Last Night's Market Recap

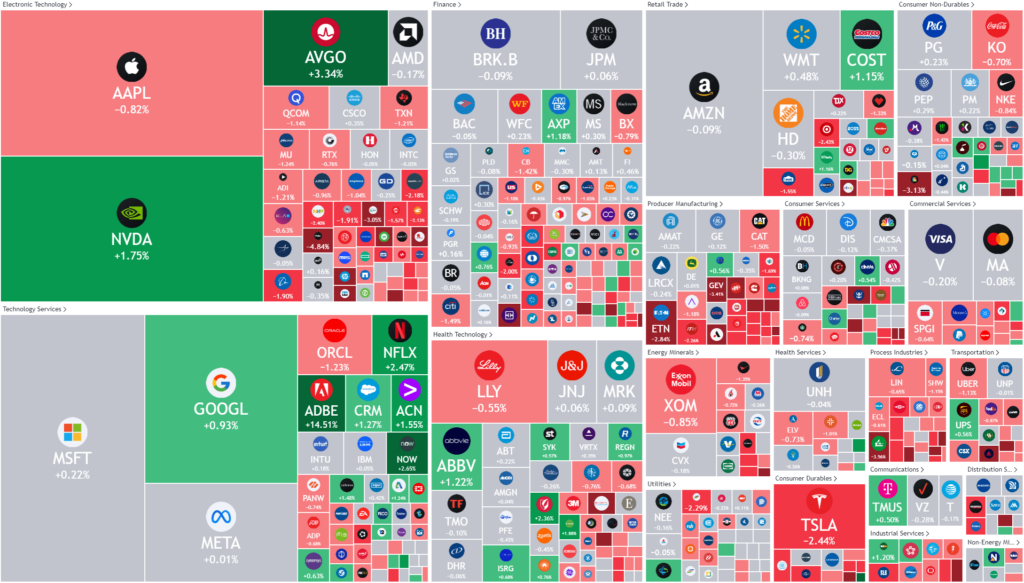

S&P 500 - Heatmap

Overnight – Tech continues rally while consumer sentiment softens

The Nasdaq closed at a record high Friday, led by tech and expectations for Federal Reserve rate cuts later this year, though a dent in consumer sentiment kept gains in check.

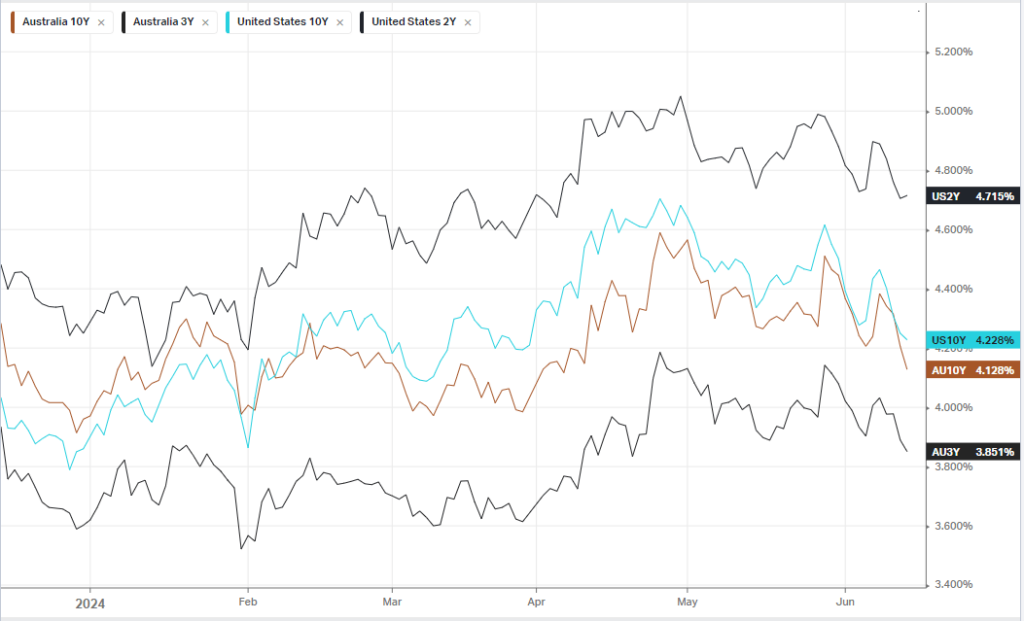

The University of Michigan’s preliminary consumer sentiment index declined to65.6 in June, the from 69.1 a month earlier, while one-year and five-year inflation expectations eased to 2.9% and 2.8% from 3.1% and 2.9%, in the prior month, respectively. The one-year preliminary inflation expectation was unchanged at 3.3% for the month in June, though a higher than the 3.2% expected. Still, bets on inflation cooling further have been boosted this week after producer prices unexpectedly fell in May, and consumer price index slowed more than expected, stoking optimism that a disinflationary trend is in play, likely leading to lower interest rates by the end of the year.

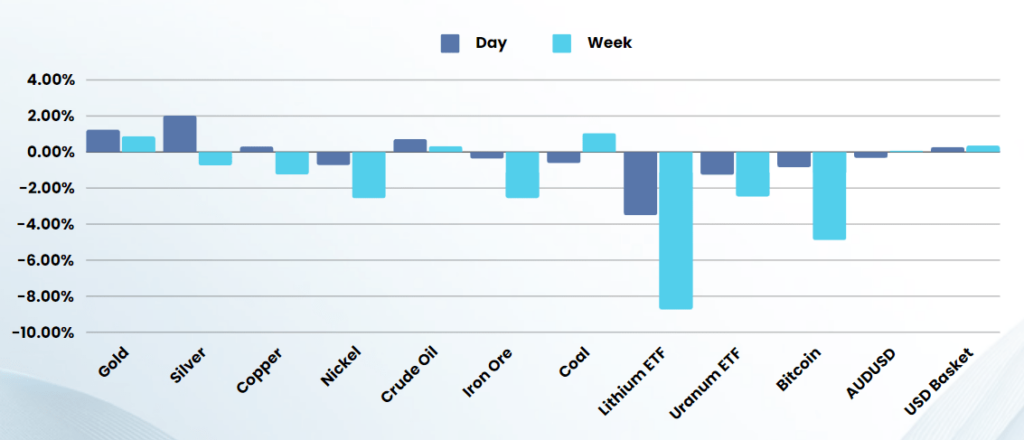

The softening in the data also saw yields fall which helped precious metals finish with a positive day for the week

Earnings

- Adobe Systems +14% – stock soared 14% after the software giant logged strong earnings and hiked its 2024 guidance on higher demand for its AI-powered editing tools. The results also included stronger ARR guidance, a “reaffirmed outlook for Creative segment growth in 2H and an absence of any ‘weak macro’ commentary,” UBS said as it lifted its price target on the stock to $560 from $540 a share.

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7717 (-0.02%)

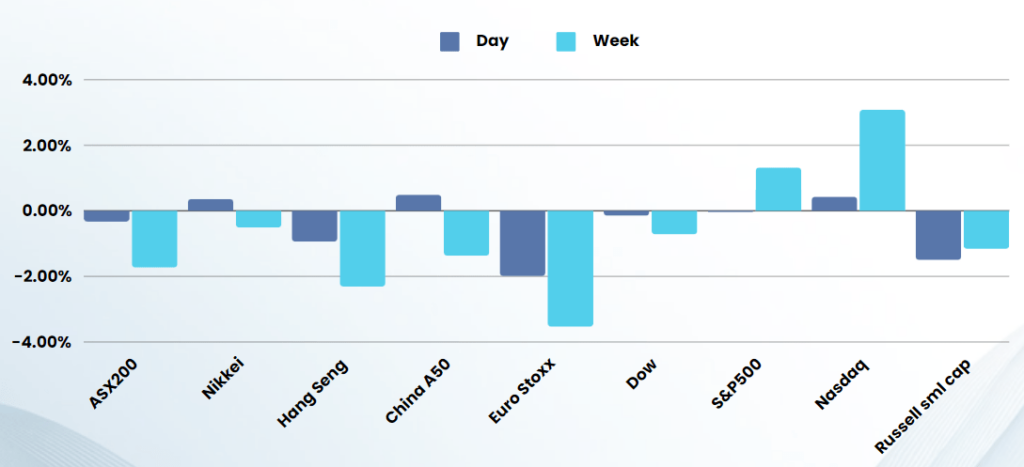

Despite tech still holding up, we are starting to see very broad weakness in the rest of the market. It is likely the ASX will underperform the US until the Mag7 tech stocks fall

With 2 weeks left in the Financial year, we expect there may be some erratic moves in single stocks, particularly ones down on the year as investors lock in tax losses