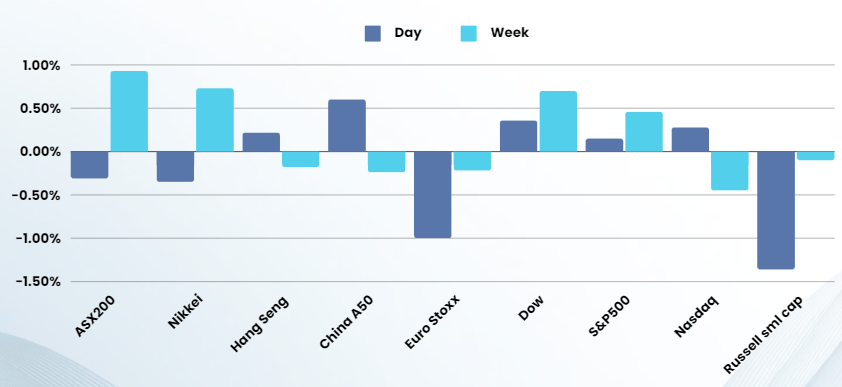

Last Night's Market Recap

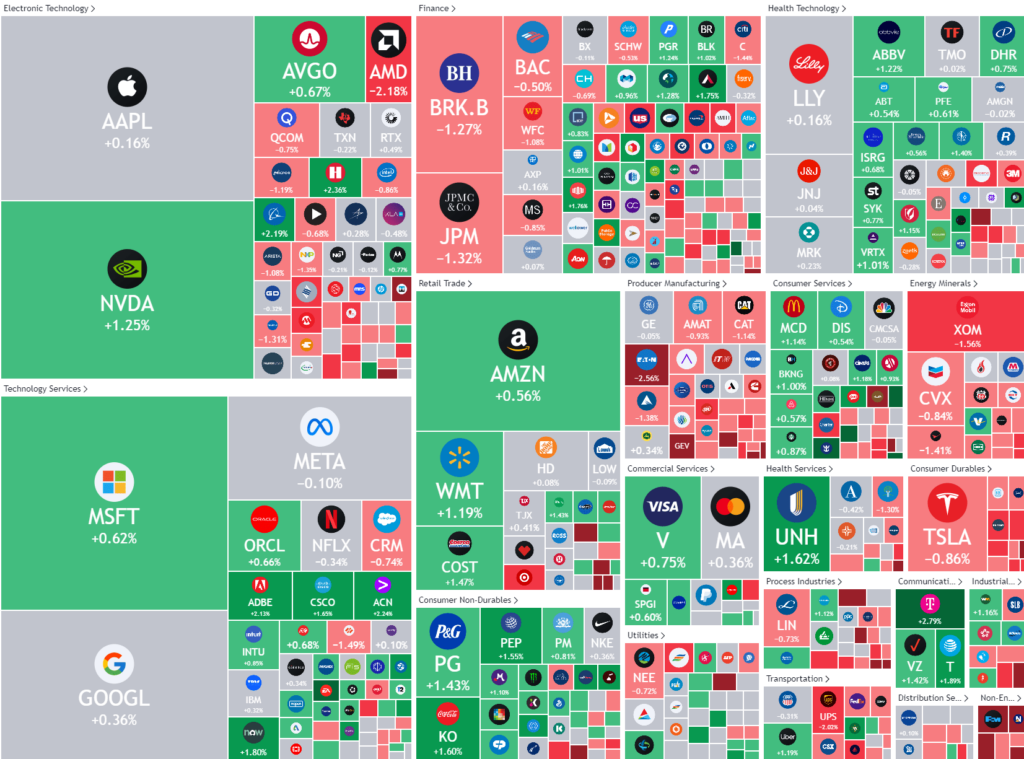

S&P 500 - Heatmap

Overnight – Stocks rally in further disconnect from economic reality

Stocks closed as a fall in job openings to three-year lows pointed to weaker economic growth, but also lifted hopes for a Federal Reserve rate cut this year.

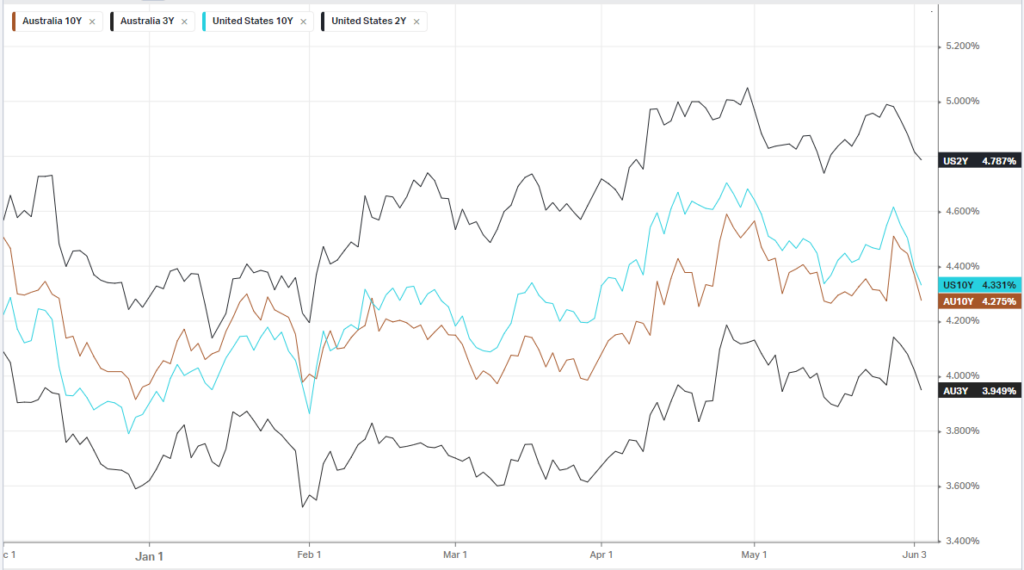

The number of job openings for April fell to a more than three-year low of 8.1 million, confounding economists’ estimates for an increase to 8.37M. The data pointing to easing in the labor market suggest the economic strength seen so far this year could be cooling. Treasury yields fell on improved hopes for a rate cut this year, with the yield on the 10-year Treasury trading 6.6 basis points lower at 4.333%. The fresh update on job openings come ahead of the nonfarm payrolls report due Friday, with the Fed meeting to follow next week.

Intel Corporation unveiled a slew of artificial intelligence chips, a day after Nvidia and AMD made a similar announcement as the chipmaker looks to narrow the wide gap on its rivals. But some on Wall Street suggest that further upgrades from Intel will likely be needed before it can meaningfully compete with its rivals.

Tesla’s stock traded below the flatline after its sales of China-made electric vehicles fell by 6.6% to 72,573 in May compared to a year ago, Reuters reported on Tuesday, citing data from the China Passenger Car Association.

Energy and commodity stocks continued to be pressured as investors turned uneasy about evidence that the U.S. economy’s “exceptionalism” may be starting to unwind, after data showed surprising weakness in business activity. Oils woes were added to following OPEC+ to increase in supply later this year.

The best way to describe the markets positive spin on weakening economic conditions, is “oxymoron”, but history has often taught us that only the later half of that word ends up describing those who buy it

Bonds

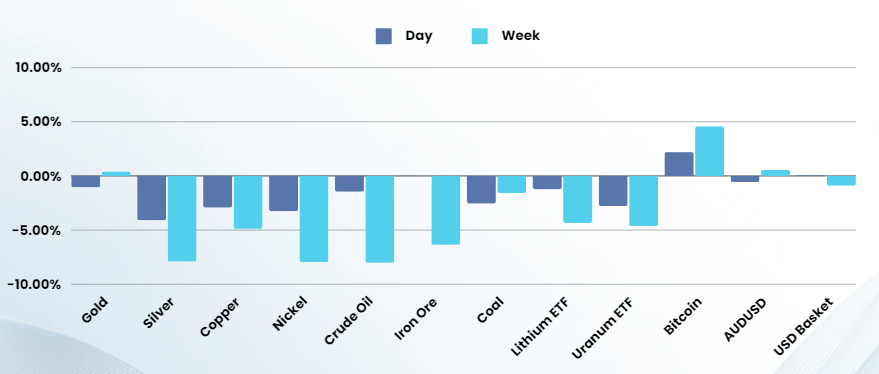

Commodities & FX

The Day Ahead

ASX SPI 7751 (-0.01%)

Australian shares are set to grind lower with only the misguided optimism of “worse economic data = rate cuts” holding the market up at present.

1130 will see AU GDP numbers released with the expectation of 0.2% growth for the quarter. A range of Asian and European PMI numbers over the next 24 hours will also give insight on economic health.

We recommend a return to defensive positioning or cash for the rest of the financial year

Company Specific:

- Treasury Wines investor day in the US overnight

- Infratil and the Qualitas Real Estate Income Fund shares both trade ex-dividend.