Last Night's Market Recap

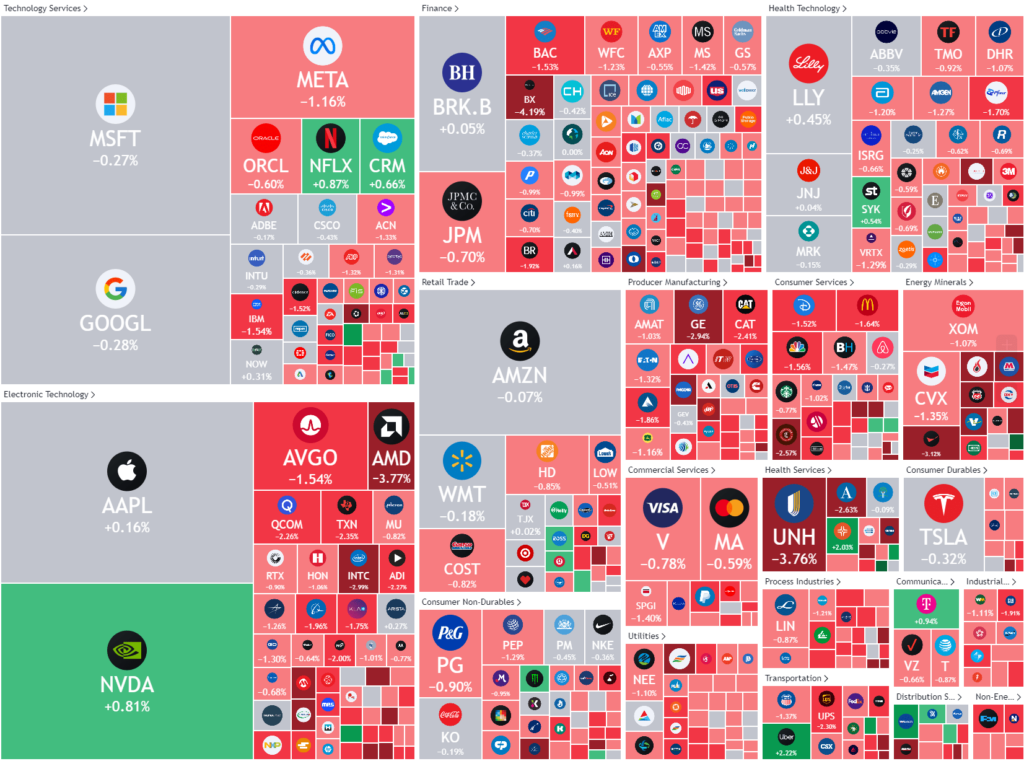

S&P 500 - Heatmap

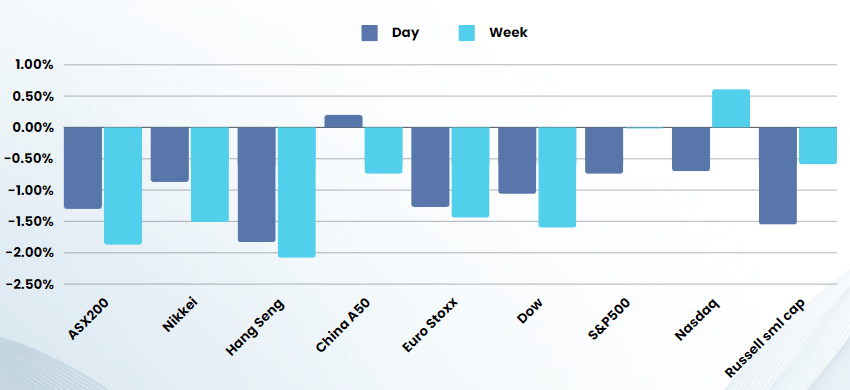

Overnight – Rising bond yields sink stocks

Rising bond yields weighed down stocks overnight as investors become increasingly wary of stubborn inflation and the prospect of rates remaining higher for longer

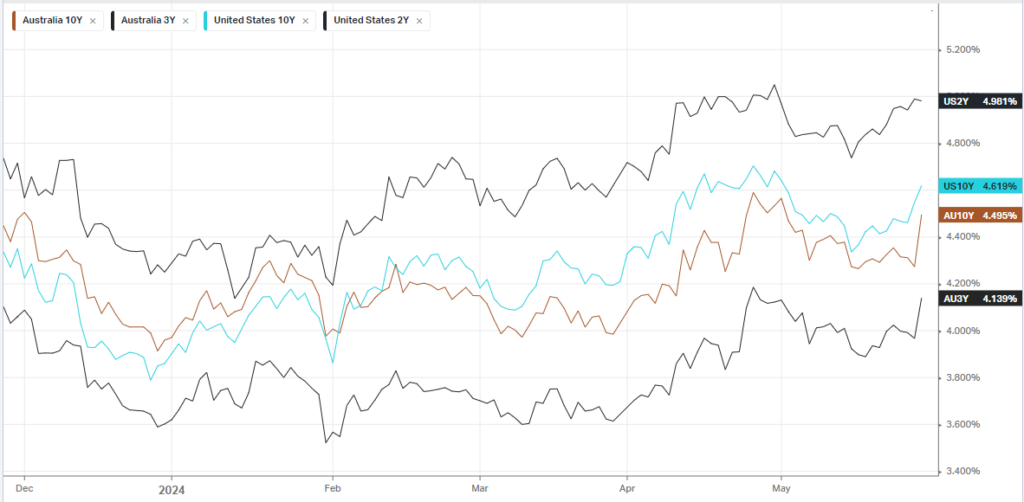

Treasury yields continued to climb following a series of weaker than expected auction results, signaling weaker demand, for government bonds including the $44B of 7-year notes auctioned Wednesday. The move in higher in Treasury yields come ahead of key inflation data this week. PCE price index data, which is the Federal Reserve’s preferred inflation gauge, is due this Friday, and is likely to factor into the central bank’s outlook on interest rates. Signs of sticky inflation have led several officials to suggest in recent days that they would like to see more evidence of cooling prices before starting to bring rates down from more than two-decade highs.

Industrials and energy stocks led the market lower as airline stocks weighed heavily on industrials after American Airlines Group cut its guidance on Q2 profit, sending its shares more than 13% lower. The downgrade guidance prompted some on Wall Street turn bearish amid worries that American Airlines is struggling to keep up with competition from low and ultra cost carries. Meanwhile, energy stocks were heavy, despite a jump in Marathon Oil who agreed to be acquired by ConocoPhillips in a $17.1B all-stock deal.

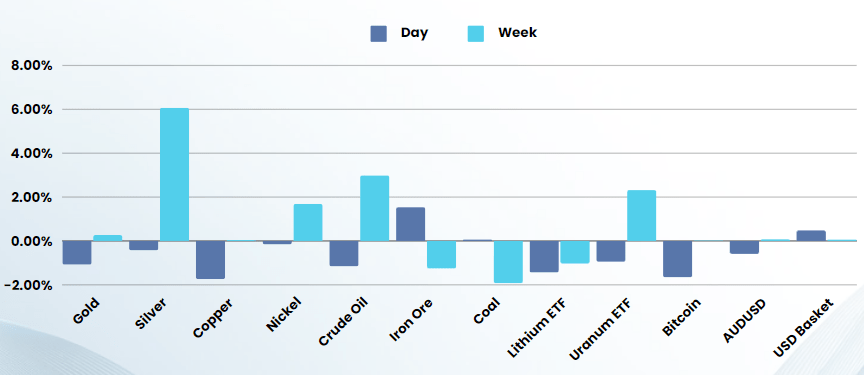

A stronger USD and the prospect of a lengthy period of higher rates dragged down commodities, with gold, silver, copper and oil all drifting lower

Earnings

- Salesforce -16% – forecast second-quarter profit and revenue below Wall Street estimates on Wednesday due to weak client spending on its cloud and enterprise business products, sending its shares down more than 16% after the bell. The company expects revenue between $9.20 billion and $9.25 billion compared with estimates of $9.37 billion, according to LSEG data. Salesforce’s forecast indicates that clients are scaling back spending as the possibility of higher-for-longer interest rates and elevated inflation prompt them to keep a tight leash on costs.

Bonds

Commodities & FX

The Day Ahead

ASX SPI 7640 (-0.67%)

Yesterdays higher than expected inflation number added to market woes as investors digest the fact that rates are not going down any time soon. This is likely to drag heavily on the big4, REITs, industrials and consumer discretionary, all being rates sensitive and/or cyclical.

Rising bond yields globally is a problem for equities as investors had largely assumed the goldilocks stance on the outlook for stock markets. US bonds are very close to 15+ year highs again, while Japanese bonds broke 10 year highs, making the inflation data out of the US on Friday, critical to path of equities for the coming months

Company Specific:

- BHP Group decided against making a firm offer for Anglo American, instead walking away for now from what would have been the biggest mining deal in over a decade.

- Champion Iron issues earnings.

- Life360 and Sigma Healthcare host AGMs.

- Technology One trades ex-dividend