Last Night's Market Recap

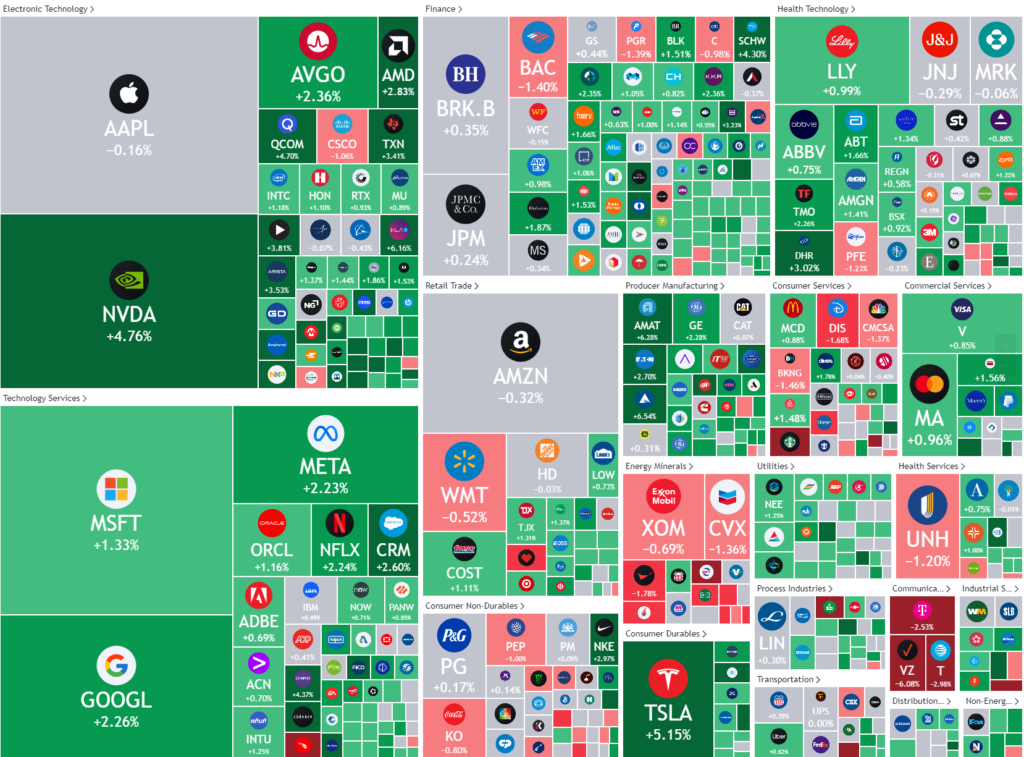

S&P 500 - Heatmap

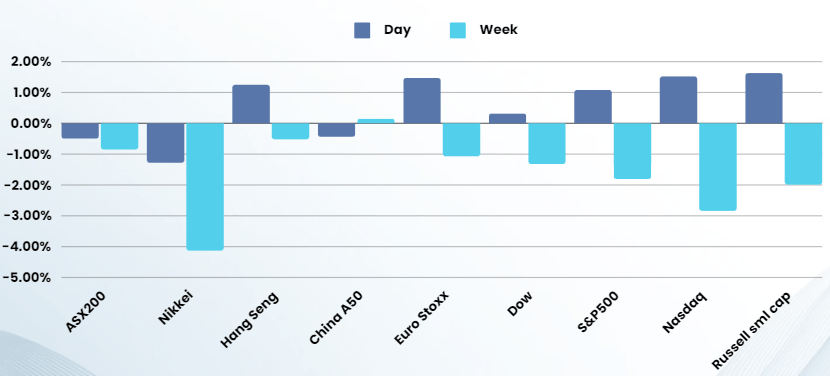

Overnight – Stocks bounce despite US political disarray as Nvidia plans new chip

Stocks were higher overnight in an Nvidia-led rebound in tech stocks following recent weakness as investors ignored America’s political disarray and looked ahead to megacap tech quarterly earnings this week

NVIDIA closed nearly 5% higher following a Reuters report that the chipmaker is is developing a B20 version of its Blackwell GPU specifically for the Chinese market that would be in compliance with U.S. export controls. The chip in Nvidia help lift the broader tech sector higher and stoked dip buying following the sector’s recent wobble as investors looked ahead to earnings due Tuesday from megacap tech companies including Alphabet and Tesla

Biden’s withdrawal comes amid growing calls from members and donors of his party for him to step down, amid concerns over his mental health and that he may not be able to effectively run against the Republican candidate Donald Trump.

Biden, the 46th president, endorsed Vice President Kamala Harris as his successor, but she still needs to be officially nominated by the Democratic Party, with a vote due in August. Trump was nominated as the Republican presidential candidate last week.

Beyond earnings, CrowdStrike closing 14% lower as several firms on Wall Street including Scotiabank, BTIG, and Guggenheim downgraded the cybersecurity firm, with the latter citing potential demand damage from the update that caused widespread outage of Windows computers.

Company Earnings

- Verizon -6% – fell 6% after its second-quarter revenue fell short of estimates as despite the telecoms giant adding more wireless subscribers than expected in quarter.

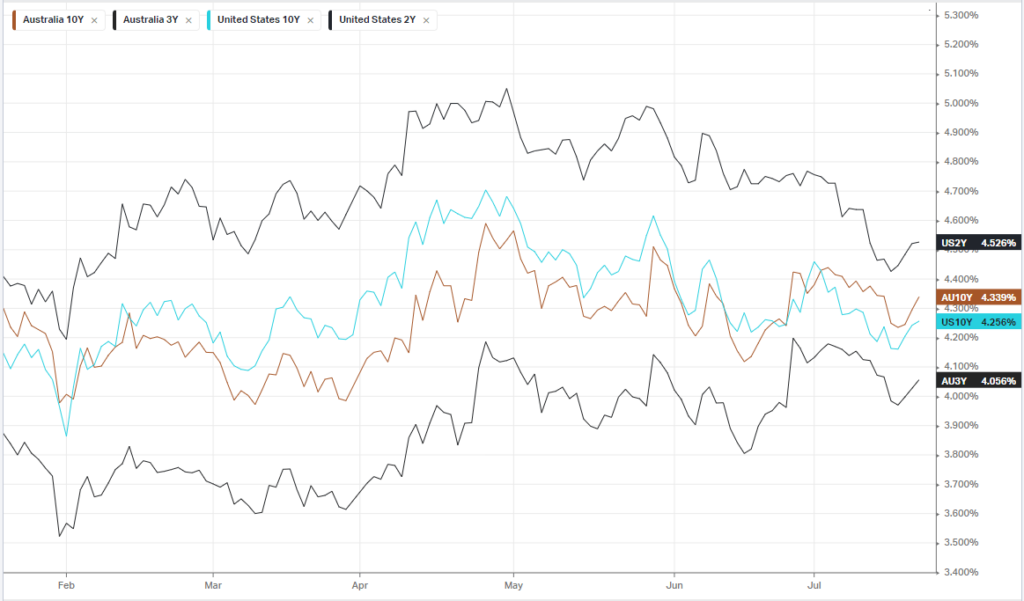

Bonds

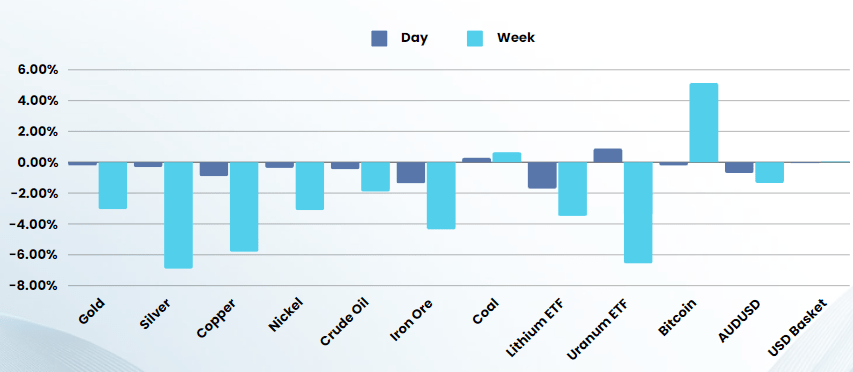

Commodities & FX

The Day Ahead

ASX SPI 7956 (+0.69%)

We are in for a quiet day as the seemly bullet-proof US equity market continues to provide a security blanket for investors while several geopolitical, economic and company specific issues boil over in the background.

Currently we have Ukraine and Middle east conflicts, new hung parliaments in Europe and the UK, Chinese economic weakness, global tech outages, an election circus and spiralling debt in the US…. But yet the market seems blissfully ignorant

We remain cautiously agile as this market is sitting on the foundation of the Mag 7, which starts earnings tonight with Telsa and Google.

Company specific:

- Quarterly Updates – Woodside Energy Group, Lynas Rare Earths and Atlas Arteria