Last Night's Market Recap

S&P 500 - Heatmap

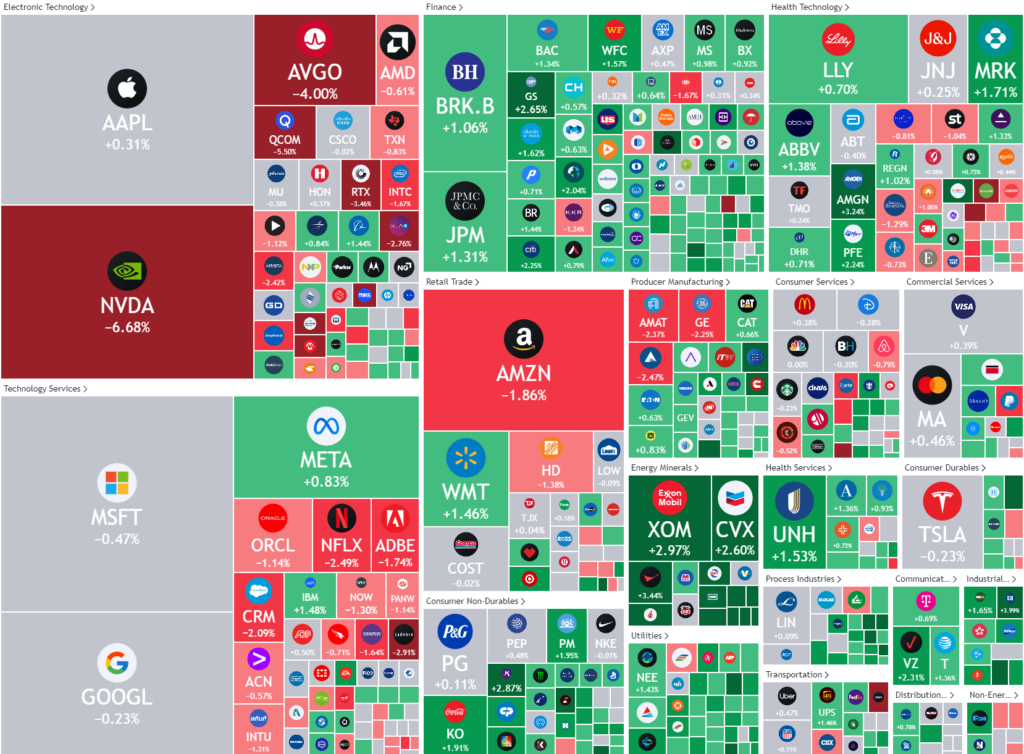

Overnight – Nvidia slumps for third consecutive session, dragging down tech

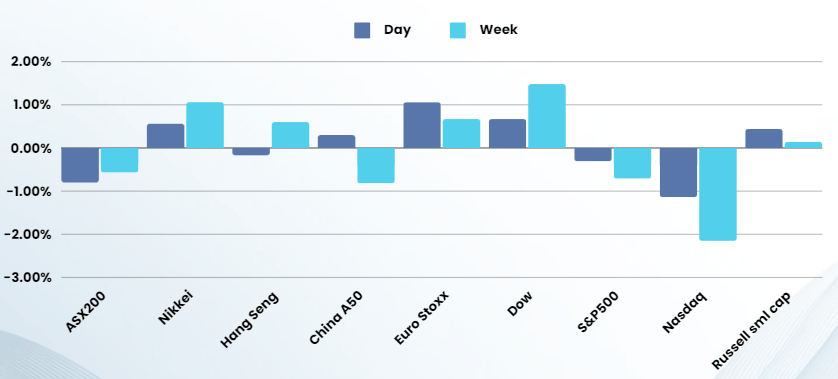

Equities were mixed overnight as profit taking in Semiconductor stocks saw a shift back to the blue-chip DOW and the Russel2000 (small caps) with Nvidia now down 14% in 4 days.

Overall the market was very quiet with light volumes as investors looked to key inflation data this week for more cues on interest rates. Markets are focused chiefly this week on PCE inflation data, which is due Friday. The reading is the Fed’s preferred inflation gauge, and is likely to tie into the central bank’s stance on interest rate cuts. The PCE reading is expected to show inflation cooled slightly in May, but remained well above the Fed’s 2% annual target. Expectations of an eventual lowering in interest rates had driven Wall Street indexes to record highs through June, even as the Fed signalled that sticky inflation and a strong economy kept chances of such a scenario slim.

Nvidia shares fell another 6.7% on Monday, extending losses for a third straight session and erasing more than $430 billion in market capitalization over the three-day slide. Today’s drop was the largest in two months. Nvidia ended last week with a market valuation of around $3.1 trillion, lower than Apple’s (AAPL) $3.2 trillion and Microsoft’s (MSFT) $3.3 trillion. The AI chipmaker briefly overtook Microsoft last week to become the most valuable company in the world, though it couldn’t hold onto the top position for long. Despite the recent slide, NVDA is up 138% year-to-date

Apple is the first company to be charged with violating the Digital Markets Act, a law passed in 2022 that gives European regulators wide authority to force the largest “online gatekeepers” to change their business practices. The EU rules threaten to fragment the global tech market as companies delay the releases of certain products and services because of regulatory concerns. Last week, Apple said it would not release a software update for iPhone users in the EU that included new artificial intelligence features because of “regulatory uncertainty.” Meta did not release Threads, its Twitter-like service, in the bloc until five months after it was available in the United States for similar reasons. While this is not an immediate concern, it will slow the Mega-caps ability to earn revenue from AI which could see AI spending reduced until the uncertainty has cleared

Earnings – some key quarterly earning prints are also on tap this week

- FedEx – Delivery and logistics firm FedEx, whose earnings are also viewed as a bellwether for global economic activity, is set to report its earnings for the quarter ended May on Tuesday.

- Micron – Memory chip maker Micron Technology is set to report its quarterly earnings on Wednesday, after forecasting a major demand spike from the fast growing artificial intelligence industry.

- Nike – Sports apparel maker Nike and pharmaceutical retailer Walgreens Boots Alliance are set to report earnings on Thursday.

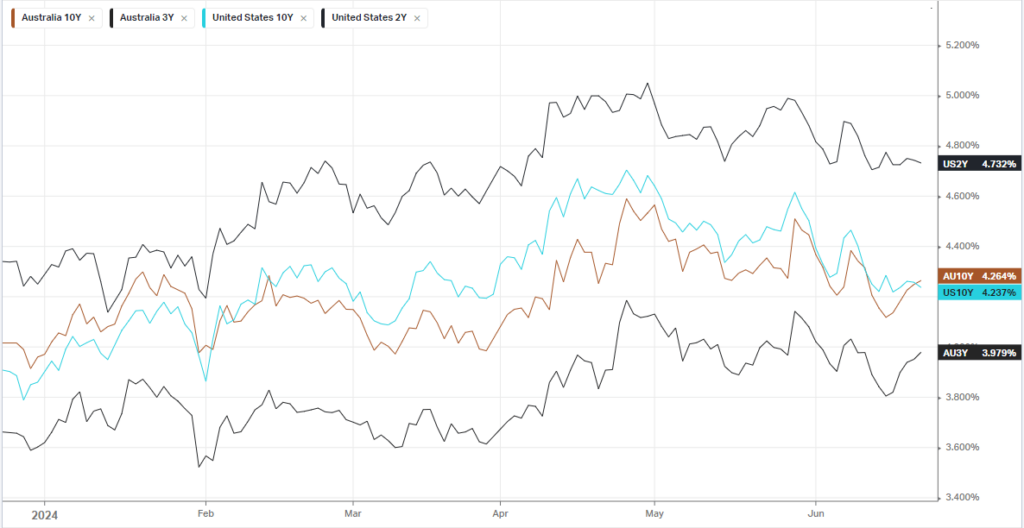

Bonds

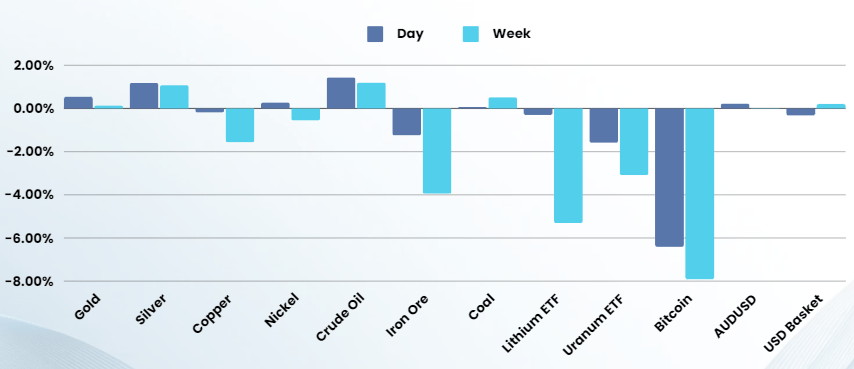

Commodities & FX

The Day Ahead

ASX SPI 7761 (+0.46%)

The ASX will be weighed down by the materials sectors as commodities prices headed lower on Friday night. This was a strange move given positive manufacturing data.

This week is likely to be very quiet with little corporate or economic news until Core PCE on Friday

Company Specific:

- Paladin Energy – Paladin Energy has pitched a takeover of Toronto-listed Fission Uranium to bring its proposed Canadian mine into production by 2029 to meet global demand.

- Sky City – has agreed to sell its entire 10 per cent shareholding in Europe-based Gaming Innovation Group.