Last Night's Market Recap

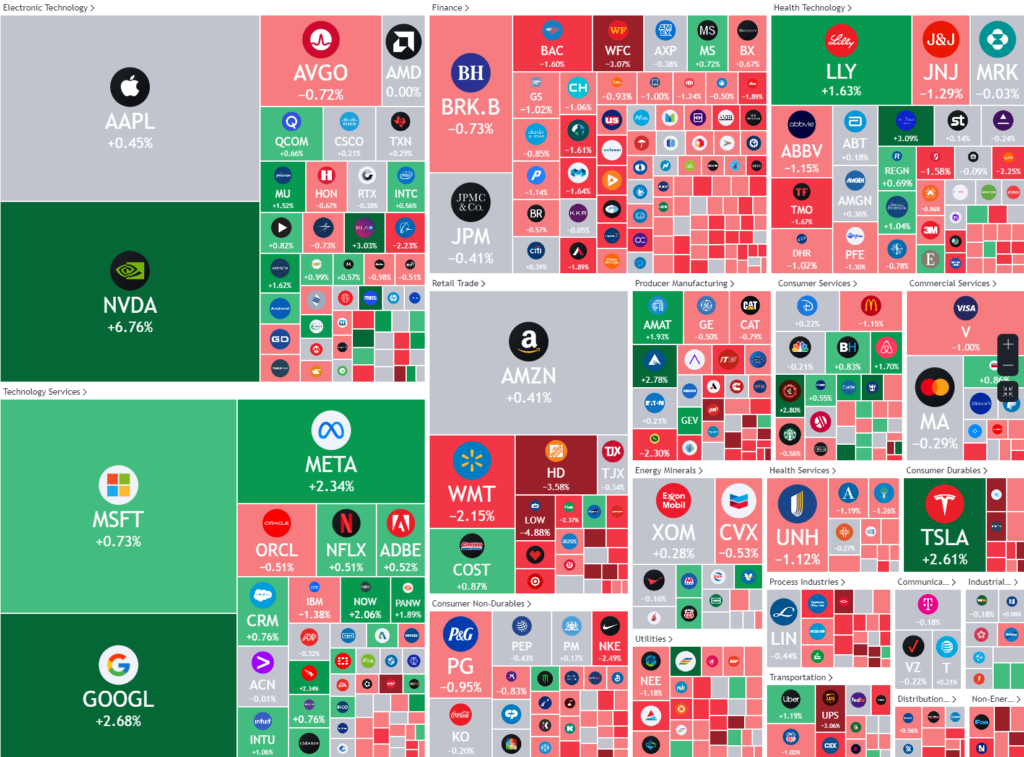

S&P 500 - Heatmap

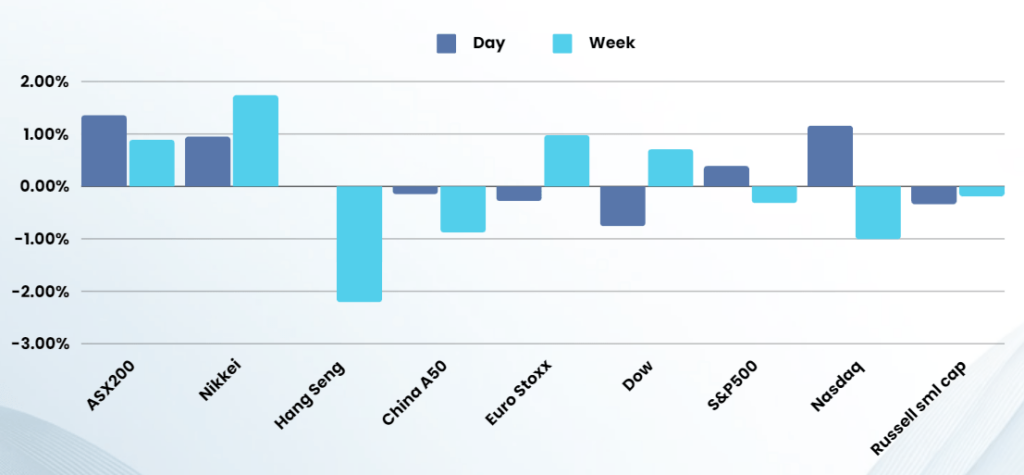

Overnight – Market struggles for direction in the lead up to key inflation data

Equities appeared lost for direction in the lead up to the key PCE data this Friday with Nvidia stemming the bleeding by bouncing 6.5% after a 20% fall from its highs last week

The tech sector is set to show a recovery Tuesday after being hit hard during the previous session, with the Nasdaq dropping 1.1%, its worst day since April, as investors collected profits following a stellar rally over the past few months. AI darling Nvidia stock gained 6.8% Tuesday, bouncing after having fallen almost 7% and tumbling for a third straight session after it briefly became the most valuable company on Wall Street last week.

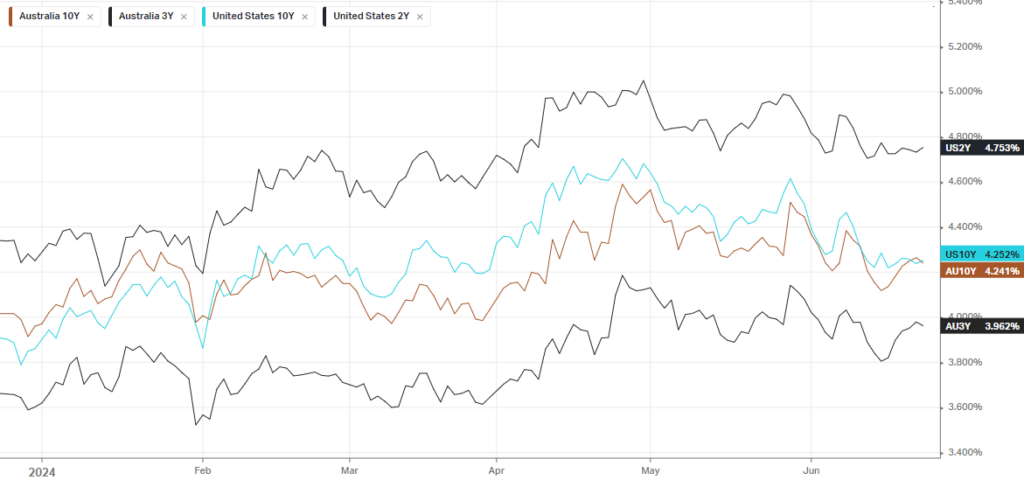

Focus this week was squarely on PCE price index data, which is the Federal Reserve’s preferred inflation gauge. The reading is due on Friday and is expected to show some mild cooling in inflation, but it is also expected to remain well above the Fed’s 2% annual target range. UBS expects the Federal Reserve to begin cutting interest rates in September. While there has been unusual volatility in economic data since the start of the pandemic, certain trends now appear to be well established, UBS said. The labour market, which was severely overheated two years ago, has returned to near pre-pandemic conditions, supported by a strong increase in labour supply. Moreover, retail sales and inflation are also showing signs of moderation. Although the year-over-year core inflation rate is trending lower, it remains considerably above its pre-pandemic levels.

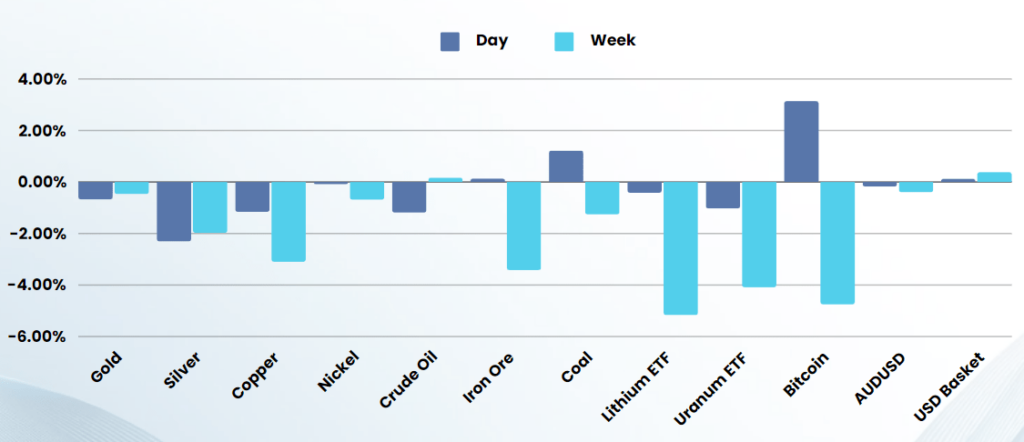

Commodities and precious metals fell for no apparent reason, washing around in the range

Company specific

- FedEx +14% (aftermarket) – Economic bellwether FedEx reported positively after the market close. The logistics company forecast fiscal 2025 profit above analysts’ estimates on Tuesday, anticipating that the cost reductions planned for the year would deliver margin gains even as revenue remains challenged by lackluster demand for parcel shipping

- Novo Nordisk stock rose 3.3% after the drugmaker’s blockbuster Wegovy weight-loss treatment received approval from regulators in China.

- German carmaker, Volkswagen has announced a major investment plan in Rivian Automotive, an American electric vehicle (EV) maker. This partnership, which could see investments reaching $5 billion by 2026, aims to form a joint venture for sharing knowledge on EV architecture and software. This strategic partnership news boosted Rivian’s shares by 55% in after-hours trading

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7801 (-0.37%)

The ASX is likely to be quiet leading into monthly inflation data today, with the materials sector likely to weigh down the index due to weakness in underlying commodities. Analysts are expecting the inflation gauge to rise to 3.8 per cent in annual terms, from a 3.6 per cent rise in April. The RBA may want to take note of the Bank of Canada looking a little red-faced in pre-emptively cutting rates early this month as inflation data came in hot overnight, double the analysts monthly expectations

Bond traders are pricing the first rate cut from the Reserve Bank of Australia by July 2025. There is also a modest 16 per cent

Company Specific:

- Seven West Media – senior lieutenants including the head of sport and chief revenue officer as he attempts to reduce the company’s cost base.

- Cettire – Brokers have turned on former market darling Cettire, slashing their price targets in half after the online fashion retailer’s shock profit downgrade led them to question whether the company could restore its earnings power.