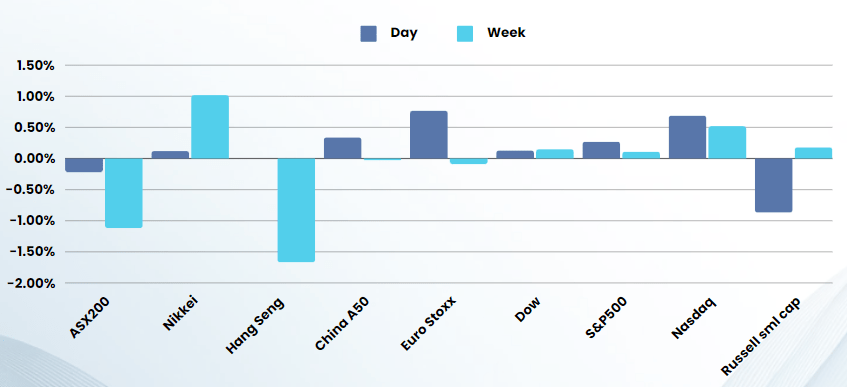

Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Tech buoys equities as investors wait on Powell and Payrolls

Stocks edged higher overnight, buoyed by tech as stocks kicked off the second half of the year on the front foot ahead of Powell speaking in Europe and crucial monthly jobs report due later this week.

A slew of updates on the labour market including the job openings report due Tuesday and further clues on monetary policy is slated for this week in the run up to Friday’s nonfarm payrolls data for June. The monthly jobs report reading is set to provide more insight into the labour market, whose resilience has also been a key point of contention for the Fed in cutting rates. Ahead of the nonfarm payrolls data, the Federal Reserve is set to release the minutes of the its June meeting, with many keen for fresh clues on the central bank’s monetary policy outlook after the Fed signal that it now only expects one cut this year, from a prior estimate of three cuts.

Fed speak is also on the agenda with Chairman Jerome Powell set to appear at the European Central Bank’s annual forum in Portugal on Tuesday, but the Fed chief isn’t expected to offer fresh insight into monetary policy. Powell is likely to continue to emphasize that while the latest data point is a step in the right direction, Fed officials will need to see several more positive prints before gaining sufficient confidence to begin cutting rates.

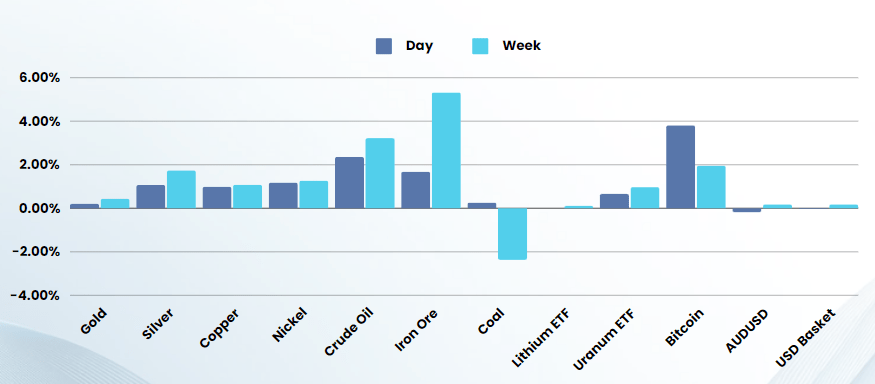

Oil hit a 2-month high on on hopes of rising demand during the Northern Hemisphere’s summer driving season and worries that conflict in the Middle East could spread and reduce global oil supplies

Company specific

- Tesla +6% – moved higher ahead of the its second-quarter delivery numbers expected on Tuesday. The Q2 deliveries is expected to reflect the softer electric vehicle demand seen in the first-half of the year, but the EV maker “saw a ‘mini rebound’ in 2Q which should help Tesla come close to the Street’s 435k units estimate,” Wedbush said in a recent note.

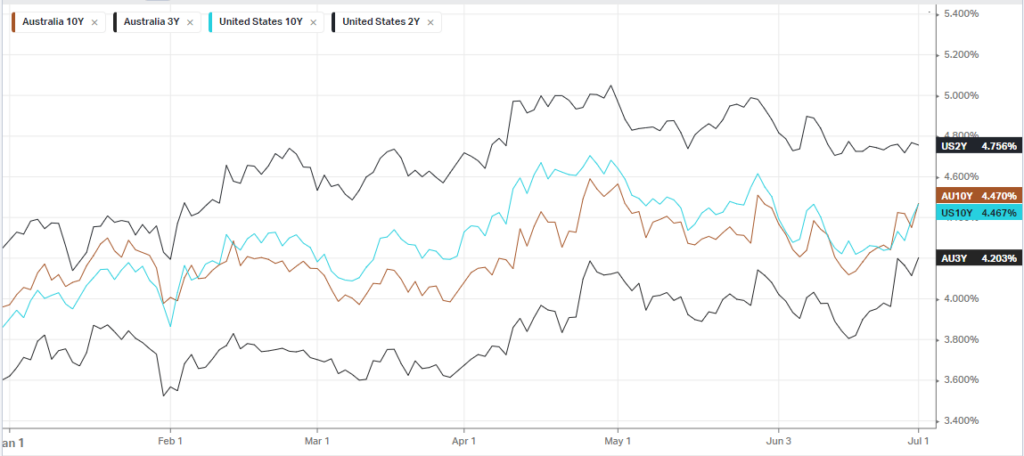

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7720 (-0.30%)

The ASX is likely to be slightly softer on the open with the weak offshore lead (outside tech). We expect the market to continue yesterdays pattern of new FY buying in the oversold sectors and selling in the big FY winners as investors take profit in the new financial year