Last Night's Market Recap

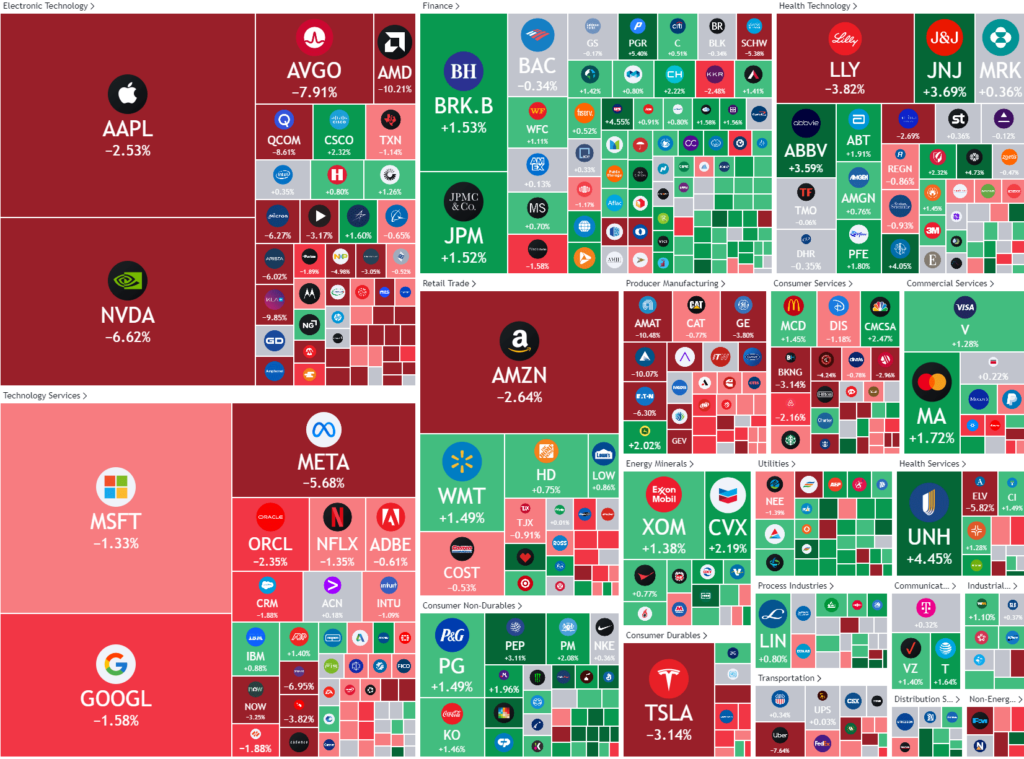

S&P 500 - Heatmap

Overnight – Nvidia tumbles, Value stocks gain as rotation out of tech continues

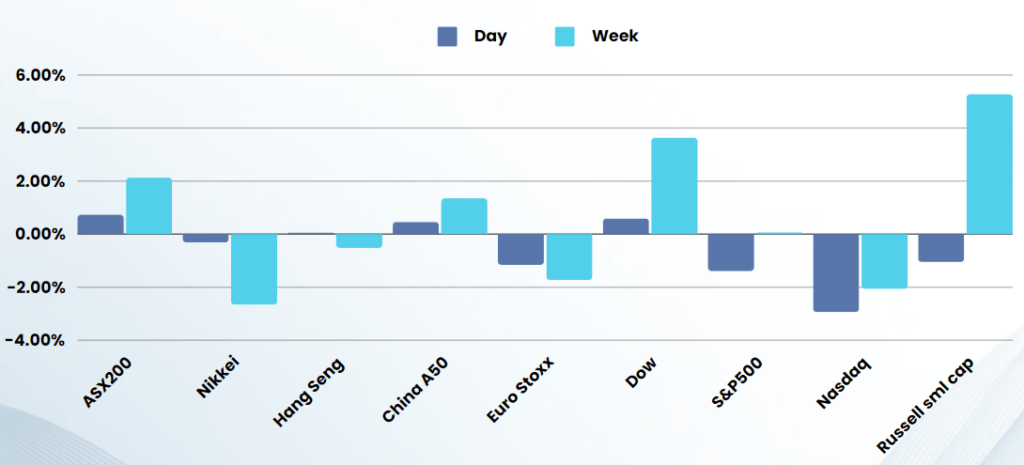

Value stocks, led by financial and energy, gained overnight as the rotation away from tech was accelerated following an Nvidia-led retreat in tech on geopolitical jitters.

NVIDIA fell more than 6% on concerns the U.S. is looking to deepened its ban on companies exporting chipmaking equipment to China. The Biden administration is considering clamping down on companies exporting their critical chipmaking equipment to China, Bloomberg reported Tuesday. As well as Biden, Donald Trump also raised geopolitical tensions by stating that Taiwan should pay the U.S. for supplying defence equipment as “it does not give the country anything,” causing Taiwan Semiconductor Manufacturing (TSMC), Taiwan’s biggest stock and the largest contract chipmaker in the world, to fall nearly 8%.

A disruption to the supply chain from TSMC is the largest geopolitical risk for the US tech stocks as they are the manufacturer of 90% of the worlds advanced chips.

Fed speakers overnight continued to fuel rate cut speculation as Waller said that the timing on rate cuts is drawing closer following recent data showing a more moderate economic growth and declining inflation pressures. “While I don’t believe we have reached our final destination, I do believe we are getting closer to the time when a cut in the policy rate is warranted,” Waller said for a speech at a Kansas City Fed event. Adding to this optimism was Richmond Fed president Tom Barkin, meanwhile, said he was started to see the slowdown in inflation broaden out, but added that the central bank would debate whether inflation is still elevated at the upcoming July meeting.

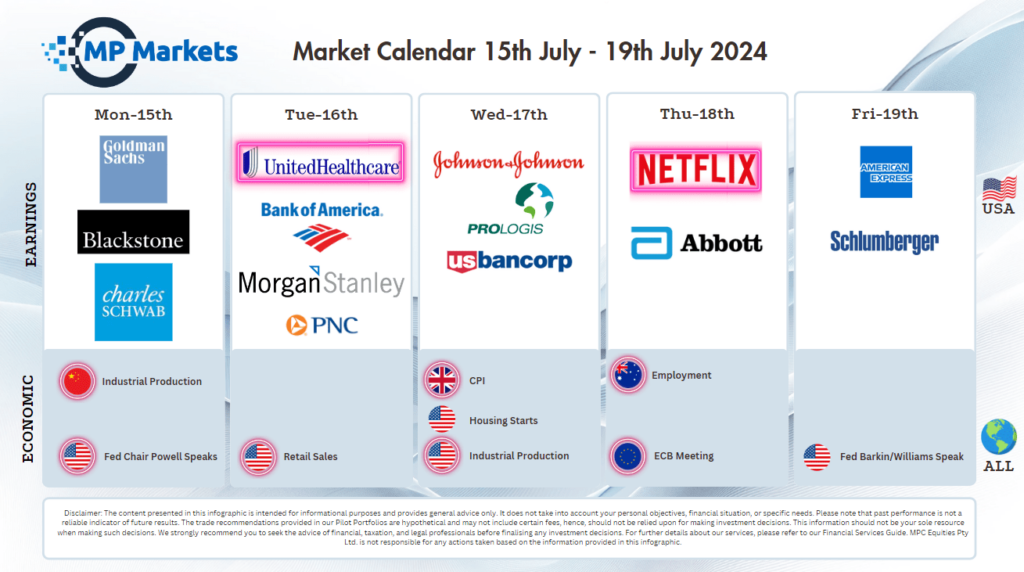

Company Earnings

- Johnson & Johnson +4% – stock rose nearly 4% after the the healthcare giant reported a robust second quarter, with both earnings and revenue surpassing Wall Street estimates, driven by strong sales of its drugs.

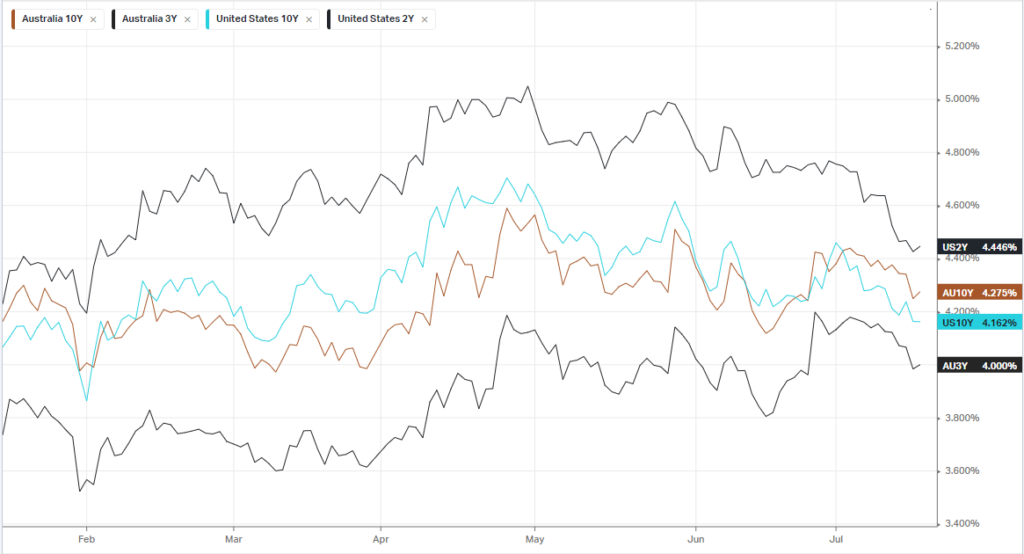

Bonds

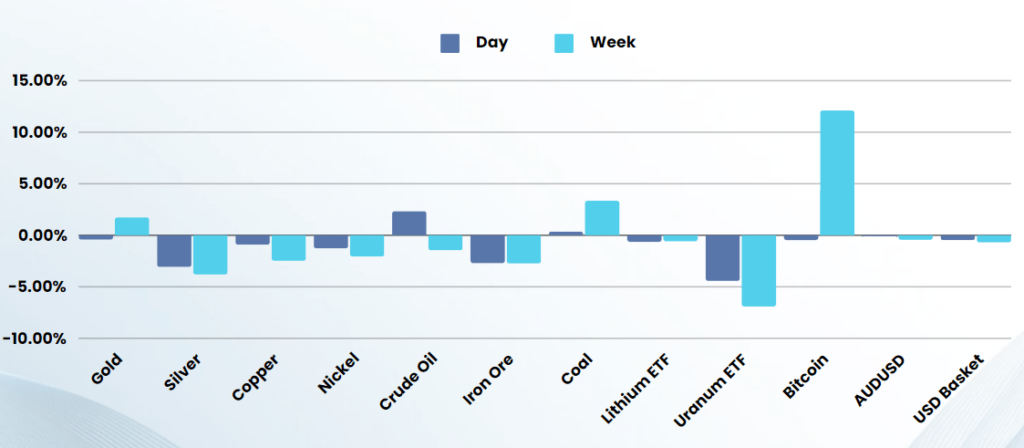

Commodities & FX

The Day Ahead

ASX SPI 7986 (-0.57%)

While the headlines of the semiconductor stocks in the US falling will make investors nervous, we have to remember the ASX200 has a very different composition and the rally in the small caps and value stocks is far more relevant to the local market.

That said, the continued fall in iron ore and a pull back in gold and silver will see the materials sector drag down the index. This coupled with the looming reality check the Big4 “building societies” has coming at earnings season, the index will find it difficult to rally.

Company specific:

- FMG – In the biggest shake-up of Fortescue’s structure and strategy in years, the company will mothball their hydrogen plans, cutting 700 jobs. This will be music to the market’s ears, but is more evidence the energy transition is spluttering.