Last Night's Market Recap

S&P 500 - Heatmap

Overnight – stocks slip on weaker economic data

Stocks closed lower led by a slump in energy stocks on falling oil prices and weaker manufacturing data pointing to a slowing in the economy.

Energy stocks fell more than 2% to pressure the broader market following a slump in oil ongoing as OPEC and its allies, or OPEC+, agreed to extend the current production curbs through 2025, though said they would face would begin to phase out some voluntary cuts after the third quarter.

The move to ease some of the production curbs stoked fears of a supply surplus at a time when many are questioning the strength of the crude demand.

The phasing out “represents a stronger indication that extreme levels of market support by OPEC+ (principally Saudi Arabia) may not last forever,” Macquarie said in a note, warning that it “appears problematic for 2025.”

Chips in focus as AMD, Nvidia unveil new AI chips

Advanced Micro Devices fell more than 2% even as the chipmaker unveil new artificial intelligence chips, while rival NVIDIA Corporation was up more than 4% after revealing its next generation superchips to succeed its current blackwell chips.

Manufacturing activity dips; nonfarm payrolls eyed

Ahead of busy week on the economic calendar for top tier data, manufacturing activity fell more than expected in May as high interest rates continued to weigh on investment and expansion plans.

“The environment for capex investment remains very challenging so long as interest rates remain elevated,” Jefferies said in a note.

The focus week will be on the upcoming nonfarm payrolls data for May, due later this week, which is set to offer more cues on the labor market — another key consideration for the Fed in cutting interest rates.

The central bank is set to meet next week and is widely tipped to keep rates steady.

Bonds

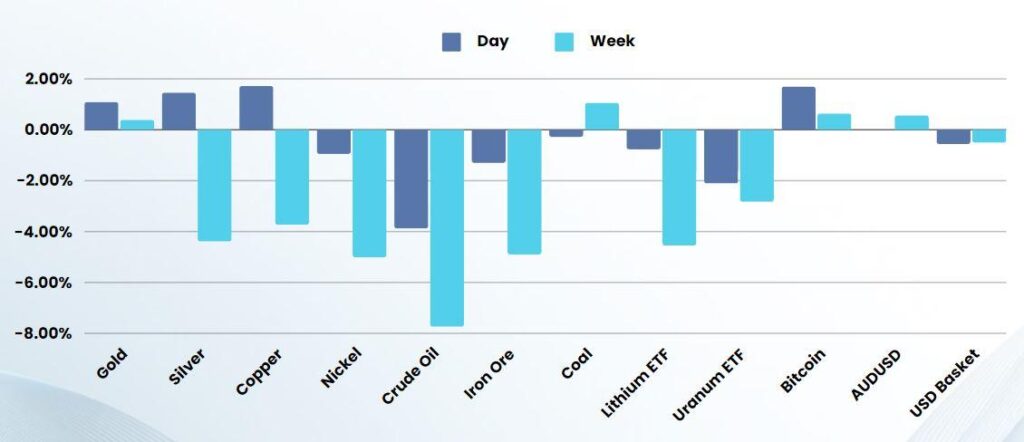

Commodities & FX

The Day Ahead

ASX SPI 7769 (-0.12%)

Australian shares are poised to fall, tracking a mixed Wall Street after US manufacturing data disappointed, while a tumble in iron ore and falling oil prices will also weigh on sentiment.

Company Specific:

- Newmont Trades ex-dividend