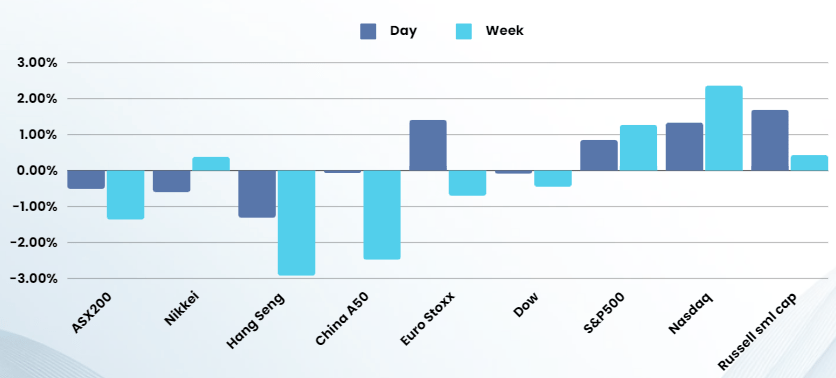

Last Night's Market Recap

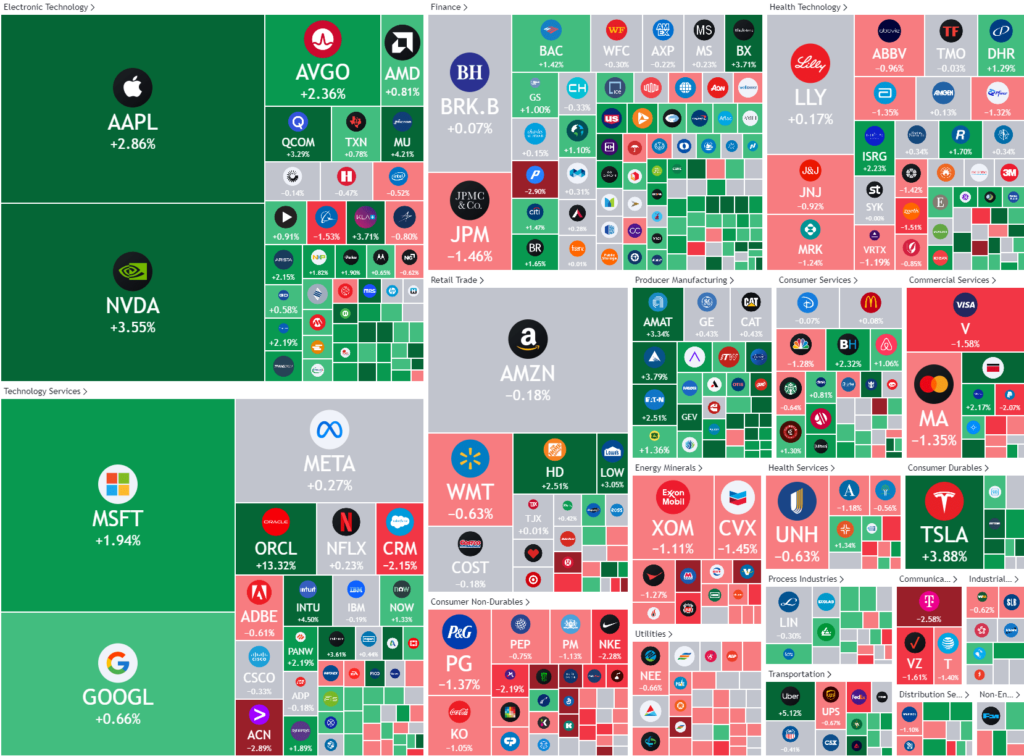

S&P 500 - Heatmap

Overnight – AI stocks keep climbing despite hawkish Fed

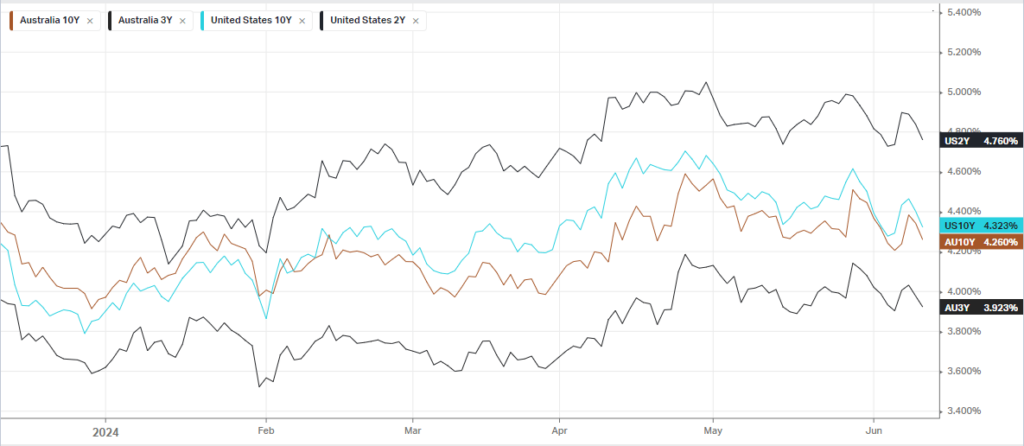

The seemingly endless AI rally continued overnight despite the Fed being more hawkish than expected, whittling down the possibility of rates cuts to just one cut this year, and less in 2025 as the central bank remains cautious on inflation.

This is stark contrast to the 7 rate cuts expected from analysts at the start of 2024. The unwinding of these poor prediction would, in any normal circumstances, have seen equities cool, however the AI thematic keeps dragging the indices higher, ignoring all risks this poses to the broader economy, who are the very customers needed for AI to become a boom.

Fed members now see the benchmark rate falling to 5.1% this year (currently 5.5%), suggesting just one rate cut in 2024, compared with a prior estimate in March for three cuts. In 2025, Fed members see the rates falling to 4.1%, up from a prior forecast for 3.9%, before eventually declining to 3.1% in 2026. In a sensible move, Chair Powell also said the board wasn’t prepared to speculate that inflation will fall, unlike the ECB and BOC last week who seem swayed by popular opinion.

The day started positively after US Consumer Price Index was unexpectedly unchanged in May due to cheaper gasoline, a factor normally ignored when it influences a higher CPI number, but in the current world of one-eyed bullish investor sentiment, it was acknowledged.

Logic seems to have left the building for now in equity markets, which means there will be a lot of short, sharp irrational movements in pockets of the market. An agnostic and well-planned approach is essential in these markets to take advantage and we warn against initiating any long term positions during these times of fundamental disconnect.

Bonds

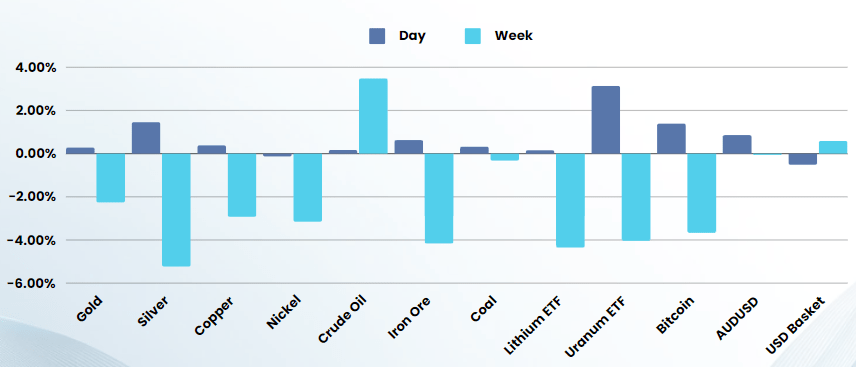

Commodities & FX

The Day Ahead

ASX SPI 7782 (+0.67%)

A mild bounce in commodities overnight should see the ASX mildly supported as we near EOFY. With the Fed and US inflation numbers now out of the way, it’s unlikely the AU market will move significantly in either direction for the next few weeks with a lack of any major catalyst

Recent weakness in the ASX has been put down to “EOFY tax loss selling” by many pundits/analysts/journalists. This lazy analysis is highly unlikely given we are 8% higher for the year and just 1.5% from record highs would imply any selling would be profit taking, not losses.