Last Night's Market Recap

S&P 500 - Heatmap

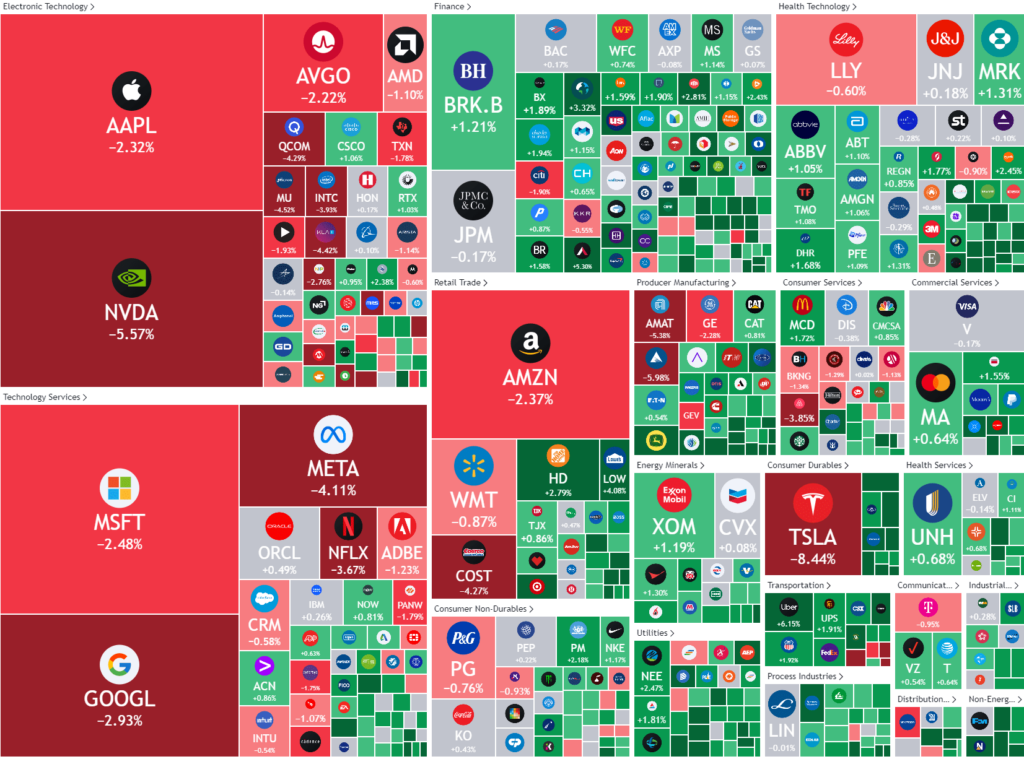

Overnight – Joy of softening inflation becomes concern about softening economy

In a surprising turn of sentiment, the Magnificent 7 had their worst day in months, while the broader market was firmer, despite cooling inflation data. The sentiment of rejoicing falling inflation became the reality check investors have been blind to, as it points to a slowing in the U.S. economy even if Federal Reserve interest rate cuts become a possibility later this year.

Data released earlier Thursday showed the June Consumer Price Index fell 0.1% on a monthly basis, instead of the expected 0.1% increase forecast. Annually, it increased 3%, lower than the expected 3.1% rise. The widely-watched core figure, which excludes volatile food and energy components, rose just 0.1% on a monthly basis, and gained 3.3% annually, versus an estimated 3.4% increase. These figures added to expectations that the Federal Reserve could start cutting rates as soon as September, the next Fed policy-setting meeting.

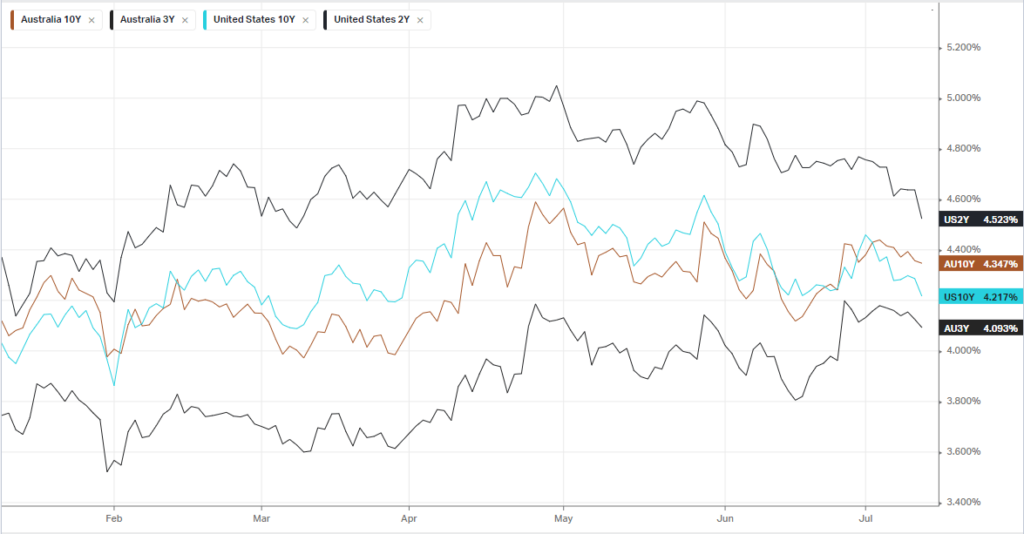

Following the CPI announcement, Treasury yields dipped as traders increased their bets on forthcoming interest rate cuts. The likelihood of a rate reduction in September jumped to about 93%, as indicated by the CME FedWatch Tool, although the market consensus is that the Fed will maintain rates at the upcoming meeting later this month.

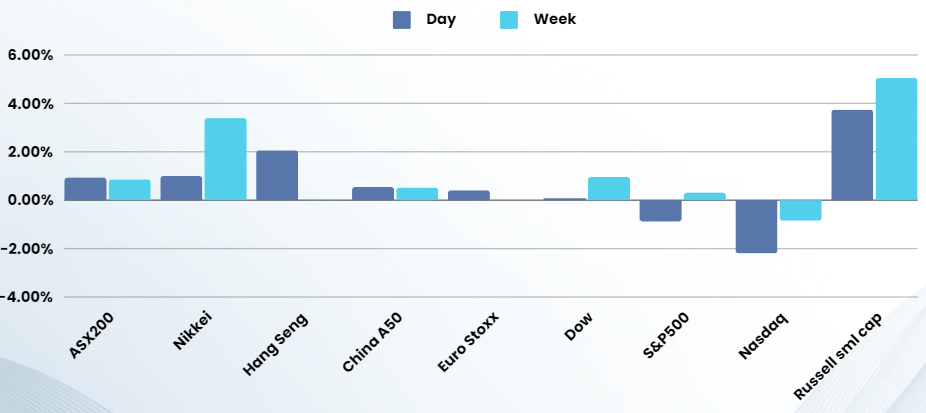

The seemingly bullet proof tech/AI index, the Nasdaq Composite, retreated from its daily high by 1.95%, ending at 18,283.41, with Nvidia’s shares dropping by over 5.5%. In contrast, the value based, Dow Jones Industrial Average edged up slightly by 32.39 points, or 0.08%, while Small-cap stocks, as measured by the Russell 2000 Index, rose as much as 3.6%. This rally was fueled by expectations of a Federal Reserve rate cut in September and hopes for an economic soft landing, bolstered by the latest inflation data.

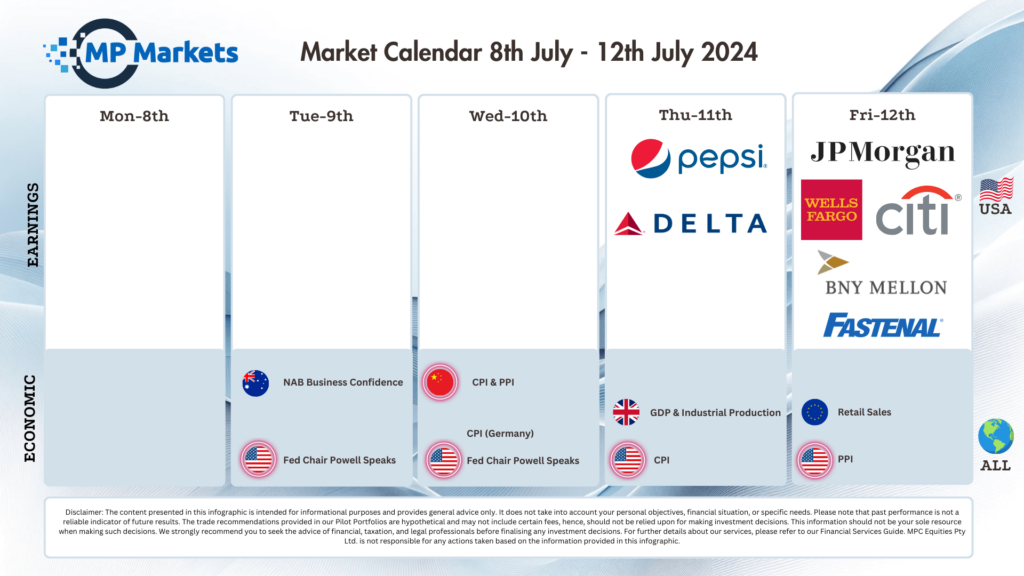

Company Earnings

- PepsiCo +0.2% – stock closed 0.2% higher after reporting disappointing second-quarter sales figures, hurt by declining demand in North America for its drinks and snacks.

- Delta Air Lines -4% – stock fell 4% after the carrier forecast lower profits in the current quarter than expected, citing discounting pressure in the low end of the market.

Bonds

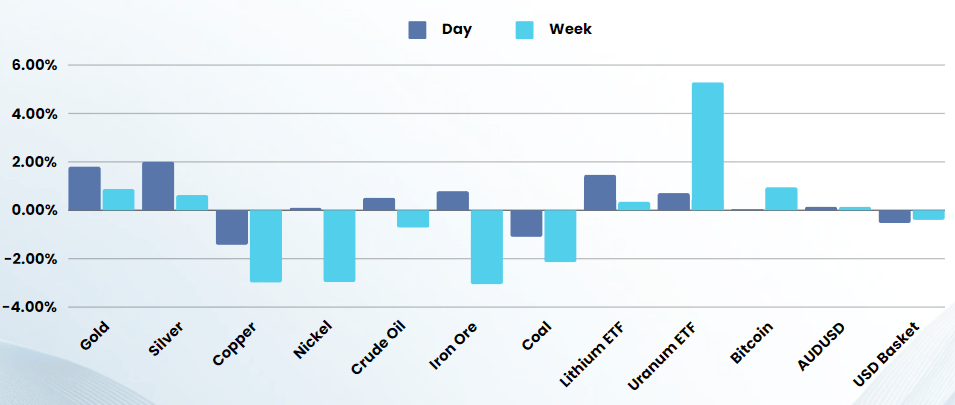

Commodities & FX

The Day Ahead

ASX SPI 7914 (+0.57%)

The shift out of the mega-caps to the rest of the market overnight should be a good thing for the Aussie market as investors finally start to talk about something else apart from Nvidia and AI. Lower rates will help the smaller end of the market and bring attention back to other sectors of the market, currently sitting at depressed levels.

The AI thematic has been a black hole for capital inflows for over a year, with fund managers not bothering to allocate outside the Magnificent 7 stocks. While 1 night doesn’t signify a trend, If the shift continues, we are likely to see high volatility in the coming weeks.

Company specific:

- BHP – shuts down nickel production to arrest losses