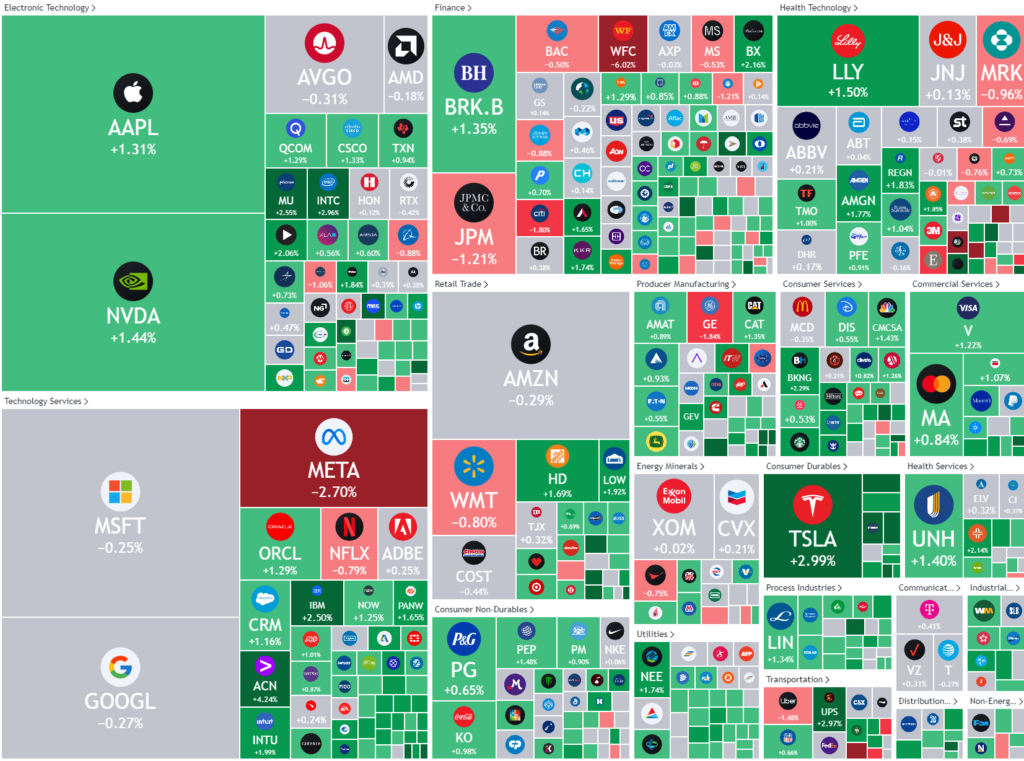

Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Stocks rally on rate cut hopes, Trump assassination attempt reflects America’s divide

Over the weekend, an attempt was made on Former President Trumps life at a rally, further reflecting the deep political divide in the county. While equities closed higher on Friday night on bets that the US Federal Reserve will cut interest rates in September, while big banks fell after reporting mixed results.

Inflation Data showed producer prices were slightly hotter-than-expected in June but that did little to change bets on the first rate cut in September. The producer price index, or PPI, which measures the average change over time in the selling prices received by domestic producers for their output, rose to a 0.2% last month, contrary to the 0.1% rise anticipated by economists, taking the annualized figure for June to 2.6%.

The report follows data showing a surprise fall in U.S. consumer prices on Thursday. Traders are betting on a 94% chance of a rate cut by September, up from 78% a week ago, according to CME Group’s FedWatch.

The S&P 500 banks index lost 1.5% as JPMorgan Chase’s second-quarter profit was lifted by rising investment banking fees. However, shares of the world’s largest bank dipped 1.2%, while Wells Fargo tumbled 6% after the lender missed estimates for quarterly interest income, while Citigroup fell 1.8% despite reporting a surge in investment banking revenue.

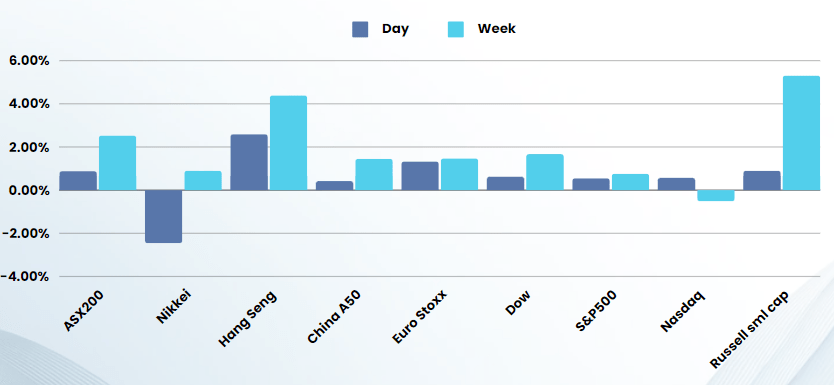

The small-cap Russell 2000 rallied for a third straight day, gaining 1.1% and reaching its highest since 2022, while the S&P 400 Mid Cap index rose 0.9%. The two indexes have lagged the S&P 500 this year. That rotation into small- and mid-caps is still continuing and that’s a positive sign overall.

The attempt on former President Trump over the weekend further emphasised the divide in American politics and almost certainly sealing the election result against Joe Biden. Historically, when such an attempt is made, the victim has won by a landslide, Roald Regan being the most recent example

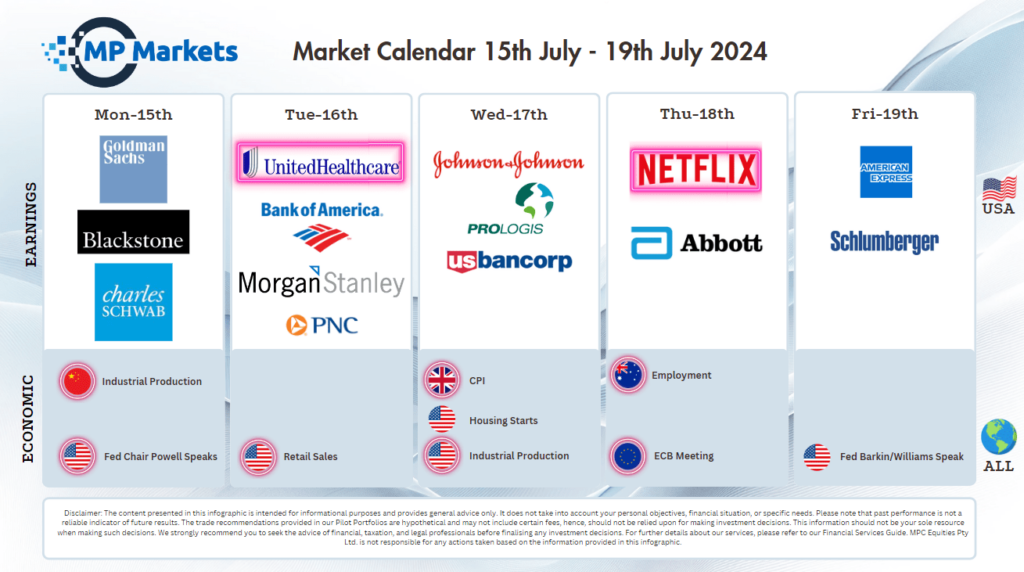

Company Earnings

- JPMorgan Chase -1% – has reported a robust financial performance for the second quarter of 2024, with a net income of $18.1 billion and earnings per share (EPS) of $6.12 on revenue of $51 billion. These figures include a substantial net gain from the sale of Visa shares and a philanthropic contribution. The company’s Corporate and Investment Bank (CIB) and Consumer and Community Banking (CCB) segments showed strong performance, alongside a solid contribution from Asset and Wealth Management (AWM). JPMorgan also announced an increase in its quarterly dividend to $1.25 per share.

- Wells Fargo -6% – reported its second-quarter financial results, revealing both strengths and challenges as it continues its transformation journey. Highlighted in the financials, including a 19% increase in non-interest income and a slight decline in the allowance for credit losses. However, the bank also faced increases in non-interest expenses and net loan charge-offs, particularly in the commercial real estate office portfolio.

- Citigroup -1.8% – reported a strong second quarter for 2024, with a net income of $3.2 billion and earnings per share (EPS) of $1.52. The bank saw revenues increase by 4%, with notable growth in its Services, Markets, Wealth, and US Personal Banking divisions. Despite the positive financial performance, Citigroup CEO Jane Fraser discussed the ongoing regulatory concerns, including recent actions by the Federal Reserve and the OCC related to consent orders from 2020.

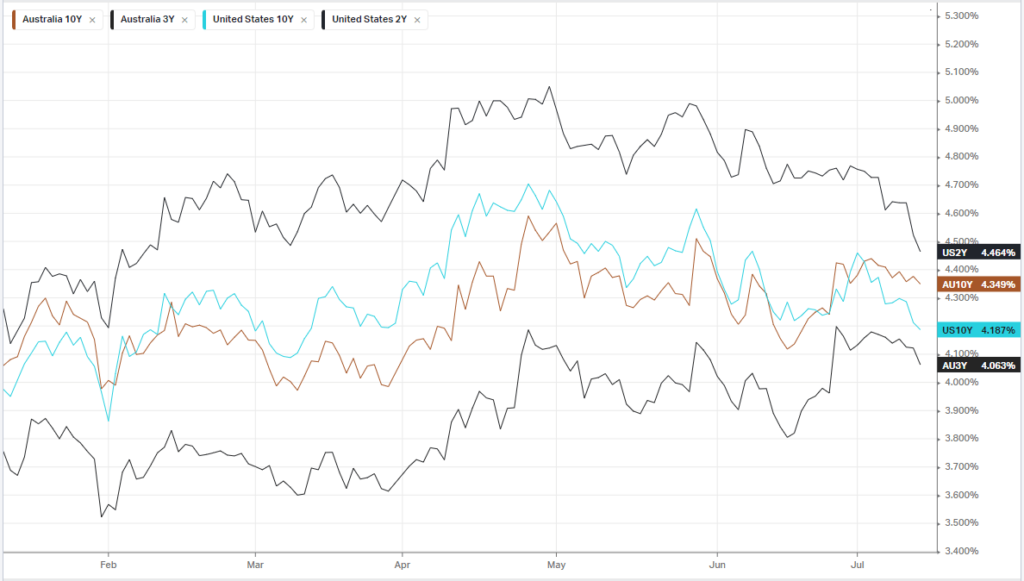

Bonds

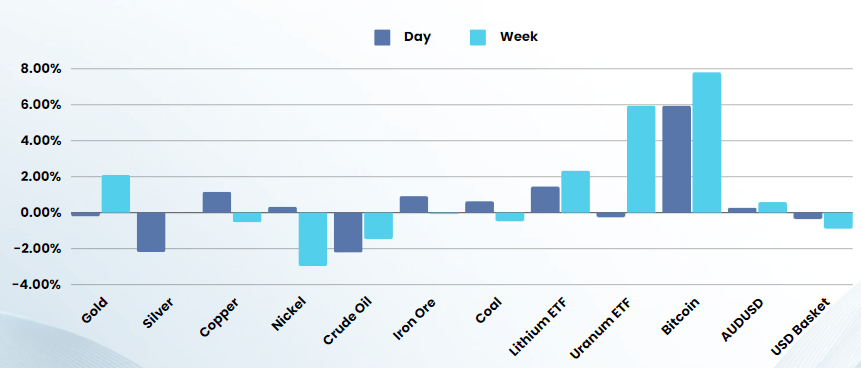

Commodities & FX

The Day Ahead

ASX SPI 8021 (+0.64%)

The ASX is looking at hitting 8000 for the first time in history this morning as the optimism of Fed rate cuts buoyed global stock markets.

The Trump assassination attempt is likely to push traders towards safe haven trades like Gold, Silver and bonds, extending current trends.

The AU banks may see some negativity after underwhelming results from JP Morgan and Citi, particularly at these elevated prices