Last Night's Market Recap

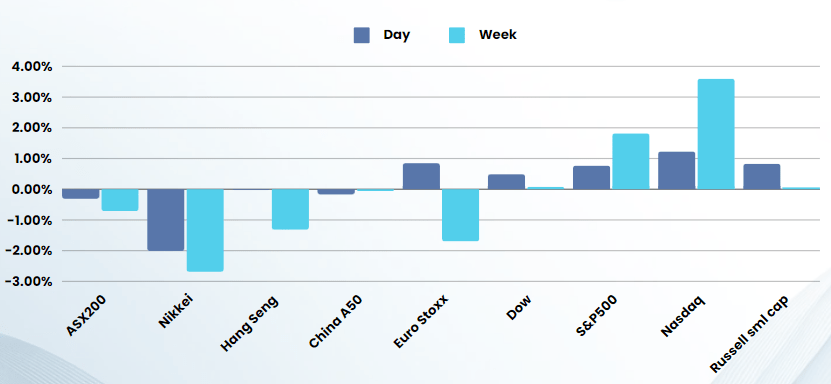

S&P 500 - Heatmap

Overnight – Tech investors ignore Fed warnings of rate-cut delays

Yet another record high led by the mega-cap tech stocks overnight as investors shrugged off a climb in Treasury yields amid ongoing Fed speak around delays to rate cuts and flow of key economic data due later this week.

Big tech including Amazon, Microsoft, Apple led the broader market gains, with the latter up 2% adding to recent gains as it seeks to usurp Microsoft as the most valuable follow its plans to push into artificial intelligence. The jump in tech lifted the value of Apple to $3.33 trillion and Microsoft to 3.35 trillion, with many talking up the chances of an ongoing bull run in tech.

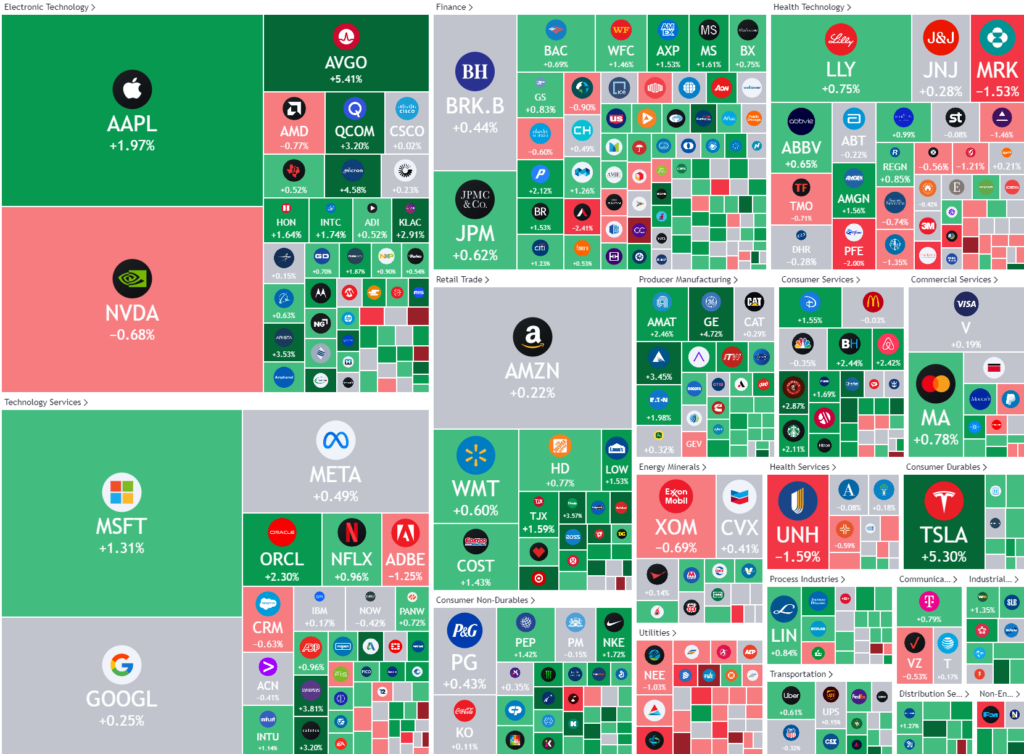

Philadelphia Fed president Patrick Harker said Monday, he expects only one rate cut if the economy progresses as expected as the current level of rates will likely push inflation lower and prevent upside inflation risk. And if all of it happens to be as forecasted, I think one rate cut would be appropriate by year’s end,” Harker said, though added that two cuts or no cuts were also a possibility. “I see two cuts, or none, for this year as quite possible if the data break one way or another.” The remarks come ahead of a day ahead retail sales for May, with many keen to assess whether the consumer continues to show strength.

There are several Fed officials due to speak this week, including New York Fed President John Williams, Minneapolis Fed President Neel Kashkari, San Francisco Fed President Mary Daly and Richmond Fed President Thomas Barkin. Treasury yields, meanwhile, racked up gains, attempting to clawback some of their recent losses. The softening in the data also saw yields fall which helped precious metals finish with a positive day for the week.

Bonds

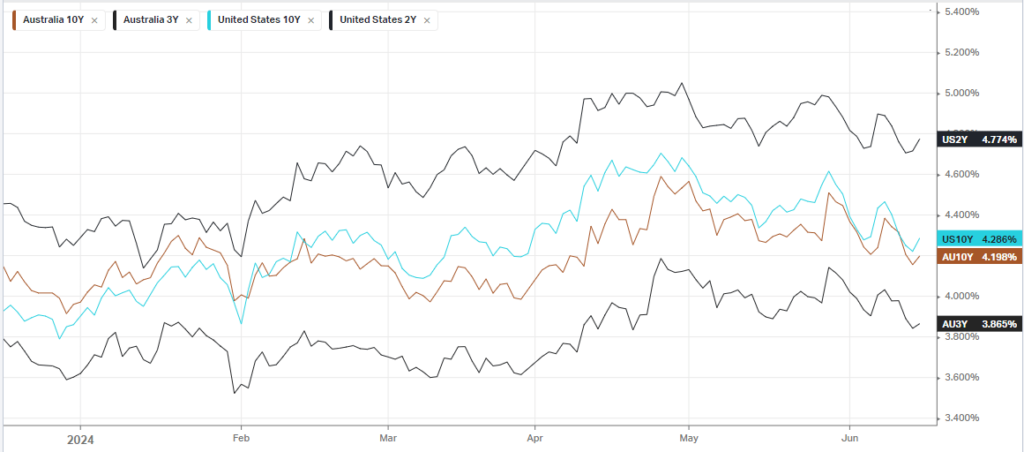

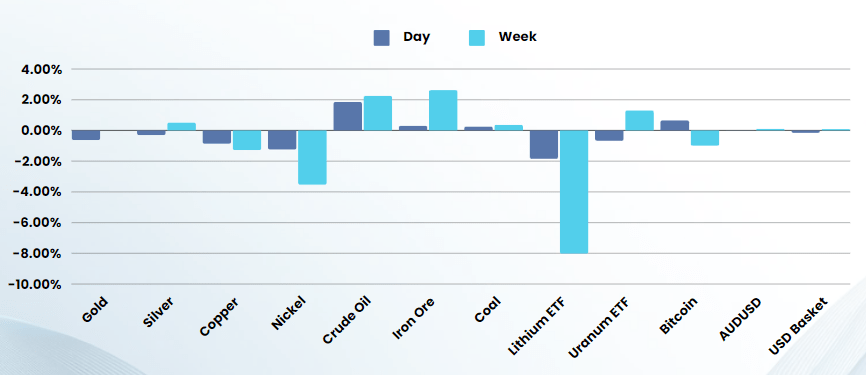

Commodities & FX

The Day Ahead

ASX SPI 7743 (+0.37%)

All eyes will be fixed on the RBA meeting and press conference today at 1430 as investors look for clues on the level of future domestic rates. While this is unlikely to significantly move the needle, an overly hawkish RBA could rattle the high PE stocks, REITs and Consumer Discretionary stocks which currently sit at precarious highs.

Yesterdays rout in commodity stocks, particularly in lithium seemed like a capitulation with many high quality names trading a 52-week lows, could present value if the goldilocks scenario that the AU banks stocks and the US Tech stocks have priced in, comes to fruition

Company Specific:

- Premier Investments goes ex-dividend

- NextGen Energy hosts an AGM