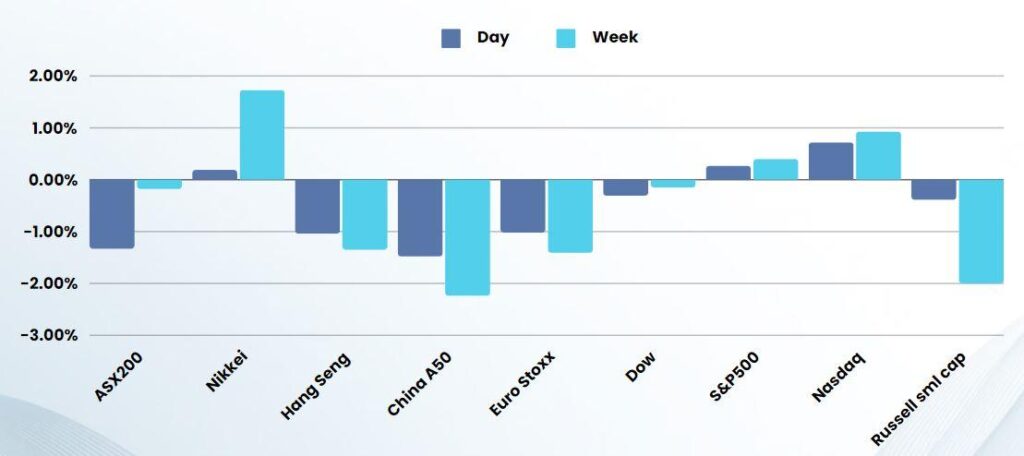

Last Night's Market Recap

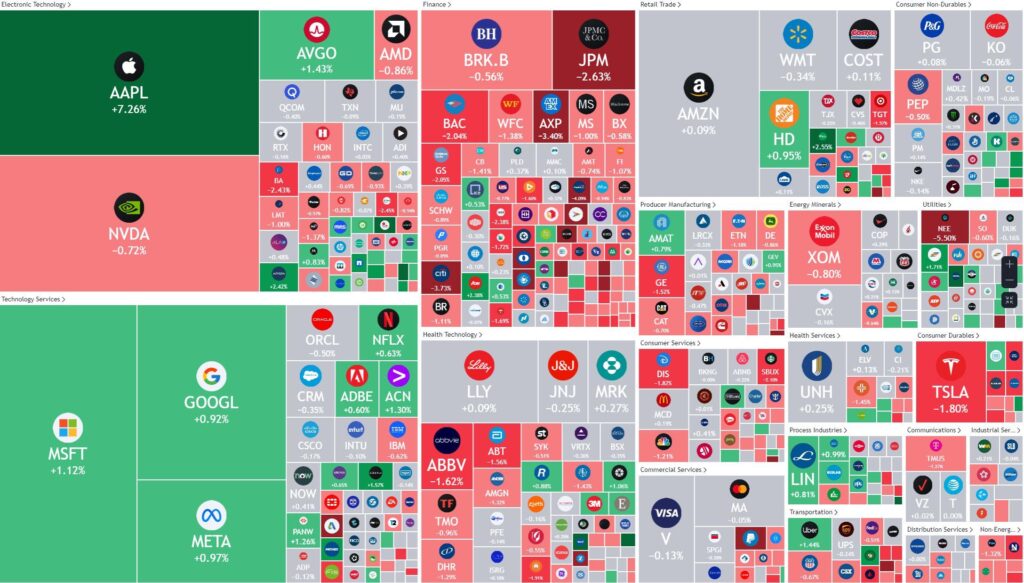

S&P 500 - Heatmap

Overnight – Walls St cheers Apple, despite being 18 months late to the AI Party

In the Wall St equivalent to a participation award, S&P 500 and Nasdaq climbed to a record close for the second-straight day, on a surge in Apple to all-time highs, on AI…. 18 months late and not even their own product

Apple rose 7%, hitting a record high after its AI strategy, which was unveiled a day earlier at its annual developer conference was confusingly cheered by Wall Street as it was barely a catchup to other platforms. The hope from Wall St and Apple is because the AI functionality will only be backward compatible to iPhone 15 Pro…it “could lead to a much-needed upgrade cycle of iPhones

The yield on the 10-year Treasury fell 7.4 basis points to 4.397% after a $38 billion auction of 10-year notes were awarded at lower than expected yields, pointing to signs of stronger demand. Yields on 2-year, 5-year and 30-year Treasuries were also under pressure following the strong-than-expected auction results.

The Federal Reserve kicked off its two-day policy-setting meeting Tuesday, and the central bank is widely expected to leave interest rates unchanged in a range of 5.25% to 5.5% on Wednesday. The monetary policy statement will also include the Fed’s updated “dot plots,” or the outlook on interest rates, inflation, and unemployment. Remarks from Fed Chair Jerome Powell, meanwhile, is also expected to garner the bulk of investor attention. As well as the Fed decision, the May reading of its U.S. consumer price index, a highly-anticipated gauge of inflation in the world’s largest economy, is also set to be released. Further signs of inflation easing could cement expectations for rate cuts, especially given signs of economic weakness, but a bad inflation miss could spook investors and bring back recession fears that have laid dormant for months.

Bonds

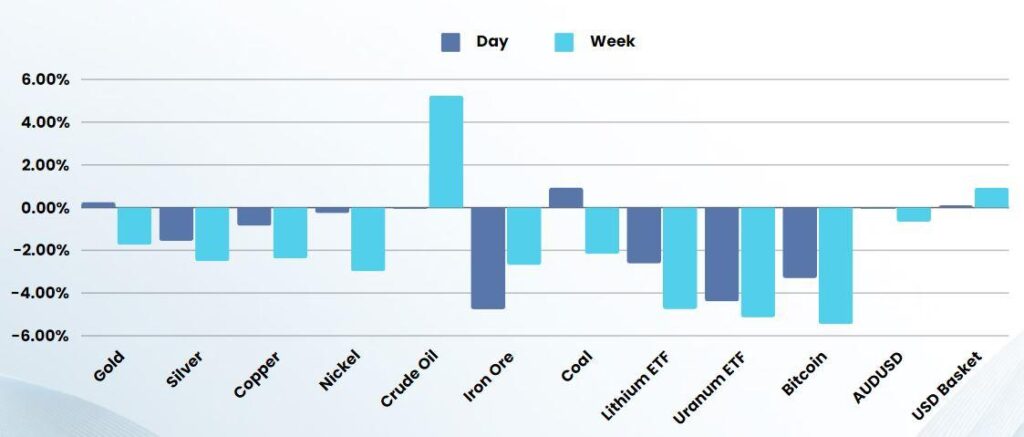

Commodities & FX

The Day Ahead

ASX SPI 7727 (-0.46%)

Expect little movement from the ASX today as the market remains dominated by the Fed meeting and US inflation numbers with very little correlation between financial instruments.

It is very difficult to even find an ounce of journalistic integrity amongst major news wires as most pundits and journalists are just retro-fitting facts into news articles that appear to be “pre-written”

I have only seen this a few times in my nearly 3 decades in markets, and the clear disconnect from economic fundamentals makes me feel that high caution is warranted.