Last Night's Market Recap

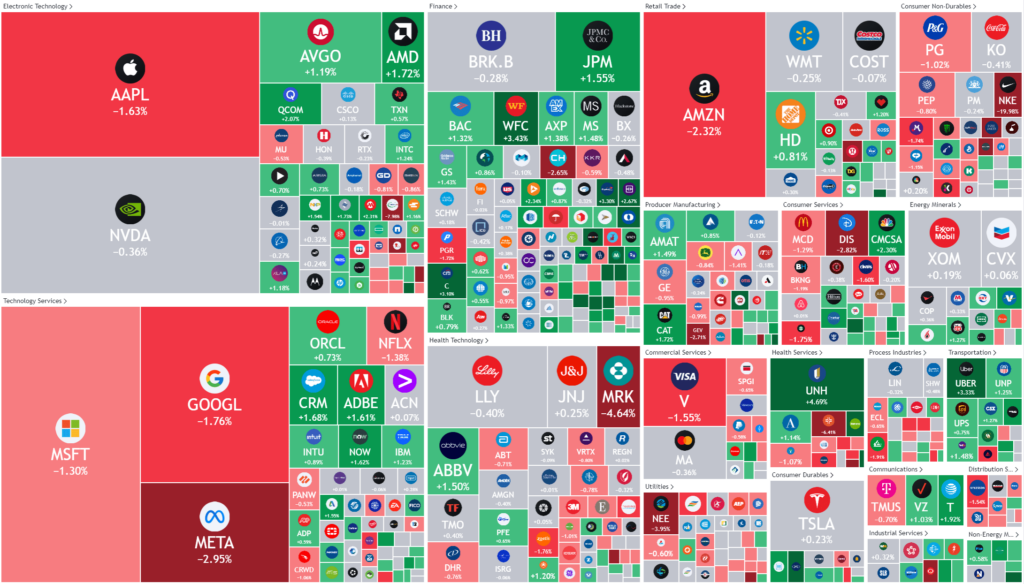

S&P 500 - Heatmap

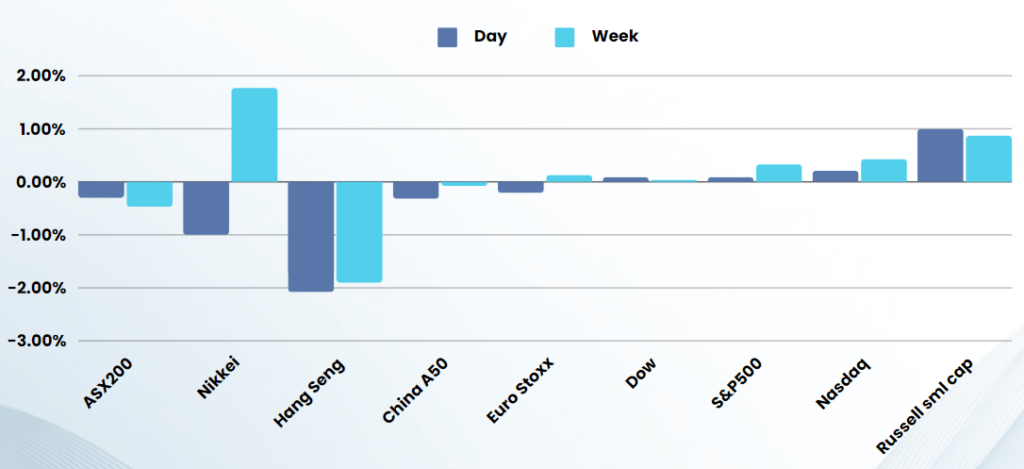

Overnight – Stocks drift lower as investors digest inflation data, presidential debate

Stocks drifted lower on Friday after an early rally fizzled as investors digested in-line inflation data and weighed political uncertainty after the U.S. presidential debate.

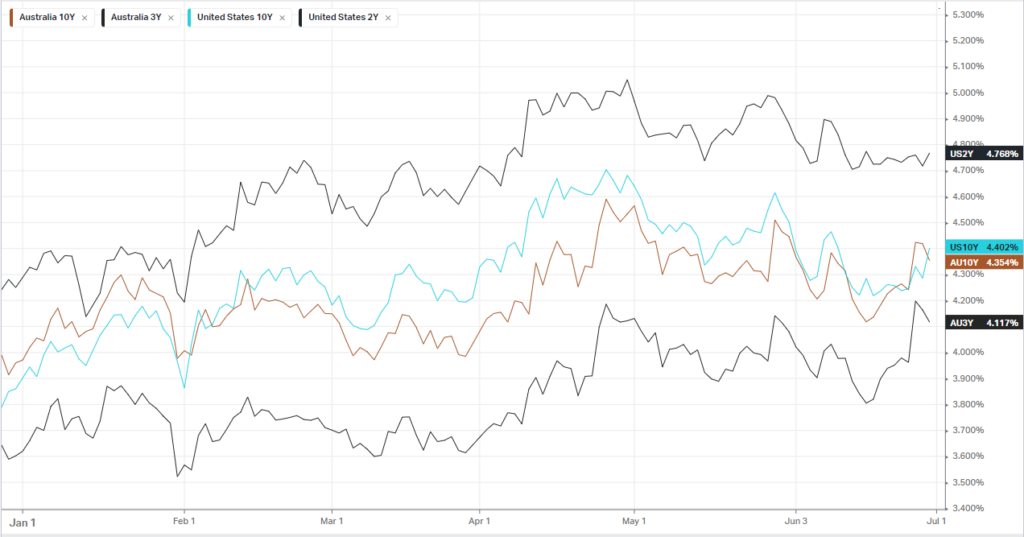

Data showed U.S. monthly inflation was unchanged in May, an encouraging development after strong price increases earlier this year raised doubts over the effectiveness of the Fed’s monetary policy. The Commerce Department report also showed consumer spending rose marginally last month, fueling optimism that the U.S. central bank could engineer a much-desired “soft landing” for the economy. Traders have maintained bets on two cuts despite Fed projections of just one this year, as they hope inflation will keep cooling (emphasis on hope). Treasury yields reversed early losses to end higher, adding pressure on some megacap stocks.

The first debate on Thursday between U.S. President Joe Biden and Republican rival Donald Trump also weighed on stocks, with the incumbent, Biden putting in a shaky performance that have even shortened the odds of the Democrats replating a sitting President as candidate, a situation that has only happened once before in history. The debate was light on policy and high on showboating. This has led to increased uncertainty, rather than clarity on policy

San Francisco Fed President Mary Daly acknowledged the cooling inflation, and noted that it is “good news that policy is working.” Fed Governor Michelle Bowman said the central bank would follow its own path as its inflation goal has yet to be reached.

Company specific

- Nike -20% – Nike slumped 19.98% after forecasting a surprise drop in fiscal 2025 revenue, weighing on the broader consumer discretionary sector.

Bonds

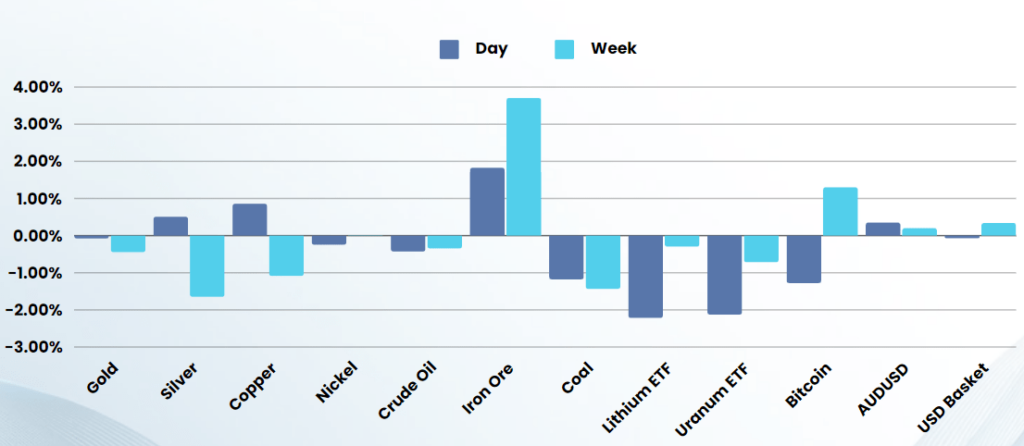

Commodities & FX

The Day Ahead

ASX SPI 7737 (-0.45%)

We expect to see some relief for the downtrodden EOFY tax loss selling stocks this week after thin markets made for nightmarish EOFY settlements for many stocks like the lithium sector.

The FY rollover likely now turns to selling in the stocks that were higher for the FY, that should be lower like the Big4 banks and the consumer discretionary sector.

With the US in the middle of their summer holidays and the 4th of July coming up, we expect the market to remain relatively thin (low volume)

There are a raft of manufacturing and services data from around the world this week and employment numbers in the US.