Last Night's Market Recap

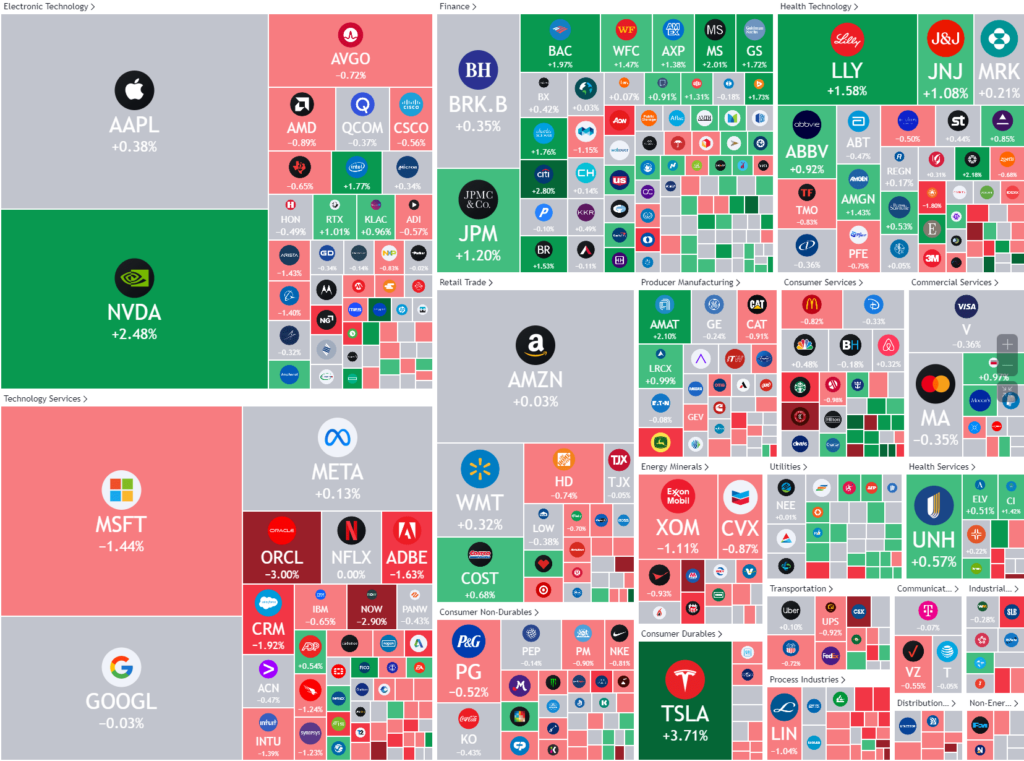

S&P 500 - Heatmap

Overnight – Stocks grind higher as Powell flags signs the economy is softening

Stocks eked out another tiny gain to secure another record close for the fifth-straight session as testimony from Federal Reserve Chair Jerome Powell didn’t sway investors from bets on a first rate cut in September.

In sign that the Federal Reserve continues to believe that its policy measures are slowing the economy, Powell said the economy was no longer “overheated” as the job market tightness nearly eased to pre-pandemic levels. The fed chief also said that “good data” in the coming months would boost the chances of interest rate, and flagged the risk of keeping rates too high for too long. The remarks boosted investor bets on a September rate cut just ahead of key inflation data later this week. The consumer price index inflation data for June, which is due on Thursday, is set offer more cues on the path of inflation. The Fed has repeatedly signalled that it needs more confidence that inflation is easing, before it can begin cutting interest rates.

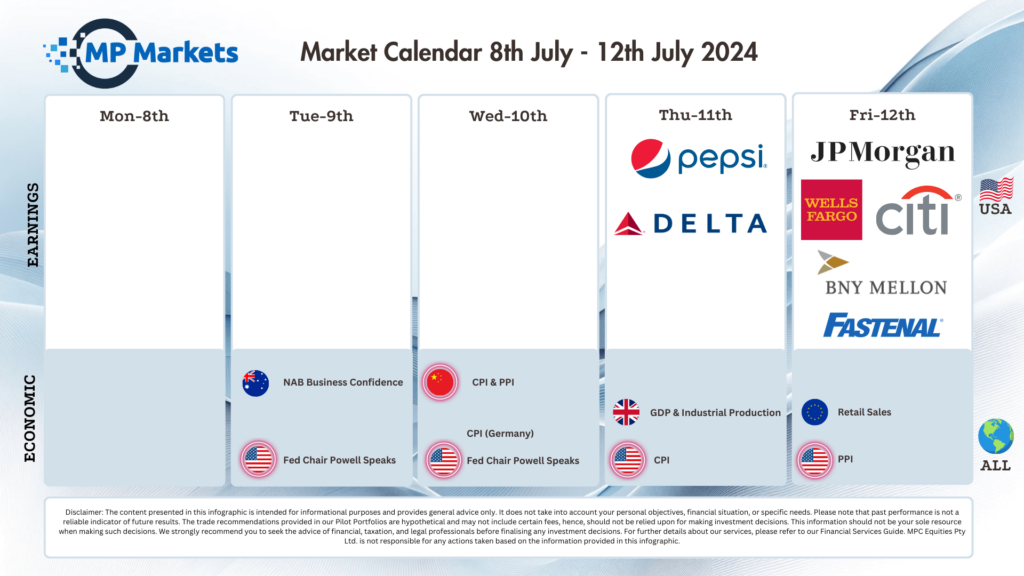

Focus this week will also be on the second quarter earnings season, which is set to begin with results from several major banks at the end of the week. JPMorgan Chase, Wells Fargo and Citigroup are set to report quarterly earnings on Friday. Analysts, on average, see S&P 500 companies increasing their aggregate earnings per share by 10.1% in the second quarter, up from an 8.2% increase in the first quarter

Company specific

- NVIDIA+2% – rose more than 2% after Keybanc upgraded its price target on the chipmaker to $180 from $1300, citing rising AI demand.

- Tesla +2% – rose more than 3% as Morgan Stanley reiterated its overweight rating on the stock amid positive signs of the EV maker’s foothold in the global battery electric vehicle market, which stood at 15% in May.

- Helen of Troy -27% – plunged 27% to 52-week low as the housewares company slated its full-year guidance after reporting fiscal first quarter earnings that fell short of estimates.

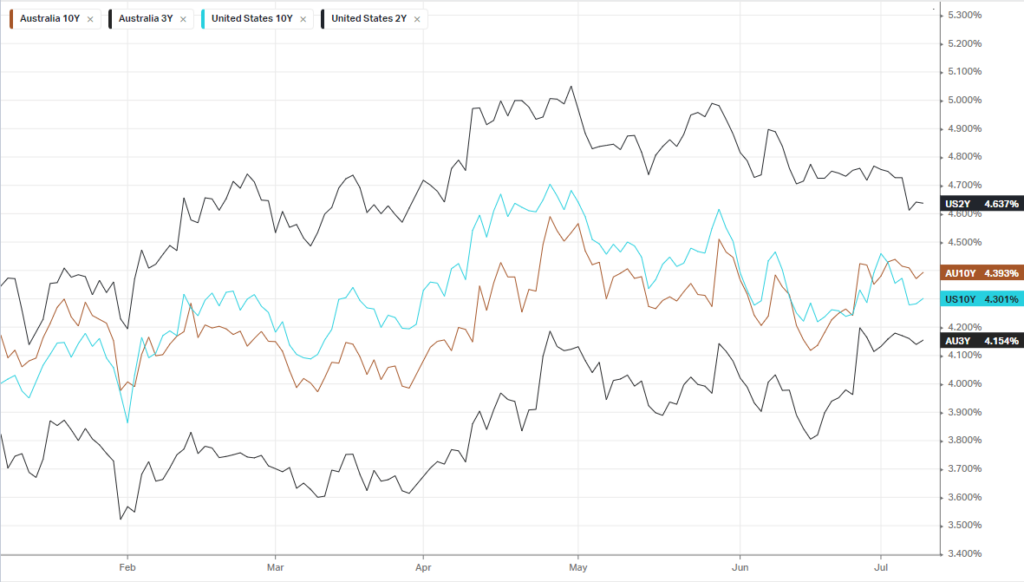

Bonds

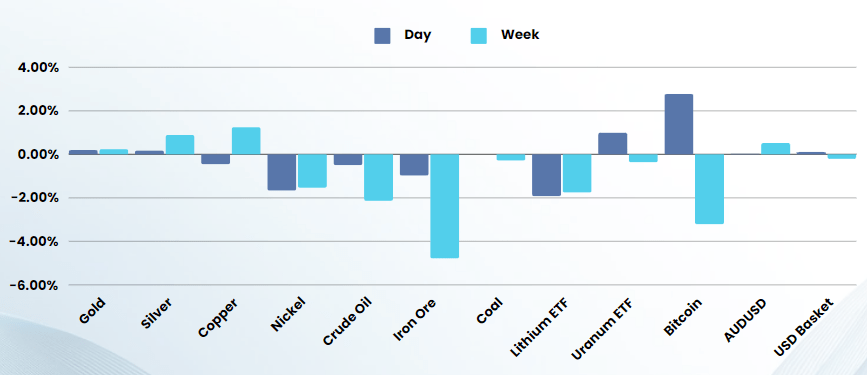

Commodities & FX

The Day Ahead

ASX SPI 7771 (-0.52%)

Judging by the overnight reaction in the ASX200 futures, we are in for a negative day, although looking at overnight market lead and the full calendar for the rest of the week, we don’t see significant downside. The analyst & press negativity on Iron ore is dragging down the materials sector, but we believe the negativity is overstated due to the rumoured government buying in Asia for military purposes would not flow through into the manufacturing data, and therefore be missed by the price models used by “experts”

Despite the constant run of record highs in US stocks, the market seems exhausted at these levels and the optimism around rate cuts can quickly turn into pessimism about the economy.

Company Specific:

- Cettire – The online fashion retailer is now the second most shorted stock on the ASX as hedge funds ramped up bets against the stock over the past week.

- Booktopia – Rumours are floating that a new suitor has emerged for Booktopia, as bid the Thursday deadline looms. McGrath Nicol are hoping to sell or recapitalise the business