Last Night's Market Recap

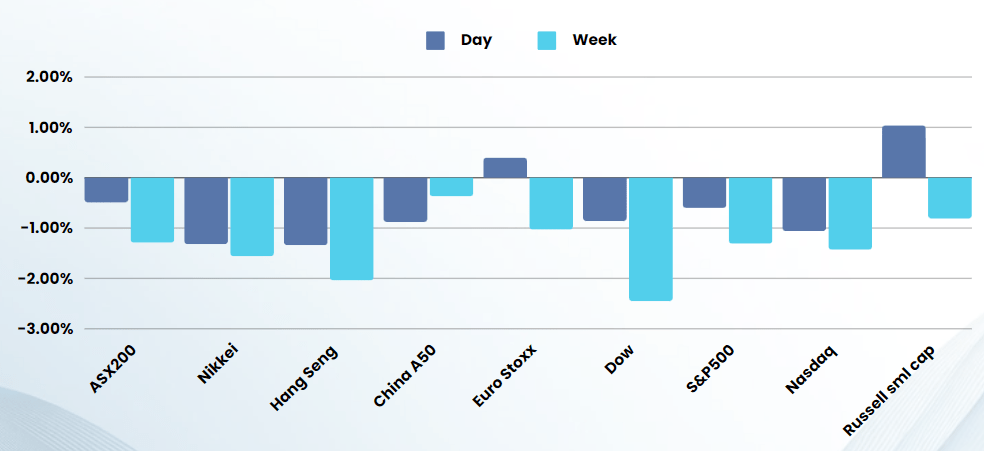

S&P 500 - Heatmap

Overnight – Tech slumps as Salesforce & Dell dent AI optimism

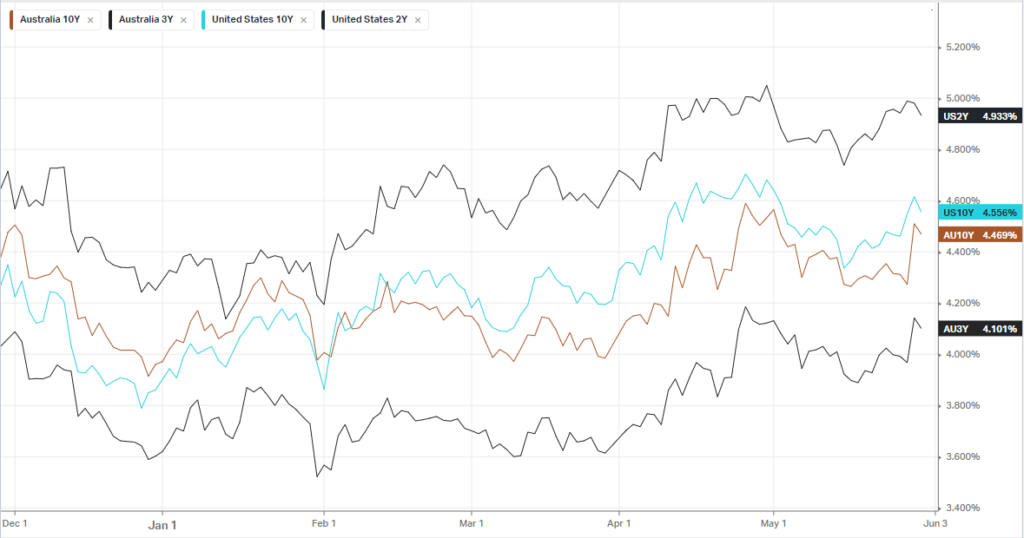

Stocks closed lower for a second straight session, pressured by a salesforce-led dent in technology and cautious sentiment ahead of key inflation data due tonight.

Salesforce fell nearly 20% to remain on track for its worst day since 2004 after reporting guidance that missed analyst estimates. The weaker results come amid a malaise in the software sector that isn’t likely to recovery in the second half of the year. Weak demand for the companies AI product should be of concern to the broader market as it may be one of the first signs that unrestricted spending on AI wont necessarily yield an instant return on investment

Big tech also took a breather with NVIDIA, Microsoft and Alphabet leading to the downside, but Apple Inc bucked the trend.

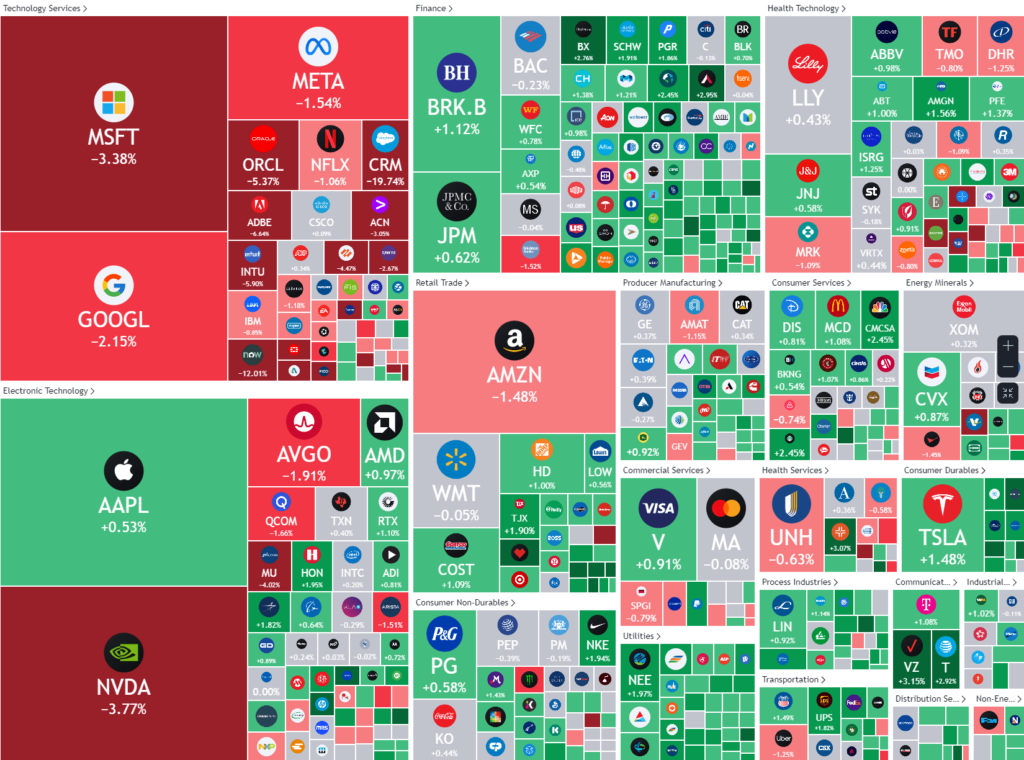

The U.S. economy grew more slowly in the first quarter than previously estimated, as gross domestic product grew at an 1.3% annualized rate from January through March, lower than the advance estimate of 1.6% and notably slower than the 3.4% pace in the final three months of 2023. The data came just ahead of remarks by Federal Reserve president John Williams, who pushed back against fears of a rate cut, saying the current level of monetary policy was working to restrain the economy. Federal Reserve policymakers have pushed back expectations for when they’ll be able to pivot to interest rate cuts, bringing Friday’s PCE price index data — the Federal Reserve’s preferred inflation gauge — firmly into focus.

In a historic verdict, the jury in former President Donald Trump’s “hush money” trial in New York has found him guilty on all charges. This unprecedented ruling marks the first time a former US president has been convicted of a crime. Polling around the presumed republican nominee as shown that voters are 25% less likely to vote for Trump with a guilty verdict, potentially bringing another candidate into the fold

Earnings

- Dell -5% (-17% after hours) – despite beating of Wall Street estimates for first-quarter revenue this morning, ending a streak of six-quarters of decline, results failed to impress investors, sending its shares down more than 17% in extended trading. Shipments of the company’s AI-optimized servers more than doubled to $1.7 billion, and the backlog grew more than 30% to $3.8 billion, Chief Operating Officer Jeff Clarke said in a statement. The availability of AI PCs is expected to boost demand for PC makers, helping the market rebound from a lull in orders after the pandemic-driven buying spree. Fueled by optimism about demand for its AI-optimized servers, Dell’s stock has more than doubled this year and hit a record high earlier this week.

Bonds

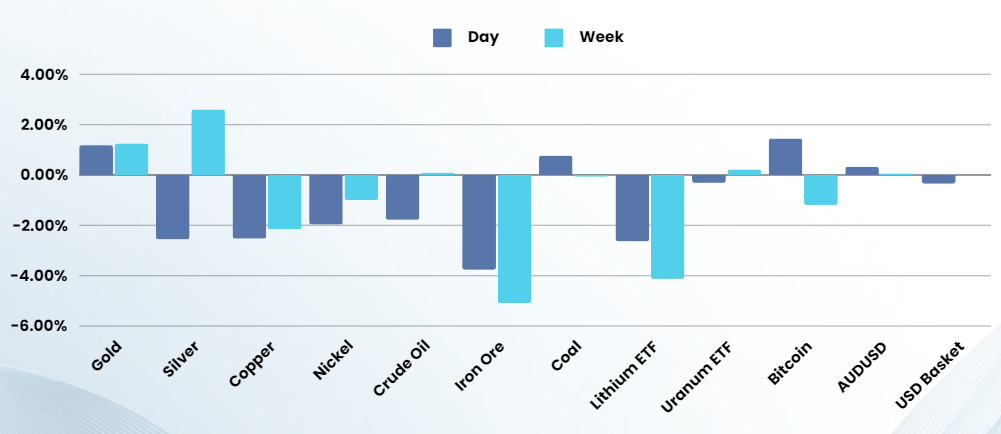

Commodities & FX

The Day Ahead

ASX SPI 7705 (+0.65%)

Despite the weak offshore lead, the ASX is likely to bounce a little today as the heavy selling in the materials sector yesterday looks to be premature as commodities bounced in the US session. The selling in the US was laser focused on the tech sector, with the rest of the market broadly in positive territory.

The focus has now shifted to the release of April’s personal income, spending and price reports. Economists expect the personal consumption expenditures price index minus food and energy, due tonight, to rise 0.2 per cent in April. That would mark the smallest advance so far this year for the measure, which provides a better snapshot of underlying inflation.

Company Specific:

- BHP Group decided against making a firm offer for Anglo American, instead walking away for now from what would have been the biggest mining deal in over a decade.

- Select Harvest issues earnings.

- Nickel Industries host an AGM.