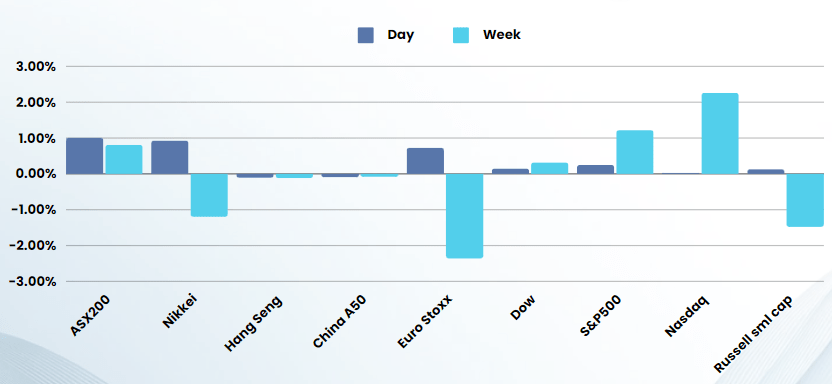

Last Night's Market Recap

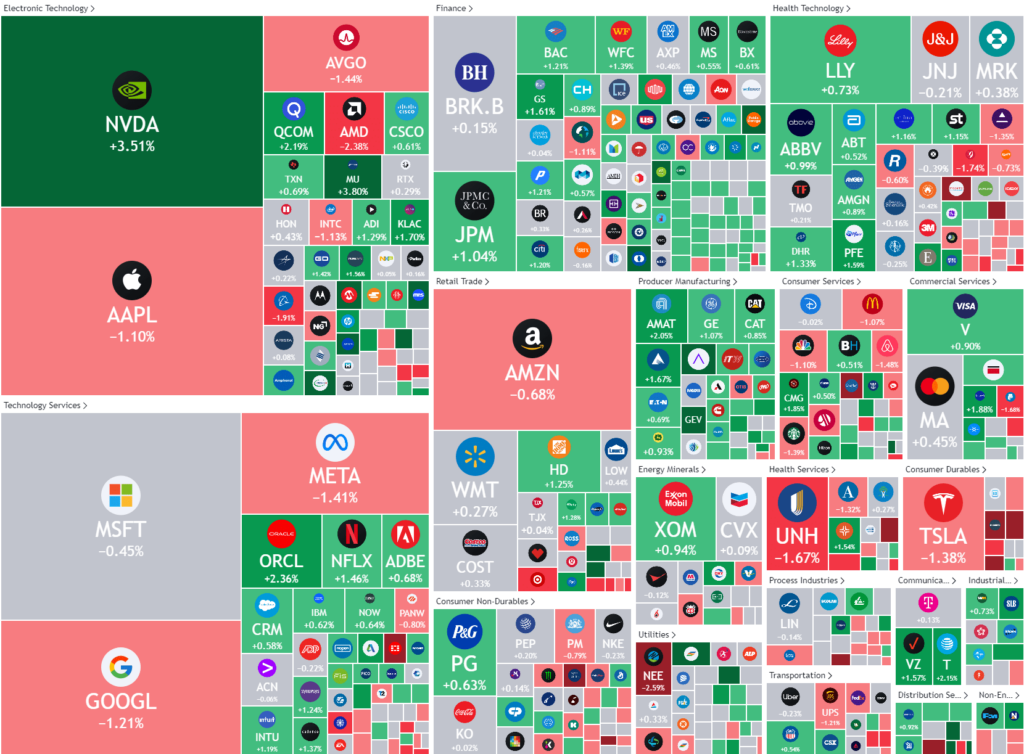

S&P 500 - Heatmap

Overnight – Nvidia crowned most valuable, King of stocks

The US markets closed at another record high on Tuesday as Nvidia rallied to usurp Microsoft as the most valuable company, pushing the broader tech sector higher and overshadowing economic data pointing to a more wary U.S. consumer.

NVIDIA rose more than 3%, pushing its market cap to $3.34 trillion, surpassing Microsoft’s $3.31T, making the chipmaker the most valuable company by market cap. The latest surge in the chipmaker wasn’t the result of any fundamental news, merely a bullish call from little known broker, Rosenblatt Securities raising its price target on the latter to $200 from $140 a share, suggesting nearly 50% upside from its current price. The call for Nvidia to rise another $1.6 Trillion in market cap would make Nvidia 5% of the total value of the global economy, a figure astoundingly divorced from reality

U.S. retail sales increased at a slower-than-anticipated rate on a monthly basis in May, rising 0.1%, an improvement from a downwardly-revised decline of 0.2% in April. Economists had predicted that retail sales, which mostly reflect goods and are not adjusted for inflation, would grow by 0.3%. The weak retail sales figure could impact the outlook for the wider economy, which may in turn influence how the Federal Reserve approaches potential interest rate reductions later this year.

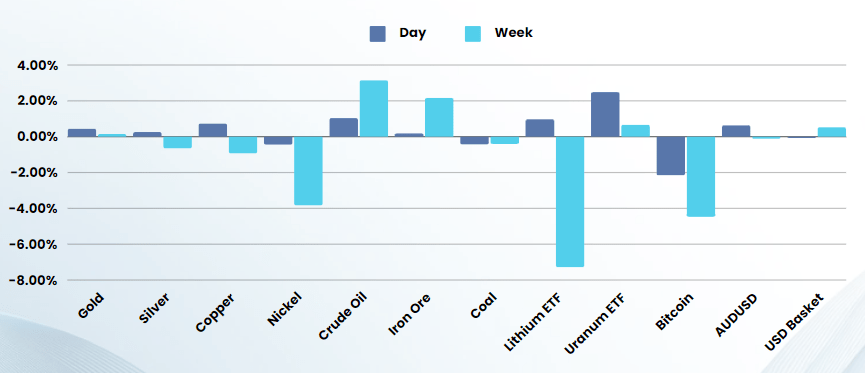

Oil settled more than 1% higher on Tuesday due to escalating geopolitical risk in Europe and the Middle East, where wars continue to threaten global supply.

Focus now turns to central bank speakers and manufacturing data later in the week

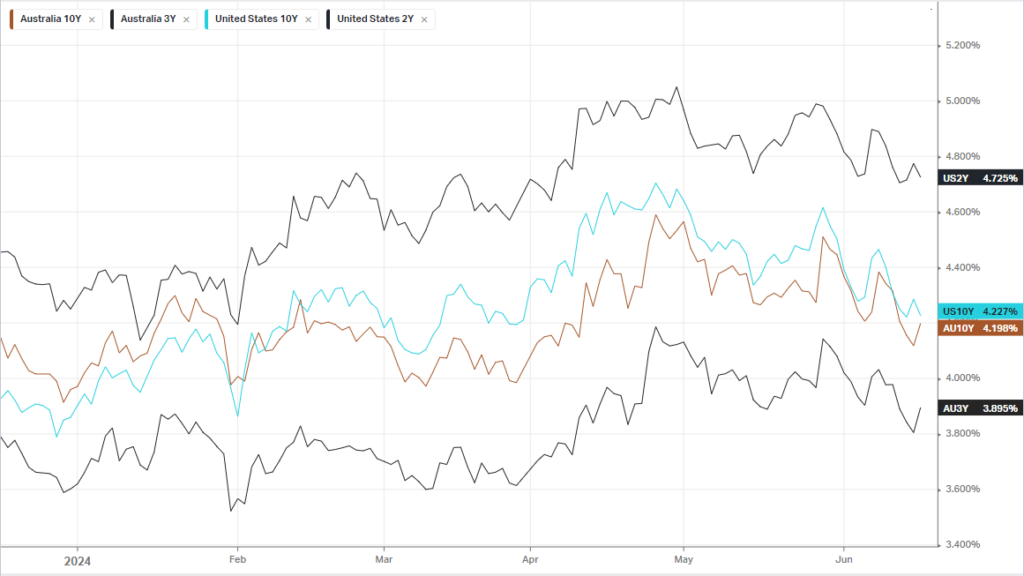

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7775 (-0.01%)

The ASX is in for a lackluster day with little offshore lead to provide any catalyst. The RBA held rates steady yesterday, however there was a slightly more hawkish tone than the market was expecting as Gov. Bullock admitted inflation was far from under control.

We don’t see any reason for a significant move for the rest of the month, with the likelihood being the market merely extends the current trend of rallying AI stocks and broad market weakness