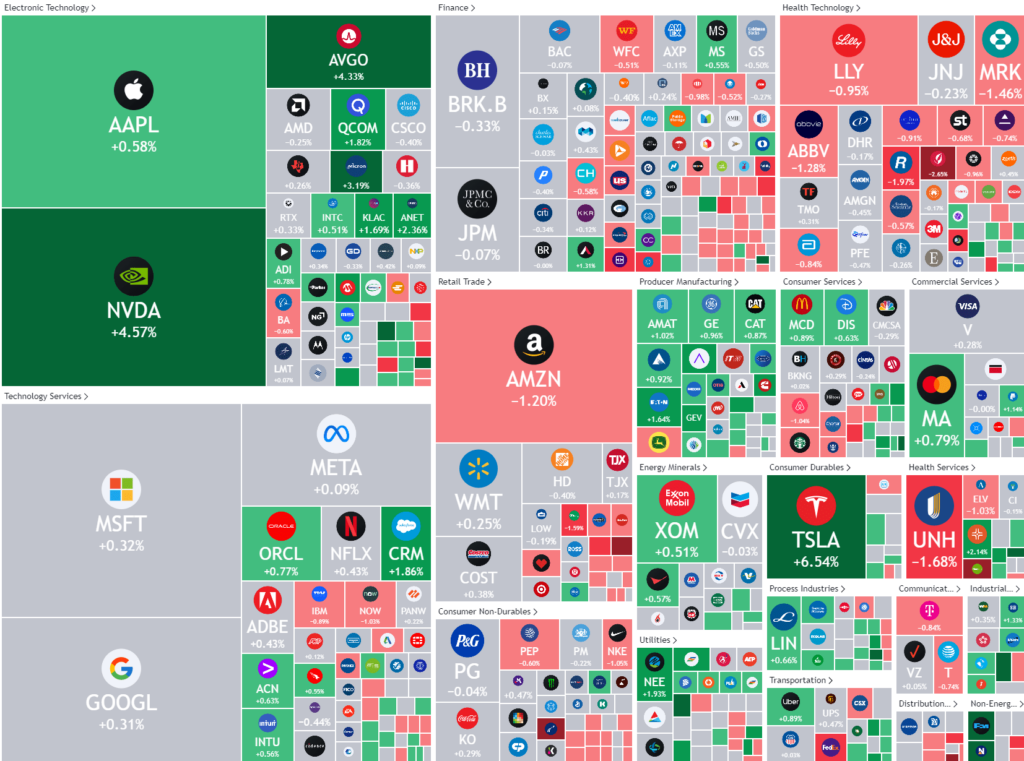

Last Night's Market Recap

S&P 500 - Heatmap

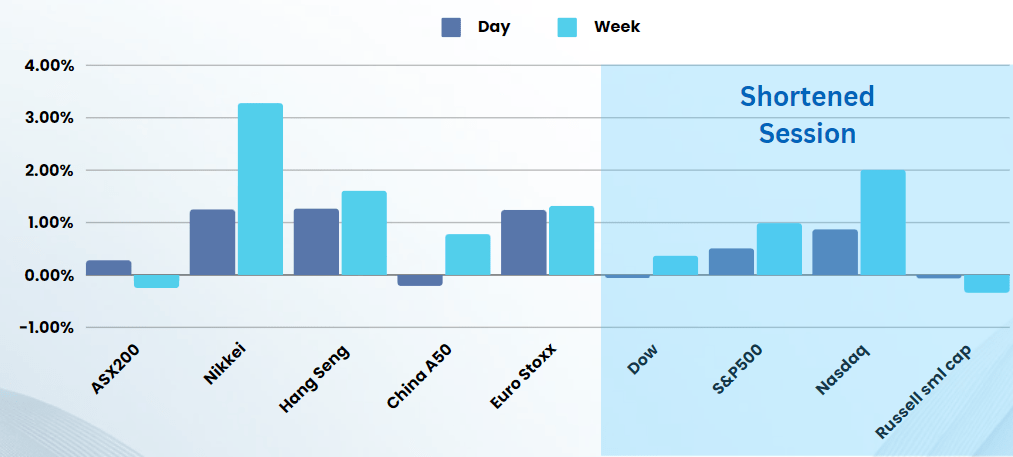

Overnight – Another day, another record close despite economy weakening

Equities notched another record close overnight, in a holiday-shortened session as a slew of weaker economic data boosted hopes for sooner rate cuts, a day ahead of the 4th of July holiday.

The US had a shortened trading day ahead of Thursday’s Independence Day holiday and come off strong gains on Tuesday after Federal Reserve Chair Jerome Powell flagged some progress in cooling inflation. The strength in the session came off a dramatic fall in services PMI, falling into contractionary territory at 48.8 (50 is neutral) 2.8 points lower than expectation and 4 points lower than the previous month. Factory orders also fell unexpectedly with a 0.5% decline, 0.7% lower than expected.

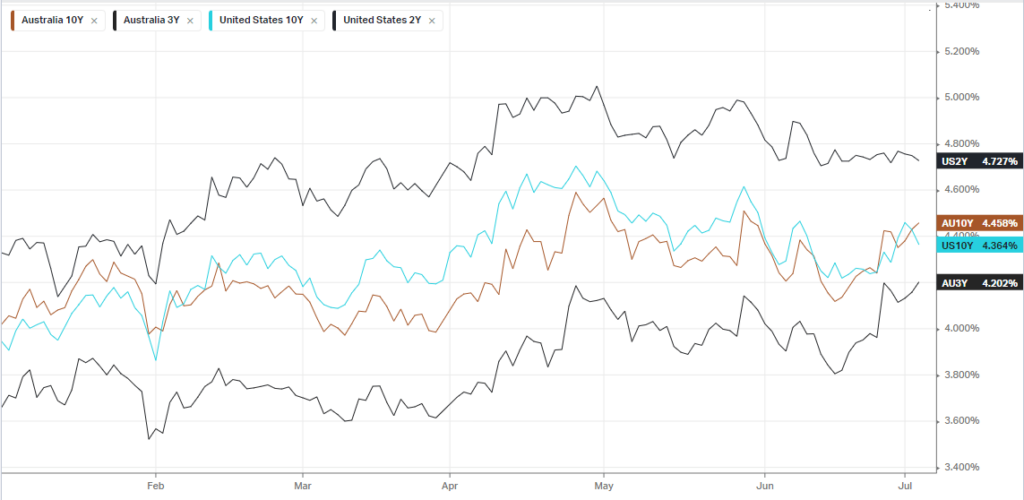

This show of economic weakness saw bond yields drop around 7bps as traders bet that the Fed would cut in September, supporting the mega-cap stocks, but seeing the broader market drift lower

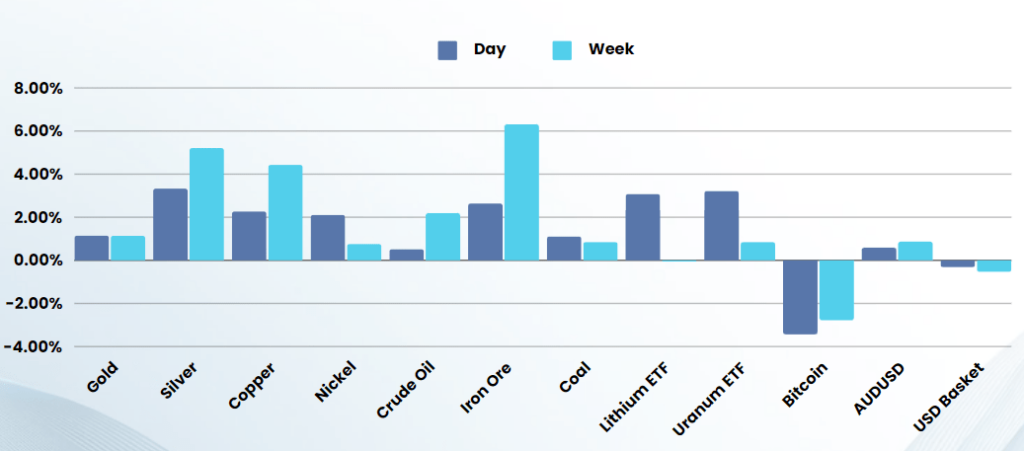

The fall in bond yields also saw support for commodities with Silver up nearly 4% and Copper rising 3%

After the bell in the shortened session, the FOMC Meeting minutes were released, showing that the vast majority of participants assessed that growth in economic activity appeared to be gradually cooling but despite this slowdown, the Fed is awaiting additional information before gaining the confidence to reduce interest rates. The central bank noted that it would not consider lowering the federal funds rate target until more data emerged to provide greater assurance that inflation was on a sustainable path lower

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7802 (+0.94%)

The first week of the new FY has, and will continue to be, a quiet one with US summer holidays and 4th of July holiday grinding global markets to a halt.

The materials sector will be buoyed by a rally in iron ore, while gold and energy stocks are likely to continue their recovery, while tech will remain supported by the US lead

Company Specific:

- Santos – Saudi Aramco and Abu Dhabi National Oil Co have been separately studying potential bids for Santos, as the Middle Eastern energy giants seek to ramp up their gas investments overseas,

- New Hope – cash-rich coal miner New Hope was out with a $300 million convertibles raising last night. There was no reason cited for the capital raise apart from “balance sheet flexibility” which is a stock-standard answer. Watch out for M&A.

- Regal Partners – said it achieved net inflows of $300 million for the June quarter to take total funds under management to $12.2 billion. The group also said it expects to earn performance fee revenue between $55 million and $56 million in financial 2024. The group’s valuation has lifted 25 per cent over the past year and it will post full-year results on August 26.