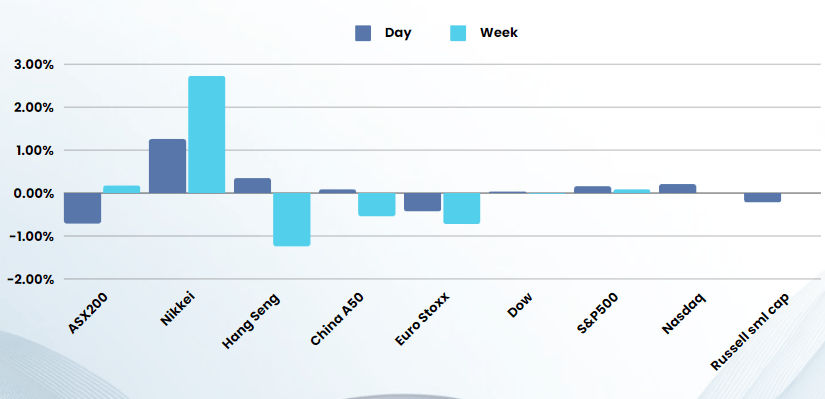

Last Night's Market Recap

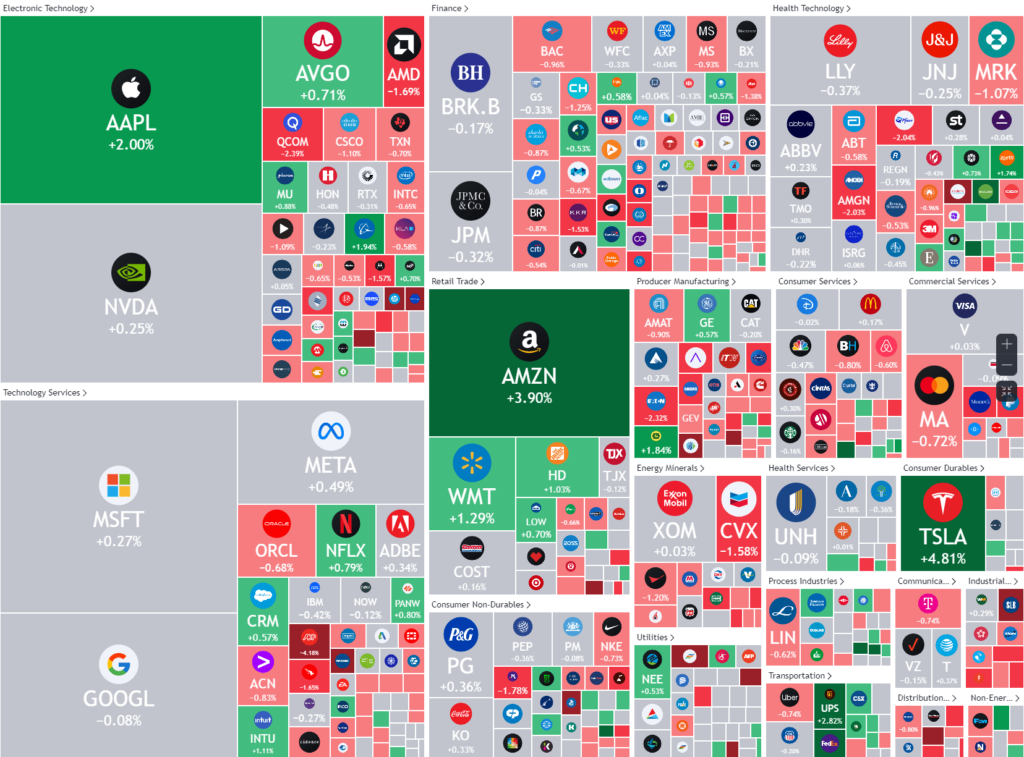

S&P 500 - Heatmap

Overnight – Amazon joins the $2T club as markets grind to quarter end

Equities ground higher overnight as surge in Amazon to a record high, joining the $2 Trillion club, helped push tech higher just days ahead of key inflation data.

Amazon.com, closed at record high after gaining 4% on the day that took its market cap to $2 trillion. Meanwhile, NVIDIA gave up early day gains to close just above the flatline, a day after the chipmaker rallied more than 7%, though investor sentiment on the stock remains steady amid a AI-infused optimism that has seen the company rack up double digit percentage gains so far this year.

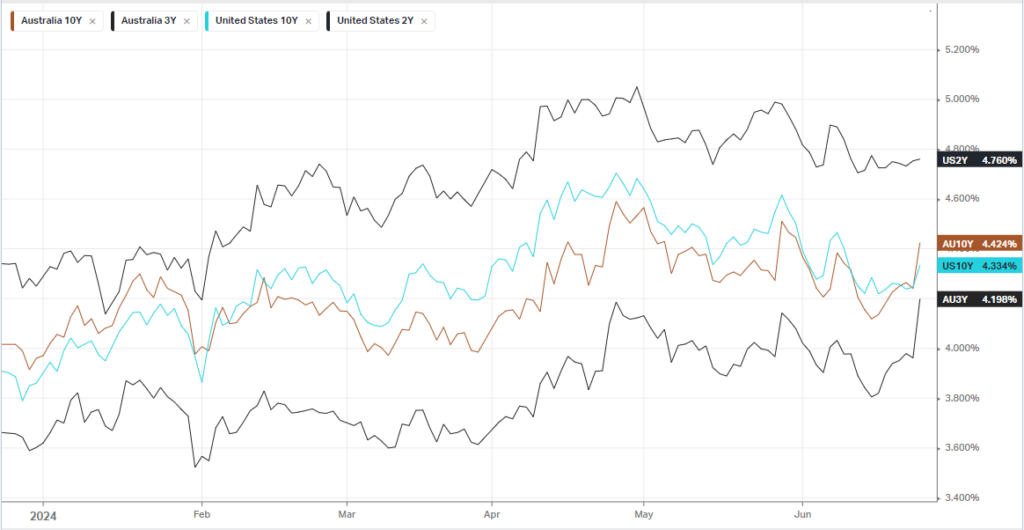

The week’s main economic data release will arrive on Friday, in the shape of the monthly PCE price index, the Federal Reserve’s preferred inflation gauge. With the Fed projecting only one interest rate cut in December, all eyes will be on whether the data continue to show a moderation in price pressures.

Banking stocks were also in the spotlight Wednesday ahead of the Federal Reserve’s annual stress test, which serves as gauge to whether the largest U.S. banks can withstand an economic shock.

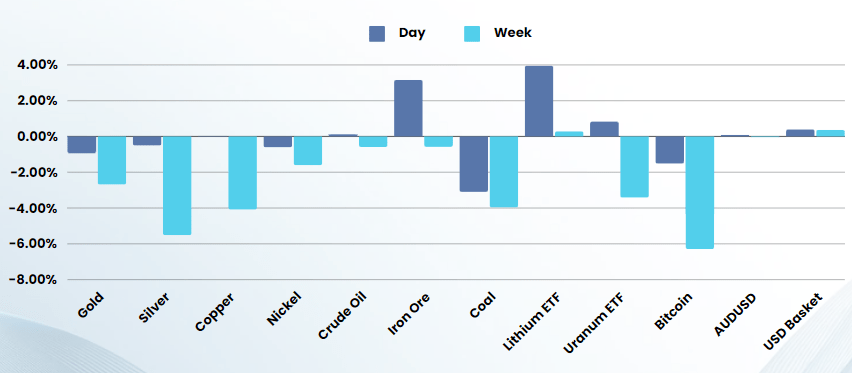

Energy stocks were the biggest losers on the day, pressured by weakness in oil oil prices after data showed that domestic crude and gasoline stocks unexpectedly increased last week, stoking concerns about demand.

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7689 (-1.09%)

The ASX is in for a rough day despite a mildly positive lead from offshore markets. Yesterdays CPI numbers in Australia gave cause for the RBA to seriously consider hiking interest rates, rather than rate cuts that many media exhibitionist analysts have called for all this year. How wrong interest rate predictions have been from the likes of AMP, Market Economics and MLC is embarrassing and make the RBAs job harder than it needs to be, spreading mis-information

Interest rate sensitive stocks in the REIT’s and consumer discretionary sector are likely to be heavily hit once distributions are paid and EOFY is out of the way. We also believe that the Big4 will see a wall of selling once July 1 rolls over on the calendar

Around 36 companies trade ex-dividend, including real estate investment trusts (REITS).