Last Night's Market Recap

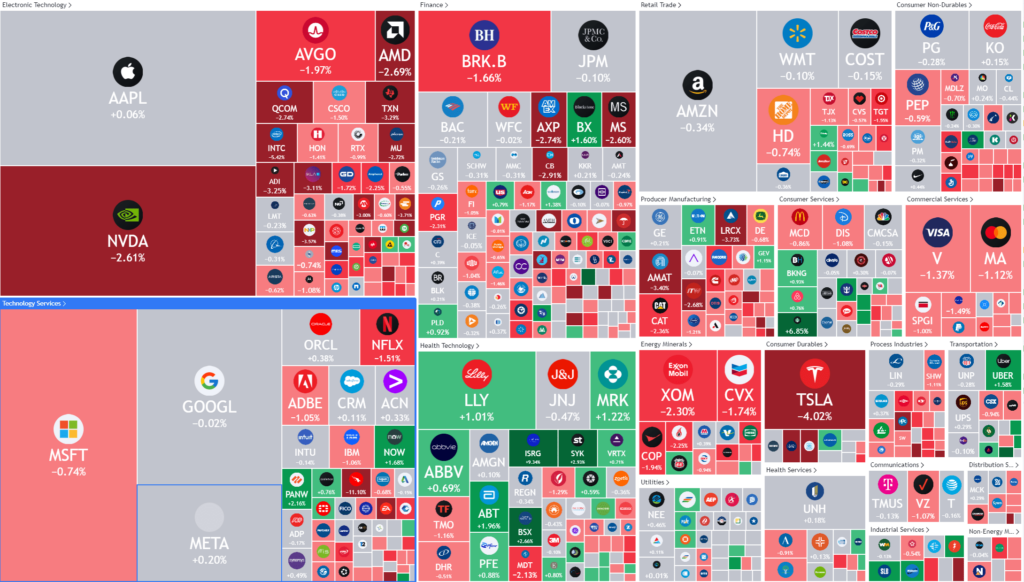

S&P 500 - Heatmap

Overnight – Global IT outage adds to tech misery

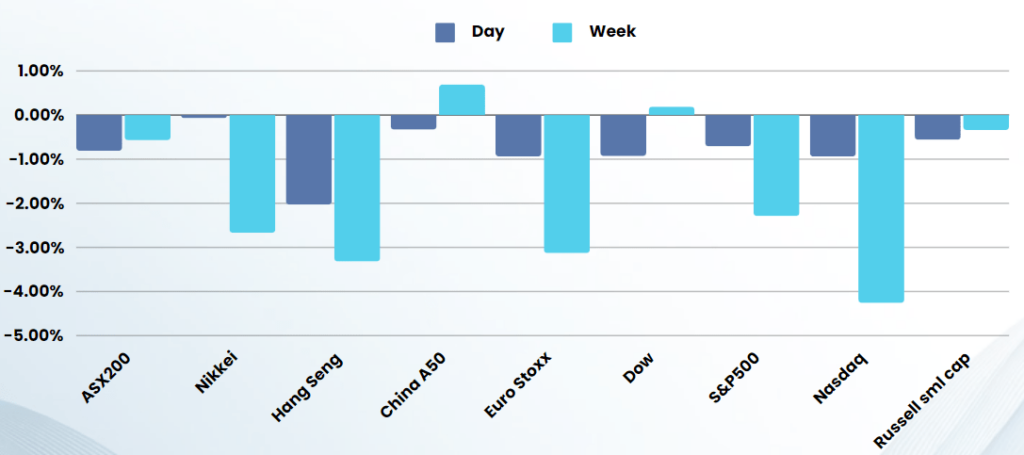

Equities slumped to their worst weekly loss since April as the broad rotation out of high-flying tech stocks rattled markets.

a global cyber outage rattled investors by disrupting operations across multiple industries, while the dollar climbed along with Treasury yields. Cybersecurity firm CrowdStrike fell 11.1% after an update to one of its products appeared to trigger the outage that affected customers using Microsoft Windows Operating System, disrupting businesses across sectors. Microsoft ended down just 0.7%. Fridays outages remind us that services can have supply chain disruptions too

The Cboe Volatility index – Wall Street’s “fear gauge” – touched its highest level since late April.

Investors also braced for important results in the U.S. second-quarter earnings season in the upcoming weeks. Results from megacaps will be in focus, with the S&P 500 technology-related sector falling 5.1% this week as investors rotated into sectors that have languished so far in 2024.

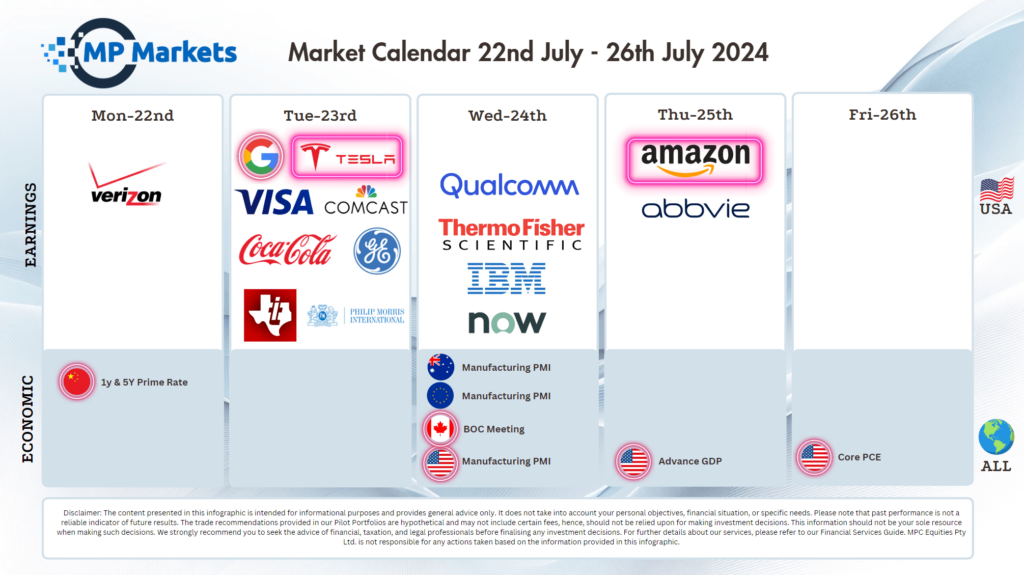

Tesla and Google-parent Alphabet both report on Tuesday, kicking off results from the “Magnificent Seven” megacap group of stocks that have propelled markets since early 2023. Microsoft and Apple are set to report the following week.

Company Earnings

- Netflix -1% – fell 1.5% after reporting weaker-than-expected revenue guidance that overshadowed better-than-expected quarterly results. The streaming giant, however, also touted further efforts to boost its ad-tier streaming tier after phasing out the basic ad-free version in the U.S. and France.

Over the weekend

Joe Biden finally caved to pressure, dropping out of the race and endorsing Kamala Harris.

Also, Israel has stuck Southern Lebanon in an effort to strike back at the Houthis after a drone attack cracked defenses due to “human error” travelling 500km and bombing Tel Aviv, highlighting the Houthis growing capability

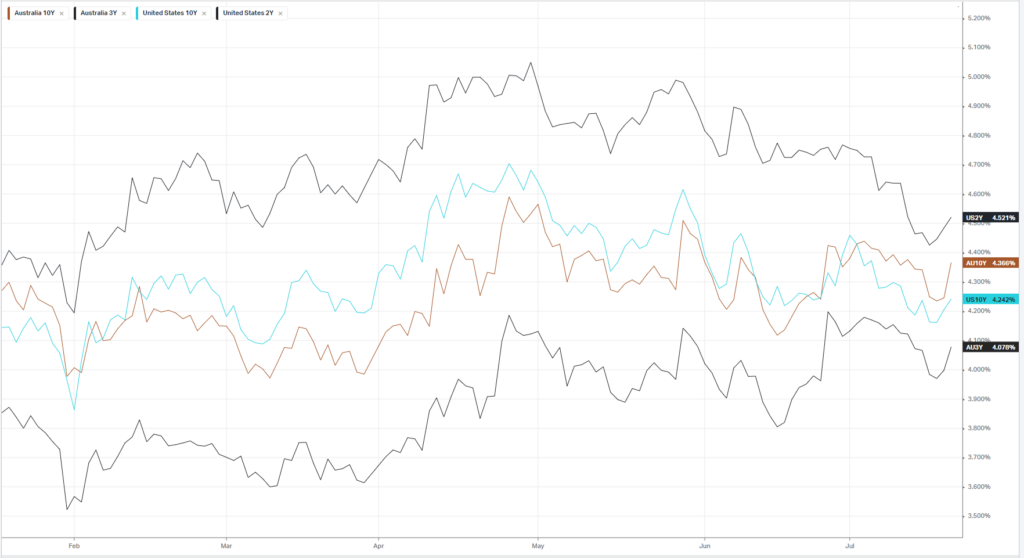

Bonds

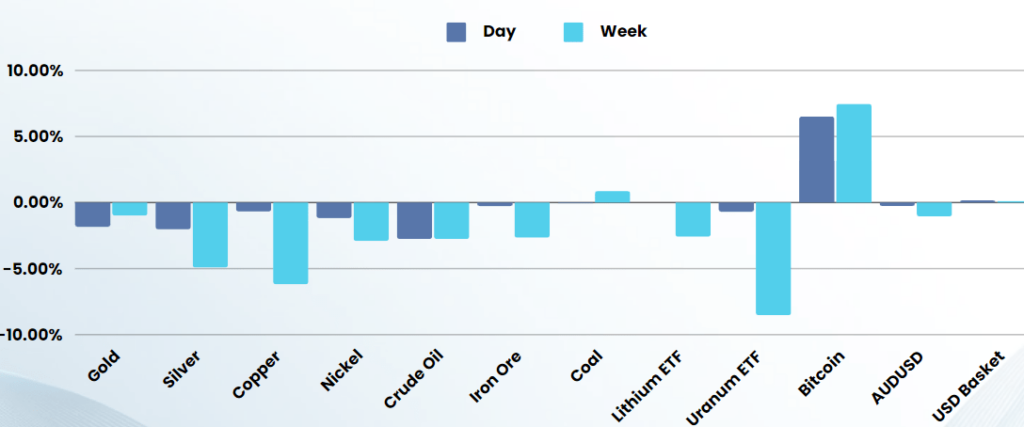

Commodities & FX

The Day Ahead

ASX SPI 7876 (-0.84%)

The ASX is in for a rough start to the week with political instability in the US, Geopolitical tensions in the middle east and the fallout of the Microsoft outage.

We are likely to see a broad sell off outside of Gold and Oil