Last Night's Market Recap

S&P 500 - Heatmap

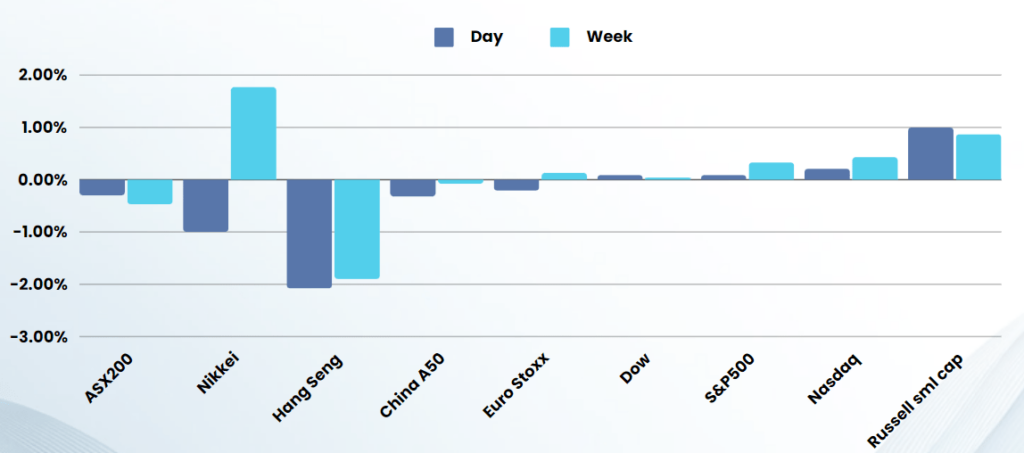

Overnight – Equities eek out gain ahead of key inflation data

Equities eked out a gain Thursday as investors weighed up a slump in chipmaker Micron and gains in consumer stocks just a day of key inflation data.

Economic data and Presidential debate in focus as investors appear to be in something of a holding pattern ahead of key U.S. inflation data and the upcoming Presidential debate. New orders for key U.S.-manufactured capital goods unexpectedly fell in May, suggesting that business spending on equipment weakened in the second quarter as borrowing costs remain elevated. However, first-time applications for U.S. unemployment benefits drifted lower last week, which could allay fears of a signification deterioration in the labour market. However, most eyes will be on Friday’s PCE price index, as this is widely regarded as the Federal Reserve’s preferred inflation gauge. Markets were also on edge before the first Presidential debate of the year later Thursday, between Democrat and Republican candidates, Joe Biden and Donald Trump.

Micron Technology reported better-than-expected quarterly results, but that was overshadowed by in-line revenue guidance that disappointed investors who were expecting more, especially given that Micron more than doubled in value over the past year. Its stock fell over 7%. Other chipmaking stocks also retreated including market darling Nvidia Broadcom

Consumer stocks supported the broader market, underpinned by a jump in casino stocks including MGM Resorts and Caesars after the Nevada Gaming Control Board reported gaming win rose 2.5% in the 12 months through May to $1.32B, while Las Vegas Strip casinos reported a 3.7% increase in gaming win in May.

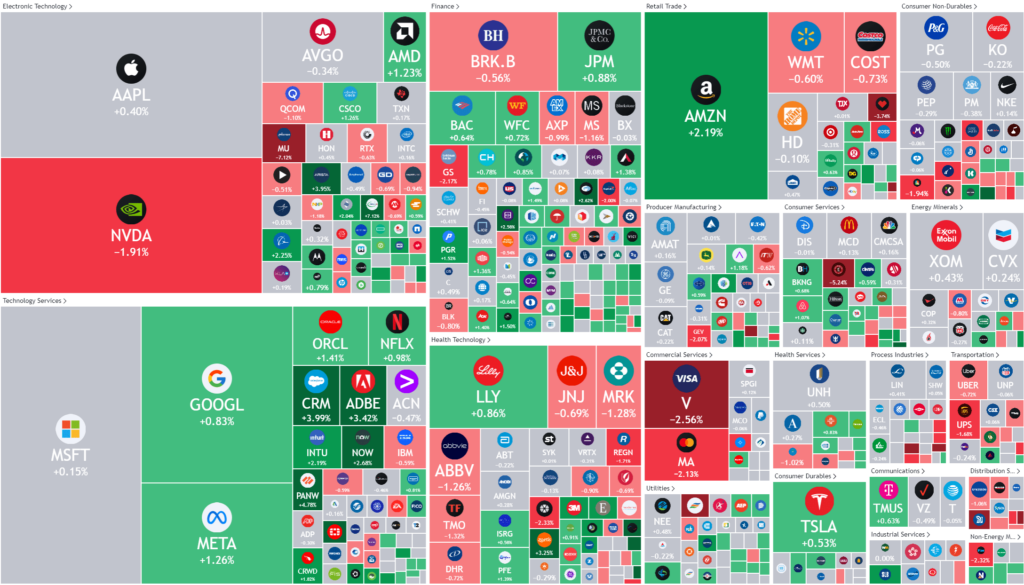

Bonds

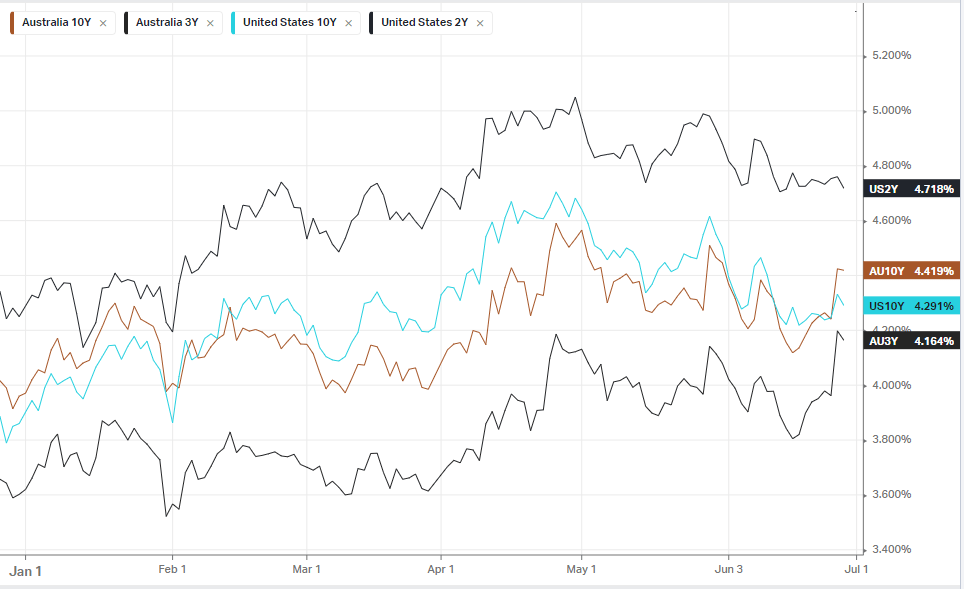

Commodities & FX

The Day Ahead

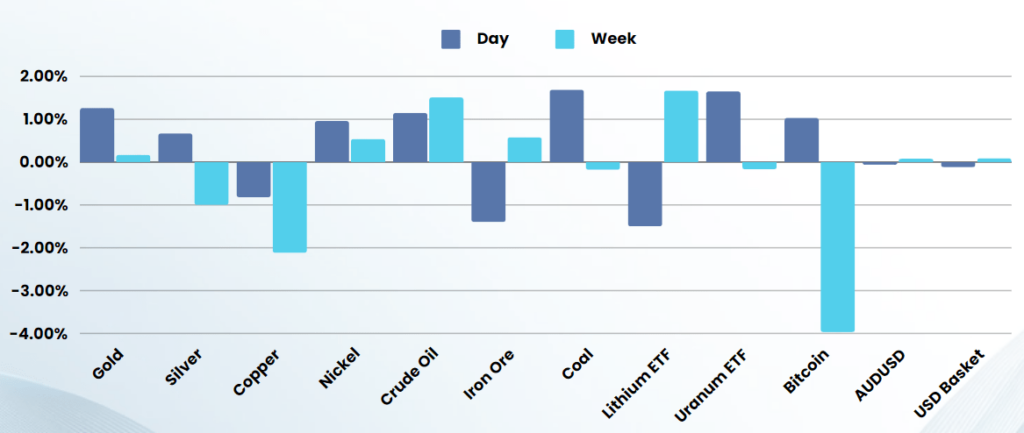

ASX SPI 7775 (+0.33%)

Expect a positive day for no reason

The ASX is likely to see strength due to EOFY window dressing today as fund managers prop up their end of quarter, half and Financial year numbers. The moves are likely to make a lot of sense and be taken back next week, however, this is the game they play.

Focus will be on the key PCE data tonight in the US, although end of quarter and half year window dressing will likely be in play in the US as well

Company Specific:

- ANZ & Suncorp – Treasurer Jim Chalmers has announced ANZ’s proposal to buy Suncorp Bank can proceed subject to enforceable conditions.

- IAG – Insurance group IAG said it has renegotiated deals with global reinsurers and confirmed it’s on track to achieve profits and margins in line with prior guidance in financial 2024.