Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Quiet markets, US closed for Juneteenth -Freedom Day

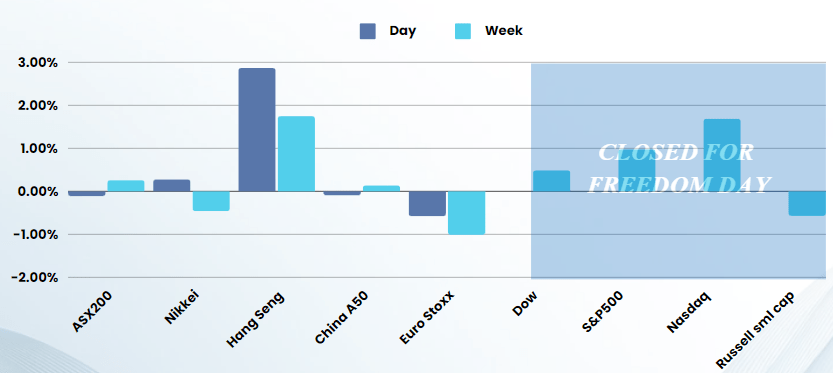

The US markets were closed overnight for the “Juneteenth” or Freedom Day holiday, commemorating the end of slavery in 1865.

While Index Futures were open for trading, there was very little movement with the DOW edging 0.15% lower and the Nasdaq slightly higher by 0.19%

European indicies closed lower, however they have been weak relative to the rest of the world in the last week due to potential political instability in the EU

In Europe, inflation in the UK dropped back to the BOE target band, giving the central bank room to lower interest rates at their meeting this week

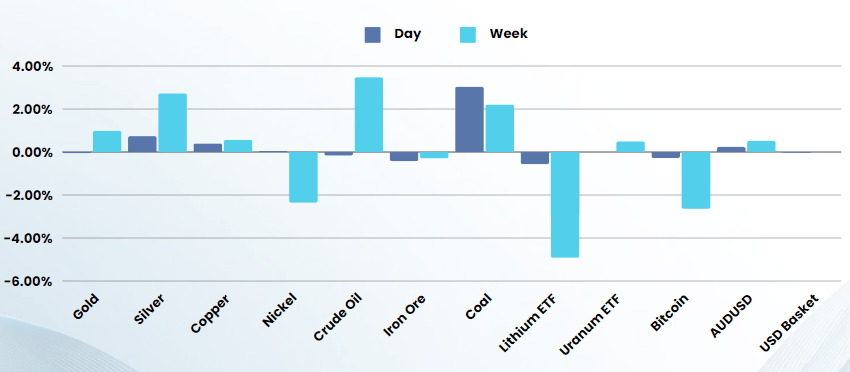

Commodities were also quiet, with precious metals edging slightly higher and oil unchanged

The focus now shifts to global manufacturing data for the rest of the week and a Central Banks speakers from the UK, EU and the US

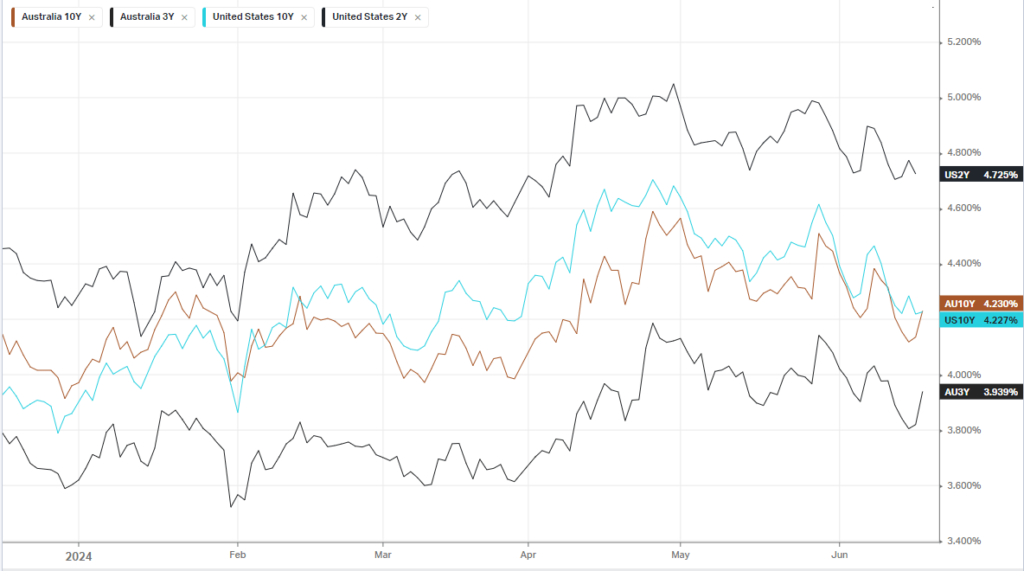

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7752 (-0.27%)

While SPI futures edged lower overnight, we see very little movement today on the ASX. Real estate and Tech were the weak sectors in Europe, however this is unlikely to have much of an influence

One of the first big IPO’s in recent times goes live today, with Guzman y Gomez (GYG) floating with a listing valuation of $2.2B.

Company Specific:

- Mineral Resources – slashed 1000 jobs at Iron Ore operations

- City Chic – capital raise a steep 30% discount