Last Night's Market Recap

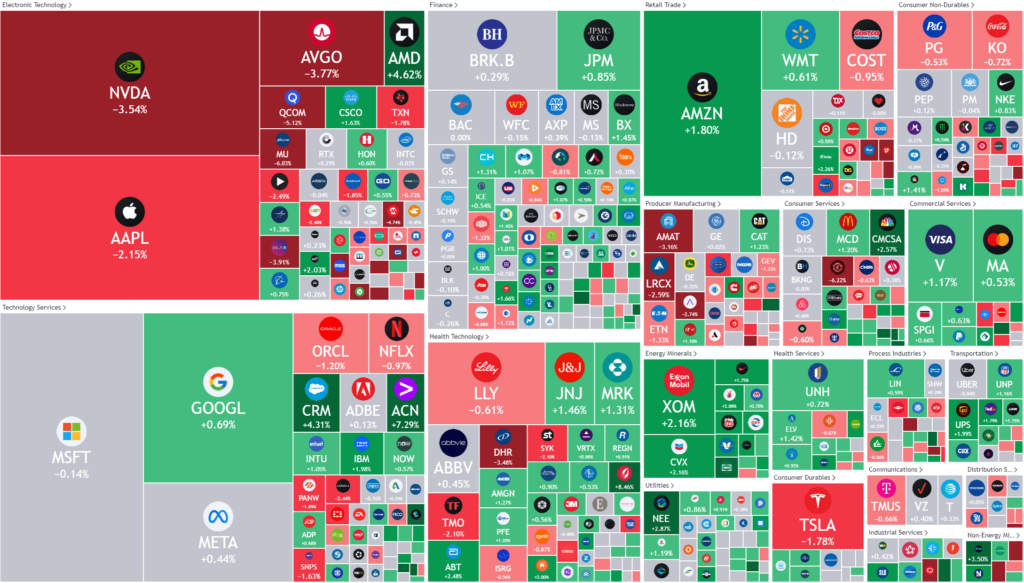

S&P 500 - Heatmap

Overnight –Cracks starting to show as Housing starts slump & Jobless claims rise

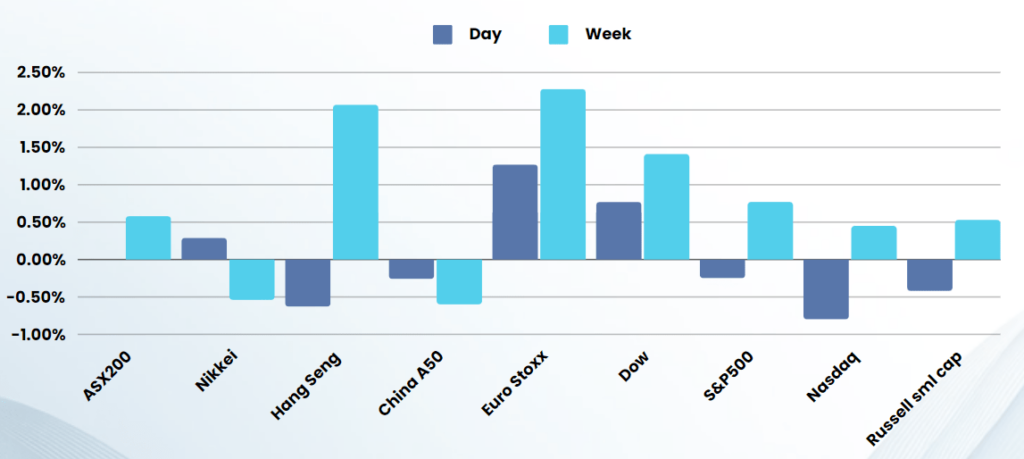

Equities closed lower Thursday after briefing topping the 5,500 milestone for the first time ever as Nvidia cooled its recent rally, dragging the broader tech sector lower and flurry of economic data pointing to signs of a weaker economy.

Economic data released earlier Thursday pointed to a slowing economy, with initial jobless claims coming in at 238,000, above the 235,000 expected, while housing starts slumped 5.5% in May.

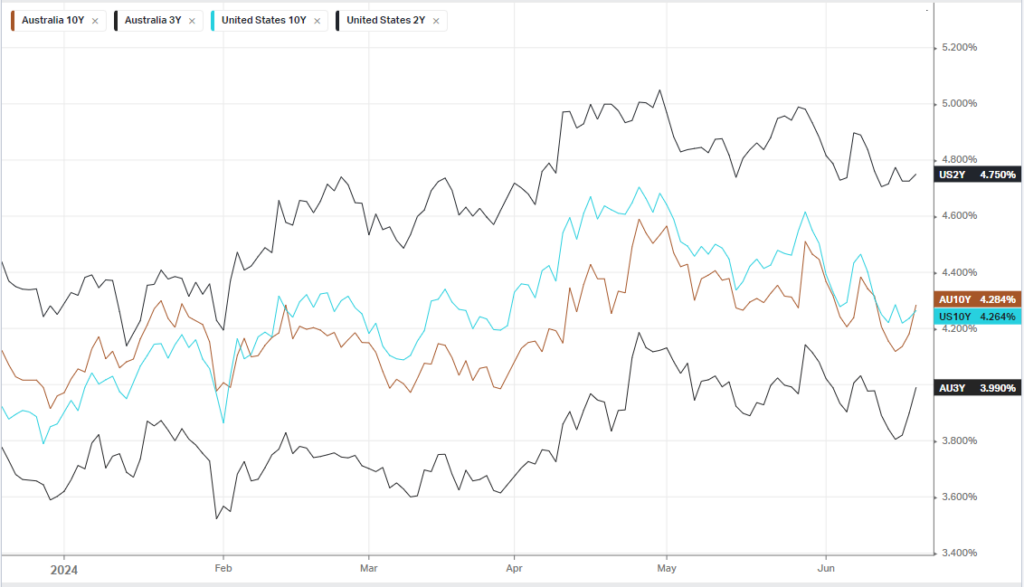

A series of Fed officials have expressed caution about expecting rate cuts too soon, seeking more evidence that inflation has been tamed before the central bank would agree to easing monetary policy.

FOMC member Thomas Barkin is set to speak later in the session, and follows Minneapolis Federal Reserve President Neel Kashkari saying it could take up to two years to get U.S. inflation back to the Federal Reserve’s medium-term target.

Kashkari, talking at the annual Michigan Bankers Association Convention earlier Thursday, said wage growth was too high to bring inflation back to the 2% target right now.

Bonds

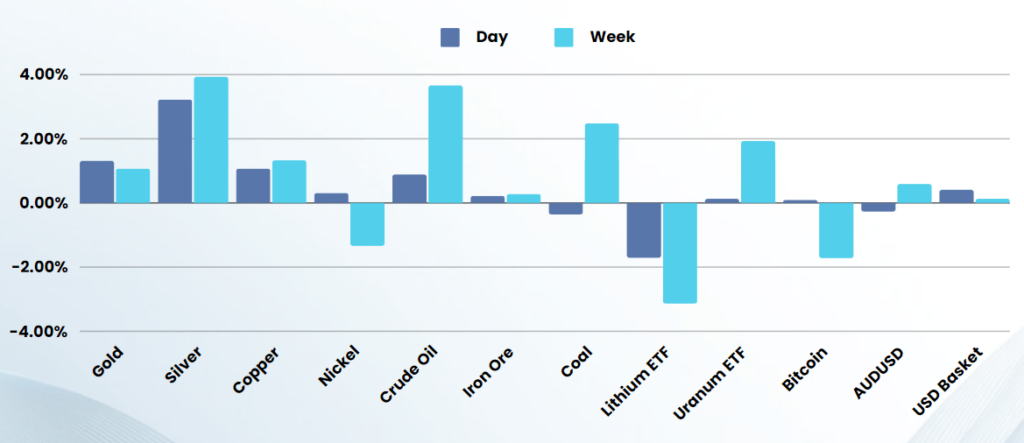

Commodities & FX

The Day Ahead

ASX SPI 7760 (+0.01%)

The ASX should see a small rally on resource stocks today, with the rest of the market likely very quiet

Company Specific:

- Kathmandu – apparel and camping business warned of softening sales in 2024 as rising living costs hit consumers

- Guzman y Gomezwhich surged 36 per cent to $30 on its first day of trade

- Pilbara Mineralshas updated potential production guidance for its West Australian lithium hard rock mining operations