Last Night's Market Recap

S&P 500 - Heatmap

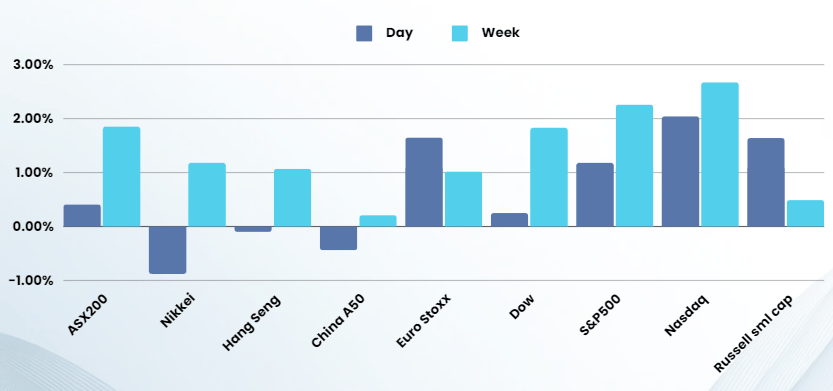

Overnight – Investors rejoice as Canada cuts rates and labour market worsens

A Bank of Canada rate cut and signs of further cooling in the labor market fueled investors “one-eyed” optimism, lifting hopes that the Federal Reserve will cut interest rates later this year

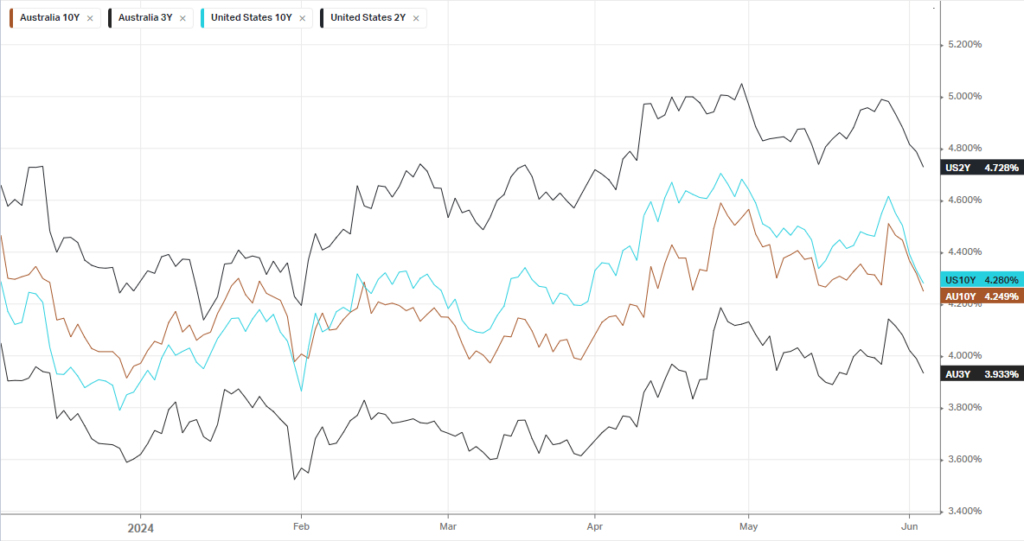

Treasury yields continued their stumble this week as rate-cut bets were boosted by data showing the economy created fewer than expected private sector jobs in May, with just 152,000 workers hired in the month, down from 188,000 in the prior month, and missing economists estimates of 173,000. About 65% of traders expect the Fed to roll out a 25 basis-point reduction in September, compared with odds of below 50% a year earlier, according to CME’s closely-watched FedWatch Tool. The data comes a day after a separate report showed that job openings slipped to their lowest level in over three years in April. The slew of U.S. jobs data showing cooling in the labor market comes just ahead of the all-important monthly nonfarm payrolls report due Friday.

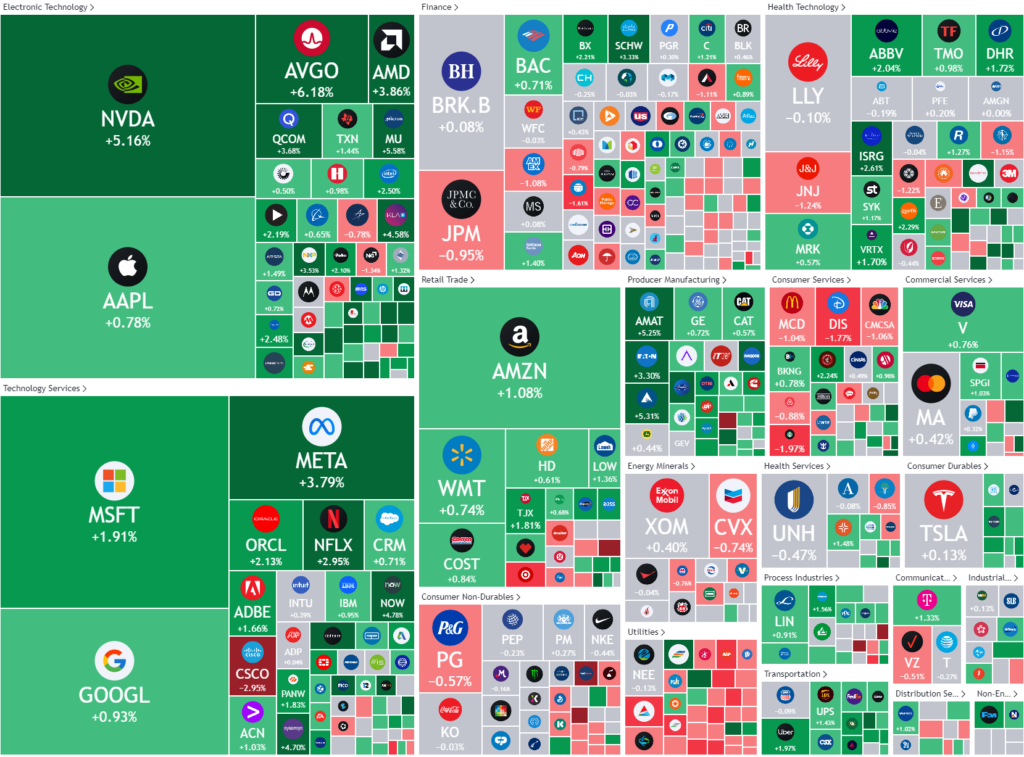

Investors needed no encouragement to once again fire up the Nvidia monster truck, seemingly oblivious to any concept of the value of money. Nvidia, rallied 5% overnight or $160B in value, pushing its value above $3 trillion for time ever as the chipmaker continues to ride the artificial-intelligence wave to new heights.

Apple rose 1%, briefly recapturing its $3 trillion market cap, as optimism continues to build ahead of the tech giant’s AI conference next week. Alphabet and Microsoft were also leading to the upside.

As well as Nvidia, Taiwan Semiconductor Manufacturing also led chips higher after Barclays hiked its price target on the chipmaker’s stock to $170 from $150, on optimism that company, which supplies chips to Apple, Qualcomm, Nvidia, will build on its market share amid growing demand for next generation chips

The Bank of Canada cut was widely expected and very pre-emptive as they claimed “inflation was under control”, more wishful thinking than fact. The ECB is likely to follow suit tonight, as they try to kick start the European economy and ignore inflation in the hope it brings itself under control

Bonds

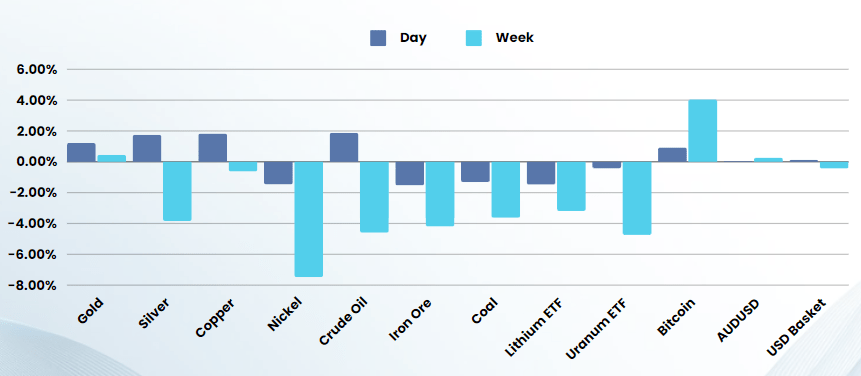

Commodities & FX

The Day Ahead

ASX SPI 7825 (+0.54%)

The ASX should do very nicely today after the recent rout in the materials sector will reverse with a bounce in commodities. There was a distinct flow of capital to defensive sectors like healthcare and defensive stocks like Graincorp, Transurban, Telstra yesterday, which could be a sign of things to come.

Recent movements in global markets are bewildering and conflicting at best, with different sectors taking the same indicator, different ways. We remain cautious at these levels