Further signs of slowing inflation have underpinned growing hopes that the Federal Reserve could cut rates more than once this year starting in September. A separate report showed durable goods orders fell 6.6% in June, compared with expectations for a 0.3% rise.

Google fell more than 3%, pressuring the rebound in tech amid worries that its search business is set for fierce competition from OpenAI’s Search GPT. OpenAI said Thursday that it is testing a AI powered search engine as the AI software maker looks to take the fight to Alphabet’s Google. IBM rose more than 4% after big blue talked growing demand for its AI offering and lifted its annual cash flow guidance. “Management highlighted that the GenAI book of business has grown to over $2B since watsonx launched a year ago, ahead of expectations in our view,” RBC said in a recent note.

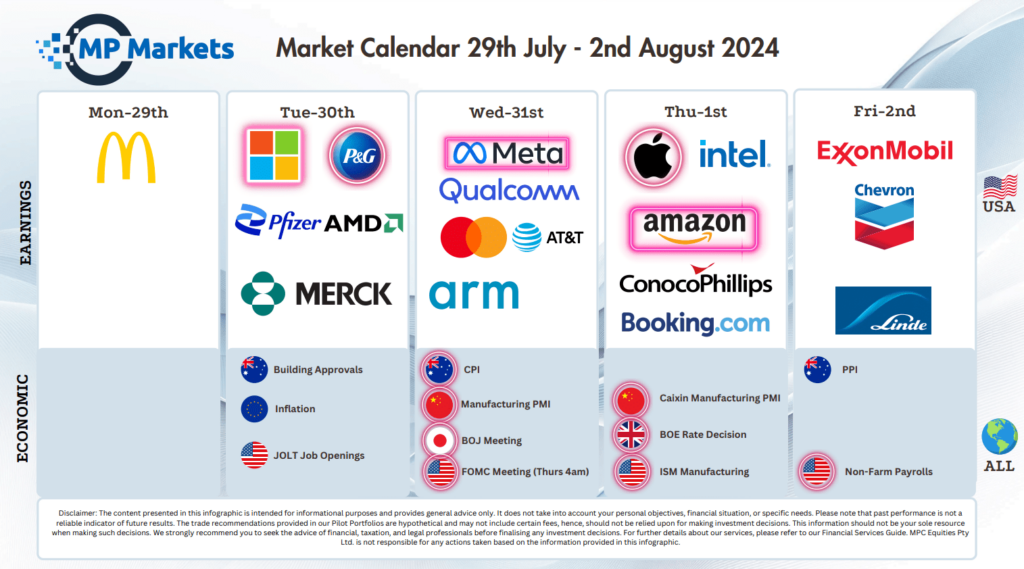

Company Earnings

- American Airlines +4% – rose more than 4% even as the carrier cut its annual profit forecast, pressured by weaker pricing power amid uneven demand trends and overcapacity in certain markets.

- Hasbro +3%– rose 3% after the toy maker posted a smaller-than-expected drop in second-quarter as steady digital gaming demand offset a slump in toy sales, while cost-control strategies helped it beat profit expectations.

- Ford -18% – slumped over 18% after clocking disappointing earnings, as automobile sales slowed sharply amid decreased consumer spending.

- ServiceNow +13% – jumped 13% after the software marker reported quarterly results late-Wednesday that topped Wall Street and lifted its annual guidance.

Bonds

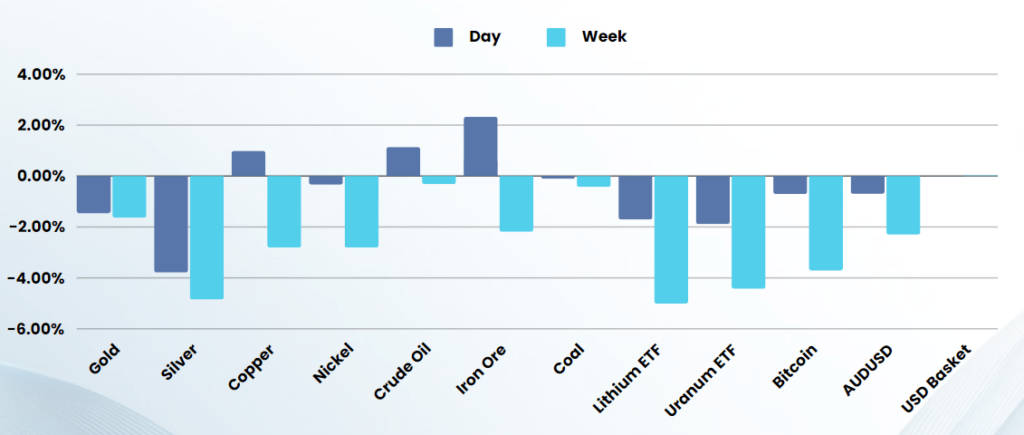

Commodities & FX

The Day Ahead

ASX SPI 7865 (+0.42%)

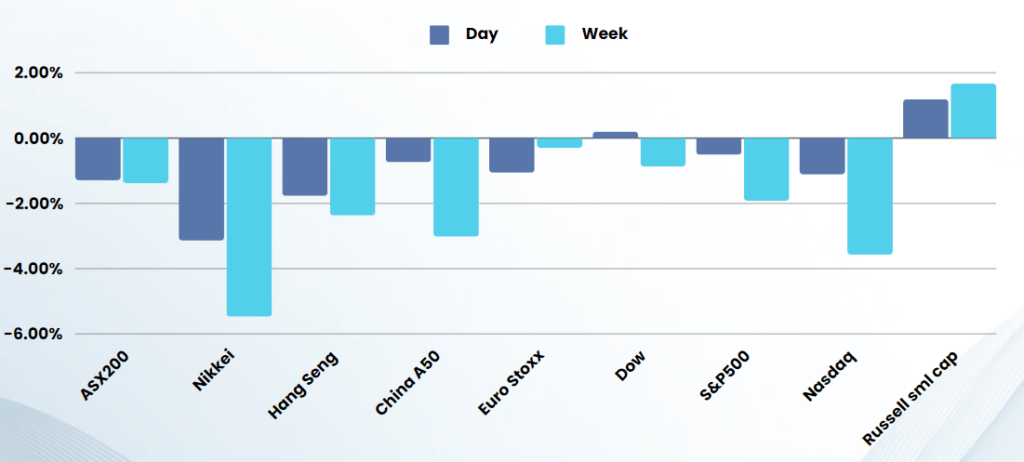

We are in for a relatively quiet session as investors look towards the huge calendar next week, nursing bruises from a damaging week where almost every asset class has been sold off

While tech has stolen the headlines, Commodities, Crypto, Bonds and equities are all lower this week

Next week we have 3 Central Banks, AU inflation data, US Employment…. And 4 of the Mag7 reporting earnings, in what is likely to be one of the busiest weeks of the year

Company specific:

- Mineral Resourcesprovides an operational update and Arcadium Lithium hosts an AGM.