Last Night's Market Recap

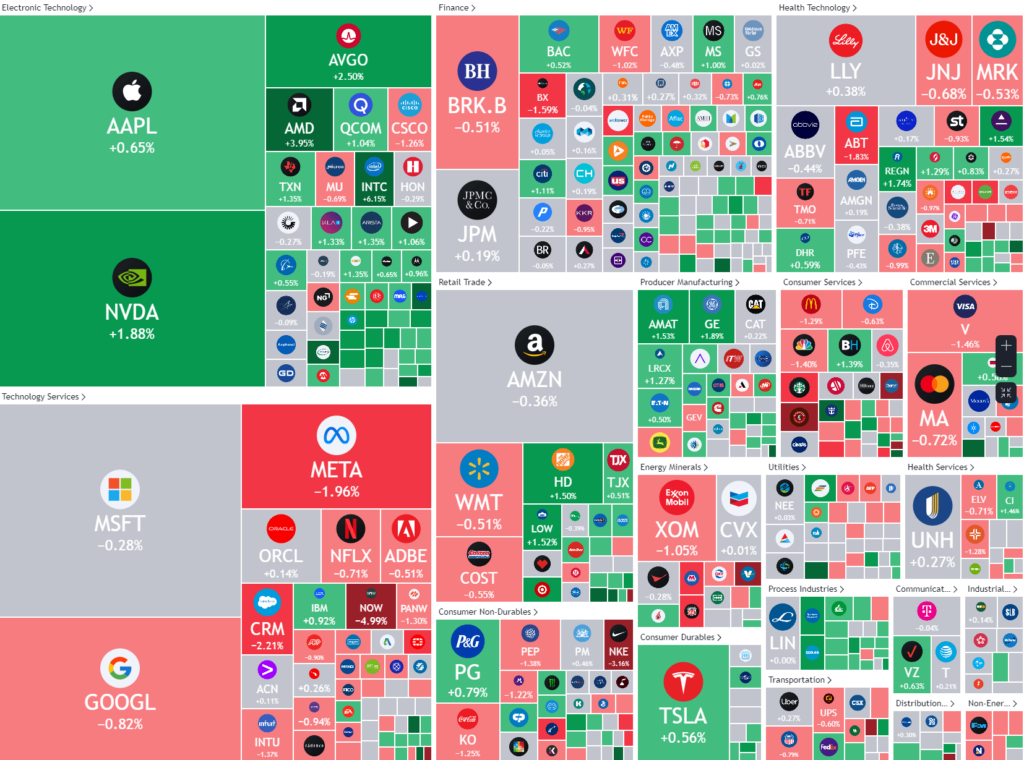

S&P 500 - Heatmap

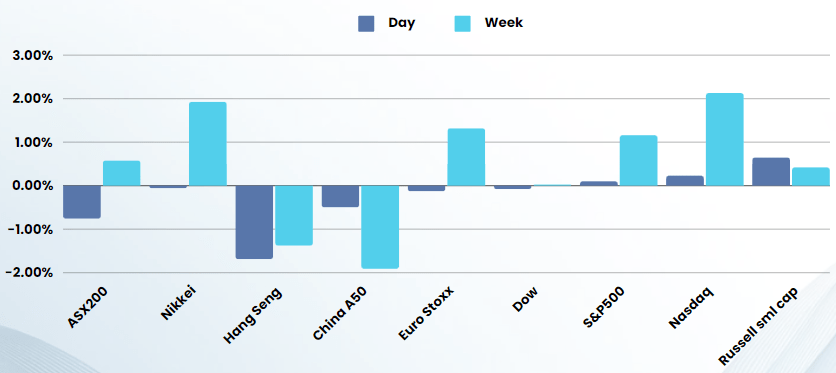

Overnight – Markets lost for direction into Inflation data & Powell testimony

Markets lacked direction as investors showed a cautious sentiment ahead of testimony by Federal Reserve Chair Jerome Powell to Congress and key inflation data this week.

Powell will testify before the Senate and the House on Tuesday and Wednesday, respectively, with the bulk of his testimony expected to focus on monetary policy. Powell had signalled last week that while the Fed had made some progress towards bringing down inflation, policymakers still did not have enough confidence to begin trimming rates. The minutes of the Fed’s June meeting furthered this notion.

Weaker-than-expected labour data from last week ramped up hopes that the jobs market was cooling, giving the Fed more impetus to begin cutting interest rates. But inflation is likely to be the central bank’s key point of consideration in reducing interest rates. The consumer price index is due on Thursday, and is expected to rise 0.1% m/m and 3.1% y/y. The core CPI is expected to increase by 0.2%.

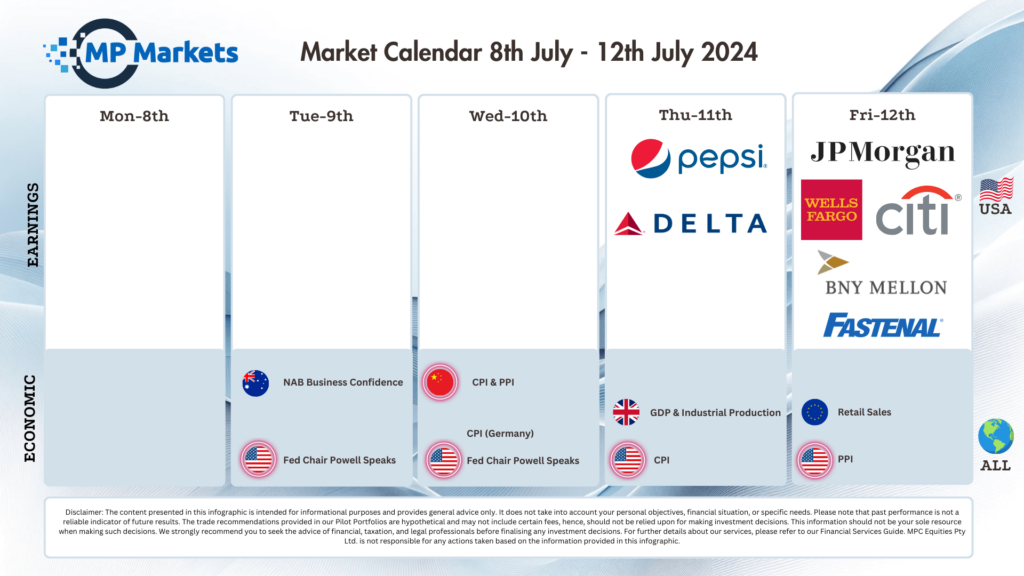

Outside the macro focus, second-quarter earnings season kicks off this week, with the heavyweight bank earnings on Friday. Markets will be watching to see just how robust corporate earnings remained under pressure from high interest rates and sticky inflation. JPMorgan Chase, Wells Fargo and Citigroup are set to report earnings on Friday. Numbers from PepsiCo and Delta Air Lines are also die this week.

S&P500 stocks are expected to report Y/Y earnings growth of 8.8% for Q2 2024, which is slightly below the estimate of 9.1% earnings growth on March 31.

Company specific

- Boeing +0.5% – stock closed just above the flatline after the aircraft manufacturer agreed to plead guilty to a criminal fraud conspiracy charge to resolve a U.S. Justice Department investigation into two 737 MAX fatal crashes.

- Paramount Global -5% – stock fell 5% after Skydance Media agreed to merge with the entertainment giant, ending months of speculation.

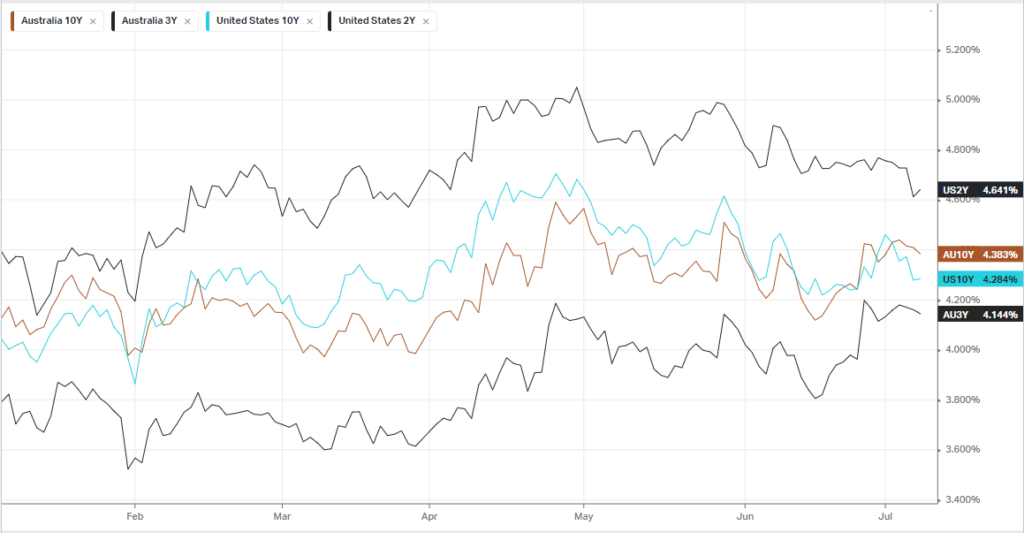

Bonds

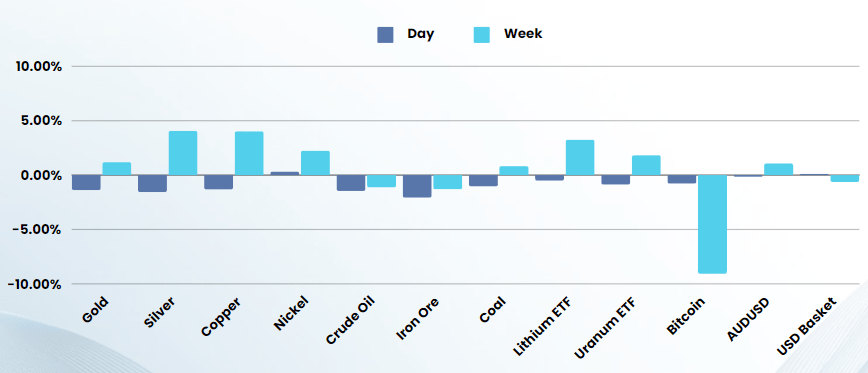

Commodities & FX

The Day Ahead

ASX SPI 7766 (+0.21%)

Today is looking to be as uneventful as the rest of global markets with investors having little reason to place new money until the a clearer picture on rates is given with inflation late in the week and the Fed Chair testifying tonight and tomorrow.

Adding to the uncertainty is the political uncertainty due to election results in Europe. Initially polling suggested a swing to the right from European and UK citizens, however the backlash seems to be against incumbent government’s, fueling bets that Donald Trump will win another term, a dent to any hopes of geopolitical calm or any form of fiscal discipline.