Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Stocks hit new records as Bank and Healthcare earnings impress market

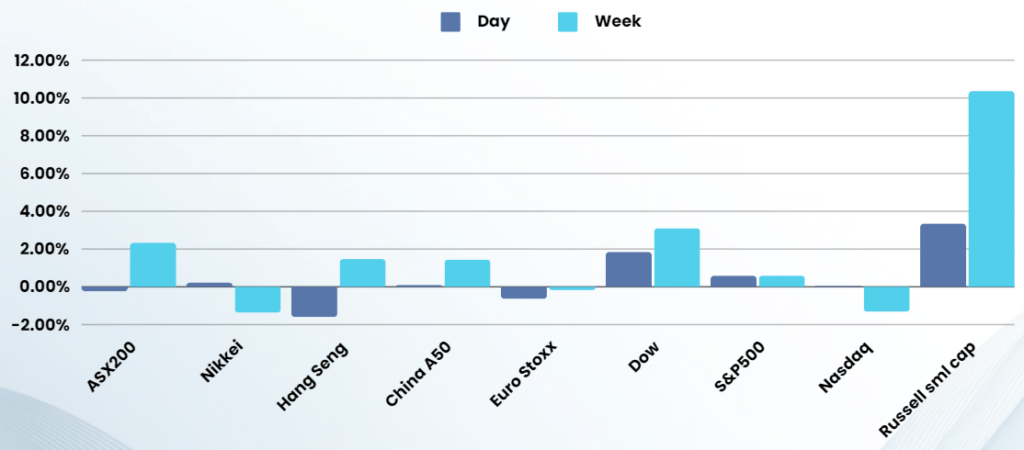

The Dow had its best day in more than a year Tuesday, closing at fresh record highs, underpinned by better-than-expected retail sales data and a slew of mostly upbeat quarterly earnings from corporates

US retail sales were unchanged in June on a monthly basis, according to data released earlier Tuesday, following on from an upwardly revised 0.3% gain in May. This release was stronger than the expected fall of 0.3% expected, after a previously reported 0.1% gain in May, pointing to still strong consumer spending that could likely limited how many rate cuts the Fed delivers.

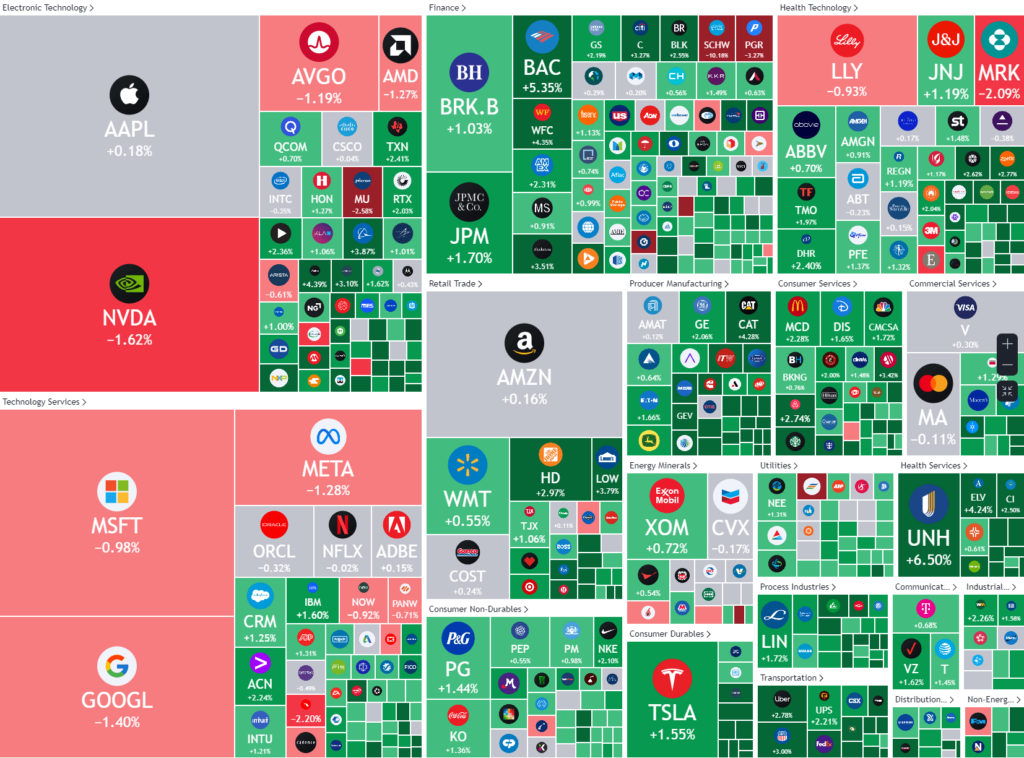

Unitedhealth Group, a major DOW component, jumped 6% after the health insurance giant reported Q2 results that beat on both the top and bottom line, despite headwinds in its Medicaid business.

Wall Street banks continued to dominate earnings, with Bank of America surging 5% after the lender reported second-quarter revenue and profit topping expectations on rising investment banking and asset management fees. Morgan Stanley cut early losses, to close 1% higher following better-than-expected results, but Charles Schwab fell 10% as brokerage firm said on an earnings call it may pause buybacks to pay down debt and reported net interest margin that fell short of estimates.

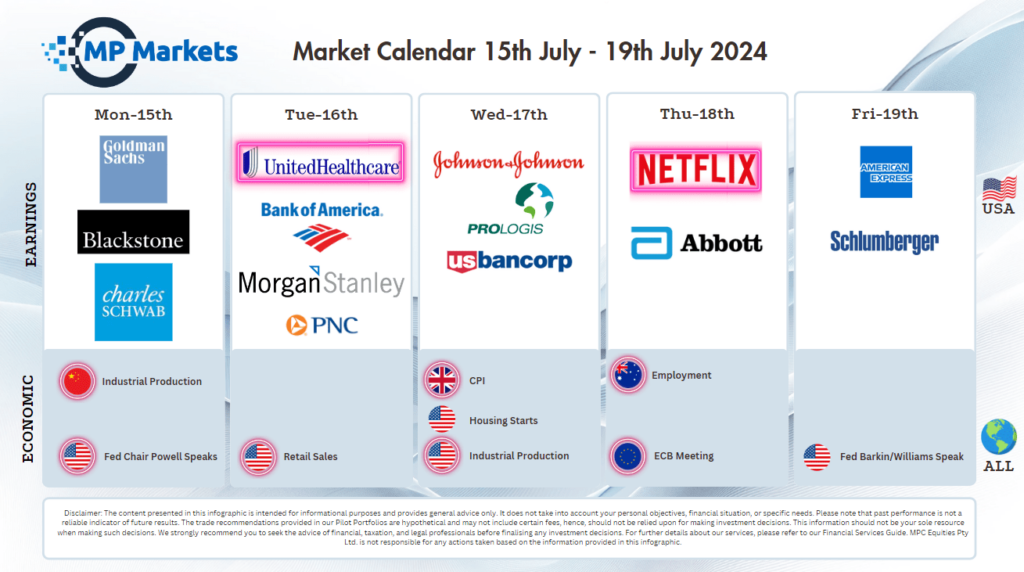

Company Earnings

- UnitedHealth +6.5% – reported on Tuesday earnings and revenue for the fiscal Q2 2024 that beat consensus estimates. Q2 earnings per share (EPS) stood at $6.80, above the analyst expectations of $6.67. Revenue for the quarter was $98.9 billion, slightly above the consensus estimate of $98.72 billion.

- Morgan Stanley +0.98% – second-quarter profit beat expectations on Tuesday, driven by a surge in investment banking and trading revenues that overcame muted results in wealth management. The bank joined other Wall Street lenders, including Bank of America and JPMorgan in reporting higher investment banking revenue, fueled by growing confidence in the U.S. economy that prompted companies to raise more money and strike deals.

- Bank of America +5% – reported a robust second-quarter performance with a net income of $6.9 billion and diluted earnings per share (EPS) of $0.83. The bank’s revenue has increased compared to the previous year, driven by a rise in non-interest income and growth in customer numbers and activity across all business segments. Bank of America also announced plans to boost its quarterly dividend by 8% and expects net interest income (NII) to rise in the latter half of the year. The bank’s capital strength remains solid, with a CET1 ratio of 11.9%

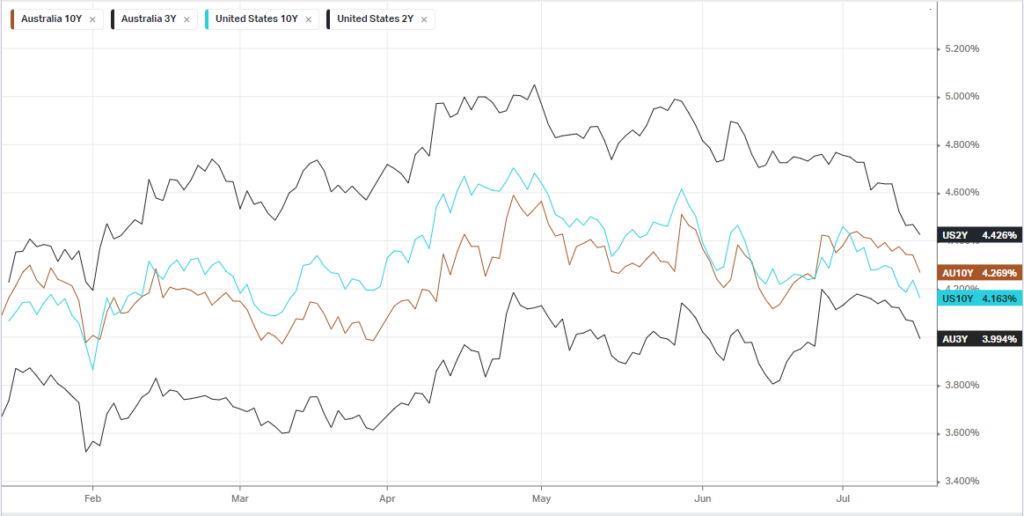

Bonds

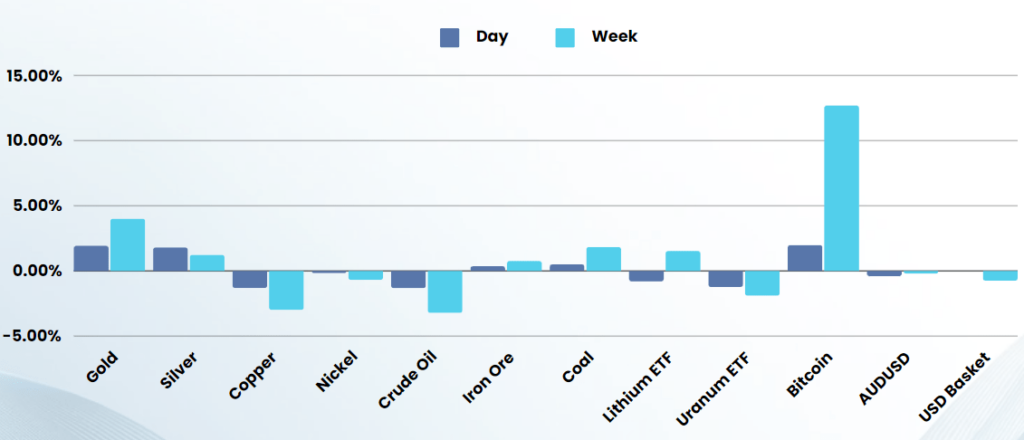

Commodities & FX

The Day Ahead

ASX SPI 8035 (+0.65%)

The broadening rally in the US market is very positive for the ASX, with many undervalued small to mid-caps returning to investors radars after a 18-months out in the cold. We would expect the ASX to follow a similar pattern of profit taking in the Large-caps as investors price in the top in interest rates, which lends itself to a “risk on” attitude from investors.

Global Bond yields continued to fall on the back of the data as traders now price in 100% chance of a September cut in the US, relieving pressure on the RBA to add another hike