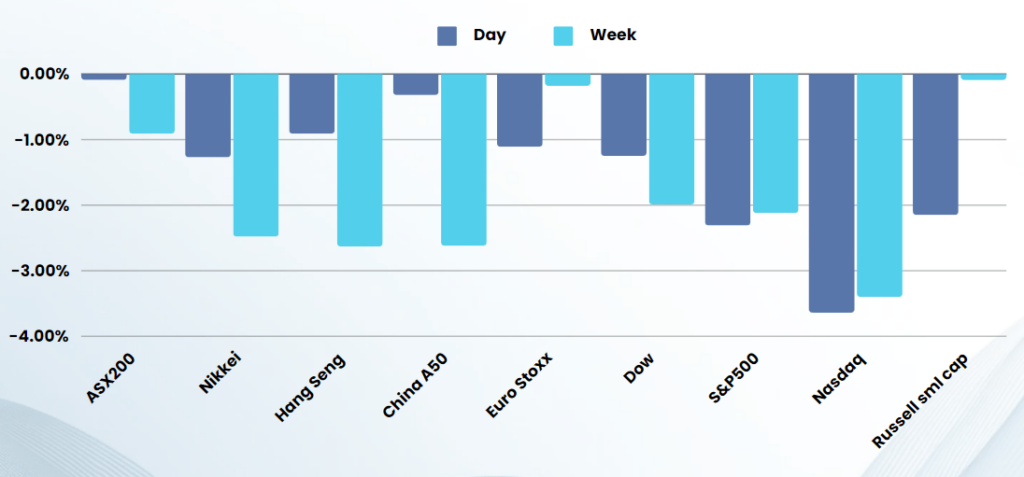

Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Big Tech earnings disappoint triggering equities avalanche

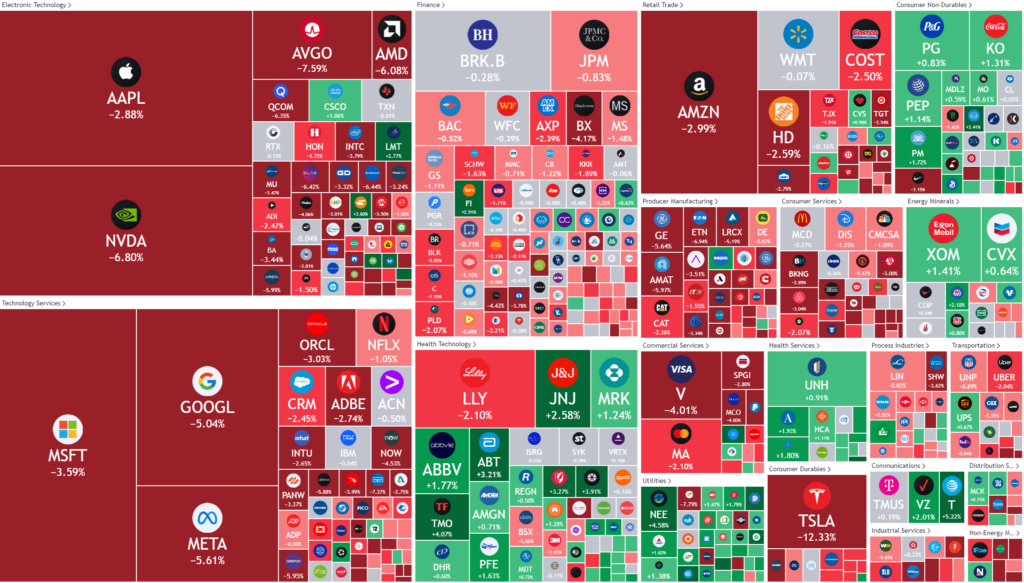

Equities suffered their biggest one day loss since 2022 as tech stocks nosedived following underwhelming second-quarter earnings from heavyweights Alphabet and Tesla.

It will be a nervous wait until the next round of Mag7 earnings next week where Microsoft, Apple, Amazon and Meta will deliver earnings.

Google-parent Alphabet fell nearly 5%, even as its second-quarter earnings beat expectations on increased advertising sales and strong demand for its cloud services. Google saw outperformance at its Search and Cloud businesses offset by “underperformance at YouTube, largely due to difficult comps, and continued weakness at Google Network.

The real issue investors have with these earnings is the lack of any form of revenue growth in the AI space, which they have happily paid a hefty premium for over the last 12 months. It also might mean a reduction in the backlog orders for the expensive Nvidia chips which are impressive, but not paying for themselves.

Tesla stock tumbled 12% after its second-quart8r earnings missed estimates amid falling vehicle sales. Tesla’s profit margins fell to a five-year low as the electric vehicle maker aggressively cut prices to grapple with increased competition in key markets such as China. Some on Wall Street continued to be optimistic on the stock despite the margin pressures amid optimism on future growth opportunities including robotaxis. “While the margin weakness is weighing on the stock … the next phase of the Tesla growth story is around autonomous, Robotaxis, and AI playing out for Musk & Co. in our view and that vision is on the doorstep,” Wedbush said in a note.

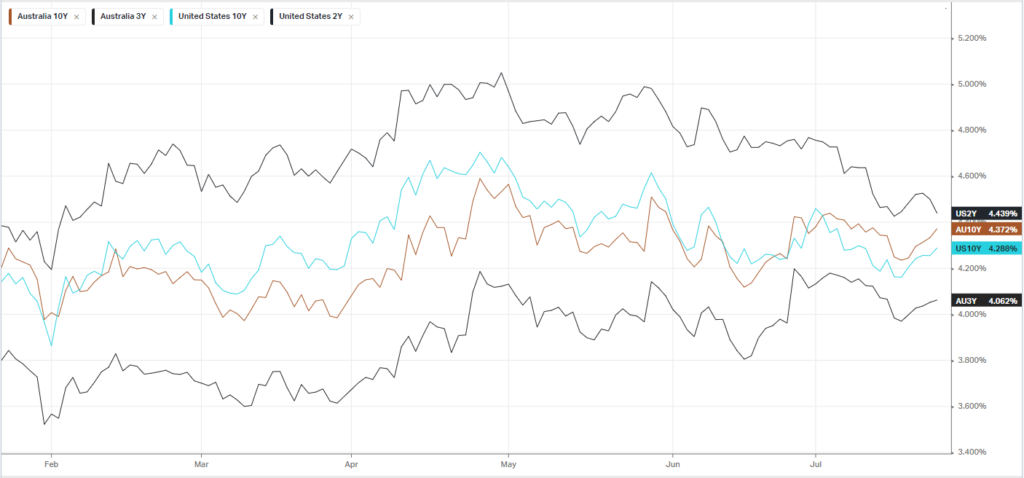

The market clutched at straws for some positivity, with news wire even quoting a former New Federal Reserve President Bill Dudley, as he called for the Fed to cut rates as soon as next week amid recession concerns, reversing his long-held view for the U.S. central bank to persist with its higher for longer rate regime. “The facts have changed, so I’ve changed my mind. The Fed should cut, preferably at next week’s policy-making meeting,” Dudley said ahead of the Fed’s July 30-31 policy meeting.

Company Earnings

- Visa -4% – reported third-quarter results that topped Wall Street estimates, but flowing payment volumes growth pointing to a weaker consumers weighed on sentiment and sent the stock about 4% lower. “It feels like the marginal consumer is weakening, as US trends through the July 21 modestly decelerated with PV growth of 4% vs. 5%,”

- Texas Instruments +0.36% – – stock was flat after the chipmaker reported a solid earnings beat for the second quarter, with adjusted earnings per share surpassing the estimates.

- AT&T +5% – stock rose 5% after the telecoms giant exceeded market expectations for wireless subscriber additions in the second quarter, as its higher-tier unlimited plans attracted customers.

- IBM +3% – second-quarter earnings that beat analysts’ forecasts as growing demand for generative AI boosted new business wins and big blue raised its free cash flows forecast for the year.

Bonds

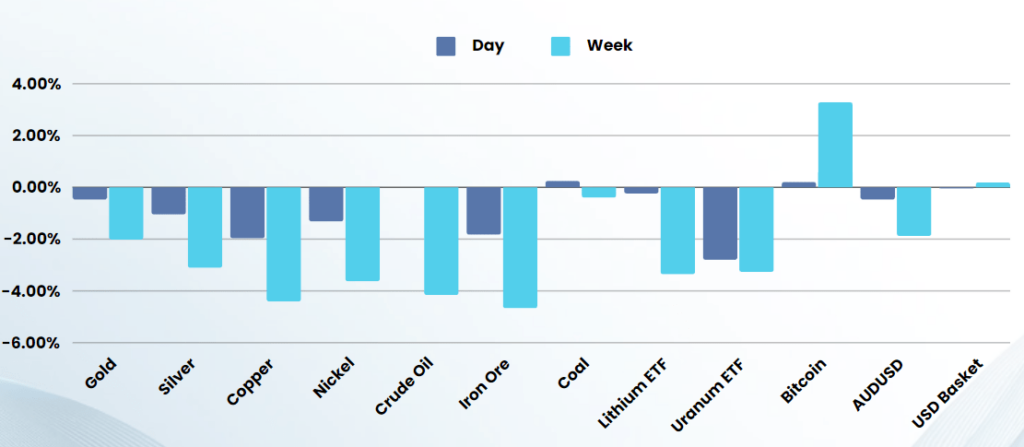

Commodities & FX

The Day Ahead

ASX SPI 7848 (-0.95%)

The belly aching from ASX investors about under-performance by the Australian market vs the Nasdaq, will turn to relief today as we miss the lions share of the savage downside in the Nasdaq.

While the materials sector will remain under pressure due to falling Iron ore prices, the bears will turn their focus to the tech sector and growth companies.

Healthcare and energy stocks are likely to be the only green on the screen as consistently solid US earnings results, coupled with the non-cyclical nature of the stocks will hold them in good stead